Chapter 10 - Thorsteinssons LLP Tax Lawyers

advertisement

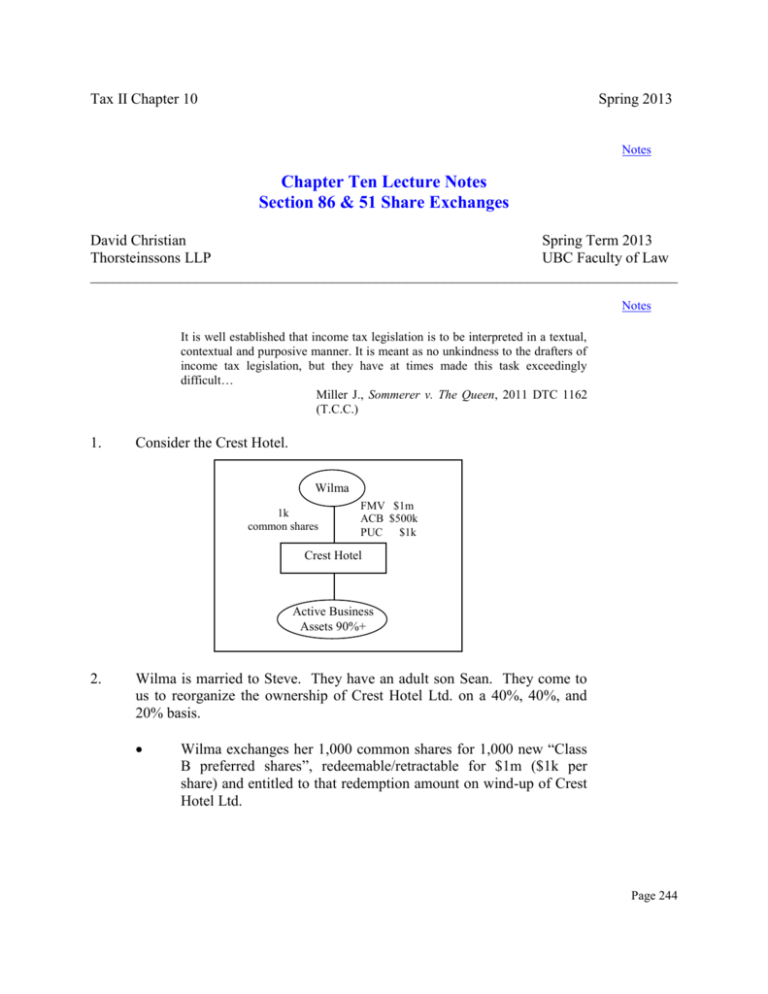

Tax II Chapter 10 Spring 2013 Notes Chapter Ten Lecture Notes Section 86 & 51 Share Exchanges David Christian Spring Term 2013 Thorsteinssons LLP UBC Faculty of Law ______________________________________________________________________________ Notes It is well established that income tax legislation is to be interpreted in a textual, contextual and purposive manner. It is meant as no unkindness to the drafters of income tax legislation, but they have at times made this task exceedingly difficult… Miller J., Sommerer v. The Queen, 2011 DTC 1162 (T.C.C.) 1. Consider the Crest Hotel. Wilma 1k common shares FMV $1m ACB $500k PUC $1k Crest Hotel Active Business Assets 90%+ 2. Wilma is married to Steve. They have an adult son Sean. They come to us to reorganize the ownership of Crest Hotel Ltd. on a 40%, 40%, and 20% basis. Wilma exchanges her 1,000 common shares for 1,000 new “Class B preferred shares”, redeemable/retractable for $1m ($1k per share) and entitled to that redemption amount on wind-up of Crest Hotel Ltd. Page 244 Tax II Chapter 10 Spring 2013 Notes Wilma, Steve and Sean each subscribe for new “Class A” common shares in the desired percentages (i.e., 40, 40, 20) that are “garden variety” common shares (subject to the rights of the Class B preferred shares) for $1 per share. Steve Wilma 1k Class B FMV $1m ACB (?) PUC (?) 40 Class A FMV $40 ACB $40 PUC $40 Sean 40 Class A FMV $40 ACB $40 PUC $40 20 Class A FMV $20 ACB $20 PUC $20 Crest Hotel 3. What tax consequences apply to Wilma? Read s.86: in the course of a “reorganization of capital” of a corporation; a taxpayer has disposed of capital property; that consists of all shares of a class owned by taxpayer (“old shares”); and property received includes shares of the same corporation (“new shares”); if the foregoing pre-conditions are present, the following rules apply: the tax cost of non-share consideration received by Wilma is its FMV (none here); the tax cost of the new shares received by Wilma is equal to the ACB of old shares ($500k) less the non-share consideration (nil here); and Page 245 Tax II Chapter 10 Spring 2013 Notes the proceeds of disposition to Wilma is the total cost of new shares ($500k) and the non-share consideration (nil here). 4. So Wilma has “proceeds of disposition” of the old share equal to $500k, and thus no capital gain or capital loss arises on the 1,000 common shares exchanged. It’s a roll-over. Wilma’s tax cost of the 1,000 Class B Preferred Shares received on the exchange is the ACB of the old shares: $500k. The rules in s.86 are automatic. There is no election of the kind in s.85, provided the above pre-conditions are met. 5. What is the tax PUC of the 1k Class B Preferred Shares received by Wilma? Read s.86(2.1) - a familiar tax PUC “grind” rule. Grind the PUC by: “A – B” A = the increase in the corporate share capital (assume, for example, $1m) on the exchange, B = extent to which tax PUC of old shares ($1k) exceeds the nonshare consideration ($0 here). A – B = $1m - $1k = $999k. Thus, the tax PUC of the new Class B shares is the corporate share capital ($1m) less the PUC grind in s.86(2.1) of $999k, resulting in tax PUC of $1k for the Class B shares. (It is common, in practice, that you only add to the corporate share capital of the new shares an amount equal to the tax PUC of the old shares exchanged less any non-share consideration.) 