Review for Exam 2

advertisement

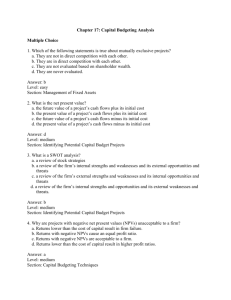

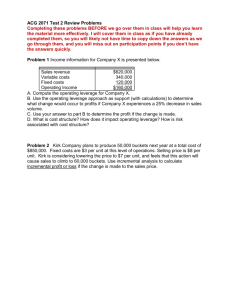

Review for Exam 2 Instructions: Please read carefully • • • • The exam will have 20 multiple choice questions and 4 work problems. Questions in the multiple choice section will be either concept or calculation questions. The calculation questions will be similar to those in the quizzes, assignment, and review. However, the concept questions will be related to any topic we have covered in the class. The concept questions in the review are only some sample questions. You should NOT study only topics in the review. For the work problems, you need to solve the problems without knowing the possible answers. The questions will be similar to those in the quizzes, assignment, and review except that the possible solutions are not given. You can bring a formula sheet to the exam. Chapter 7 COUPON 1. The stated interest payment, in dollars, made on a bond each period is called the bond’s: a. coupon. b. face value. c. maturity. d. yield to maturity. e. coupon rate. DISCOUNT BONDS 2. A bond with a face value of $1,000 that sells for less than $1,000 in the market is called a _____ bond. a. par b. discount c. premium d. zero coupon e. floating rate DEBENTURES 3. The unsecured debts of a firm with maturities greater than 10 years are most literally called: a. unfunded liabilities. b. sinking funds. c. bonds. d. notes. e. debentures. PROTECTIVE COVENANT 4. Parts of the indenture limiting certain actions that might be taken during the term of the loan to protect the interests of the lender are called: a. trustee relationships. b. sinking funds provisions. c. bond ratings. d. deferred call provisions. e. protective covenants. REAL RATES 5. Interest rates or rates of return on investments that have been adjusted for the effects of inflation are called _____ rates. a. real b. nominal c. effective d. stripped e. coupon BOND PRICES AND YIELDS 6. All else constant, a bond will sell at _____ when the yield to maturity is _____ the coupon rate. a. a premium; higher than b. a premium; equal to c. at par; higher than d. at par; less than e. a discount; higher than INTEREST RATE RISK 7. Which one of the following statements is correct concerning interest rate risk as it relates to bonds, all else equal? a. The shorter the time to maturity, the greater the interest rate risk. b. The higher the coupon rate, the greater the interest rate risk. c. For a bond selling at par value, there is no interest rate risk. d. The greater the number of semiannual interest payments, the greater the interest rate risk. e. The lower the amount of each interest payment, the lower the interest rate risk. INTEREST RATE RISK 8. You own a bond that has a 7 percent coupon and matures in 12 years. You purchased this bond at par value when it was originally issued. If the current market rate for this type and quality of bond is 7.5 percent, then you would expect: a. the bond issuer to increase the amount of each interest payment on these bonds. b. the yield to maturity to remain constant due to the fixed coupon rate. c. to realize a capital loss if you sold the bond at the market price today. d. today’s market price to exceed the face value of the bond. e. the current yield today to be less than 7 percent. TERM STRUCTURE OF INTEREST RATES 9. The term structure of interest rates reflects the: a. pure time value of money for various lengths of time. b. actual risk premium being paid for corporate bonds of varying maturities. c. pure inflation adjustment applied to