April 2015

www.wealth-monitor.com

VOLUME: 01 | ISSUE: 01

Wmonitor

EALTH

Face Value

Fathi Ben Grira, CEO,

MENACORP

Get Your Money’s Worth

RETAIL

CONUNDRUM

Does the surge in online retail

in the region ring alarm bells for

brick-and-mortar retailers?

AD

D TO

CA

RT

Mastering the Markets

BU

Y

Short Selling

Blue Chip

Peer-To-Peer Finance

Taking Stock

Islamic Credit Cards

Technology Trendz

Mobile Wallet

Bulls vs Bears

Crude Shock and Stocks

B a h r a i n : B D 1 . 5 0 | Ku w a i t : K D 1 . 2 0 | O m a n : R O 1 . 5 0 | Q a t a r : Q R 1 5 | S a u d i A r a b i a : S R 1 5 | UA E : A E D 1 5 | U S $ : 5

A clear EDGE

16

Why physical retail would continue to dominate in the region despite the

surge in online shopping

CONTENTS

P.

S-F / Shutterstock.com

P.40 Blue Chip

Peer-to-Peer Finance

12

P.

Have the crude oil prices and the

Gulf’s markets really decoupled?

P.44 What’s Not

Pressure on EM Currencies

Bulls vs Bears

35

P.

Global View

The outlook for the global economy

P.48 Dashboard

Data on M&As, PE Deals and IPOs

P.56 The Last Laugh

The Big Drop

www.wealth-monitor.com | April 2015

Major News Stories From Around the

Region

P.23 Markets Cosmos

News and data on Precious Metals, Base

Metals, Energy, Agri/ Soft, Currencies,

Arabian Bourses and Global View

P.42 Markets Rewind

Amazon’s Journey

P.43 What’s Hot

US Equities Power Ahead

P.45 Mastering the Markets

CONTENTS

P.04 Opening Bell

P.

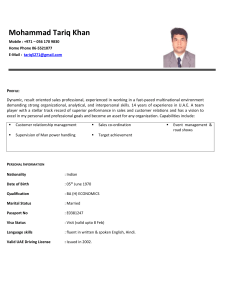

10 Face Value

Interview with

Fathi Ben Grira, CEO,

MENACORP, Dubai

46 Technology Trendz

P.

32

P.

No Shortcuts

38

P.

Exploring Islamic

Credit Cards

28

P.

Pain Of Low Oil Price May Persist

Why Grain Prices Are

Expected To Soften

30

P.

April 2015 | www.wealth-monitor.com

Mobile Wallet

APRIL 2015

VOLUME: 01 | ISSUE: 01

Wmonitor

EALTH

Get Your Money’s Worth

www.wealth-monitor.com

Publisher

Semantics Global Media FZ LLC

Office139, Building10

Dubai Media City

PO Box 500683

Dubai, U.A.E

T: +971 4 2766080 F: +971 4 2766081

info@semantics.ae | www.semantics.ae

Editor in Chief

Arshad Khan | arshad.khan@semantics.ae

Editor

Sunil Kumar Singh | sunil.singh@semantics.ae

Research Analyst

Ravindran Manickam | ravindran.m@semantics.ae

Contributors

Wayne Andrews

Deeptan Chakraberty

Ashley Freeman

Gerhard Schubert

Marketing & Advertising

info@semantics.ae

M: +971 50 7551 384

Subscriptions

subscription@semantics.ae

M: +971 50 7551 384

Design

Bhargavi Mohan | bhargavi.mohan@semantics.ae

Printed By

Masar Printing & Publishing, Dubai

T: +971 04 4484000 | www.masarprint.com

Distributed By

Tawseel Distribution & Logistics, Dubai

T: +971 4 4483888 | www.tawseel.com

Mobile, Tablet & Desktop Apps By

Yudu Ltd. London, United Kingdom

lev radin / Shutterstock.com

Disclaimer

All content published in Wealth Monitor is for information purpose only.

Nothing in this magazine shall be construed as investment advice, nor

does it represent the opinion of or recommendations by Semantics

Global Media on any particular stock, commodity, mutual fund, portfolio,

or investment strategy. Wealth Monitor or Semantics does not have any

liability for any investment loss arising due to the decisions based upon

the content published herein and under no circumstances shall Semantics

or its employees be held responsible for any loss or damage caused by

investments based on information obtained from Semantics publications.

Readers/subscribers are advised to discuss with an expert/broker/financial

planner before buying or selling any asset or making any investment

decision. Semantics and Wealth Monitor magazine do not claim to be

complete or free of errors and the liability to verify pricing, data, views and

other information published in Semantics and its publications rests with

the reader/subscriber. While the information/data/statistics in this issue are

taken from sources believed to be reliable, Semantics Global Media does

not guarantee its accuracy and correctness and any error or omission shall

not be made the basis for any claim or demand or cause of action. All rights

reserved. No part of the publication should be reproduced, distributed, or

copied without the written permission from the publisher.

EDITOR’S FLOOR

I

t gives me immense pleasure to launch the first ever issue of Wealth

Monitor! We hope you’ll enjoy reading the first issue and the subsequent

ones.

“What makes eBay successful…is the community. It’s the buyers and sellers

coming together and forming a marketplace,” Pierre Omidyar, the founder of

ebay, the California-based world’s largest online auction site so remarked once.

Things are not much dissimilar in the GCC region too if you reckon the pace

at which online retail has been evolving, or say burgeoning, buoyed by the

increasing preference of consumers, especially the younger generation, to

shop online.

The UAE has long been a trading hotspot. There was a time when the

traditional souks dotted the region, and you can still relive their hustle and

bustle. As the years went by, glitzy shopping malls rose up out of the Arabian

sands as another platform to buy and sell. Both the souqs and shopping malls

have continued to flourish together for years without encroaching on each

other’s turf. Fast forward a bit and here is another version of buying and selling

— online shops that’s fast catching the fancy of buyers. But will brick-andmortar stores and malls in the UAE and the region lose out as online shopping

grows?

As our cover story points out, the skepticism is misplaced. No doubt,

sales through online shopping portals are surging at one of the fastest rates

globally, buoyed by growing number of Internet-savvy consumers and a

high penetration of smartphones and tablets, but even as online shopping is

becoming a bigger piece of the retail pie, it by no means signifies decreasing

role of mega malls in total retail sales. There’s enough room for both physical

and online retail segments to expand. And that’s essentially because shopping

through the Internet still comprises a minuscule of the entire retail sales pie

in the region. Rather than competing against each, online retailing is in fact

supplementing physical retail here.

The red flag though is resistance or ignorance to evolve and this is true for

both players. The one that doesn’t evolve stands to lose out and runs the risk

of being marginalized.

Our inaugural issue also includes conversations with Mr Fathi Ben Grira, CEO,

MENACORP, one of the leading financial services groups in the whole Middle

East and North Africa (MENA) region. In the section, ‘Face Value’, Grira discusses

on the overall financial markets and outlook of the region.

Also, be part of the debate in the ‘Bulls Vs Bear’ section, where three experts,

viz., Muhammad Shabbir, Head of Equity Funds And Portfolios, Rasmala

Investment Bank, Dubai; Rajiv Kumar, Dy CEO, Phillip Futures DMCC, Dubai;

and MR Raghu, Senior VP-Research, Kuwait Financial Centre, deliberate on the

correlation between the crude oil prices and GCC’s stock markets.

Till the time, it’s happy reading!

ARSHAD KHAN

Editor in Chief | arshad.khan@semantics.ae

www.semantics.ae

April 2015 | www.wealth-monitor.com

wealthmonitor

wealth_monitor

wealth-monitor

OPENING BELL

News

In Numbers

48%

The growth in net profit of Dubai Airport Freezone Authority

(DAFZA) in 2014 compared with the previous year.

