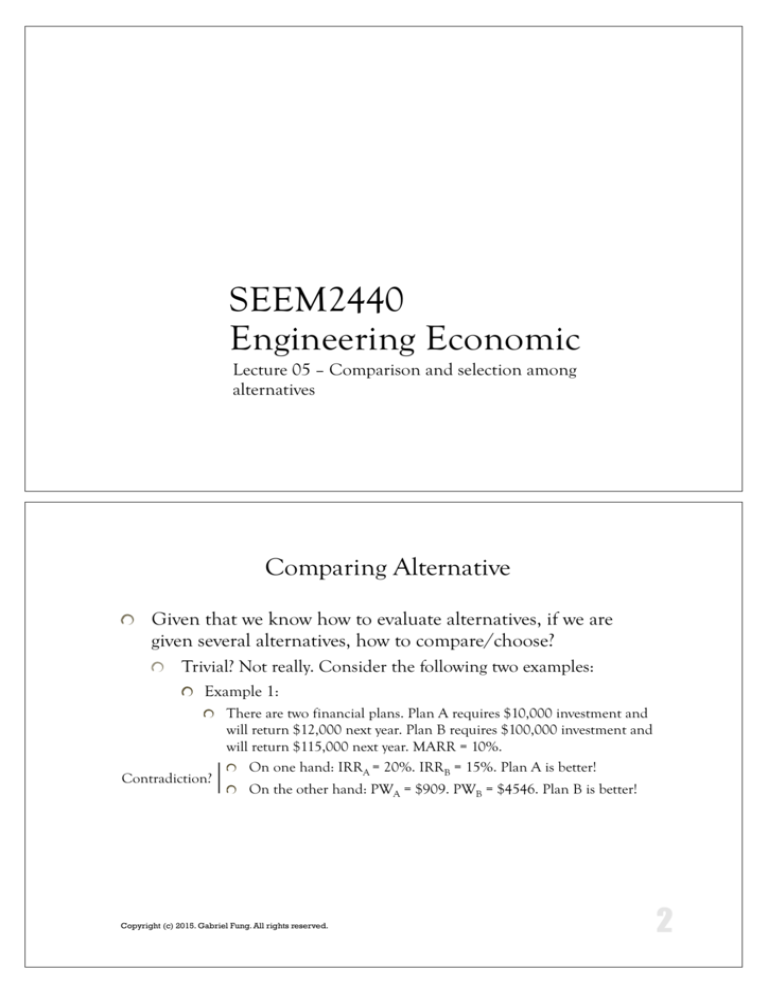

SEEM2440

Engineering Economic

Lecture 05 – Comparison and selection among

alternatives

Comparing Alternative

Given that we know how to evaluate alternatives, if we are

given several alternatives, how to compare/choose?

Trivial? Not really. Consider the following two examples:

Example 1:

There are two financial plans. Plan A requires $10,000 investment and

Contradiction?

will return $12,000 next year. Plan B requires $100,000 investment and

will return $115,000 next year. MARR = 10%.

On one hand: IRRA = 20%. IRRB = 15%. Plan A is better!

On the other hand: PWA = $909. PWB = $4546. Plan B is better!

Copyright (c) 2015. Gabriel Fung. All rights reserved.

Comparing Alternative

Example 2:

There are two financial plans. Plan A requires $350 investment and

How to make a

fair comparison?

will return $1,200 after 4 years. Plan B requires $500 investment and

will return $4,200 after 10 years. MARR = 10%.

On one hand: PWA = $469. PWB = $1119. Plan B is better!

On the other hand: The period is different! We can invest the

money obtained from Plan A to other project!

Copyright (c) 2015. Gabriel Fung. All rights reserved.

An Overview

In general, we have the following rules

Use either the Equivalent Worth Method or Incremental

Investment Analysis for ranking the alternatives.

We will discuss what is Incremental Investment Analysis shortly.

Do not use the IRR to compare the project directly.

Compare the alternatives using the same study period.

Copyright (c) 2015. Gabriel Fung. All rights reserved.

Two Investment Plans

Consider the following two plans:

Plan A:

You have to invest $73,000 now, and you will obtain $26,225 every

year for 4 years.

Plan B:

You have to invest $60,000 now, and you will obtain $22,000 every

year for 4 years.

Assume that your MARR is 10%. Which plan should you

choose (you can choose only one of them)?

Note: PW(10%)A = $10,131, PW(10%)B = $9,738, IRRA=17.3,

IRRB=16.3,

Copyright (c) 2015. Gabriel Fung. All rights reserved.