bonds of various maturities. d. interest rate risk premium applicable to bonds of varying maturities. e. nominal interest rates applicable to coupon bonds of varying maturities. PRICE OF COUPON BOND 10. Wine and Roses, Inc. offers a 7 percent coupon bond with semiannual payments and a yield to maturity of 7.73 percent. The bonds mature in 9 years. What is the market price of a $1,000 face value bond? a. $953.28 b. $953.88 c. $1,108.16 d. $1,401.26 e. $1,401.86 PRICE OF ZERO COUPON 11. Your firm offers a 10-year, zero coupon bond. The yield to maturity is 8.8 percent. What is the current market price of a $1,000 face value bond? a. $430.24 b. $473.26 c. $835.56 d. $919.12 e. $1,088.00 TREASURY QUOTE AND CURRENT YIELD 12. A Treasury bond is quoted at a price of 103:23 with a 4.625 coupon. The bond pays interest semiannually. What is the current yield on one of these bonds? a. 4.46 percent b. 4.54 percent c. 4.63 percent d. 4.68 percent e. 4.74 percent FISHER EFFECT 13. The bonds of Frank’s Welding, Inc. pay an 8 percent coupon, have a 7.98 percent yield to maturity and have a face value of $1,000. The current rate of inflation is 2.5 percent. What is the real rate of return on these bonds? a. 5.32 percent b. 5.35 percent c. 5.37 percent d. 5.42 percent e. 5.48 percent 14. Kiddy and Kat, Inc. has 6 percent semi-annual bonds outstanding with 11 years to maturity. The price these bonds is $1015.60. What is the yield to maturity? a. 5.81 percent b. 5.92 percent c. 6.07 percent d. 6.10 percent 15. Black and White, Inc. offers an 8 percent bond with a yield to maturity of 8.35 percent. The bond pays interest annually and matures in 19 years. What is the market price of one of these bonds if the face value is $1,000? a. $958.08 b. $966.94 c. $967.22 d. $1,033.61 16. A zero coupon bond is currently priced to yield 6.3 percent (YTM = 6.3%) if held to maturity 14.5 years from now. What is the current price of this bond if the face value is $1,000? a. $406.81 b. $409.12 c. $412.35 d. $414.14 17. The bonds of B&O, Inc. are currently priced at $995.40 and have a 7.25 percent coupon. The bonds pay interest semi-annually and mature in 12 years. What is the current yield on these bonds? a. 7.14 percent b. 7.23 percent c. 7.28 percent d. 7.31 percent 18. A semi-annual, five-year bond is currently selling for $1,122 and has a yield to maturity of 6.13 percent. What is the coupon rate of this bond if the face value is $1,000? a. 4.5 percent b. 6.0 percent c. 7.5 percent d. 9.0 percent Chapter 8 PROXY VOTING 19. The voting procedure where a shareholder grants authority to another individual to vote his/her shares is called _____ voting. a. democratic b. cumulative c. straight d. deferred e. proxy NYSE MEMBER 20. The owner of a seat on the New York Stock Exchange is called a(n) _____ of the exchange. a. friend b. member c. agent d. trustee e. dealer COMMISSION BROKER 21. A member of the New York Stock Exchange who executes buy and sell orders from customers once transmitted to the exchange floor is called a: a. floor trader. b. dealer. c. specialist. d. floor broker. e. commission broker. DIVIDEND YIELD AND CAPITAL GAINS 22. The total rate of return earned on a stock is comprised of which two of the following? I. current yield II. yield to maturity III. dividend yield IV. capital gains yield a. I and II only b. I and IV only c. II and III only d. II and IV only e. III and IV only STOCK MARKET REPORTING 23. The closing price of a stock is quoted at 22.87, with a P/E of 26 and a net change of 1.42. Based on this information, which one of the following