“DAFZA’s strong performance in 2014 reflects our

commitment to effectively contribute to Dubai’s

economic development and solidify the leadership of

Dubai as a global hub for business and investment.”

HH Sheikh Ahmed bin Saeed Al Maktoum, Chairman, DAFZA

$300b

Exports from the MENA oil

exporters will be reduced by

$300 billion in 2015, according

to IIF.

AED 759.3m

The net profit recorded by Dubai

Financial Market in 2014, compared

with AED 284.6 million in the previous

year.

4

107%

Total revenues increased 107% to AED

936.7 million in 2014, compared to AED

453.1 million in 2013.

3.7%

The fall in Dubai’s apartment prices in first 6 weeks of 2015

compared to the previous quarter, according to the report by

real estate advisory firm Phidar Advisory.

60,565

The number of Ultra High Net Worth

Individuals (UHNWIs) in Europe, home to

the highest number of UHNWI’s globally,

followed by North America and Asia,

with 44,922 and 42,272 respectively,

according to data compiled for Knight

Frank’s Wealth Report by WealthInsight.

Asia will overtake North America as the

second biggest hub for UHNWIs over

the next ten years, fuelled by the rising

UHNWIs populations in China and India,

the report said.

www.wealth-monitor.com | April 2015

OPENING BELL

Drop of Light / Shutterstock.com

15%

“2014 was another successful year for FGB,

marking 15 years of uninterrupted net profit

growth for the bank. Our financial results

for 2014 are testament to the success of our

restructuring efforts and focus on enhancing

capabilities and synergies across our core

businesses.”

André Sayegh, CEO, FGB

The increase in average

sales rates for apartments

in Abu Dhabi in 2014,

according to a report by

Asteco. Investors in Abu

Dhabi’s real estate sector

can expect sustained

rental

growth

and

relatively stable capital

values in 2015, on the back

of a strong performance in

2014, it added.

$40b

For the GCC, the aggregated current

account surplus will shrink from $266

billion in 2014 to about $40 billion in

2015, and the fiscal position will shift

from a surplus of 4.6% of GDP to a deficit

of 7.4%, IIF estimates.

74%

The percentage of recruiters who

expect new job creation in the Gulf in

next 6 months of 2015, according to

Naukrigulf Hiring Outlook Survey.

98.2%

The percentage

of respondents

in the MENA who

find it important

to work for an

organization that

provides learning

and training, as per

a survey by Bayt.

com.

83%

The percentage of UAE employees

who believe the gratuity does not

provide enough funds to cover

retirement expenses, according to a

research by Zurich International Life.

22%

AED 180b

Exports and re-exports of Dubai Chamber

members to GCC countries rose from AED

17 billion in 1998 to more than 10 times in

the past 15 years to reach AED180 billion

in 2014, according to a report issued by

the Dubai Chamber of Commerce and

Industry.

April 2015 | www.wealth-monitor.com

The survey of 1,000 UAE residents

also found that only one in five

respondents (22%) will use their

gratuity towards the cost of funding

their retirement.

24%

Instead, almost a quarter of employees

(24%) plan to use their gratuity as a

deposit to buy a property, while 22%

will use it to pay off debt. Another 8%

will pay school fees, rent or another

bill, while 7% will spend their gratuity

on a holiday or large luxury item.

5

OPENING BELL

News That Made Headlines

Investcorp Portfolio

Company L’azurde

Distributes $16.7m Dividend

Bahrain Bourse-listed Investcorp, the

asset management firm specialising

in

alternative

investments,

announced that its portfolio company

L’azurde, one of the world’s top five

gold jewellery manufacturers, has

distributed $16.7 million in dividends

to its shareholders, following a strong

performance in 2014.

The Investcorp Gulf Opportunity

Fund acquired a majority stake in

L’azurde in 2009 alongside Eastgate

Capital and The National Investor, its

consortium partners. After the gold

price shock in 2010, a new strategy

for the business was developed

with the objectives to strengthen

its operations and ensure it

was positioned to maximise

its

growth

potential,

while being insulated

from difficult market

conditions and gold

price volatility. Since

that time, L’azurde has

been steadily increasing

its earnings, achieving

double digit year-on-year

growth.

FITCH UPGRADES 7 QATARI BANKS

Fitch Ratings upgraded the Long-term Issuer Default Ratings

of Commercial Bank of Qatar, Doha Bank, Qatar Islamic Bank,

Al Khalij Commercial Bank Qatar International Islamic Bank and

Ahli Bank to ‘A+’ from ‘A’. The upgrade of all the Fitch-rated Qatari

banks’ IDRs follows the publication of Qatar’s Long-term IDR of

‘AA’ on 6 March 2015, which provides greater clarity over Qatar’s

ability to provide support to the banking sector in case of need.

The Qatari banking sector is healthy. Local banks are highly

capitalised and asset quality is solid with non-performing loans

at less than 2% of total loans, Fitch Ratings said in a statement.

Credit growth has slowed as the government has moved to

directly financing projects from intermediating via banks. There

is a demonstrated strong government commitment to its banks

and key public-sector companies, it said.

AIR ARABIA ANNOUNCES 9% CASH DIVIDEND

Senohrabek / Shutterstock.com

6

Following the conclusion of its Annual General Meeting (AGM), the

Board of Directors of Air Arabia announced that the assembly has

approved the distribution of a 9% cash dividend of the company’s

share capital for the year 2014, equivalent to 9 fils per share.

For last year, the net profit of Air Arabia, the largest low-cost carrier

in the Middle East and North Africa, reached AED 566 million, up

30% compared to the year earlier.

Air Arabia’s total turnover for 2014 reached AED 3.7 billion, an

increase of 17% on 2013, driven by increased passenger numbers.

The carrier served 6.8 million passengers in 2014, up 12% compared

to previous year. Air Arabia served 6.8 million passengers in the 12

months ending December 31, 2014, an increase of 12% compared

to previous year. The low-cost pioneer’s seat load factor – or

passengers carried as a percentage of available seats – reached an

impressive 81% in 2014.

www.wealth-monitor.com | April 2015

OPENING BELL

Gold, Stocks, Bonds Less Attractive To Gulf-Based Uber Rich: Survey

The GCC-based High Net Worth Individuals

(HNWIs) prefer to invest more of their

wealth in their own business and the real

estate rather than in gold, stocks and

bonds, according to a survey “GCC Wealth

Insight Report 2015”, published by Dubaibased Emirates Investment Bank.

33% of HNWIs surveyed preferred to

allocate their wealth in their own business

and 30% in the real estate, compared

to 17% in cash/deposits, 6% in direct

investment/private equity and stocks,

5% in gold/precious metals, and just 3%

in bonds. GCC HNWIs are however more

positive about the economic situation in

the Gulf region than globally, with 55%

saying the economic situation in the Gulf

is improving compared to 31% saying the

global economy is improving.

The GCC Wealth Insight Report 2015

is based on a survey of HNWIs from the

United Arab Emirates, Qatar, Kuwait, Saudi

Arabia, Oman and Bahrain. The survey was

undertaken in the fourth quarter of 2014,

a period that recorded the start of falling

oil prices, but did not capture the lowest

levels.

Respondents were more cautious

towards the global economy compared

to last year, with the view that the global

economic situation is worsening almost

doubling (29%) on last year (16%).

Nonetheless, the Report’s findings

were optimistic about the longer-term

prospects for both the Gulf region and the

global economy; 86% say they are very or

somewhat optimistic about prospects for

the Gulf region over the next five years

with 78% saying the same thing for the

global economy.