Two Investment Plans (cont’d)

Note that:

Copyright (c) 2015. Gabriel Fung. All rights reserved.

Two Investment Plans (cont’d)

Analysis using Equivalent Worth Method:

Rank the Investment Cost of the alternatives in ascending order.

Investment of Plan B < Plan A. So, Plan B is in a higher rank.

Compute the equivalent worth of the first alternative (Plan B):

PW(10%)B = $9,738

Since, PW(10%)B > 0. Plan B is chosen as the Base Alternative.

Base alternative would be automatically selected unless the extra

investment for the other plan is justified.

continued on next page…

Copyright (c) 2015. Gabriel Fung. All rights reserved.

Two Investment Plans (cont’d)

… continued from previous page

Compute the differences between the cash flows of the two

alternatives in the next rank.

Let D(A – B) be such cash flow (pls. refer to the next slide)

Compute the equivalent worth of the cash flow D(A – B).

PW(10%)D(A – B) = $393

Since, PW(10%)D(A – B) > 0 , the extra investment cost ($13,000)

is justified.

Thus, Plan A is being chosen as the base alternative now instead of

Plan B

Copyright (c) 2015. Gabriel Fung. All rights reserved.

Two Investment Plans (cont’d)

For the extra investment cost:

Plan A

$26,225

0

1

2

Plan D(A – B)

Plan B

$22,000

3

4

–

$60,000

$4,225

0

1

2

3

4

$73,000

=

0

1

2

3

4

$13,000

Thus, the additional investment cost ($13,000) has a present

value of $393.

Note that:

PW(10%)A = $10,131

PW(10%)B = $9,738

PW(10%)D(A – B) = PW(10%)A – PW(10%)B

Copyright (c) 2015. Gabriel Fung. All rights reserved.

More about Equivalent Worth Method

In short, Equivalent worth method can be done simply by…

1. Compute the equivalent worth (present worth, future worth or

annual worth) of the alternatives.

2. Rank the alternatives according to their equivalent worth in a

descending order.

Copyright (c) 2015. Gabriel Fung. All rights reserved.

Incremental Investment Analysis

We can do a similar kind of analysis, but using “Rate” instead

of “Equivalent Worth”. This is known as Incremental

Investment Analysis.

Copyright (c) 2015. Gabriel Fung. All rights reserved.

Two Investment Plans Again

Incremental Investment Analysis:

Rank the Investment Cost of the alternatives in ascending order:

Investment of Plan B < Plan A. So, Plan B is in a higher rank.

Compute the IRR of the first alternative (Plan B)

IRRB = 17.3%.

Since IRRB > MARR, Plan B is chosen as the base alternative.

Compute the differences between cash flows of the two

alternatives in the highest rank:

Let D(A – B) be such cash flow.

Continued on next page…

Copyright (c) 2015. Gabriel Fung. All rights reserved.

Two Investment Plans Again (cont’d)

… continued from previous page

Compute the IRR of the cash flow D(A – B).

IRRD(A – B) = 11.4%

Since, IRRD(A – B) > MARR, the extra investment cost ($13,000)

spent on Plan A is justified.

Thus, Plan A is being chosen as the base alternative now instead of

Plan B

Copyright (c) 2015. Gabriel Fung. All rights reserved.

Two Investment Plans Again (cont’d)

Question:

Can we compare the IRR of Plan A and Plan B directly in the

Incremental Investment Analysis but not the IRR of D(A – B)?

Just similar to the Equivalent Worth Analysis.

Answer:

Impossible!!!

IRRA = 16.3%

IRRB = 17.3%

Accordingly, Plan B is chosen

Contradictory with the previous analysis

If we based our decision on IRR solely, we will make a wrong

decision.

Copyright (c) 2015. Gabriel Fung. All rights reserved.

Two Investment Plans Again (cont’d)

See the following diagram as well

Present Worth ($)

10,131

9,738

393

10.0

11.4

16.3

i (%)

17.3

Plan B

MARR

Plan A

Copyright (c) 2015. Gabriel Fung. All rights reserved.

Incremental Investment Analysis

For the incremental investment analysis, can we use ERR

instead of IRR for evaluating the rate of return of the

incremental investment?

Sure! Why not?

Copyright (c) 2015. Gabriel Fung. All rights reserved.

Unequal Useful Life

So far, most problems that we encountered has a “life”:

E.g. The two financial plans in the previous example have a

“life” of 4 years.

