Paper

advertisement

Taste uncertainty and status quo effects in consumer choice

Graham Loomes*, Shepley Orr** and Robert Sugden*

* School of Economics, University of East Anglia

** University College London

18 May 2009

Corresponding author: Robert Sugden, School of Economics, University of East Anglia,

Norwich NR4 7TJ, UK.

email: r.sugden@uea.ac.uk

Keywords: loss aversion, taste uncertainty, reference dependence, status quo effect

JEL classification: D81, C91

Acknowledgements

This research was carried out as part of the Programme in Environmental Decision Making,

organised through the Centre for Social and Economic Research on the Global Environment,

and supported by the Economic and Social Research Council of the UK (award nos. M 535 25

5117 and RES 051 27 0146). We thank Andrea Isoni, Peter Wakker and an anonymous

referee for comments.

Note on symbols

In this draft, > and are used in place of the ‘strictly preferred to’ and ‘weakly preferred to’

symbols (which are not available in the Word version in which the paper is written).

1

Abstract

We use reference-dependent expected utility theory to develop a model of status quo effects

in consumer choice. We hypothesise that, when making their decisions, individuals are

uncertain about the utility that will be yielded by their consumption experiences in different

‘taste states’ of the world. If individuals have asymmetric attitudes to gains and losses of

utility, the model entails acyclic reference-dependent preferences over consumption bundles.

The model explains why status quo effects may vary substantially from one decision context

to another and why some such effects may decay as individuals gain market experience.

2

In the traditional theory of consumer choice, individuals are assumed to have preferences over

alternative bundles of consumption goods, and to know these preferences with certainty. In

many cases, however, this assumption seems unrealistic. In this paper, we develop a model in

which individuals’ revealed preferences over goods are influenced by uncertainty about

underlying ‘tastes’. By introducing an intuitively natural assumption about loss aversion with

respect to gains and losses of utility, we generate a simple and general model of referencedependent preferences over consumption bundles. In this model, the strength of the status

quo effect – that is, the tendency for the status quo to be preferred to change, other things

being equal – depends on the characteristics of the relevant goods and on the individual’s

knowledge about and experience of those goods. Thus, our approach can explain why status

quo effects vary can substantially from one decision context to another and why some such

effects may decay as individuals gain market or other relevant experience.

The uncertainty that we are modelling arises from two different (but complementary)

sources. Extrinsic uncertainty arises from not knowing, at the moment of making a choice

between consumption bundles, the exact conditions under which consumption will actually

take place. For example, at the time of choosing a vacation package, a consumer will

typically be somewhat unsure about the ease of (or disruption to) transport to and from the

holiday destination, the comfort of the accommodation, the weather conditions, and so on.

However well-specified the objective characteristics of a bundle may seem to be, there will

inevitably be some uncertainty about the environments in which these characteristics actually

translate into utility at the time of the consumption experience.

In addition, many consumers may have preferences which are to some extent

imprecise. For example, even under highly controlled ‘laboratory’ conditions, many

individuals’ preferences exhibit a degree of variability such that when presented with exactly

the same stimuli on two occasions only a few minutes apart they may make somewhat

different decisions. Such intrinsic uncertainty requires decision theories to make some

allowance for a stochastic component in choice behaviour (for further discussion, see Becker,

DeGroot and Marschak, 1963; MacCrimmon and Smith, 1986; Loomes and Sugden, 1995;

Butler and Loomes, 2007). On this interpretation, our model allows for the behaviour of

individuals who are conscious of the imprecision of their own preferences.

Despite the intuitive appeal of these ideas, mainstream (or ‘Hicksian’) consumer

theory has not generally used explicit models of uncertain preferences. Possibly, such models

3

have not been thought necessary because if choice under uncertainty is described by expected

utility theory (EUT), conventional assumptions about preferences over goods are unaffected

by the introduction of uncertainty. Suppose that under any given state of the world, an

individual’s preferences over consumption bundles can be represented by a ‘well-behaved’

utility function with standard properties of continuity, increasingness, concavity and

reference-independence. Since ex ante subjective expected utility is a convex combination of

such functions, it inherits those properties. Thus, the standard assumption of well-behaved

preferences over consumption bundles can be interpreted as the reduced form of a model in

which preferences are influenced by extrinsic and/or intrinsic uncertainty: these forms of

uncertainty do not need to be represented explicitly in conventional consumer theory.

However, once having recognised this feature of existing theory, it is natural to ask

whether it holds for theories of choice under uncertainty other than EUT. In this paper, we

investigate this question in relation to reference-dependent subjective expected utility theory

(RDSEUT). This theory, proposed by Sugden (2003), is a development of prospect theory

(Kahneman and Tversky, 1979; Tversky and Kahneman, 1992). Like prospect theory, but

unlike EUT, RDSEUT allows gains and losses to be treated asymmetrically. However, this

asymmetry is treated differently in the two theories. In prospect theory, ‘value’ (the concept

that corresponds with utility in EUT) is defined as a function of gains and losses of wealth

relative to a given, non-stochastic reference point. Loss aversion is then represented as a

special property of the value function. In RDSEUT, in contrast, utility is defined in an

entirely conventional way, as a reference-independent function of wealth; loss aversion is

represented as a particular attitude to state-contingent gains and losses of utility. Because of

this feature, RDSEUT can be generalised straightforwardly to decision problems in which

consequences are multi-dimensional, without the need to assume separability of utility (or

value) with respect to goods or characteristics. This proves very useful when the theory is

applied to consumer choice.

In this paper, we use RDSEUT to develop a model of consumer choice in which

individuals are uncertain about their tastes and loss-averse with respect to gains and losses of

utility.1 In the explicit form of the model, this uncertainty is described by a set of states of the

world, in each of which the individual has well-defined tastes. In this framework, a

consumption bundle can be treated as an ‘act’ in the sense of Savage’s (1954) subjective

EUT, and the subjective experiences it induces in different states can be treated as

‘consequences’. For any given configuration of uncertain tastes, an ex ante preference

4

relation over consumption bundles can be derived as a reduced form. We investigate the

properties of this preference relation, making only very general and conventional assumptions

about the structure of tastes. (From now on, for clarity of exposition, we will use the word

‘preference’ only to refer to the ex ante preference relation induced by RDSEUT. Stateconditional attitudes to consequences will be referred to as ‘tastes’.)

In Section 1 we discuss existing models of reference-dependent consumer choice. We

consider the limitations that result from their using a modelling framework in which loss

aversion is defined separately for each good or hedonic characteristic and in which, implicitly

or explicitly, utility is assumed to be additively separable in goods or characteristics. We

focus on the constraints that these models impose on differences between the strength of

status quo effects in different decision environments. We use a dimensionless measure of

exchange resistance which is specific to pairs of consumption goods, and which does not

presuppose separability. The essential idea is to interpret the strength of the status quo effect

with respect to two goods i and j as the net compensation that has to be paid to an individual,

first to induce her to trade one unit of good i for one unit of good j, and then to reverse this

trade.

In Section 2 we present our own model. We show that it induces preferences over

consumption bundles that are reference-dependent, characterised by aversion to movements

away from reference points. These preferences are not constrained by separability properties.

In this respect, our approach is compatible with the modelling strategies commonly used in

consumer theory.