The more cautious approach to the

global economy taken by regional HNWIs

is matched by an increasing preference

to keep assets closer to home, which has

risen 19 percentage points since last year

to 83%. Those who prefer to keep assets

closer to home are most likely to say the

main reasons are confidence in the stability

of their local economy (39%) and a desire

to have greater personal control over their

investments (20%).

Regional HNWIs are also more likely to

April 2015 | www.wealth-monitor.com

have a local rather than international

bank to help manage their wealth

compared to last year, with 80%

saying they prefer to use a local

bank compared to 59% last year.

Respondents said they believe that

local banks provide easier access, have

a better understanding of the local

market or regulations, and are safer.

The top four factors for selecting a local

bank have not changed since last year

– HNWIs look for level of service, bank

reputation and brand, fees and pricing,

and investment expertise and global

access.

Philanthropy has also featured

prominently in GCC countries in this

year’s survey, with 86% of respondents

saying they dedicate a portion of their

wealth to charitable giving, mostly to

humanitarian charitable causes. 60%

of those HNWIs who currently allocate

a portion of their wealth to charity are

planning to increase their distribution

to charity in the near future.

A large majority of GCC HNWIs

(84% this year and 90% last year) are

persistently more focused on growing

than preserving their wealth, the

survey found.

Amlak Finance’s Net Profit at AED 59m

Amlak Finance, a Dubai-based real estate

financier in the Middle East, recorded net

profit attributable to its equity holders (after

non-controlling interest) of AED59 million in

2014. The financial results announced were for

the year ending on 31st December 2014, after

six years of market absence. The last time the

company published its financials was in 2008,

when it recorded net profits attributable to

equity holders of AED240 million.

According to WAM, total Revenue fell by

two thirds since 2008 as no new assets were

written during the six years of restructuring

negotiations. Total operating expenses fell

by 45% between 2008 and 2014 as a result

of cuts in business related activities and staff

headcount.

Ali Ibrahim Mohammed, Vice Chairman

of Amlak Finance, said, “The year 2014

was a significant turning point for Amlak

Finance. Firstly, we achieved profits for our

shareholders, marking a positive turnaround

in our business. We closed a long and complex

financial restructuring amicably with our

financiers under the guidance, and with the

valuable support, of the UAE Government and

the Steering Committee.

7

OPENING BELL

NATIONAL BONDS’ PRODUCTS GIVE

UP TO 4% RETURNS

10 Years of Innovation and Education

National Bonds, the sharia-compliant

savings and investments schemes provider

in the UAE, has announced that its savings

and investments products provided up to

4% annual returns to customers in 2014,

outpacing the returns provided by other

competitive financial institutions in the UAE.

National Bonds revealed that its One Year

Term Bonds offered 2.50% annual returns

while the Savings Bonds provided 1.20%

annual returns in comparison to other

savings accounts in the UAE, according to

WAM.

The longer the saving period for principal

deposits held with National Bonds, the

higher the annual returns. For instance, the

total returns on saving for nine years with

National Bonds amount to 56.81%, while

saving for five years awards 13.82% in total

annual returns. Savers investing AED100,000

and above enjoy 2.36% annual returns, while

those saving amounts of AED10,000 and

below receive 1.44% annual returns. National

Bonds also offers the three year Step-up

Bonds that provide an annual profit rate of

4%.

National Bonds is audited by the Dubai

government’s audit department and is

supervised by an independent fatwa and

sharia supervisory board, in addition to

external auditing entities.

DFM ENROLLS BROKERAGE FIRM

8

Dubai Financial Market (DFM) has

accredited Al Hadaf Financial Securities

to provide Margin Trading service, lifting

the total number of DFM brokerage firms

providing this service to 25 companies.

Margin Trading permits brokerage

Over the years, the Middle East

Retail Banking Forum and Expo has

successfully brought together banking

professionals from across the region

to learn about the latest innovations

within the industry. In April, the event

will be celebrating its 10th anniversary

with an expanded format with new

and exciting features that will keep

more than 1,000 industry professionals

engaged.

New Venue, New Format, New

Features

In keeping with celebrating such a

milestone, the 10th Middle East Retail

Banking Forum and Expo has moved to

a larger location in the heart of Dubai’s

finance district, at the impressive Ritz

Carlton, DIFC. This move has allowed

the event to expand from a must attend

conference to include a dedicated

exhibition which will host more than

80 international solution providers

across retail banking, payments and

financial technologies. More than

1,000 professionals can see, hear and

networking with some of the most

influential leaders within the industry.

Keeping the audience engaged, the

new and improved event will include:

-A packed 2 day conference where

industry gurus will present best practice

strategies and the latest case studies

across the key topics affecting the

industry.

-A free 2 day seminar programme

where attendees can hear about the

latest solutions to help to improve their

business.

-A free online networking tool where

likeminded professionals can network

before the event and arrange to meet

during the event.

Don’t miss this celebratory event.

Visit www.retailbanking-expo.com for

more information and to register.

companies to fund a percentage of the

market value of securities traded, and

secure as collateral for the same securities

or any other collateral as required by the

SCA’s license. DFM is currently processing

similar applications from other brokerage

firms in collaboration with the Securities

and Commodities Authority (SCA).

www.wealth-monitor.com | April 2015

OPENING BELL

Dubai Airports Projections Revised to 126m Passengers By 2020

Growth is pushing the Dubai Airports

— operator of Dubai International and

Al Maktoum International in Dubai

World Central — to expand. “Our revised

projections for 2020 now exceed 126

million passengers. By 2030, we expect to

have around 200 million passengers traffic,”

Paul Griffiths, Chief Executive Officer

of Dubai Airports, said at the Future of

Border International Conference in Dubai,

according to WAM.

Dubai International is currently

the world’s number one airport for

international passengers and the sixth

busiest. Al Maktoum International Airport

in DWC , which presently has five to seven

million passengers capacity, saw 845,046

passengers passing through its gates in its

first full year of operations in 2014.

DWC will have a passenger capacity of

220 million on completion of its second

phase. The first phase of $32 billion dollar

expansion of DWC, approved by His

Highness Sheikh Mohammed bin Rashid

Al Maktoum, Vice President and Prime

Minister of UAE and Ruler of Dubai last year,

will enable the facility to accommodate

120 million passengers on completion over

the next six to eight years.

Situated on a 140 sq. km site to the

south of Dubai, Al Maktoum International

will be 10 times larger than the site of

Dubai International, making it the world’s

largest airport and the world’s largest

intercontinental hub. The $7.8 billion

investment will lead to ultimate capacity

of 100 million passengers at the Dubai

International. Last year, it recorded 70.4

rely on aviation activities for the livelihood

which works out to 27% of the total

workforce in Dubai. “The vision for aviation

remains single minded and utterly focused

million passengers, an increase of 6.1 per

cent and this year expected to handle 79

million passengers.

In 2013, aviation contributed $26.7

billion to the economy of Dubai or 27% of

the emirate’s GDP. About 416500 people

on building that contribution at a faster

rate than any other activity in Dubai,” he

said. By 2030, the aviation’s contribution to

the Dubai economy will have increased to

$88 billion, more than three times the 2013

figure.

Philip Lange / Shutterstock.com

VAT Could Be a Reality if Oil Woes Continue

If the oil slump continues beyond the

near term, most oil exporters in the

GCC are expected

to move more

seriously towards a

fiscal consolidation

stance to avoid a

significant rundown

of foreign assets,

Washington-based

The Institute of

International

Finance (IIF) has

said.

Low-priority projects could be

postponed or phased over time without

impeding longer-term growth prospects

April 2015 | www.wealth-monitor.com

or diversification efforts.