We call such “life” as “useful life”.

Very often, the useful life of the alternatives are different.

E.g. Plan A will generate $1,200 after 4 years. Plan B will

generate $4,200 after 10 years. Which plan is better?

Copyright (c) 2015. Gabriel Fung. All rights reserved.

Unequal Useful Life Comparison

If the alternatives can be repeated:

We find the least common divisor of the two alternatives as a

reference, and repeat the alternatives

Plan A

Plan B

2 years

3 years

Repeat Plan A three times

Repeat Plan B two times

Copyright (c) 2015. Gabriel Fung. All rights reserved.

2 years

3 years

2 years

2 years

3 years

Unequal Useful Life Comparison

If the alternatives cannot be repeated:

The longest useful life among the two alternatives is chosen as

reference. We re-invest the capital at the MARR for the

remaining periods of the alternative that has a shorter useful

life.

Known as Coterminated Assumption

Plan A

Plan B

2 years

3 years

Plan A

Plan B

2 years

Reinvest at the MARR

3 years

Copyright (c) 2015. Gabriel Fung. All rights reserved.

Two More Investment Plans

Consider the following two plans:

Plan C:

You have to invest $3,500 now, and you will obtain $1,225 every

year for 4 years.

Plan D:

You have to invest $5,000 now, and you will obtain $1,480 every

year for 6 years.

Assume that your MARR is 10%. Which plan should you

choose (you can choose either one of them)?

Copyright (c) 2015. Gabriel Fung. All rights reserved.

Two More Investment Plans (cont’d)

Assume both projects are repeatable.

The least common multiple of the useful lives of Plan C and

Plan D is 12 years.

Thus, we try to repeat the cash flows until 12 years reached.

For example, for Plan C

Plan C

Plan C with 3 cycles

$1,225

$1,225

0

0

1

2

3

4

$3,500

1

$3,500

2

3

4

$3,500

5

6

7

8

9

10

11

$3,500

Copyright (c) 2015. Gabriel Fung. All rights reserved.

Two More Investment Plans (cont’d)

Equivalent Worth Method:

PW(10%)C = $1,028

PW(10%)D = $2,262

So, Plan D is better.

Note that instead of computing PW, we should better compute

AW (Why?)

AW(10%)C = $151

AW(10%)D = $332

Copyright (c) 2015. Gabriel Fung. All rights reserved.

12

Two More Investment Plans (cont’d)

Assumption of repeatability is failed. Coterminated

assumption is taken.

We reinvest all of the money into the firm’s MARR until the

end of the study period.

Plan C

$1,225

0

1

2

3

4

$3,500

Copyright (c) 2015. Gabriel Fung. All rights reserved.

Two More Investment Plans (cont’d)

Equivalent Worth Method:

PW(10%)C = $478

PW(10%)D = $1,446

So, Plan D is better.

Note that instead of computing PW, we should better compute

FW (Why?)

FW(10%)C = $847

FW(10%)D = $2,561

Copyright (c) 2015. Gabriel Fung. All rights reserved.

Useful Life Versus Study Period

Sometimes, the study period is different from the Useful Life.

E.g. I want to buy a printer for my project. There are two

printers with different printing capabilities, which last for 10

and 8 years. I will complete my project after 6 years, and I will

no longer use the printer. Which printer should I buy?

If the study period is greater than the useful life:

We may use the repeatability method or coterminated method

to solve the problem.

If the study period is less than the useful life:

We have to use the imputed market value to solve the problem.

Copyright (c) 2015. Gabriel Fung. All rights reserved.

Imputed Market Value

Also known as “implied market value”.

An estimation of the market value of a piece of asset when the

useful life of the asset is less then the study period.

Let T be the study period and L be the useful life, where T < L.

Imputed Market value is based on the sum of the following

two parts:

MVT = (PW of the remaining Capital Recovery Amounts at T)

+ (the Market value at L discount back to T)

Copyright (c) 2015. Gabriel Fung. All rights reserved.

Capital Recovery Amount

For each period i (i = 1, 2, …, N) in the study period, it is the

amount, Ai, from the capital investment that will be spent on

the asset (e.g., an equipment), such that A1 = A2 = … = An.

Conceptually, it is the “annual cost” of the capital invested.

Mathematically:

CR(i %) = I (A | P, i %, N) – S (A | F, i %, N)

where I is the initial capital investment

S is the salvage value (market value)

Copyright (c) 2015. Gabriel Fung. All rights reserved.