In Section 3, we show that our model allows the strength of the status quo effect to be

different for different pairs of goods even though utility loss aversion remains constant. Other

things being equal, exchange resistance increases with increases in utility loss aversion and

with increases in the individual’s degree of uncertainty about her tastes with respect to the

relevant goods. The latter result is the most distinctive implication of our analysis. We show

that it has implications which can be tested without identifying taste states explicitly.

In Section 4 we show how this feature of our model can explain why the strength of

status quo effects is liable to vary substantially from one decision context to another. For

example, disparities between willingness-to-accept (WTA) and willingness-to-pay (WTP)

valuations tend to be smaller for everyday consumption goods than for the unfamiliar and/or

non-traded goods that are typically the subject of stated preference studies. Our analysis

5

suggests that this effect might be a predictable consequence of different degrees of taste

uncertainty. Our results may also explain the observed tendency for WTA/WTP disparities to

decay over the course of experiments in which valuations are elicited repeatedly. Any general

theory of reference-dependent preferences needs to be consistent, not only with the

accumulated evidence of ‘anomalies’, but also with the routine behaviour of well-informed

and experienced consumers in repeated markets. We discuss the various circumstances under

which both may be regarded as compatible with our model. Formally, our model of

preferences converges to that of conventional consumer theory as individuals become

increasingly certain about their tastes.

1. Existing models of reference-dependent consumer choice

Reference-dependence in consumer choice is most commonly interpreted as an asymmetric

attitude to gains and losses in each dimension of some commodity or attribute space,

considered separately. We will call this the dimension-based approach.

To see the intuition behind this approach, consider the experiment reported by

Knetsch (1989), in which participants are divided equally between two treatments. In one

treatment, each participant is endowed with a chocolate bar and is given the opportunity to

exchange this for a coffee mug. In the other, participants are endowed with mugs, which they

can exchange for chocolate bars. Contrary to the implications of conventional consumer

theory, the proportion of participants choosing to exchange (summed over the two treatments)

is significantly less than 50 per cent. This is a status quo effect. One explanation of this

finding is that it is the result of loss aversion with respect to consumption dimensions. In its

most general form, the loss aversion hypotheses is that losses have more subjective weight

than equal and opposite gains. If each participant perceives an exchange between a mug and a

chocolate bar as a loss of one good and a gain of another, loss aversion will induce the status

quo effect found by Knetsch.

Tversky and Kahneman (1991) – henceforth, TK – develop this idea into a theory of

reference-dependent consumer choice. To aid the exposition of this and other existing

theories, we introduce some of the notation that we will need later when we present our own

analysis. We consider the preferences of a given individual. These are defined in an ndimensional space of consumption characteristics. Any non-negative vector of quantities of

these characteristics is a bundle; typical bundles are denoted by x, y and z. In any given

6

decision problem, one of these bundles is the reference point. A preference is a ranking of

two bundles, assessed in relation to (or viewed from) some reference point; the reference point

may be (but need not be) one of the two bundles in question. The proposition that x is weakly

preferred to y, viewed from z is denoted x y | z; strict preference (>) and indifference (~) are

denoted analogously. A preference structure is a set of such preference relations, one for

each possible reference point. It is sometimes convenient to represent a preference structure

by a real-valued function v(., .), such that v(x, z) v(y, z) if and only if x y | z.

TK’s model defines a preference structure and imposes certain restrictions on it. TK

describe this model as an ‘extension’ of prospect theory, Kahneman and Tversky’s (1979)

theory of choice over money (or other one-dimensional) lotteries. The key features of the

value function in prospect theory – reference-dependence, loss aversion, and diminishing

sensitivity – are ‘applied to’ riskless consumer choice (TK, pp. 1039–40). However, the

relationship between the two models is not made explicit. It seems that TK started from a

dimension-based model in which

v(x, z) = i wi(xi – zi),

(1)

where, for each characteristic i, wi(.) is a value function with the same properties as the

corresponding function in prospect theory.2 The special restrictions that TK impose on

preference structures are implications of the basic model defined by (1), and are motivated by

arguments which implicitly invoke the characteristic-based separability of that model.3

However, TK do not impose all the restrictions that are implied by the basic model.

Were all those restrictions imposed, the resulting model would have certain unrealistic

properties, which might be thought to disqualify it a general-purpose consumer theory. First,

the additively separable form of (1) does not allow characteristics to be complements; nor, in

cases in which income effects are negligible, does it allow them to be substitutes. Second,

preferences between bundles are independent of absolute levels of consumption; they depend

only on increments and decrements of consumption, relative to the reference point. Third,

because of diminishing sensitivity, indifference curves are concave to the origin in the region

of characteristics space that is dominated by the reference point. (We will call this region the

loss domain; the region that dominates the reference point is the gain domain.) In not

imposing these restrictions, TK’s theory is a compromise between the basic model and

Hicksian consumer theory.

7

Kőszegi and Rabin (henceforth KR; 2006) propose a theory of reference-dependent

preferences which ‘build[s] on the essential intuitions’ of TK (p. 1134). KR are explicit in

using an additively separable structure similar to that of TK’s basic model; as they explain,

this structure ‘is at the crux of many implications of reference-dependent utility, including the

endowment effect’ (p. 1138). However, they replace (1) by:

v(x, z) = i {mi(xi) + (mi[xi] – mi[zi])}

(2)

where mi(xi) is ‘intrinsic consumption utility’ derived from characteristic i and (.) is a

‘universal gain-loss function’ with essentially the same properties as TK’s value function.

This specification allows preferences to depend on absolute consumption, and does not entail

the concavity of indifference curves in the loss domain (although this possibility is not ruled

out). However, because the additive separability of the basic model is retained, KR’s model

does not allow characteristics to be complements or (except as a result of income effects)

substitutes.

Because (.) is independent of characteristics, KR’s model has very strong

implications about the relative strength of status quo effects in different circumstances. Here

it is convenient to introduce another theoretical concept that will be important in our own

analysis – the concept of exchange resistance. Since a status quo effect reveals an

individual’s unwillingness to make exchanges, it is natural to measure the underlying attitude

by identifying sequences of exchanges which, according to Hicksian consumer theory, the

individual is indifferent about making, and then measuring any subjective resistance to those

exchanges. Clearly, a Hicksian individual is indifferent about any sequence of exchanges

which leads from one bundle back to itself. Thus, resistance to exchange can be measured by

the net compensation required to induce an individual to complete such a cycle of exchanges.

For simplicity, we consider a case in which n = 2. (This analysis can easily be

generalised to cases in which there are three or more characteristics, and consumption of

characteristics 3, ..., n is held constant.) Consider an individual for whom z = (z1, z2) is the

reference point. In conventional consumer theory, there is a uniquely-defined marginal rate of

substitution of characteristic 2 for characteristic 1 at this point. In KR’s model, in contrast,

loss aversion can induce a kink at the zero point of (.), with the implication that indifference

curves are kinked at the reference point. Thus, there is a distinction between marginal WTP

for characteristic 1 in terms of units of characteristic 2 (the absolute value of the rate at which

decrements of characteristic 2 compensate for increments of characteristic 1), denoted r21WTP,

8

and marginal WTA for characteristic 1 in terms of units of characteristic 2 (the absolute value

of the rate at which increments of characteristic 2 compensate for decrements of characteristic

1), denoted r21WTA. Notice that r21WTP 1 / r12WTA and r21WTA 1 / r12WTP.