6. Do you see the deemed dividend rules in s.84(3) applying here? Why? Read it again. The deemed dividend in s.84(3) is driven off of the “amount paid” on the acquisition of the old shares by the corporation. Page 246 Tax II Chapter 10 Spring 2013 Notes What is the “amount paid” here? Is it the value of the new Class B shares of $1m? Is there a deemed dividend “disaster” here = tax owing of over $336k? Read s.84(5). The value of the new shares issued for the old shares, for purposes of s.84(3), is the tax PUC of those new shares. This is the “amount paid”. In our case, this is $1k for the new Class B shares as just computed under s.86(2.1). Thus, no s.84(3) deemed dividend arises on the exchange. $1k “paid” - $1k tax PUC of the old common shares exchanged = $0. No deemed dividend arises. 7. 8. Change the facts. Wilma wants $100k of cash in the company, plus say 900 Class B Preferred Shares having a value of $900k. What is the result? s.86(1)(a) – Wilma’s tax cost of the cash is $100k. s.86(1)(b) – Wilma’s tax cost of the new 900 Class B shares is the ACB of old shares ($500k) less the non-share consideration ($100k): or $400k. s.86(1)(c) – Wilma’s “proceeds of disposition” is the total of the cost of (a) & (b) = $100k plus $400k: or $500k. The tax PUC of the new 900 Class B shares: assume the starting PUC is say $900k. Compute the PUC grind in s.86(2.1): A - B = $900k – ($1k – $100k = $0) = $900k. Thus, ending tax PUC is nil by reason of the s.86(2.1) grind: Opening PUC $900 less PUC grind of $900k, results in tax PUC of the Class B preferred shares being $0. On the face of it, Wilma has “proceeds of disposition” of $500k. Does she have a capital gain? No: proceeds ACB $500k $500k $0 Page 247 Tax II Chapter 10 Spring 2013 Notes But remember s.84(3) – the “amount paid” on the acquisition of the company’s own shares over the tax PUC of those shares is deemed to be a dividend paid. And, the new Class B shares are valued at their ending tax PUC for this dividend computation: Amount paid $100k tax PUC of old $ dividend 1k $ 99k Thus, proceeds of disposition: $500k ($99k) Proceeds analysis) ACB Capital Loss $401k ($100k cash, plus $0 tax PUC of the new Class B shares) (tax PUC of the old common shares acquired by the company) (taxed as a deemed dividend to Wilma!) (as computed above) (remember the s.54 exclusion for any deemed dividend amount in the proceeds of disposition) (proceeds of disposition for capital gain $500k $99k1 It is wise to compute the potential dividend under s.84(3) before any capital gain or loss under s.86. 9. Read s.86(3): s.86(1) does not apply if s.85(1) applies? The latter has priority. 10. Satisfy yourself that a s.85(1) election could be filed by Wilma and Crest Hotel; “eligible property” (yes), disposed of to a taxable Canadian corporation (s.84(9)) (yes), consideration includes shares of that corporation (yes). Why would they want to use s.85(1)? Maybe trigger a capital gain, and avoid a dividend, by selecting an elected amount? 