Sen. Insurance

advertisement

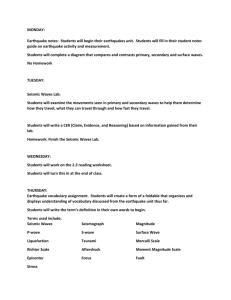

SENATE COMMITTEE ON INSURANCE Senator Richard Roth, Chair 2015 - 2016 Regular Bill No: Author: Version: Urgency: Consultant: AB 1440 Nazarian April 20, 2015 No Erin Ryan Hearing Date: June 24, 2015 Fiscal: Yes Amended Subject: Earthquake loss mitigation: grant programs. SUMMARY Recognizes the California Residential Mitigation Program (CRMP), a joint powers authority (JPA) created in 2012 by the California Earthquake Authority (CEA) and Office of Emergency Services (OES) to provide grants to residential homeowners for the purpose of defraying the cost of seismic retrofitting, among other purposes; and requires, if the legislature appropriates funds, the CRMP to implement a grant program and, on or after July 1, 2017, make grants that assist a qualifying owner of a singlefamily residential structure that defray the owner’s cost of seismic retrofitting of the structure, as specified. DIGEST Existing law 1) Provides that no policy of property insurance may be issued or delivered in this state unless the insurer has been offered earthquake insurance (mandatory offer). 2) Defines a residential property for purposes of the mandatory offer as individually owned residential structure of not more than 4 dwelling units. 3) Establishes the CEA, a privately financed, publicly managed entity to provide residential earthquake insurance. 4) Defines residential earthquake insurance as a policy insuring individually owned residential structures with no more than four dwelling units. 5) Establishes the Earthquake Loss Mitigation Fund (ELMF) within the CEA to provide grants or loans to dwelling owners who wish to retrofit their homes. (Insurance Code § 10089.37 et seq.) 6) Allocates to the ELMF five percent of CEA’s investment income, or $5 million, whichever is less, annually. 7) Requires the OES to carry out a variety of duties with respect to emergency preparedness, mitigation, and response activities in the state, including earthquake education and preparedness activities. AB 1440 (Nazarian) Page 2 of 4 This bill 1) Makes legislative findings regarding the impact recent earthquakes have had on increasing interest in mitigating the damage to residential homes from earthquakes, the Earthquake Brace + Bolt (Brace + Bolt) program operated jointly by the CEA and the OES, the low take-up rate for earthquake insurance, and the need to create and fund a program to assist California homeowners with earthquake mitigation repairs. 2) Recognizes the CRMP, a JPA created in 2012 by the CEA and OES to provide grants to residential homeowners for the purpose of defraying the cost of seismic retrofitting, among other purposes. 3) Requires, if the legislature appropriates funds, the CRMP to implement a grant program and, on or after July 1, 2017, make grants that assist a qualifying owner of a single-family residential structure that defray the owner’s cost of seismic retrofitting of the structure. 4) Requires an applicant for a grant to meet specified conditions, including: a. The applicant is the owner of record, and lives in the structure to be retrofitted; b. The structure is a single-family, detached, residential building of not more than 4 dwelling units; c. The structure and work to be done meet eligibility requirements established by the JPA. 5) Specifies the grant cannot exceed the lesser 75% of the qualifying retrofit, or $3,000. 6) Requires the CRMP governing board to adopt policies and procedures necessary to implement this program. COMMENTS 1. Purpose of the bill According to the author, only 12% California homeowners have earthquake insurance, but there are between 1.2 to 1.6 million pre-1940s homes with so called "cripple walls," and homes on hillsides, and those with living space over garages that are at serious risk in even a minor quake, let alone a major one. California has an existing seismic mitigation incentive program called Brace + Bolt, which is administered by the CRMP, but is limited to only 650 homes in the Bay Area, LA County and Napa. The goal of this legislation is to expand on Brace + Bolt and create a statewide earthquake retrofit program to cover tens of thousands of more homes. 