Starting from z, the individual is (at the margin) just willing to give up one unit of

characteristic 2 for every r12WTA units of characteristic 1 that she gains in return. Having done

so, and her reference point having adjusted to this change in her holdings, she is just willing

to accept r21WTA units of characteristic 2 as compensation for each unit of characteristic 1 she

gives up. (Given suitable differentiability assumptions, the values of r21WTP and r21WTA are

constant for sufficiently small changes in the reference point.) Thus, the net compensation

required to induce the individual to trade one unit of characteristic 2 for an equivalent

quantity of characteristic 1, and then to trade back again, is r21WTA .r12WTA – 1 units of

characteristic 2. This value, which we denote by Q21, is a measure of exchange resistance

with respect to the two characteristics, defined at z. It is dimensionless and directionless (in

the sense that Q12 = Q21). Positive values of exchange resistance indicate aversion to

movements away from status quo positions (that is, the status quo effect); a zero value

indicates neutrality towards such movements. In the case in which characteristic 1 is a nonmoney good and characteristic 2 is money, this measure has a familiar interpretation. In this

case, r21WTA is the WTA valuation, in money units, of a marginal unit of the non-money good,

while r12WTA is the reciprocal of the corresponding WTP valuation. Thus, our measure of

exchange resistance can be written as (WTA/WTP) – 1, or (WTA – WTP)/WTP: it is the

excess of marginal WTA over marginal WTP, expressed as a proportion of marginal WTP.

We now consider the extent of exchange resistance in KR’s model. Let –(0) and

+(0) be the limits of (.) as its argument tends to zero, respectively from below and from

above, and define [1 + –(0)]/[1 + +(0)]. Intuitively, measures the degree to which

(.) is kinked at zero – in other words, the degree of ‘universal’ loss aversion. It can be

shown that, at all reference points z, Q21 = 2 – 1. Thus, the extent of exchange resistance

between pairs of characteristics is constant, irrespective of the reference point and irrespective

of what those characteristics are.4

It seems clear that, if characteristics were interpreted as objective goods, KR’s model

would be too restrictive for general-purpose consumer theory. Certainly, it would be unable

to explain differences in the strength of status quo effects between different decision

environments. KR partially acknowledge these limitations. While suggesting that ‘in most

9

applications it is appropriate to identify these dimensions [i.e. characteristics] with the

physical consumption dimensions’, they refer to an alternative modelling strategy in which

characteristics are identified with hedonic dimensions – that is, ‘dimensions of consumption

that people experience as psychologically distinct’ (pp. 1156).5

A natural way to incorporate hedonic dimensions into consumer theory is to treat each

objective good as a linear combination of hedonic characteristics. Then, if KR’s specification

is assumed to apply to characteristics, we can derive reference-dependent preferences over

goods as a reduced form of their model. This reduced-form model allows the degree of

substitutability to be different for different pairs of goods, although it still cannot

accommodate complementarity. (The minimum degree of substitutability occurs when two

goods are composed of completely distinct sets of characteristics; in this case, if income

effects are zero, the cross-price elasticity of substitution is zero.) If exchange resistance is

defined in relation to goods rather than characteristics, the unrealistic result of the constancy

of exchange resistance no longer holds. Instead, comparing across different pairs of goods,

the extent of exchange resistance is inversely related to the degree of hedonic similarity

between the goods in question. Intuitively, this seems realistic. (In terms of one of KR’s

examples, an individual who can barely distinguish between two brands of premium orange

juice is unlikely to reveal much resistance to exchanging one for the other [p. 1156, note 25].)

In contrast to the model we will propose, KR’s model (whether formulated in terms of

goods or characteristics) does not imply any systematic effect of information or experience on

exchange resistance. This is a consequence of the fundamental hypothesis that status quo

effects result from loss aversion with respect to consumption dimensions. As an individual

gains information about two goods, she may change her beliefs about the mixtures of

characteristics that they comprise. If she comes to believe that they are hedonically less

distinct than she previously thought, she will become less exchange-resistant with respect to

them; and conversely if she comes to believe them to be more distinct. But there seems no

reason to assume that, in general, uninformed individuals tend to overestimate hedonic

differences between goods.

In understanding this implication of KR’s model, it is important to remember that

exchange resistance is defined relative to given reference points. Another feature of KR’s

model, conceptually distinct from the issues we address in this paper, is that reference points

are endogenous. An individual’s reference point is ‘the probabilistic beliefs she held in the

recent past about outcomes’; these beliefs are modelled as rational expectations (p. 1134–

10

1135). Thus, one effect of repeated experience of a given trading environment may be to

move reference points from pre-trade endowments of goods to expected post-trade holdings.

If an individual’s expected post-trade position is her reference point, she will not exhibit loss

aversion with respect to the trades that she expects to make. But this is not equivalent to the

decay of exchange resistance. Suppose, for example, that some individual’s expected trade is

to buy a daily newspaper on her way to work. If the outcome of this transaction is

incorporated into her reference point, she will perceive her daily decision problem as a choice

between the reference point (buying the paper) and the alternative of losing the paper and

gaining the purchase price. In KR’s model, these dimensionally separate gains and losses are

evaluated in terms of the gain-loss function (.). If characteristics are identified with goods,

the degree of exchange aversion remains equal to 2 – 1, whether a trade is anticipated or not;

the effect of anticipation is merely to change the reference point at which exchange aversion

is measured. One way of testing this implication is to elicit WTA and WTP for a trade that an

individual expects to make (such as buying the newspaper). KR’s model implies that, in this

case, WTP will exceed WTA to exactly the same degree that WTA exceeds WTP for

unanticipated sales and purchases of the same good.6 This result holds whatever the extent of

the individual’s information or experience.

As we have explained, KR build on the basic model that provides much of the

motivation for TK’s theory; however, that latter theory is a compromise between the basic

model and conventional consumer theory. An alternative strategy, followed by Munro and

Sugden (henceforth MS; 2003), is to use Hicksian consumer theory as a template and to make

the minimum revisions necessary to accommodate observed patterns of reference-dependent

choice. MS use the concept of a preference structure, as defined by TK, but impose only very

general restrictions on the function v(., .) which represents it. Essentially, these conditions

require that preferences viewed from any given reference point have conventional properties,

that preferences do not change discontinuously as the reference point changes, and that

reference-dependent preferences do not exhibit cycles. (For example, there is a cycle over x,

y and z if x > y | y, y > z | z and z > x | x.) The ‘acyclicity’ condition is a generalisation of the

requirement that exchange resistance is non-negative. (Recall that exchange resistance

measures the compensation that an individual requires for making a particular kind of cycle.)

Because this model does not invoke additive separability, it inherits the flexibility of

Hicksian consumer theory. For each pair of goods and for each reference point, any nonnegative degree of exchange resistance is compatible with the model. However, the downside

11

of this flexibility is that no predictions can be made about how exchange resistance varies

across decision contexts. This silence reflects the fact that, unlike TK or KR, MS do not offer

any psychological explanation for exchange resistance: they simply provide a theoretical

framework in which it can be represented.

In the remainder of this paper, we propose an explanation of status quo effects that is

fundamentally different from that offered by TK and KR. It turns out that our approach

provides psychological underpinning for a model similar to that of MS, while also generating

firm implications about how exchange resistance varies across decision contexts. These

implications are properties of preferences in commodity space – that is, in the domain of

conventional consumer theory. These properties make no explicit reference to taste states.