statements is correct? a. The closing price on the previous day was $1.42 higher than today’s closing price. b. A dealer will buy the stock at $22.87 and sell it at $26 a share. c. The stock increased in value between yesterday’s close and today’s close by $.0142. d. The earnings per share are equal to 1/26th of $22.87. e. The earnings per share have increased by $1.42 this year. STOCK VALUE 24. Angelina’s made two announcements concerning their common stock today. First, the company announced that their next annual dividend has been set at $2.16 a share. Secondly, the company announced that all future dividends will increase by 4 percent annually. What is the maximum amount you should pay to purchase a share of Angelina’s stock if your goal is to earn a 10 percent rate of return? a. $21.60 b. $22.46 c. $27.44 d. $34.62 e. $36.00 REQUIRED RETURN 25. The current yield on Alpha’s common stock is 4.8 percent. The company just paid a $2.10 dividend. The rumor is that the dividend will be $2.205 next year. The dividend growth rate is expected to remain constant at the current level. What is the required rate of return on Alpha’s stock? a. 10.04 percent b. 16.07 percent c. 21.88 percent d. 43.75 percent e. 45.94 percent CONSTANT DIVIDEND 26. You have decided that you would like to own some shares of GH Corp. but need an expected 12 percent rate of return to compensate for the perceived risk of such ownership. What is the maximum you are willing to spend per share to buy GH stock if the company pays a constant $3.50 annual dividend per share? a. $26.04 b. $29.17 c. $32.67 d. $34.29 e. $36.59 GROWTH DIVIDEND 27. The Merriweather Co. just announced that they are increasing their annual dividend to $1.60 and establishing a policy whereby the dividend will increase by 3.5 percent annually thereafter. How much will one share of this stock be worth five years from now if the required rate of return is 12 percent? a. $21.60 b. $22.36 c. $23.14 d. $23.95 e. $24.79 PREFERRED STOCK 28. Butterup’s ‘N More wants to offer some preferred stock that pays an annual dividend of $2.00 a share. The company has determined that stocks with similar characteristics provide a 9 percent rate of return. What price should Butterup’s expect to receive per share for this stock offering? a. $18.35 b. $20.00 c. $21.80 d. $22.22 e. $24.22 Chapter 9 Use the following information to answer questions 29 through 31. You are analyzing a proposed project and have compiled the following information: Year Cash flow 0 -$135,000 1 $ 28,600 2 $ 65,500 3 $ 71,900 Required payback period 3 years Required return 8.50 percent ________ 29. What is the net present value of the proposed project? a. $3,289.86 b. $3,313.29 c. $4,289.06 d. $4,713.71 ________ 30. What is the discounted payback period? a. 2.57 years b. 2.64 years c. 2.87 years d. 2.94 years ________ 31. Should the project be accepted based on the internal rate of return (IRR)? Why or why not? a. yes; The project IRR is greater than the required return. b. yes; The project IRR is equal to zero. c. no; The project IRR is greater than the required return. d. no; The project IRR is greater than zero. DISCOUNTED PAYBACK RULE 32. The discounted payback rule states that you should accept projects: a. which have a discounted payback period that is greater than some pre-specified period of time. b. if the discounted payback is positive and rejected if it is negative. c. only if the discounted payback period equals some pre-specified period of time. d. if the discounted payback period is less than some pre-specified period of