“The tax base could be broadened,

including through

the introduction of

a Value Added Tax

(VAT) that would

provide additional

sources of nonoil

revenue and thus

reduce the burden

of

adjustment

needed on the

expenditure side,”

it said in a report ‘MENA: Lower Oil Prices

Present Challenges and Opportunities’.

More importantly, the rapid pace of

growth in domestic consumption of

petroleum products could be reduced.

This could be achieved by intensifying

ongoing efforts to improve efficiency and

by gradually raising the prices of domestic

petroleum products, the report said.

Banking systems in the GCC, with

relatively limited reliance on external

funding and comfortable liquidity, should

be reasonably resilient to low oil prices

in the next couple of years. The expected

modest increase in interest rates in the

U.S. during the second half of this year

and further increases in 2016 may tighten

financial conditions in the GCC countries

because of their exchange rate peg, and

eventually lead to some deceleration in

the growth of credit to the private sector.

9

FACE VALUE | FATHI BEN GRIRA

‘Fed Rate Hike Won’t Impac t

Investment Inflows Much’

Fathi Ben Grira, CEO, MENACORP, Dubai, tells Wealth Monitor that

even if the US Federal Reser ve decides to go for a rate hike, it won’t

have a big impact on regional investments

How would you describe the journey so far of

MENACORP as one of the largest financial services

companies in the region?

MENACORP’s performance so far has been excellent.

We’ve made our shareholders and more of our clients

happier. We were ranked the best brokerage firm for

the last two consecutive years. This shows that we’re a

consistent performer and we feel privileged that we’ve

managed to deliver the same quality of service all the

time. I believe this is the best way to remain at the top.

10

MENACORP has been in multiple business

verticals ranging from investment banking, asset

management, and brokerage. What are the other

business areas of growth you are seeing going

forward? What are your plans?

For us the number one priority is to add new

markets to our brokerage business. Our clients have

increasingly reposed trust and confidence and we’ve

been successful in executing trades in the best interest

of our clients. At the same time, our clients are keen

to explore profitable target markets in the region or

beyond for investment opportunities. And this is what

our strategy is focusing on. More specifically, we’re

going to focus closely during 2015-16 on the Dubai

Gold and Commodities Exchange. This is the market

in which we believe strongly, as it is extremely popular

with investors from the sub-continent and we want to

www.wealth-monitor.com | April 2015

Fathi Ben Grira, CEO, MENACORP, Dubai

FACE VALUE | FATHI BEN GRIRA

be able to serve our clients better in this

market.

Talking about the global market

conditions, the historically low interest

rates in the US have been driving global

investors in recent years to search for

yield in fast growing frontier/EMs,

including the UAE. The US Fed however

is expected to raise rates soon. Do you

believe the timing of a Fed rate hike is

good for the region when oil prices are

low?

We have to see if the Fed really goes for a

rate hike so soon. We’ve been expecting

it for quite some time, but the Fed has

maintained the status quo. The US

economy still needs a low interest rate

regime because it is fuelling their economy.

I don’t really expect a major change in the

whole Fed policy so soon.

However, even if the Fed decides to

go for a rate hike, I don’t think it would

impact much the investment flow in the

GCC region, as the investment inflow in

this region is more connected to the local

considerations than global. Nonetheless,

the impact of global factors are being felt

a little bit, especially in the case of Dubai

which is a tourist hub. For instance, the

Russian rouble slump against the dollar

has negatively impacted Russian tourist

inflow and Russian investment in Dubai

real estate since they now have to shell

out more roubles for the same amount of

dirham.

So is a stronger dollar not always good

for the UAE economy?

Aside from oil, the UAE and the region is

largely an import-based economy. So a

strengthening dollar has a positive impact

in terms of lower cost of living because

anything you buy in supermarkets that’s

coming from non-dollar denominated

countries costs less. At the same time, a

strong dollar makes this country more

expensive for overseas investors, as it

makes holidays in Dubai or hotel room

rates and realty investments in the region

more expensive for a German, Swiss or

French traveler or investor.

The outlook of crude oil looks bearish,

at least in the short term. How do you

assess the impact of weaker oil price

playing out in the UAE and the wider

region?

Initially, the impact was quite severe on

April 2015 | www.wealth-monitor.com

the regional financial markets, and worried

investors rushed to take their money off

the table.

But now after this knee-jerk reaction, the

dust is settling down and investors have

now become used to the conditions. The

great thing is that local governments like

the UAE have reiterated their commitments

to not curtail their infrastructure spending.

More importantly, the low oil price

poses an opportunity for the region’s

governments with huge fiscal reserves to

be more efficient.

The rise of the dollar against major

currencies has also brought down

the valuations of European equities,

because of the weaker Euro. Do you

believe many regional investors are now

finding European stocks more attractive

and are putting their money there than

keeping it in the region?

We recommend our clients to invest in

European markets especially in stocks

of companies that are more exportoriented and which sell their products

worldwide. This is largely because a weaker

euro benefits Europe’s export-oriented

companies, as it boosts their sales earnings

and makes them more competitive. We

therefore believe these companies are

good picks.

On the opposite side, in the US markets

we believe focusing on blue chips which

are leaders in the home market, as the

local US economy is gathering pace.

Nevertheless, despite European stocks

looking cheaper, we can’t say the money

will shift from here to Europe because

regional investors still like to invest in their

backyard, though it might be tempting for

sophisticated investors such as Sovereign

Funds to look at Europe.

The Q4 corporate earnings in the UAE

are a bit down from Q3. What according

to you explains this and what’s the

outlook for the rest of the year?

I don’t believe it’s something dramatic.

Now we’ve new catalysts coming for the

economy with the Expo 2020 in Dubai and

the 2022 FIFA World Cup in Qatar. I’m sure

after the Ramadan, you’ll see all the first

tenders issued for big projects, which will

need performance bonds and guarantees

from banks. This is going to have a

multiplier effect as it will benefit not only

the banks, but contracting companies, fitout companies and everyone else.

Saudi Arabia is about to open its equity

markets, the largest in the Middle East,

to foreign investors. What impact do you

believe it could have on other markets in

the region? Will we see a flight of capital

from UAE to Saudi markets?

The positive impact of it would be felt

across the region, since at the end of the

day all GCC stock markets are one big

market. Some fear the money will shift

from here to Saudi Arabia. To some extent,

it may be the case, but when international

investors would come to Saudi markets, it’ll

benefit the neighborhood markets as well.

Going forward, how do you assess the

overall investor sentiment in the UAE?

We are in a position of wait-and-see. The

first half of 2013 was amazing for UAE’s

stock markets but after that many investors

got their fingers burned largely because

of oil price slump and other issues. Now

these investors are expecting new catalysts

that I just talked about. Overall I believe

this market is maturing and investors are

learning that you can’t win all the time and

you have to accept your loss, wait for some

more time and then take wiser decisions.

There is growth happening in the UAE

and the region. Although there’s a little

bit of fear because of geo-political factors,

but at the end of the day the region is full

of opportunities with a young dynamic

population, who have deep faith in the

future of the UAE and the region.

Any particular sectors you are most

bullish on in the region?

I believe banking sector in the mid-term has

lot of potential. The population is growing

fast and new infrastructure projects are

coming up that need bank financing. The

banking sector though is facing some

challenges, especially related to the

deposits made by the governments which

could come down because of the cheaper

oil price making it a bit difficult for banks

to lend. However, for smart investors this

could be a good investment opportunity

if he chooses wisely the timing of when to

enter and exit banking stocks.

Are you bearish on any sector?