Thus, the applicability of our approach does not depend on the ‘observability’ of taste states.

Like TK and KR, we use a concept of loss aversion, but we define gains and losses in

terms of taste uncertainty rather than consumption dimensions. For example, with reference

to Knetsch’s experiment, consider a participant who is endowed with the mug and whose

preference between this and the chocolate bar is uncertain or imprecise. Extrinsic uncertainty

exists if he can imagine some circumstances in which he would enjoy the chocolate more than

the mug, but he can also envisage circumstances in which the opposite might be true. This

may be supplemented by the intrinsic uncertainty entailed by vacillation between a state of

mind in which he feels more desire for the chocolate and one in which he feels more desire

for the mug. Due to either or both sources of uncertainty, he construes the act of trading the

mug for the chocolate as one which gives him some chance of a utility gain and some chance

of a utility loss. If he is loss averse with respect to utility, this will impart resistance to the

exchange.

2. A model of consumer choice with uncertain tastes

We define preferences in an n-dimensional space of objective consumption goods. Nonnegative vectors of quantities of these goods are bundles, typically denoted by x, y and z. We

represent uncertainty about tastes by postulating a set S = {s1, ..., sm} of mutually exclusive

and exhaustive (taste) states. Choosing any particular bundle generates a consequence in

each state; the consequence of bundle x in state sh, denoted c(x, sh), is to be interpreted as the

agent’s subjective experience of consuming x, given the particular consumption environment

of that state (defined to include the individual’s state of mind at the time of consumption).

12

The set of all possible consequences is denoted by C.7 In this theoretical framework, the

choice of a bundle is an act in the sense of Savage’s subjective expected utility theory, that is,

a function from S to C. This allows us to use RDSEUT as a theory of preferences over

bundles.

RDSEUT is a theory of choice under uncertainty in which an individual’s preferences

between given options may vary according to that individual’s reference point. The

fundamental psychological intuition behind the theory is that attitudes to gains and losses of

utility are asymmetric, losses being more aversive than equal and opposite gains are

attractive. In these respects, RDSEUT is similar to prospect theory. However, unlike

prospect theory, RDSEUT uses a conceptual framework similar to that of Savage’s subjective

expected utility theory, in which the objects of preference are acts. Rather than representing

an agent’s reference point implicitly, as the zero point from which gains and losses are

measured, RDSEUT represents it explicitly as a ‘reference act’. This feature allows RDSEUT

to be applied to problems in which the agent’s endowment is a lottery.8 In RDSEUT,

preferences have the same structure as in reference-dependent consumer theory: a preference

is a ranking of two acts, as viewed from a reference act, which may be one of the two acts in

question, or some third act. The proposition that the act of choosing x is weakly preferred to

the act of choosing y, assessed relative to the reference act of choosing z, is denoted x y | z;

strict preference (>) and indifference (~) are denoted analogously; z is the reference act.

In this paper, we do not address the question of how reference points should be

interpreted. In the literature of reference-dependence, reference points are interpreted in

various ways. Often, and particularly in the context of experiments in which participants are

given unexpected opportunities to make trades, the individual’s reference point is assumed to

be his endowment of goods prior to trade. Sometimes, it is interpreted as a pattern of

consumption to which the individual has become habituated; asymmetric attitudes to gains

and losses are then interpreted as implications of the psychological theory of adaptation

(Kahneman and Varey, 1991, pp. 147–158). On a third interpretation, the individual’s

reference point is a rational expectation of future consumption (Kőszegi and Rabin, 2006).

While we recognise the need for an integrated theory of how reference points are determined,

that issue is orthogonal to the analysis we present in this paper. In our analysis, the reference

point is taken as exogenous; it can be given any of these three interpretations.

RDSEUT postulates three functions. The probability function (.) assigns a nonnegative real number to each state in S, satisfying the condition h (sh) = 1. The utility

13

function u(.) assigns a real number to each consequence in C. The gain/loss evaluation

function (.) is a continuous, increasing and weakly concave function from the set of real

numbers to the set of real numbers, with (0) = 0. Applied to the case of uncertain

preferences over bundles, RDSEUT implies that reference-dependent preferences satisfy the

property that, for all x, y, z:

x y | z h (sh) (uh[x] – uh[z]) h (sh) (uh[y] – uh[z]),

(3)

where each function uh(.) is defined so that, for all x, uh(x) = u[c(x, sh)]. In interpreting (3),

(sh) can be thought of as the subjective probability of the state sh; uh(x) can be thought of as

the subjective value of the consequence c(x, sh), considered in isolation; and (uh[x] – uh[z])

can be thought of as the subjective value of the increment or decrement of utility uh[x] – uh[z].

Notice that if (.) is linear, (3) reduces to:

x y | z h (sh) uh(x) h (sh) uh(y).

(4)

In this special case, the preference ranking of x and y is independent of the reference act; this

ranking is determined by the expected value of utility, as in Savage’s expected utility theory.

Outside this special case, however, the concavity of (.) implies that utility losses are

weighted more heavily than utility gains of equal absolute size – the property of utility loss

aversion.

Sugden (2003) presents a set of conditions on the reference-dependent preference

relation which are equivalent to the representation (3); given these conditions, (.) is unique,

u(.) is unique up to affine transformations, and (.) is unique up to multiplication by a positive

constant.9 Formally, these conditions are closely related to a set of axioms that characterises

regret theory (Loomes and Sugden, 1987; Sugden, 1993).10

On the analogy of (1) and (2) in the dimension-based approach, it is useful to define a

function v(., .) such that, for all bundles x and z:

v(x, z) = h (sh) [uh(x) – uh(z)].

(5)

We can interpret v(x, z) as the subjective value of moving from z to x, when the actual taste

state is unknown and when z is the reference point. Thus, if we treat z as a constant, v(., z) is

a representation of preferences over bundles, viewed from z. That is, for any x, y: x y | z if

14

and only if v(x, z) v(y, z). Ranging over all values of z, v(., .) can be interpreted as

representing a system of reference-dependent preferences over bundles.

For the purposes of consumer theory, it is convenient to be able to work with the

reference-dependent preference relation – or with its representation v(., .) – as a reduced form

of the model, without taking explicit account of taste states and their associated consequences.

Thus, we look for properties of that preference relation that are implied by very general

assumptions about the state-conditional utility functions uh. Specifically, we assume only

that, in each state sh, uh(.) is continuous, strictly increasing and strictly concave. This amounts

to assuming that, in each state, preferences over bundles have the standard properties of

Hicksian consumer theory.11

In order to state the main result of this part of our analysis, we need to define the

following properties of v(., .):

Well-Behavedness: v(x, z) is continuous in x and z, strictly increasing in x, strictly

decreasing in z, and strictly concave in x.

Acyclicity: there is no sequence of bundles x1, x2, ..., xM such that v(x2, x1) 0, v(x3,

x2) 0, ..., v(xM, xM – 1) 0 and v(x1, xM) > 0.

The result (which is proved in the Appendix) is:

Result 1 If, for all states sh, uh(.) is continuous, strictly increasing and strictly

concave, then v(., .) satisfies Well-Behavedness and Acyclicity.