time. e. only if the discounted payback period is equal to zero. INTERNAL RATE OF RETURN 33. The discount rate that makes the net present value of an investment exactly equal to zero is called the: a. external rate of return. b. internal rate of return. c. average accounting return. d. profitability index. e. equalizer. NET PRESENT VALUE 34. The primary reason that company projects with positive net present values are considered acceptable is that: a. they create value for the owners of the firm. b. the project’s rate of return exceeds the rate of inflation. c. they return the initial cash outlay within three years or less. d. the required cash inflows exceed the actual cash inflows. e. the investment’s cost exceeds the present value of the cash inflows. INTERNAL RATE OF RETURN 35. The internal rate of return is: a. more reliable as a decision making tool than net present value whenever you are considering mutually exclusive projects. b. equivalent to the discount rate that makes the net present value equal to one. c. difficult to compute without the use of either a financial calculator or a computer. d. dependent upon the interest rates offered in the marketplace. e. a better methodology than net present value when dealing with unconventional cash flows. PROFITABILITY INDEX 36. Analysis using the profitability index: a. frequently conflicts with the accept and reject decisions generated by the application of the net present value rule. b. is useful as a decision tool when investment funds are limited. c. is useful when trying to determine which one of two mutually exclusive projects should be accepted. d. utilizes the same basic variables as those used in the average accounting return. e. produces results which typically are difficult to comprehend or apply. NET PRESENT VALUE 37. You are considering the following two mutually exclusive projects. The required rate of return is 11.25 percent for project A and 10.75 percent for project B. Which project should you accept and why? Year 0 1 2 3 a. b. c. d. e. Project A -$48,000 $18,400 $31,300 $11,700 Project B -$126,900 $ 69,700 $ 80,900 $ 0 project A; because its NPV is about $335 more than the NPV of project B project A; because it has the higher required rate of return project B; because it has the largest total cash inflow project B; because it returns all its cash flows within two years project B; because it is the largest sized project INTERNAL RATE OF RETURN AND NET PRESENT VALUE 38. You are considering two independent projects with the following cash flows. The required return for both projects is 10 percent. Given this information, which one of the following statements is correct? a. b. c. d. e. Year Project A Project B 0 -$950,000 -$125,000 1 $330,000 $ 55,000 2 $400,000 $ 50,000 3 $450,000 $ 50,000 You should accept project B since it has the higher IRR and reject project A because you can not accept both projects. You should accept project A because it has the lower NPV and reject project B. You should accept project A because it has the higher NPV and you can not accept both projects. You should accept project B because it has the higher IRR and reject project A. You should accept both projects if the funds are available to do so. PROFITABILITY INDEX 39. What is the profitability index for an investment with the following cash flows given a 9 percent required return? Year 0 1 2 3 a. b. c. d. e. Cash Flow -$21,500 $ 7,400 $ 9,800 $ 8,900 .96 .98 1.00 1.02 1.04 PAYBACK PERIOD 40. Jack is considering adding toys to his general store. He estimates that the cost of inventory