2. Background Currently, fewer than 12% of California homeowners purchase earthquake insurance, despite predictions that the state will experience a major earthquake sometime in the next 30 years. The low frequency of earthquake disasters, compared to other natural catastrophes, tends to shape the perception AB 1440 (Nazarian) Page 3 of 4 that earthquake risk is much lower than it actually is, even in places where there have been very deadly and damaging events like California. In addition, earthquake insurance policies can be expensive and carry large deductibles, making them unattractive to homeowners who are not mandated to carry such coverage by their lenders. Homeowners can greatly reduce their exposure to earthquake damage by taking relatively simple, low cost steps to strengthen their structures to better withstand earthquakes. An additional benefit to homeowners of seismic retrofitting is the availability of discounts on earthquake insurance premiums as a result of the lower risk of damage to their home. In August 2011, the CRMP was established as a JPA entity by the CEA and OES to carry out mitigation programs to assist California homeowners who wish to seismically retrofit their houses. CRMP’s goal is to provide grants and other types of assistance and incentives for these mitigation efforts. Brace + Bolt, the CRMP’s first program launched in 2013, provides grants of up to $3,000 for homeowners who have qualifying homes and meet specified building code requirements. The cost of Brace + Bolt retrofits is coming in between $3,000 and $6,000 for the single-family dwellings presently eligible—the cost seems to be lower in Southern California than in the Bay Area. But the more complicated the retrofit (e.g., for “soft-story” and hillside houses), the more expensive the project will be. According to the CEA, 16 homes have qualified and completed retrofits under the program, and 650 retrofits are planned in 2015. CEA estimates that there are approximately 1.6 million owner-occupied houses in California that meet the criteria of Brace + Bolt—1.2 million of those are in higher-hazard areas. Those numbers do not include other, non-Brace + Bolt eligible homes that would benefit from seismic retrofits. Without any appropriation in the budget, this bill simply codifies the existing CRMP. It is committee staff’s understanding that language that mirrors this bill and AB 1429, also before this committee today, has been included in a budget trailer bill, along with an appropriation to increase funding for CRMP to award earthquake mitigation grants. 3. Support According to the Insurance Commissioner, AB 1440 will expand on Brace + Bolt and scale it into a statewide, sustainable earthquake retrofit incentive program. United Policyholders supports AB 1440 because they encourage people who live in earthquake country to protect their investment in their home by retrofitting, buying earthquake insurance, and by setting aside funds to pay for repairs below the deductible. They believe that providing incentives to homeowners to retrofit in the form of monetary grants is good public policy. 4. Opposition None received. 5. Questions Without any appropriation, this bill simply codifies the existing CRMP, already operating under existing authorities. Language that mirrors this bill and AB AB 1440 (Nazarian) Page 4 of 4 1429, also before this committee today, has been included in a budget trailer bill, along with an appropriation to increase funding for CRMP to award earthquake mitigation grants. Is this legislation necessary? 6. Related Legislation AB 1429 (Chiu) would require the CRMP to implement a grant program, on or after July 1, 2017, for qualifying owners of multiunit residential structures that defrays the owner’s cost of seismic retrofitting of the structure if the legislature appropriates money for that purpose. SB 602 (Monning) adds the CEA to the list of public entities authorized to utilize property assessment districts, impose liens and issue bonds for the purpose of creating a statewide earthquake mitigation assessment district to fund voluntary residential seismic strengthening improvements. AB 428 (Nazarian) would allow, for taxable years beginning on or after January 1, 2016, and before January 1, 2021, a tax credit under the Personal Income Tax Law and the Corporation Tax Law in an amount equal to 30% of the qualified costs paid or incurred by a qualified taxpayer for any seismic retrofit construction on a qualified building, as defined. POSITIONS Support California Department of Insurance (sponsor) California Association of Realtors City of West Hollywood United Policyholders Oppose None received -- END --