Well-Behavedness implies that, viewed from any given reference point, preferences

over bundles have the standard Hicksian properties of completeness, transitivity,

increasingness, strict convexity and continuity. It also implies that preferences over given

pairs of bundles are continuous with respect to changes in the reference point. Notice that no

separability assumptions have been made about the state-contingent utility functions uh and

that, as a result, separability properties are not imposed on reference-dependent preferences.

Acyclicity implies a particular form of (weak) aversion to movements away from

reference points. Specifically, it rules out the possibility that, for any bundles x1, ..., xM: x2 is

weakly preferred to x1, viewed from x1, and x3 is weakly preferred to x2, viewed from x2, and

.... , and x1 is strictly preferred to xM, viewed from xM. Were this possibility to arise, the

individual would have a positive evaluation of a combination of exchanges, each of which

15

involves a movement away from a reference point, and which, taken together, make up a

loop. This would be indicative of a preference, other things being equal, for moving away

from reference points. Conversely, Acyclicity is a natural way of representing aversion to

such movements, which has conventional Hicksian consumer theory as a limiting case. In

other words, Acyclicity encapsulates the status quo effect.

Result 1 derives the reduced form of our model. This is a preference structure with

exactly the properties of Well-Behavedness and Acyclicity proposed by Munro and Sugden

(2003), and shown by them to be consistent with a large body of evidence of systematic

deviations from Hicksisan predictions. However, as we noted in Section 1, Munro and

Sugden do not provide any psychological foundations for this model, and so are unable to

investigate how status quo effects differ across decision problems. Having grounded the

model on assumptions about taste uncertainty, we are in a position to pursue this

investigation.

3. The determinants of exchange resistance

We now consider how, within our model, the extent of any status quo effect can differ

between different choice problems. As a measure of the strength of such effects, we use the

concept of exchange resistance that we defined in Section 1. As in that earlier analysis, we

consider bundles which differ only in the quantities of goods 1 and 2. We make the

simplifying assumption that, for all states sh, uh(.) is differentiable everywhere, and that, at all

values of t where t 0, (t) is differentiable; we allow the gain/loss evaluation function to be

kinked at the boundary between gains and losses.12 These assumptions ensure that, for any

given reference point, the marginal rates of substitution r21WTP and r21WTA, and hence also the

measure of exchange resistance Q21, are well-defined. We now investigate how this measure

is related to the parameters of our model.

For each taste state sh (h = 1, ..., m), let Uh and Vh be the marginal utilities of goods 1

and 2 respectively, evaluated at z. (That is, Uh = uh(x1)/x1 and Vh = uh(x2)/x2.) As a

normalisation, we define units of the two goods so that h (sh)Uh = h (sh)Vh = 1. One

implication of this normalisation is that, starting from z, the individual is indifferent between

gaining a marginal unit of good 1 and gaining a marginal unit of good 2. We index taste states

so that U1/V1 U2/V2 ... Um/Vm, that is, so that the preference for good 2 relative to good

1, defined in terms of the marginal rate of substitution, is greater in higher-numbered states.

16

We normalise (.) so that, as t tends to zero from above, (t) = 1. We then define a

parameter such that, in the limit as t tends to zero from below, (t) = . Because (.) is

concave, 1; the higher the value of , the greater the asymmetry between the evaluation of

marginal gains and marginal losses.

We now evaluate r21WTA, using an indirect method. Suppose that the value of r21WTA is

known. We can define an integer K such that, in each state s1, ..., sK, Uh/Vh r21WTA, while in

state sK+1, ..., sm, Uh/Vh < r21WTA. Consider the effect of moving away from the status quo by

giving up one unit of good 1 and accepting r21WTA in exchange. This move leads to a (weak)

ex post loss of utility if the true state is a member of the set of loss states L = {s1, ..., sK}.

Conversely, if the true state is a member of the set of gain states G = {sK+1, ..., sm}, the move

leads to a (strict) ex post gain of utility. Since we know that, ex ante, the individual is

indifferent about the move, we have:

hL (sh) (r21WTA Vh – Uh) + hG (sh) (r21WTA Vh – Uh) = 0.

(6)

Rearranging:13

r21WTA = [ hL (sh) Uh + hG (sh) Uh] /

[ hL (sh) Vh + hG (sh) Vh].

(7)

The value of r12WTA can be derived in a symmetrical way.

The right-hand side of (7) is a ratio between a weighted sum of Uh terms and a

weighted sum of Vh terms. If = 1, the weights are equal to the probabilities of the respective

taste states, with the implication that r21WTA = 1; by symmetry, r12WTA = 1, and so Q21 = 0.

However, if > 1, the weighting is biased towards those states in which Uh/Vh is highest.

Hence the following result:

Result 2 If = 1, or if Uh/Vh has the same value in all states, Q21 = 0. If the value of

Uh/Vh differs across states, the value of Q21 is strictly increasing in .

This result establishes one of the determinants of exchange resistance: other things being

equal, exchange resistance is greater, the greater the individual’s loss aversion for utility.

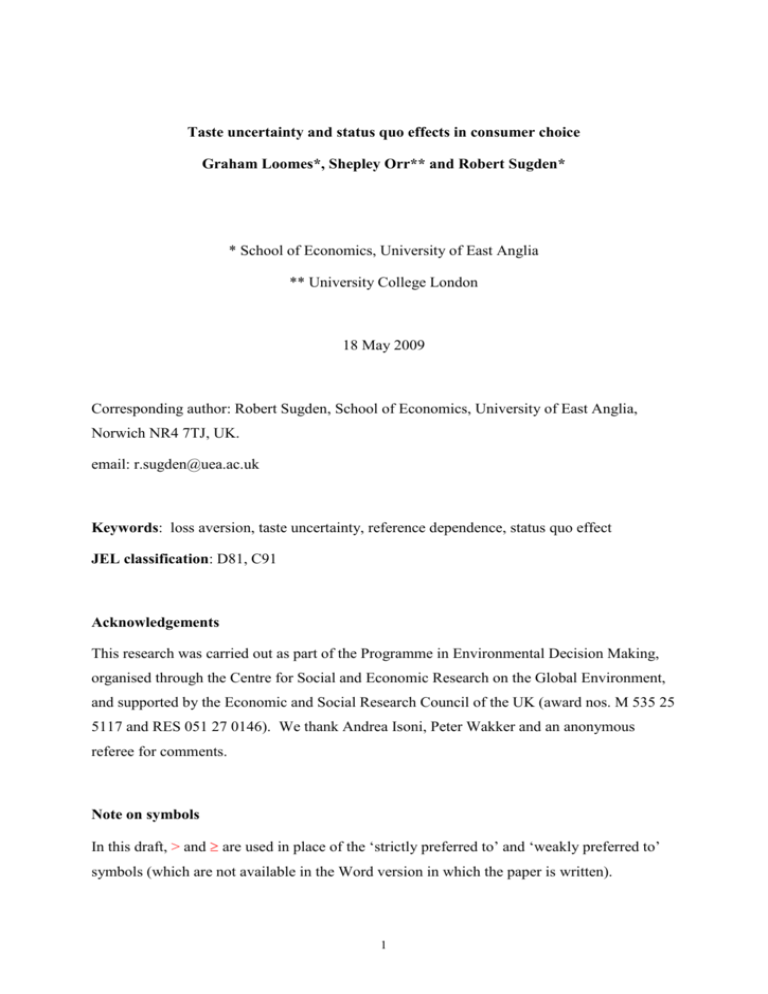

Figure 1 shows how Result 2 can be proved. It shows a case in which there are four

taste states with distinct Uh/Vh values, but the proof can be adapted to any case in which there

are two or more such states. Let z be the status quo and let x be the bundle which differs from

z by containing one less (marginal) unit of good 1 and q additional units of good 2. Consider

17

the effect on utility of giving up z and taking x in exchange. The horizontal axis of the

diagram measures cumulative probability, progressively including states s1, ..., s4. The broken

line, labelled Uh, graphs the marginal utility of good 1 in states s1, ..., s4 successively. The

solid line, labelled Vhq, graphs the incremental utility of q units of good 2, with q treated as a

constant. Because higher-numbered states have lower values of Uh/Vh, these two graphs can

cross no more than once. (To the left of the crossing point, Uh/Vh > q; to the right, Uh/Vh < q.)