1 Take the same facts as above. Wilma exchanges her old shares for the Class B preferred shares worth $1m. The corporate share capital of these Class B shares is limited to $1k (which is possible under corporate statutes). Wilma and the company elect under This loss may be subject to “stop loss” rules in section 112, which are beyond the scope of this course. Page 248 Tax II Chapter 10 Spring 2013 Notes s.85(1) at an agreed amount of $1m. Work through the s.85(1) results: proceeds to Wilma $1m (agreed amount) gain to Wilma $500k ($1m less $500k) tax cost of new Class B pref shares to Wilma $1m dividend to Wilma $0 (work through s.84(3) and (5)) This is sometimes referred to as a “crystallization” transaction – if Wilma can use her $750k capital gain exemption to shelter the gain (Chapter 13). Why do it? Maybe worried the next federal budget will take away the $750k capital gain exemption, or that the shares may not qualify in the future. Here, she has used it and increased the ACB of her new shares of the company. 11. Change the facts. What if Wilma only receives 500 Class B Preferred Shares worth $500k on the exchange for the old common shares. No election is filed under s.85(1). Read s.86(2) preamble, then (a) and (b) and the mid-amble. The “benefit” here is 60% of $500k ($300k) – being the value indirectly conferred on Steve and Sean. Read paragraph 86(2)(c). The solution to this valuation point is the same as the s.85(1) “benefit rule”: namely, a “price adjustment clause” for the Class B Preferred Shares. 12. Read s.51(1): another internal share exchange rule. a share is acquired “in exchange for”; paragraph (a): a capital property that is another share of that corporation (the exchanged share); and no consideration is received other than these shares; THEN: paragraph (c): there is no “disposition” (at all); Page 249 Tax II Chapter 10 Spring 2013 Notes paragraph (d): the cost of the new shares received is the ACB of shares given up (subject to the usual pro-rating rule). 13. It’s a roll-over: automatic. Why have yet another roll-over rule here? 14. Read s.51(4): s.51(1) is not applicable if s.85(1) applies (i.e., an election is filed), or if s.86(1) applies. There is a ranking, in the case of overlap: first s.85(1), then s.86(1), then s.51(1). 15. When might s.51(1) be useful? When s.85(1) election is not filed, and s.86(1) does not apply. Example: Public common shares “Convertible” Preferred Shareholders preferred shares (convertible) Pubco 16. Widely held: conversion right buried in the preferred share rights. The holder is free to exchange, in a set ratio, at any time. There may be no “reorganization of share capital” required (i.e., existing common and preferred). Holder may not exchange all shares of the class held (as required by s.86(1)). Subsection 85(1) election may be impractical, or cumbersome at best. Thus, a s.51(1) roll-over could be very useful to these convertible shareholders. Read s.51(3) - a familiar tax PUC grind rule: “A - B”. The effective limit is the tax PUC of shares exchanged. Page 250 Tax II Chapter 10 Spring 2013 Notes Page 251