The real estate sector could face headwinds

if the Russian rouble weakening lingers.

Nevertheless, if the oil price goes up or

new catalysts related to Expo 2020 projects

come on stream, we can see investors

getting excited back again.

11

11

Point

BULLS VS BEARS | Crude Shock & Stock Prices

Decoupling

Have the crude oil prices and the GCC stock markets really decoupled, or at least

are showing any signs of decoupling? Does a drop in crude oil price threaten hard

times for Gulf economies and the markets? Three experts debate how deeper is the

correlation between the crude oil prices and GCC’s stock markets

C

Bulls

vs

Bears

12

rude oil is continuing its

bearish run. On March 16 this

year, it touched its lowest

level since 2009 as West Texas

Intermediate crude dropped to

$44.39 a barrel. Last year, Crude

oil price dropped by almost 55%,

sending shock waves across the

global stock markets including the

UAE and GCC region. In the UAE, the

Dubai Financial Market (DFM) which

was the best performing market in

the world in 2014 slipped to being

one of the worst in just over a month

last year.

On Feb 10 this year, ratings

agency S&P revised its outlook

on Saudi Arabia to negative from

stable following sharp decline

in oil prices, while it lowered its

sovereign credit ratings on Bahrain

and Oman. Economic diversification

has been one of the key elements

in the GCC. However, some believe

diversification efforts have met

limited success and oil price

continues to be the key element for

the Gulf economies and the regional

stock markets.

There’s another side to this

argument that the crude oil price

volatility is more a psychological

than a fundamental determinant for

the region. The Gulf economies’ huge

fiscal reserves along with growth in

non-oil sectors such as tourism, trade

and the real estate, will continue to

fuel the economies and remain the

major driver of growth than alone

the crude oil.

Wealth Monitor invited experts

to discuss the implications of low

crude oil prices on the performance

of GCC stock markets. We asked a

few questions from these experts,

such as how do you see the regional

economies’ outlook if oil price

continues to decline this year; do

they agree diversification efforts

have met limited success and

oil price continues to be the key

element for the GCC economies

and stock markets; do they believe

the magnitude of oil price shock

on the GCC and the UAE’s stock

markets is gradually waning; do they

believe oil price volatility is more a

psychological than a fundamental

determinant for regional economies,

as the Gulf economies’ huge fiscal

reserves will continue to fuel their

economies and remain the major

driver of growth than the oil price;

are they bearish or bullish for the

regional markets in the near term

and do they expect UAE’s and GCC’s

markets to consolidate in the short

term amid mixed global cues?

And here’s what they had to say….

www.wealth-monitor.com | April 2015

BULLS VS BEARS | Crude Shock & Stock Prices

MR Raghu, Senior Vice President-Research, Kuwait Financial Centre

Reserves As Cushion

The Brent crude oil price has rebounded

in Feb, and has reached above $60 per

barrel. Some of the GCC countries have

already released their budgets for this

year, and there doesn’t seem to be any

drop in government expenditure. In fact,

Oman, which doesn’t enjoy the cushion

of oil surplus reserves unlike Saudi, UAE

and Kuwait, has increased government

expenditure, and is preparing to face a

deficit situation. Saudi and Kuwait too have

released budgets with larger deficits, with

budgeted price assumptions pegged at

$55-63 for the former, and $45 for the latter.

Countries like Saudi Arabia and Kuwait have

built up substantial reserves during the

oil boom which cushions them from any

sudden impact on spending. If oil prices

go below $40 again, and remains there

and thereabouts for a sustained period of

time, then the regional economies may be

adversely affected.

Changing Correlation

In the last few years, the correlation

between the oil price and GCC markets

has moved towards a new dimension. GCC

stock markets react negatively to a fall in oil

prices but do not have a similar trend with

an upward move in oil prices. Prior to 2008,

the index values approximately followed

the movement in oil prices, while after

2008, the relationship changed slightly.

The gradual increase in oil price seen from

early 2009 till Apr 2011, had little or nil

effect on the index values of oil exporting

countries. This may be due to the regional

governments’ efforts to diversify away from

oil. Recent fall in oil price affected the GCC

indices after a lag, as the markets were

wary of medium to long term effect of

lower oil prices in government spending,

and also because of OPEC’s decision to not

cut the daily output target. So we believe

the magnitude of oil price shock on the

GCC markets is gradually decreasing.

UAE More Successful

While the governments have shown

the intent to diversify their respective

economies, the execution of the plans has

varied across the region. UAE has been

relatively more successful, while countries

like Kuwait have not. But despite the efforts

taken, oil revenues still contribute majorly

to the economies, and more efforts are

needed to improve non-hydrocarbon

economy in the region. For Saudi Arabia

and Kuwait the contribution of oil

revenues is still at 90% and 80% of total

revenues respectively which shows that

the diversification programs have not had

the desired effect.

GCC stock markets

react negatively to a fall

in oil prices but do not

have a similar trend with

an upward move in oil

prices

April 2015 | www.wealth-monitor.com

A Fundamental Determinant

The fiscal reserves accumulated so far are by

no means inexhaustible, and investors are

aware of the fact that oil price determines

the longevity of the accumulated reserves.

If in case low oil prices are sustained over

a period of time,

they will have an

adverse impact

on the regional

economies, and

will also eat up

the reserves at

the same time.

So

oil

price

volatility remains

a fundamental determinant of the

regional economies, until the efforts of

diversification bear fruit. According to the

IMF, the fiscal break-even price for Kuwait

is the lowest in the region at $54 while for

countries like UAE and Saudi Arabia, it is

higher at $80 and $98 respectively.

UAE’ Outlook Positive

While oil prices have plunged and

uncertainty prevails regarding its outlook,

we believe GCC governments have

accumulated significant reserves, offshore

assets and command robust surpluses that

could support continued infrastructure

and social spending. With GCC reserves

totalling over USD 2.8 Trillion, the key

economies command an expenditure

coverage ratio of over 3x, based on 2014

estimated expenditure figures. This should

provide sufficient comfort and cushion to

future government expenditure programs,

and allay investor fears about regional

prospects, which are predominantly fuelled

by government expenditure programs.

Our 2015 outlook for UAE remains positive

on the back of robust reserves, buoyant

economy, healthy earnings growth and

surging market liquidity while we are

neutral on other economies.

13

BULLS VS BEARS | Crude Shock & Stock Prices

Rajiv Kumar, Dy CEO, Phillip Futures DMCC, Dubai

Budgets Highly Reliant On Oil

Despite

progress

on

economic

diversification in the GCC over the

last decade, regional budgets remain

highly reliant on oil revenues and are

thus vulnerable to sustained changes

in oil prices. Lower revenues may force

governments to curtail their efforts to

tackle energy subsidy reforms as a result

impacting petrochemicals. Saudi Arabia

derives substantial revenues from the

hydrocarbons sector. Saudi Arabia’s

economy is undiversified and vulnerable

to a steep and sustained decline in the oil

price. However, Kingdom’s decision to give

bonuses to public sector workers recently

is a clear indication that the kingdom will

maintain currently budgeted public sector

spending. With a forex reserve of almost

$780 billion and government debt being 3

% of the GDP, indications are clear that in

the near term falling crude prices may not

have a drastic effect.

However, Qatar and UAE will be least

affected by sharp fall in oil prices due to

large scale diversification in non-oil sectors.

In fact, the current situation may also

turn out to be a trigger point for the GCC

economies to reduce their dependency on

Oil and diversify into other areas.