The darker-shaded area A measures the expected loss of ex post utility in states in which z

gives more utility than x. The lighter-shaded area B measures the expected gain of ex post

utility in states in which the reverse is true. Thus, x is strictly (weakly) preferred to z, viewed

from z, if and only if B is strictly (weakly) greater than A.

It is immediately obvious that, as q increases, B increases and A decreases. Thus, for

any given value of , there is a unique value of q at which x ~ z | z; by definition, this value is

r21WTA. Other things being equal, increases in increase A while having no effect on B. So

if the indifference property x ~ z | z is to be maintained, increases in must be offset by

increases in q. That is, r21WTA increases as increases. A symmetrical argument shows that

the same is true of r12WTA. So Q21 increases as increases.

Result 2 establishes that, in our model, exchange resistance increases with loss

aversion in utility. This result has two implications that can be tested using betweenindividual data on choice behaviour. First, it implies that, other things being equal,

individuals who show greater exchange resistance with respect to any one pair of goods (thus

revealing that the values of their parameters are relatively high) will also show greater

exchange resistance with respect to other pairs. Second, since higher values of imply

greater risk aversion with respect to monetary gambles which involve chances of both gain

and loss, exchange resistance in commodity space will be positively associated with greater

risk aversion in this sense.14

We now consider how exchange resistance varies with changes in the specification of

taste uncertainty, for given values of (greater than 1). Intuitively, one might expect that as

uncertainty about tastes increases, so does exchange resistance. But if that intuition is to be

firmed up, we need a formal definition of an ‘increase’ in taste uncertainty. Because

exchange resistance is defined with respect to a pair of goods, the relevant concept of

uncertainty must apply to tastes for the two goods relative to one another. We offer the

following definition.

18

We analyse taste uncertainty with respect to two goods, 1 and 2. As before, units of

these goods are normalised so that h (sh)Uh = h (sh)Vh = 1. The m taste states are

indexed so that higher-numbered states have (weakly) lower values of Uh/Vh. Consider a

change in the vector of state-conditional marginal utilities of good 1 from (U1, ..., Um) to (U1,

..., Um), such that h (sh)Uh = 1 (that is, the mean value of marginal utility is preserved),

with the state-conditional marginal utilities of good 2 held constant. This change is a meanpreserving disalignment of u(.) with respect to v(.) if, for each g = 1, ..., m – 1, h=1 g (sh)(Uh

– Uh) > 0. In terms of Figure 1, such a change is a shift in the Uh graph which keeps the area

under the graph constant while shifting its mass from the right (that is, states with low values

of Uh/Vh) to the left (states with high values of Uh/Vh). Intuitively, the vectors of marginal

utilities for the two goods are becoming ‘more different’.

The following result firms up the intuition that, other things being equal, exchange

resistance increases with taste uncertainty (or, one might say, with taste disalignement):

Result 3 If, other things being equal, there is a change in taste uncertainty which takes

the form of a mean-preserving disalignment of u(.) with respect to v(.), and if > 1,

then there is a strict increase in the value of Q21.

The proof is given in the Appendix. The essential idea can be illustrated by Figure 1. A

mean-preserving disalignment of u(.) with respect to v(.) increases both the area A (the

expected loss of utility from choosing x rather than z in states in which z gives more utility)

and the area B (the expected gain of utility from choosing x rather than z in states in which x

gives more utility); and these increases are equal in absolute size. Since A is weighted by the

loss-aversion parameter , the overall effect is to make the move from z to x less attractive.

This can be offset only by an increase in q. In other words, as taste uncertainty increases, so

does WTA.

In combination with certain credible auxiliary hypotheses, this result has significant

implications which can be tested without any need for taste states, or preferences conditional

on those states, to be observed directly. One such auxiliary hypothesis is that taste

disalignment between pairs of goods tends to be negatively related to the similarity of the

relevant goods. For this purpose, ‘similarity’ should be interpreted subjectively: two goods

are similar if, in typical consumption environments, most consumers treat an unanticipated

gain of one of them as more or less interchangeable with an unanticipated gain of the other.15

Given this hypothesis, Result 3 implies that exchange aversion is inversely related to

19

similarity. Kőszegi and Rabin’s model has a parallel implication, illustrated by the example

of the two brands of orange juice (discussed in Section 1). On Kőszegi and Rabin’s analysis,

these products are similar in hedonic characteristics, and so exchanging one for the other does

not involve significant gain or loss on any dimension. On our analysis, they are similar in the

sense that, in most circumstances, consumers do not have strong preferences for either over

the other.

Another possible auxiliary hypothesis is that, in relation to given consumption

prospects, taste disalignment tends to decrease as the moment of consumption approaches.16

One might expect that, as that moment becomes closer, there will be some resolution of

uncertainty about the taste state in which consumption will take place. The implication is

that, other things being equal, exchange aversion between given consumption prospects will

decline over time. However, this is not to predict that exchange aversion will have

disappeared entirely at the moment of consumption. Intrinsic uncertainty – not feeling sure of

one’s tastes – is not necessarily eliminated by objective information.

A more direct implication of Result 3, and one which has no counterpart in a

dimension-based model, is that exchange aversion is positively related to preference

imprecision. For this implication to be tested, we need an operational measure of preference

imprecision. Such a measure has been developed by Butler and Loomes (2007). The

essential idea is to present an individual with a sequence of choice tasks between a fixed

option A and a variable option B. For example, A might be a consumption good and the B

options might be different amounts of money. In each task, the respondent has to give one of

four alternative responses: ‘I definitely prefer A’ (response 1), ‘I think I prefer A but I’m not

sure’ (response 2), ‘I think I prefer B but I’m not sure’ (response 3), and ‘I definitely prefer B’

(response 4). The incentive is that each task has some chance of being used to determine the

individual’s payoff; in this event, responses 1 and 2 are treated as indicating the choice of A,

while responses 3 and 4 indicate the choice of B. Whether the respondent records a choice of

(say) A as ‘I definitely prefer’ or ‘I think I prefer’ is not incentivised, but one might expect

this intuitive distinction to be salient for someone who is thinking carefully about whether to

choose A or B. This procedure can be used to elicit both a point estimate of the money value

of the good (that is, the switch point between responses 2 and 3) and an imprecision interval

(the interval between the switch point between responses 1 and 2 and the switch point

between responses 3 and 4). Butler and Loomes show that imprecision intervals vary

20

systematically between tasks in ways that are consistent with a theory of preference

imprecision.