An Equipment

A photocopying machine has useful life 9 years. Its market

value at the end of its useful life will be $5,000. Its current

price is $47,600. Assume that MARR is 20%. If we want to buy

this machine and use it for T=5 years, what is its imputed

market value?

Copyright (c) 2015. Gabriel Fung. All rights reserved.

An Equipment (cont’d)

Answer:

First, compute the PW of the Capital Recovery Amount at T:

PW(20%)CR = [$47600 (A|P, 20%, 9) – $5000(A|F, 20%, 9)] (P | A

20%, 4) = $29,949

Second, compute the PW of the market value at T:

PW(20%)MV = $5,000 (P | F, 20%, 4) = $2,412

The imputed market value at T is:

MV5 = PWCR + PWMV = $32,361

Copyright (c) 2015. Gabriel Fung. All rights reserved.

Cost Only Alternative

We need to buy insurance for our employee! Which of the

following two financial plans is better?

$26,000

0

1

2

3

0

$38,100

1

2

$27,400

$39,100

$40,100

$380,000

Answer:

Since,

PW(10%)1 = –$477,077

PW(10%)2 = –$463,607

So, the decision is…

Copyright (c) 2015. Gabriel Fung. All rights reserved.

$415,000

3

Incremental Investment

Suppose we got six mutually exclusive projects as follows:

A

Investment

Revenue

B

C

D

E

F

$1,500

$900

$5,000

$2,500

$4,000

$7,000

$276

$150

$1,125

$400

$925

$1,425

Which one is preferable? Suppose MARR is 10% and study

period is 10 years.

Copyright (c) 2015. Gabriel Fung. All rights reserved.

Incremental Investment (cont’d)

Answer:

Rank the alternatives according to their investment cost:

B

A

D

E

C

F

Investment

$900

$1,500

$2,500

$4,000

$5,000

$7,000

Revenue

$150

$276

$400

$925

$1,125

$1,425

Compute their IRR:

IRR

B

A

10.6%

13.0%

D

9.6%

E

C

F

19.1%

18.3%

15.6%

Since IRRD = 9.6% < MARR, we reject Project D immediately.

Continued on next page…

Copyright (c) 2015. Gabriel Fung. All rights reserved.

More about Incremental Investment (cont’d)

…Continued from previous page

Compute the IRR of the incremental investment:

B

D(A – B)

D(E – A)

D(C – E)

D(F – C)

Investment

$900

$600

$2,500

$1,000

$2,000

Revenue

$150

$126

$649

$200

$300

10.6%

16.4%

22.6%

15.1%

8.1%

Justifiable?

Y

Y

Y

Y

N

Base Alternative

B

A

E

C

C

Next Alternative

A

E

C

F

--

IRR

Copyright (c) 2015. Gabriel Fung. All rights reserved.

Reconstruction

The owner of a downtown parking lot now determine whether

it would be financially attractive to construct an office building

on the site now being used for parking:

Investment Net Revenue

P. Keep existing parking lot, but improve

$200,000

$22,000

B1. Construct one-story building

4,000,000

600,000

B2. Construct two-story building

5,50,000

720,000

7,500,000

960,000

B3. Construct three-story building

The study period is 15 years. For each plan, the property has an

estimated market value that is equal to 50% of the investment

cost. Comment on which plan is the best if the MARR is 10%.

Copyright (c) 2015. Gabriel Fung. All rights reserved.

Reconstruction (cont’d)

By using the Equivalent worth method:

PW(10%)B1 = $1,042,460

PW(10%)B2= $590,727

PW(10%)B3 = $699,606

Copyright (c) 2015. Gabriel Fung. All rights reserved.

Reconstruction (cont’d)

By using the IRR method:

P

Investment

Net Revenue

Residual Value

B1

B2

B3

$200,000

$4,000,000

$5,550,000

$7,500,000

22,000

600,000

720,000

960,000

100,000

2,000,000

2,775,000

3,750,000

9.3%

13.8%

11.6%

11.4%

IRR

B1

Investment

Revenue

Residual Value

IRR

Justifiable?

Baseline Alternative

Copyright (c) 2015. Gabriel Fung. All rights reserved.

D (B2 – B1)

D(B3 – B1)

$4,000,000

$1,550,000

$3,500,000

600,000

120,000

360,000

2,000,000

755,000

1,750,000

13.8%

5.5%

8.5%

Y

N

N

B1

B1

B1