14

Limited Exceptions

The latest IMF regional economic outlook

points out that despite progress on

economic diversification in the GCC over

the last decade, regional budgets remain

highly reliant on oil revenues and are

thus vulnerable to sustained changes in

oil prices. Limited exception to these are

UAE and Qatar where diversification has

brought down the breakeven price of oil to

large extent. In fact, Dubai is an exception

in that it relies more heavily on trade,

tourism, real estate and construction, and

transportation and is enjoying favourable

economic conditions. Qatar also is moving

slowly in this direction by way of huge

infrastructure investments.

to enter

markets.

these

Correlation between oil

prices and performance

of local GCC markets will

largely be dependent

on the ability of the GCC

countries to diversify

their economies’ revenue

Fiscal Spending

A Key Driver

No doubt, poor

sentiment related

to oil prices could

slow

growth

next year however, big Gulf economies on

account of their large accumulated fiscal

and external reserves, can ride out an era of

lower oil prices without facing debt crises or

steep reductions in their economic growth.

Fiscal spending, a key driver of economic

growth in the region, will probably remain

unchanged. Secondly, dependency of

some of the GCC economies like the UAE

and Qatar on oil revenue has come down

on account of diversification.

Gulf economies are also facing intense

competition from non OPEC producers

to maintain their market share in the key

emerging markets, where they export.

As a consequence, they are offering deep

discounts to these key importers which will

prevent the oil price to rebound in the near

future.

The impact on overall spending plans by

respective economies are not going to be

significant unless the oil prices remains low

for a prolonged period as high oil prices

over the past four years have allowed the

GCC to build up massive financial reserves.

According to IMF report, the GCC states

held some $881 billion in official foreign

reserves in 2013. In fact, with the emerging

market status accorded to UAE and Qatar,

low prices in the DFM and ADX can actually

trigger a lot of funds inflow from Global

Institutions and Funds as the valuation

at this level may look attractive to them

Markets Will Remain Under Pressure

Down 13.3 percent this year, Kuwait’s index

is the worst performer in the Gulf whereas

Qatar so far has been the best performer.

UAE and Qatar markets may attract decent

foreign funds into the markets because

of the emerging market status accorded

to them. As a diversification step, Saudi

Arabia is also opening up its stock market

to international investors in the first half of

2015, giving foreigners greater access to

the Arab world’s biggest bourse.

Overall, markets will remain under

pressure however, some consolidation may

be seen in near term. Further it will recover

faster if oil price start rising.

Prolonged Drop Will Hurt

Correlation between crude oil prices and

performance of local GCC markets will

largely be dependent on the ability of

the local GCC countries to diversify their

economies revenue that is so far largely

dependent on crude oil revenues. The nonoil sector particularly construction and

retail trade will continue to drive economic

activity especially in UAE and Qatar.

www.wealth-monitor.com | April 2015

BULLS VS BEARS | Crude Shock & Stock Prices

Muhammad Shabbir, Head of Equity Funds And Portfolios,

Rasmala Investment Bank, Dubai

Limited Success in Diversification

Despite GCC governments efforts regarding

diversification of their economies most of

the economies are still too much reliant on

oil. The dependence is visible as share of

non-oil receipts to total receipts for the GCC

as a whole have only worsened between

2003 and 2013, from just over 23% to less

than 20%. Therefore we agree with the

notion that diversification have had limited

success. However, for a fuller picture one

needs to look at the trend in this ratio over

the last 10-15 years.

The magnitude of

the shock will depend

on the actions of

governments regarding

spending rather than

just on the oil price

Spending Also Matters

The correlation between oil and the regional

stock markets spiked to 0.9 in December

2014 compared to around 0.5 during the

period between Jan 2012 to June 2014.

Since then it has come down a bit but is still

at elevated level. We believe going forward

the correlation will remain significant but

the magnitude of the shock will depend on

the actions of

governments

regarding

spending rather

than just on the

oil price.

Fundamentals

To Rule In Long

Term

We partially agree with the statement

(that oil price volatility is more a

psychological than a fundamental

determinant for regional economies, as

the Gulf economies’ huge fiscal reserves

will continue to fuel their economies and

remain the major driver of growth than

the oil price). As was mentioned in the

previous point the real determinant will

be how those reserves will be spent during

the period when oil prices are either low

or volatility is high. While influence of the

psychological factor will be high in the

short term, the fundamental factors will

rule over the longer term.

Consolidation in Near Term

We expect some consolidation in the

near term as earnings will be pressured

for names which are more linked to oil

prices and investors wait for more cues

regarding spending by both corporates

and governments.

Wrapping Up

April 2015 | www.wealth-monitor.com

While there is a strong correlation between the GCC countries and oil price, the extent of

correlation is not homogeneous for all countries in the region. Whilst for markets such as Qatar

and the UAE whose dependency on oil has come down due to their economies’ diversification

in non-hydrocarbon sectors, the impact of dip in oil price is going to remain varied there from

that in other economies of the region. Nevertheless, if the world is going to experience much

more than a temporary dip in oil price, it could have a knock-on effect on the overall investor

sentiment in the region.

15

PORTFOLIO | E-commerce

IT’S

CLICKING

More and more buyers in the UAE and the region are shopping online. But

does the rise of e-tailers pose a challenge to brick-and-mortar shopping

centres and mega malls in the UAE and the region, or do they supplement

each other? Sunil Kumar Singh explores in this cover story

16

www.wealth-monitor.com | April 2015

PORTFOLIO | E-commerce

L

et’s do a little bit of number-crunching

first. One company with just 2 years

in operation and a whopping 500%

jump in sales year-on-year. And it is for real!

The UAE-based online shopping platform,

awok.com, has done just that.

Awok.com is just a case in point. There

are a host of online retailers in the UAE and

the region that are raking in the moolah

through selling products online.

Online retail in the region has taken a

giant leap and is still growing. Log on to

any of the sites, such as souq.com, namshi.

com, jadopado.com, and you’ll invariably

be lost in a world of almost infinite choice

or get mystified by the multiplicity of

branded products that are available at a

bargain price.

Online shopping is fast catching the

fancy of shoppers in the UAE. According

to Online Shopping Behaviour Study 2014

conducted by MasterCard, over 50% of

those surveyed indicated they access the

Internet for online shopping of which more

than 80% said they were highly satisfied

with their online shopping experience.

Jockeying For Position?

So as more and more shoppers log on to

shop, is it a warning bell for the malls in

the UAE? Will they struggle to maintain

customer loyalty? Is online retail out to

trump traditional shopping malls? Far from

it.

No doubt, the UAE, and especially

Dubai, has established itself as a shopping

paradise, thanks to behemothic malls

showcasing high-street brands and

attracting shoppers from around the

world. But when it comes to comparing

online and offline retail in the region, many

tend to pit conventional retail against

online retail.

There is no competition between the

two, shrug off experts!

“The growth of online retail and

commerce quadrupled in the last couple

of years due to the accelerating growth

and continuing influence of the Internet

internationally, the high rate adoption

regionally and the proliferation of online

businesses and services. However, the

online retail sector is still behind compared

April 2015 | www.wealth-monitor.com

f

to the global benchmarks,” argues Adey

Salamin, Founder & CEO, iMENA Group,

Dubai.

Despite rapid strides, sales through

online channels in the UAE and the wider

Middle East & Africa (MEA) region still

comprise a minuscule of the entire retail

sales pie.

According to eMarketer, in 2015 while

the total ecommerce retail sales (excluding

travel and event tickets) is expected to

touch $25.24 billion in the MEA region,

it’ll be a paltry 2.9% of the total retail sales.

Next year, the figure is expected to touch

$31.48 billion and 3.3% respectively, while

in 2017 this is not expected to improve

much with $38.51 billion and 3.7% share

respectively ( See Catching the...)