For any individual and any consumption good, this procedure could be used to elicit

an ‘equivalent gain’ valuation of that good (that is, the sum of money such that the individual

is indifferent between gaining that sum and gaining the good) and the corresponding

imprecision interval. The latter could be expressed in a dimension-free way as proportion of

the valuation. WTA and WTP valuations of the good could also be elicited, yielding a

measure of exchange resistance between the good and money. Our prediction is that,

comparing across different goods, the two measures would be positively correlated.

4. How exchange resistance varies with information and experience

In this Section we consider some more general implications of the most distinctive feature of

our model – that exchange resistance is positively associated with taste uncertainty.

With the growth of experimental evidence about the effect of experience on

‘anomalies’, it has become increasingly obvious that economics needs a theory that can

explain why status quo effects may be variable across different environments and between

different rounds of trading within the same environment. There is now a substantial body of

evidence which suggests that the prevalence and strength of disparities between WTA and

WTP valuations tend to decay as individuals gain certain kinds of market experience (e.g.

Shogren et al, 1994; List, 2003; Loomes, Starmer and Sugden, 2003). Since the frequentlyobserved disparity between WTA and WTP is one of the most salient stylised facts that

theories of reference-dependence purport to explain, evidence that this disparity decays with

market experience presents a challenge for those theories. A further challenge is set by the

observation (which we will discuss in more detail later) that WTA/WTP disparities observed

in stated-preference studies involving health and environmental goods are often much greater

than those observed in controlled laboratory experiments.

Some commentators interpret this evidence as indicating that WTA/WTP disparities

do not reflect a genuine property of individuals’ preferences, as represented in models such as

Tversky and Kahneman’s. Instead, it is suggested, these effects are artefacts of experimental

and survey designs which do not give respondents adequate opportunities and incentives to

rid themselves of misconceptions about the tasks they confront (e.g. Plott and Zeiler, 2005).

According to this account, WTA/WTP disparities will be greater in decision problems that are

21

more susceptible to misconceptions and carelessness. The decay of disparities in repeated

market experiments might be explained as a result of participants’ progressively improving

understanding of the trading environment. The wide disparities found in stated-preference

surveys might be attributed to the hypothetical nature of the scenarios used in such surveys:

hypothetical scenarios provide no material incentives for careful deliberation, and may be

more susceptible to misunderstanding than tasks which involve buying or selling familiar

consumption goods. In evaluating these arguments, it is important to know whether the same

evidence can be explained by theories in which preferences are reference-dependent.

The taste uncertainty approach implies that status quo effects are likely to be

particularly strong when individuals face problems that they have not faced before or thought

about much in advance. Some support for this suggestion is provided by Shogren et al’s

(1994) finding that WTA/WTP disparities in repeated experimental markets are vastly greater

when the good that is being traded is an upgrade from an ordinary sandwich to a sandwich

that has been screened for food-poisoning pathogens than when it is an upgrade from a piece

of candy to a candy bar.17 Intuitively, one would expect respondents to be much more

uncertain of their tastes between money and food-poisoning-screening than between money

and candy. In a between-subjects experimental test, Georantzí and Navarro-Martinez (2008)

find that WTA/WTP disparities for a bottle of wine are smaller for subjects who report greater

familiarity with the product.

This feature of our model may help to explain why WTA/WTP disparities tend to be

particularly large in stated-preference data. A review of 201 studies that have elicited

comparable WTA and WTP valuations finds that WTA/WTP disparities are much greater

when the valuations are of non-marketed goods or health or safety – contexts in which one

would expect taste uncertainty to be particularly prevalent – than when they are of ordinary

private goods or lotteries (Horowitz and McConnell, 2002).

If status quo effects are induced by taste uncertainty, we should expect a general

tendency for experience – whether in markets or not – to reduce the degree of such effects.

Thus, our approach provides a possible explanation for the observed tendency for WTA/WTP

disparities to decay with market experience.

There are at least two potential mechanisms here. One is the mechanism of

discovered preference, through which an individual learns about tastes that, in some sense,

she had from the outset (Plott, 1996). As the individual gains experience of consuming

22

particular goods, she may learn more about the degree to which she enjoys them.

Independently of actual consumption, the process of deliberating about whether to buy or sell

a good may recall memories, or provide cues for ideas, which reduce her subjective

uncertainty about her tastes. (An opposite effect is also possible: the more one thinks about

certain unfamiliar goods, the more conflicting feelings, doubts and concerns might arise.)

The second mechanism works through the acquisition of information about other

people’s tastes. Such information may influence the formation of tastes in ways that, from the

standpoint of conventional theory, are irrational. In relation to the experimental evidence

concerning loss aversion and market experience, the effects of exposure to price information

are of particular interest: an agent may treat market prices as if they were indicators of what

the relevant good is worth to her, even though its ‘true’ value to her is an entirely private

matter. This hypothesis is supported by the evidence that individuals’ bids and asks in

successive rounds of experimental markets where values are not induced tend to track price

feedback from previous rounds – the shaping effect of price information (Knetsch, Tang and

Thaler, 2001; Loomes, Starmer and Sugden, 2003). If market (or other social) experience

makes agents feel less uncertain about their tastes, it will tend to reduce status quo effects.

Significantly, our model reduces to Hicksian consumer theory when there is no

uncertainty about tastes. In that case, m = 1; u1(.), the utility function for the only taste state,

has the standard properties of utility functions in consumer theory. Because (.) is an

increasing function, (3) reduces to x y | z u1(x) u1(y). This is a fundamental point of

difference between our approach and the dimension-based models proposed by Tversky and

Kahneman and by Kőszegi and Rabin. As we explained in Section 1, dimension-based

models provide no general mechanism by which information or experience can attenuate

status quo effects. The multi-dimensionality of consumption bundles is a fact of life; if there

is loss aversion with respect to dimensions, the effects of this cannot be removed by learning.

In terms of the familiar diagram of indifference curves in commodity space, status quo effects

correspond with kinks in those curves at the reference levels of each good. If (as

hypothesised by Kőszegi and Rabin) reference points are endogenous, the locations of these

kinks may change as a consumer gains experience, but the kinks will remain. In our model, in

contrast, indifference curves become smoother as taste uncertainty is eroded. Thus, our

approach might be interpreted as legitimating the use of standard Hicksian consumer theory

when modelling the behaviour of well-informed consumers, or when modelling long-run

equilibrium.

23

5. Conclusion

Recently, attempts have been made to adapt consumer theory to take account of the growing

evidence of status quo effects – the tendency for individuals to prefer the status quo to

change. Some of the most influential work in this area has followed a ‘dimension-based’

approach, in which loss aversion is treated as a separable property of each dimension of

commodity or characteristics space. Implicitly or explicitly, theories which follow this

approach assume that utility is additively separable in goods or characteristics. In doing so,

they sacrifice an important property of standard consumer theory, and one which helps to

make that theory flexible enough for general-purpose use. One of the crucial steps in the

development of modern consumer theory was the elimination of the assumption of additive

separability that early neoclassical economists had thought necessary. This move allowed

consumer theory to accommodate different degrees of substitutability or complementarity

between goods, and made the implications of the theory much less dependent on particular

specification of the dimensions of the space over which preferences are defined. It would be

unfortunate if these useful properties of consumer theory had to be given up in order to

accommodate status quo effects and other forms of reference-dependence.