will be $4,200. The remodeling expenses and shelving costs are estimated at $1,500. Toy sales are expected to produce net cash inflows of $1,200, $1,500, $1,600, and $1,750 over the next four years, respectively. Should Jack add toys to his store if he assigns a three-year payback period to this project? a. yes; because the payback period is 2.94 years b. yes; because the payback period is 2.02 years c. yes; because the payback period is 3.80 years d. no; because the payback period is 2.02 years e. no; because the payback period is 3.80 years DISCOUNTED PAYBACK PERIOD 41. Ginny Trueblood is considering an investment which will cost her $120,000. The investment produces no cash flows for the first year. In the second year the cash inflow is $35,000. This inflow will increase to $55,000 and then $75,000 for the following two years before ceasing permanently. Ginny requires a 10 percent rate of return and has a required discounted payback period of three years. Ginny should _____ this project because the discounted payback period is _____ a. accept; 2.03 years. b. accept; 2.97 years. c. accept; 3.97 years. d. reject; 3.03 years. e. reject; 3.97 years. 42. Genuine Products Inc. requires a new machine. Two companies have submitted bids, and you have been assigned the task of choosing one of the machines. Cash flow analysis indicates the following: Machine A Machine B Year Cash Flow Cash Flow 0 -$2,000 -$2,000 1 0 832 2 0 832 3 0 832 4 3,877 832 What is the internal rate of return for each machine? a. b. c. d. e. IRRA = 16%; IRRB = 20% IRRA = 24%; IRRB = 20% IRRA = 18%; IRRB = 16% IRRA = 18%; IRRB = 24% IRRA = 24%; IRRB = 26% B B B B B 43. You are analyzing the following two mutually exclusive projects and have developed the following information. What is the crossover rate? a. b. c. d. e. Year 0 1 2 3 11.113 percent 13.008 percent 14.901 percent 16.750 percent 17.899 percent Project A Cash Flow -$84,500 $29,000 $40,000 $27,000 Project B Cash Flow -$76,900 $25,000 $35,000 $26,000 44. A company is analyzing two mutually exclusive projects, S and L, whose cash flows are shown below: The company's required rate of return is 12 percent. What is the IRR of the better project? (Hint: Note that the better project may or may not be the one with the higher IRR.) a. 13.09% b. 12.00% c. 17.46% d. 13.88% e. 12.53% ________ 45. Which of the following statements are correct concerning the internal rate of return (IRR)? I. IRR is used to determine which one of two mutually exclusive projects should be accepted. II. IRR is the discount rate that makes the net present value equal to zero. III. There can be multiple IRRs if the cash flows are unconventional. IV. You should accept a project when the IRR is less than the required return. a. I and III only b. II and IV only c. II and III only d. I and II only Answer 1. a 2. b 3. e 4. e 5. a 6. e 7. d 8. c 9. a 10. a ⎧ ⎡ .0773 9× 2 ⎤ ⎫ 1 − ⎢1 /(1 + ) ⎥⎪ ⎪ .07 × $1,000 ⎪ ⎣ $1,000 2 ⎦⎪+ P= ×⎨ ; P = $447.977 + $505.305 = ⎬ .0773 9× 2 .0773 2 ⎪ (1 + ⎪ ) ⎪⎭ ⎪⎩ 2 2 $953.282 = $953.28 (rounded) Enter 9×2 N Solve for 7.73/2 I/Y PV -953.28 70/2 1,000 PMT FV 11. a P= $1,000 ; P = $430.24 (1 + .088)10 Enter 10 N Solve for 8.8 I/Y PV -430.24 PMT 1,000 FV 12. a Current yield = (.04625 × $1,000) ÷ (103 and 23/32 percent of $1,000) = $46.25 / $1,037.19 = 4.46 percent 13. b (1 + .0798) = (1 + r) × (1 + .025); r = 5.35 percent 14. a Enter Solve for 11×2 N /2 -1015.60 I/Y PV 5.81 60/2 PMT 1,000 FV 15. c [ ⎧⎪1 − 1 / (1 + .0835)19 P = (.08 × $1,000) × ⎨ .0835 ⎪⎩ Enter 19 N 8.35 I/Y Solve for 16. c P= $1,000 (1 + .063)14.5 Enter ]⎫⎪⎬ + PV -967.22 ⎪⎭ $1,000 (1 + .0835)19 ; P = $749.3206 + $217.8967 = $967.22 80 PMT 1,000 FV PMT 1,000 FV ; P = $412.35 14.5 N 6.3 I/Y Solve for PV -412.35 17. c CY = $72.50 ÷ $995.40 = .0728 = 7.28 percent 18. d ⎧ ⎡ ⎛ .0613 ⎞5× 2 ⎤ ⎫ ⎪1 − ⎢1 / ⎜1 + ⎟ ⎥⎪ 2 ⎠ ⎦⎥ ⎪⎪ $1,000 C × $1,000 ⎪⎪ ⎣⎢ ⎝ ; C = .0900 = 9.0% $1,122 = ×⎨ ⎬+ 5× 2 . 