More Than Shopping Venues

The GCC and particularly Dubai has been a

global shopping paradise and will remain

so despite coming up of multiple online

retailers, believe experts.

One of the greatest reasons behind

it is the popularity of malls as the hub of

17

17

PORTFOLIO | E-commerce

the most required sizes in store, will

continue to attract shoppers to malls and

departmental stores in the region, he adds.

Market Size in 2014 - US$ bn

4,000

3,600

3,200

2,800

2,400

2,000

1,600

1,200

800

400

0

Internet Retailing

The GCC and particularly

Dubai has been a global

shopping paradise and

will remain so despite

coming up of multiple

online retailers, believe

experts

4,000

3,600

3,200

2,800

2,400

2,000

1,600

1,200

800

400

0

Asia-Pacific

Western Europe

Latin America

North America

Source: Euromonitor International, “Top 10 Global Consumer Trends for 2015”

entertainment, leisure, dining, recreation,

and, of course, shopping, all under one roof.

The colossal malls in Dubai and the region

are more of a destination for family and

entertainment than just plain shopping,

giving them an edge over online retailers.

“In the Gulf, mall shopping is very much

a social and recreational event. Younger

consumers when it comes to fashion like

to shop with a small group of their peers

perhaps having searched online and shared

the results via social media prior to making

an actual purchase in a conventional

shopping centre,” says Simon Thomson,

Founder & Principal, Retail International

UK, a retail consultancy firm.

Ambience, attractive offer, good choice

of merchandise and sufficient stock of

Store-based Retaling

Coming Together

For many offline retailers in the region,

the online channel is increasingly

becoming a supplementary tool to

support their business, as opposed to

a being a competitor. There’s no more

watertight door keeping online and offline

retailers apart, thanks to the adoption of

omnichannel strategy.

Omnichannel approach gives buyers

the freedom to buy any merchandise, for

example a shirt, either by walking into

a store and purchasing the product or

surfing the Internet through a mobile

phone and ordering online. The customer

can either buy the shirt online or try it out

Market Size in 2014 - US$ bn

David Macadam, CEO, Middle East

Council of Shopping Centres

Sizing Up the Market

are scaling up their online presence too.

Jumbo Group in the UAE, for instance, sells

its products through its online store too.

Similar is the case with other retailers such

as Sharaf DG, Giordano, among others.

“Offline retail isn’t going anywhere, and

online is here to stay. Contrary to what

either sector would have you believe,

in any of that particular brand’s stores, and

buy it there. Either through purchasing

online or offline the customer can return

the shirt online if it’s not fitting well or

return the shirt to the traditional shop.

Additionally, brick-and-mortar retailers

Catching the Retail Pulse: How Middle East & Africa Stack Up

Retail Ecommerce Sales Growth (% change)

Asia-Pacific

2013

39.7

38.0

s growth

Sale

29.7

27.1

16.6

16.0

Central & Eastern Europe

2014

29.9

26.3

22.6

16.1

15.8

15.8

Latin America

2015

18

2016

2013

2014

2015

2016

2017

24.5

2017

28.2

20.5

20.5

22.7

24.7

16.9

26.3

15.4

22.3

16.4

14.4 13.6

13.1 10.8

15.9

12.3 9.7

North America

Middle East & Africa

Western Europe

www.wealth-monitor.com | April 2015

PORTFOLIO | E-commerce

Omar Kassim, Founder, JadoPado

we’re rapidly approaching a time of omnichannel commerce, where retail serves

customers across multiple channels,

regardless of whether they’re in-store,

online, on mobile or otherwise,” says Omar

Kassim, Founder, JadoPado, an online

marketplace to buy and sell products.

Fairer Deal?

The cost of goods sold online in the

region could be lower due to the lower

operational and distribution cost involved,

compared to physical malls or stores.

However, the difference in prices in many

cases isn’t significant.

This is because in the UAE and the region

there is no tax for buying products online

or in traditional retail shops. In developed

markets such as the USA, online shoppers

do not pay tax at the same level as

traditional retail shops.

“Generally in this region I don’t see

any substantial differences in the price

of merchandise bought either online or

offline. The advantage of online shopping

is wider than just the price differential, i.e.

a customer is able to source and shop a

variety of products from anywhere in the

world even though it might not be freely

available in the conventional store located

in that country or region,” argues David

Macadam, CEO, Middle East Council of

Shopping Centres, Dubai.

This means buying online isn’t the

cheapest deal always, at least in this

region. If you’re a bargain hunter, you can

get great deals on street markets in Dubai

as opposed to online. You can buy, for

example, an Apple iPhone 6 Plus - 16GB,

4G LTE, Gold at just AED 2700, from an

Retail Ecommerce % of Total Retail Sales

Adey Salamin, Founder & CEO,

iMENA Group, Dubai

electronics shop in Bur Dubai, if you aren’t

terrified of haggling, even though it’s

selling a tad higher at AED 2749 on a few

online shopping sites in the UAE (price as

on March 12).

Price apart, however, what distinctly

separates the online buying behaviour

of this region vis-à-vis rest of the world

is the majority of younger generation

shoppers who’re not so price conscious

(unlike many markets such as India where

value chase is what that’s bringing more

and more shoppers online, causing many

conventional retailers to lose a chunk of

their customers).

Value chase therefore is not the biggest

determinant or the pull factor driving

buyers to log on and shop, as is the wider

choice and convenience that it offers. This

is what’s giving ample space to both online

Retail Ecommerce Sales Worldwide, by Region, 2013-2017 (billions)

2017

10.5

8.3

8.5

3.2

3.7

3.2

2017

1148.15

2016

9.4

7.6

7.8

3

3.3

2.9

2016

953.21

2015

8.2

7

7.1

2.7

2.9

2.6

765.38

2014

2015

7

6.4

6.3

2.5

2.4

2.3

2013

5.9

5.7

5.5

2.3

2.1

2.1

480.16

38.51

75.36

355.59

427.48

31.48

65.04

377.82

2014

597.25

2013

459.86

20

282.7

48.41

285.26

244.11

16.32

29.54

55.12

64.43

25.25

321.04

56.38

330.29

41.69

April 2015 | www.wealth-monitor.com

390.17

Source: eMarketer, Dec 2014

Hosam Arab, Co-founder and

Managing Director, Namshi.com

37.29

45.75

19

PORTFOLIO | E-commerce

What Lies Ahead

One thing is sure that online shopping in

the region isn’t a fad among youngsters any

more. However, despite rapid strides made

by online retail in the region riding on the

growth of Internet users, there’s a little

probability of it taking on the conventional

shopping behemoths head on.

Both segments are comfortable playing

in their own turf and are not poles apart,

as is the case in many markets around

the world. Above all, the adoption of

omnichannel strategy is making the

difference between online and offline retail

indistinct.

Secondly, the online retail biggies such

as amazon, ebay are yet to see the region

as an opportunity. Another factor limiting

the growth of online retail is the preference

for cash-on-delivery payment mode than

paying through credit cards.

Shoppers mostly buy cash-on-delivery

through online portals, which is less

efficient for the retailers and a limitation

for the growth of online retail in the region.

When more and more online shoppers pay

through their credit cards, these online

portals will enjoy a greater reach, maintain

experts.

“The challenge however in the UAE

and the region is that many buyers prefer

to pay through cash-on-delivery mode

as generally they don’t trust paying

through their credit cards online. That’s

a key difference between developed

online markets like the west (where most

shoppers buy online through their credit

cards) and this region where cash-ondelivery is the major payment mode,” says

Macadam.

There are some issues with logistics,

Hot Online Deals In GCC

20

The GCC region is increasingly becoming

a high growth market for e-commerce

deals. This year two major deals hogged

the limelight. In February this year, German

e-commerce firm Rocket Internet agreed to

acquire 100% of the shares in Kuwait-based

online food takeaway firm Talabat, for approximately EUR 150 million. In another

deal, global online food delivery company

foodpanda in February announced that it

acquired food delivery business 24h.ae in

the Middle East. In another development,

last year, Souq.com, the largest ecommerce

platform in the MENA region, secured US$75

million (AED 275.5m) in an additional round

of funding from existing investor Naspers

Limited. This round of funding brought the

total amount raised by Souq.com to US$150

million (AED 551m) – the largest amount

raised by any Internet-based business in the

region.

Top Online Shopping Trends in GCC

and conventional retailers to expand here,

without encroaching upon each other’s

turf.

“For online businesses, wider choice

and convenience are major factors that

encourage consumers to shop online.

Choice is definitely a motivator; while

we do not believe that value is equally

as important. That is not to say that as a

retailer, one should not focus on offering

value, but the younger generation is

largely driven by choice and convenience,

much more so than they are by value,” says

Hosam Arab, MD and Co-Founder, Namshi,

an online fashion retailer, where younger

consumers make up a large portion of its

customer base with 70% of all its customers

between the ages of 18 and 34.

warehousing and funding too.

“The only challenge for us in terms

of expansion and logistics is that we

are required to stock our products and

maintain warehouses. But these problems

are comparably nothing than what

traditional businesses face. In terms of IT

and bandwidth we don’t face any problem,”

says Ulugbek Yuldashev, Founder and CEO,

awok.com.

Adds Adey Salamin of iMENA Group,

“We believe that the high cost and large

startup capital required to set up and run

an e-retail business — given the need for

offline transportation and warehousing

— is an obstacle to the success of this

business model in the region. This is due to

the scarcity of financial resources (in terms

of funding) and the fragmented nature

of the region’s markets, not to mention

challenges with online payments due to

the conventionality and traditionalism of

banking institutions in MENA.”

Time is a major factor in this fast growing

market. Businesses that enter too late in

the game will be pushed out of the market

in the long term, he cautions.

UAE

Ecommerce sites

Websites offering coupons and

deals, home appliances or

electronic products and apps

stores.

Sites Seeing

Increase In

Visitors:

Entertainment-specific portals

including movie theatres, sites

for music downloads, digital

content for entertainment,

books, CDs and DVDs, and

paid-for local and international

news websites.

Sites Seeing

Decrease In

Visitors:

Top 3 Items Bought

Through Mobile

Phones:

Airline tickets

Mobile apps

Coupons or deals

www.wealth-monitor.com | April 2015

PORTFOLIO | E-commerce

What Buyers in MENA Shop Most Online

Insurance (e.g., car, home, life)

Car spare parts and

accessories

5%

Media products

(e.g., books, DVDs,

CDs)

Borrowing services

(e.g., loans and

mortgages)

4%

3%

9%

Digital

technology (e.g.,

TV, cameras,

Mp3s)

Airline tickets

22%

20%

12%

19%

16%

Clothing,

accessories,

and cosmetics

Hotel bookings

17%

17%

Media

downloads

(e.g., e-books,

movies, Mp3s)

Computers,

laptops, and

tablets

Oman

Qatar

Saudi Arabia

Souq, Cobone and Amazon

Souq, Amazon, eBay, Saudi

Airlines

Websites offering coupons and

deals, beauty-care brands and

apps stores.

Airline portals, websites offering

home appliances, electronic

products and app stores.

Sites offering travel, groceries,

music.

Computer software websites,

travel, personal education and

professional development

websites, as well as paid-for local

and international news websites.

Computer software, coupons

and deals, personal care and

medicines.

Home appliances websites,

online gaming, and computer

software sites.

Source: 2014 Online Shopping Behaviour Study by MasterCard

Mobile

subscriptions

and credit

Mobile phones

Source: Booz & Company–Google Arab Digital Generation survey 2012

10%

21

Mobile phones

Music

Airline tickets

April 2015 | www.wealth-monitor.com

Mobile apps

Toys & gifts

Airline tickets

Groceries

Movie tickets

Music

PORTFOLIO | E-commerce

Tipping

Point

M-Commerce in the UAE is gaining momentum

with increasing number of shoppers using

their mobile devices to make purchases online,

writes Manickam Ravindran

G

22

lobally, mobile commerce is

estimated to grow from roughly

$102 billion in 2013 to around $291

billion in 2016, according to a survey report

of PayPal, in association with the market

research company Ipsos covering the e

commerce habits of 17,600 consumers in

22 countries.

As per the survey, in the UAE, mobile

shopping makes up for 24% of overall

online spending closely followed by China

at 21% and Turkey, at 19% respectively.

In terms of smartphone shopping

density, more than 68% of Chinese online

consumers said they have used their

mobile devices to make purchases on a

smartphone in 2014. The number is only

slightly lower for UAE shoppers, at 57%, and

53% for Turkish consumers. In the US, 31%

of consumers report that they have used

their smartphones to shop in the past 12

months.

Overall, a third of online shoppers

surveyed by PayPal said they have used

their smartphone for making an online

purchase in the past 12 months. The

increase in mobile shopping is being driven

by smartphone shoppers in the age group

of 18-34 (59% of smartphone shoppers in

that age bracket reported using mobile to

shop online).

Globally, 64% of smartphone users

reported using an app for purchases as

opposed to the 52% who used mobile

browsers. The reasons cited for that are

convenience and speed. Convenience was

cited by 35% of users and speed by 30%.

Instant payment confirmation and having

a reminder in the app to use discounts or

coupons were two other major reasons

cited by those surveyed.

In terms of actual mobile shopping

behaviour, 36% of consumers say they use

mobile to get info on a product, 27% use

mobile to find a business and 25% use

devices to read reviews on particular stores

or products. But 33% of the consumers

surveyed reveal that in the future, they are

interested in using their smartphones for

more mobile-centric tasks.

Three of the top five players in the mobile

commerce space is from Asia (China, Japan

and Indonesia) and they account for $280

billion worth of turnover in 2014, according

to the PayPal survey.

In North America, the US market

generates billions worth of mobile retail

sales, with its share on total online retail

reaching over 15%. In Latin America,

mobile shopping is on the rise, as mobile

penetration grows and retailers introduce

mobile apps with Mexico leading the pack

followed by Brazil, the region’s largest

retail market and Argentina. In Central

Europe, Germany leads in penetration

of smartphone/tablet owners who shop

on mobile at least once a week with

m-Commerce sales accounting for 10% of

the total online retail sales in 2013.

In Western Europe, the UK leads by share

of mobile retail on total B2C e-commerce

sales, with sales from tablets growing

faster than sales from smartphones. In

France, over a quarter of online shoppers

preferred to purchase from mobile in 2014,

while in the Netherlands over 2 million

people already engage in mobile shopping.

In Eastern Europe, mobile shopping is

capturing a growing share of the retail

sales pie. In Asia-Pacific, South Korea sets

the newest trends for global m-commerce,

such as integration of mobile shopping into

messaging platforms.

In Japan, a high double-digit share of

mobile users shops via their devices. The

number of mobile Internet users in China

topped half a billion in 2013, with over

a hundred million of them engaging in

m-commerce.

Both in South Africa and in the UAE the

share of Internet users shopping though

mobile phones shows an uptrend. Mobile

commerce has a high potential in the

Middle East, as smartphone and tablet

penetration is high, and mobile is often the

most common mode of connection to the

Internet in the region.

www.wealth-monitor.com | April 2015

MARKETS C

SMOS

In this section, Manickam Ravindran analyses news and data from the regional and