0613 2 ⎪ ⎪ ⎛ .0613 ⎞ 2 ⎪ ⎪ ⎜⎝1 + 2 ⎟⎠ ⎩⎪ ⎭⎪ Enter 5×2 N 6.13/2 -1,122 I/Y PV Solve for PMT 45.00 1,000 FV Coupon rate = ($45.00 × 2) ÷ $1,000 = .0900 = 9.0% 19. e 20. b 21. e 22. e 23. d 24. e 24. 25. a P0 = $2.16 ; P0 = $36.00 .10 − .04 $2.205 − $2.10 $2.10 $2.205 ; P0 = $43.75; g = ; g = .05; $43.75 = ; $2.10 P0 R − .05 R = 10.04 percent .048 = 26. b P0 = $3.50 ; P0 = $29.17 .12 P5 = $1.60 × (1 + .035)5 ; P5 = $22.36 .12 − .035 27. b 28. d P = $2.00 ÷ .09 = $22.22 29. a NPV = −$135,000 + $28,600 (1 + .085) 1 + $65,500 (1 + .085) 2 + $71,900 (1 + .085) 3 ; NPV = $3,289.86 -$135,000 CF0 C01 $28,600 F01 1 C02 $65,500 F02 1 C03 $71,900 F03 1 I = 8.5 NPV CPT $3,289.86 30. d Year 1 2 3 Cash flow $28,600 $65,500 $71,900 Discounted payback = 2 + 31. a Discounted cash flow $26,359.45 $55,639.32 $56,291.09 $135,000 − $26,359.45 − $55,639.32 = 2.94 years $56,291.09 -$135,000 CF0 $28,600 C01 F01 1 C02 $65,500 F02 1 C03 $71,900 F03 1 I = 8.5 IRR CPT 9.69 percent The project should be accepted because the IRR of 9.69 percent is greater than the required return of 8.5 32. d 33. b 34. a 35. c 36. b 37. a NPVA = −$48,000 + CF0 C01 F01 C02 F02 C03 F03 I = 11.25% NPV CPT $2,326.46 $18,400 $31,300 $11,700 ; NPVA = $2,326.46 + + 1 2 (1 + .1125) (1 + .1125) (1 + .1125)3 -$48,000 $18,400 1 $31,300 1 $11,700 1 38. e Project A: CF0 -$950,000 C01 $330,000 F01 1 C02 $400,000 F02 1 C03 $450,000 F03 1 IRR CPT 11.06 percent Project B: CF0 -$125,000 C01 $ 55,000 F01 1 C02 $ 50,000 F02 2 I = 10 NPV CPT $18,670.17 I = 10 NPV CPT $3,888.05 IRR CPT 11.79 percent Since these are independent projects and both the IRR and NPV rules say accept, you should accept both projects if there are sufficient funds to do so. 39. d PVinf lows = $7,400 $9,800 $8,900 ; PVinflows = $21,909.89 + + (1.09)1 (1.09) 2 (1.09)3 CF0 C01 $ 0 $7,400 F01 1 C02 $9,800 F02 1 C03 $8,900 F03 1 I=9 NPV CPT $21,909.89 PI = $21,909.89 = 1.02 $21,500 40. e Payback period = 3 + ($4,200 + $1,500) − $1,200 − $1,500 − $1,600 = 3.80 years $1,750 Jack should reject the toy project because the payback period exceeds 3years. 41. e Year 1 2 3 4 Cash flow $ 0 $35,000 $55,000 $75,000 Discounted cash flow $ 0.00 $28,925.62 $41,322.31 $51,226.01 $120,000 − $0 − $28,925.62 − $41,322.31 = 3.97 years $51,226.01 Ginny should reject the project since the payback period of 3.97 years exceeds the required 3 years. Discounted payback = 3 + 42. d Time line: IRR A 0 IRR B CF A CF B -2,000 -2,000 = = ? ? 1 0 832 2 0 832 3 0 832 Financial calculator solution: Machine A Inputs: CF0 = -2,000; CF1 = 0; N = 3; CF2 = 3877. Output: IRR = 17.996% ≈ 18%. Machine B Inputs: CF0 = -2,000; CF1 = 832; N = 4. Output: IRR = 24.01% ≈ 24%. 43. e 4 Years 3,877 832 Year 0 1 2 3 Project A Cash Flow Project B Cash Flow Difference -$84,500 -$76,900 -$7,600 $29,000 $25,000 $4,000 $40,000 $35,000 $5,000 $27,000 $26,000 $1,000 CF0 -$7,600 C01 $4,000 F01 1 C02 $5,000 F02 1 C03 $1,000 F03 1 IRR CPT 17.899 percent 44. ANS: A Financial calculator solution: Calculate the NPV and IRR of each project then select the IRR of the higher NPV project. Project S: Inputs: Output: NPVS = 24.53; IRRS = 13.88% Project L: Inputs: Output: NPVL = 35.24; IRRL = 13.09% Project L has the higher NPV and its IRR = 13.09%. 45. c