However, as Munro and Sugden (2003) showed, standard consumer theory can be

generalised to take account of reference-dependence without assuming additive separability.

In this paper we have provided psychological foundations for Munro and Sugden’s

representation of reference-dependent preferences by deriving it as the reduced form of a

model in which individuals are uncertain about their tastes, and in which choice under

uncertainty is governed by reference-dependent subjective expected utility theory. The

central idea is that loss aversion is an attitude to gains and losses of utility rather than to gains

and losses of separable characteristics of consumption.

The ‘taste uncertainty’ approach has implications that are very different from those of

dimension-based models. A key hypothesis that the strength of status quo effects is positively

related to the extent of taste uncertainty. This hypothesis may help to explain observed

differences in the strength of status quo effects between different decision contexts, and

observed tendencies for these effects to decay as individuals gain certain kinds of experience.

The challenge now is to devise and conduct controlled tests to discriminate between and build

upon the distinctive implications of the different theories in this field.

24

Appendix: Proofs

Proof of Result 1

Suppose that, for all states sh, uh(.) is continuous, strictly increasing and strictly concave. It is

straightforward to show that these assumptions imply that v(x, z) is continuous in x and z,

strictly increasing in x, strictly decreasing in z, and strictly concave in x, thus satisfying WellBehavedness. We now prove that Acyclicity is satisfied.

We define a function w(.) in the following way: for all bundles x, w(x) = h (sh) uh(x).

Thus w(x) can be interpreted as the expected value of the subjective experience of consuming

x. Notice that this value is independent of the reference point. Thus, w(.) determines a

reference-independent ordering of bundles.

We fix a parameter r such that r > 0 and, for all real numbers q, rq (q). Since (0)

= 0 and (.) is weakly concave, such a parameter must exist. (If (.) is differentiable, r must

equal (0).) Hence, for all bundles x and z, v(x, z) = h (sh) [uh(x) – uh(z)] r h (sh)

[uh(x) – uh(z)] = r[w(x) – w(z)]. Thus, v(x, z) 0 implies w(x) w(z), and v(x, z) > 0 implies

w(x) > w(z). However, v(x, z) 0 x z | z, and v(x, z) > 0 x > z | z. Thus, x z | z

implies w(x) w(z), and x > z | z implies w(x) > w(z). So, if the move from z to x is weakly

choosable, x is ranked at least as highly as z in the reference-independent ordering defined by

w(.), while if the move is strictly choosable, x is ranked above z. It follows immediately from

this result that Acyclicity is satisfied.

Proof of Result 3

Let U = (U1, ..., Um) and V = (V1, ..., Vm) be vectors of state-conditional marginal utilities for

goods 1 and 2 respectively, such that U1/V1 U2/V2 ... Um/Vm. Units of the two goods are

normalised so that h (sh)Uh = h (sh)Vh = 1. Let U = (U1, ..., Um) be an alternative

vector for good 1, such that the switch from U to U is a mean-preserving disalignment of u(.)

with respect to v(.). Let z be any bundle, and let x the bundle which differs from z by

containing one less marginal unit of good 1 and q additional units of good 2. Set the value of

q so that, when marginal utilities are given by U and V, x ~ z | z (i.e. q = r21WTA). For each

state h = 1, ..., m, we define Ah = max[(sh)(Uh – Vhq), 0], Bh = max[(sh)(Vhq – Uh), 0], Ah =

max[(sh)(Uh – Vhq), 0], and Bh = max[(sh)(Vhq – Uh), 0]. Notice that because of our

normalisations, and because of the definition of ‘mean-preserving disalignment’, h (Bh – Ah)

25

= h (Bh – Ah) = q – 1. (In terms of the notation in Figure 1, the areas A and B are equal to

h Ah and h Bh respectively.)

Because states are indexed in descending order of Uh/Vh, we can define an integer K

such that, for each h = 1, ... K, Uh/Vh q, while for each h = K + 1, ..., m, Uh/Vh < q. Since x ~

z | z, there must be at least one state in which Uh/Vh q; thus 1 < K m. It follows from the

definitions of Ah and Bh that for each h = 1, ..., K, Ah 0 and Bh = 0, while for each h = K + 1,

..., m, Ah = 0 and Bh > 0. (In terms of Figure 1, in which K = 3, the whole of area A lies to the

left of the cumulative probability of states 1 to 3, while the whole of area B lies to the right.)

It follows from the definition of ‘mean-preserving disalignment’ that h=1 K (sh)(Uh – Uh) >

0. But, for all h, (sh)(Uh – Vhq) (Ah – Bh) – (Ah – Bh). For all h = 1, ..., K, Bh = 0 (see

above) and Bh 0 (by definition). Thus, we have h=1 K (Ah – Ah) > 0. For all h = K + 1, ...,

m, Ah = 0 (see above) and Ah 0 (by definition). Thus, h (Ah – Ah) > 0. Recall that h (Ah

– Ah) = h (Bh – Bh). So the expected value of utility loss in states in which z gives weakly

more utility than x (and, equivalently, the expected value of utility gain in states in which z

gives strictly less than x) is greater in absolute value when marginal utilities are given by U

than when they are given by U. Thus if > 1, the change from U to U implies a change in

preference from x ~ z | z to z > x | z. To restore indifference, there must be an increase in q.

Thus, the change induces an increase in r21WTA.

A symmetrical argument shows that (with > 1) the same change in marginal utilities

induces an increase in r12WTA. Thus, it induces an increase in Q21.

References

Becker, Gordon, Morris DeGroot and Jacob Marschak (1963). Stochastic models of choice

behavior. Behavioral Science 8: 41–55.

Butler, David and Graham Loomes (2007). Imprecision as an account of the preference

reversal phenomenon. American Economic Review 97: 277–297.

De Giorgi, Enrico and Thierry Post (2008). Loss aversion with a state-dependent reference

point. Working paper, University of Lugano and Erasmus University Rotterdam.

26

Georgantzís, Nikolaos and Daniel Navarro-Martínez (2008). Understanding the WTA-WTP

gap through attitudes, feelings, risk preferences and personality. Paper presented at

CREED/ CEDEX/ UEA Conference, University of Amsterdam, June 2008.

Hanemann, W. Michael (1991). Willingness to pay and willingness to accept: how much can

they differ? American Economic Review 81: 635-647.

Horowitz, John and Kenneth McConnell (2002). A review of WTA/WTP studies. Journal of

Environmental Economics and Management 44: 426-447.

Horowitz, John and Kenneth McConnell (2003). Willingness to accept, willingness to pay

and the income effect. Journal of Economic Behavior and Organisation 51: 537-545.

Kahneman, Daniel and Tversky, Amos (1979). Prospect theory: an analysis of decision under

risk. Econometrica 47: 263-291.

Kahneman, Daniel and Carol Varey (1991). Notes on the psychology of utility. In Jon Elster

and John Roemer (eds), Interpersonal Comparisons of Well-Being, pp. 127-163.

Cambridge: Cambridge University Press.

Knetsch, Jack (1989). The endowment effect and evidence of nonreversible indifference

curves. American Economic Review 79: 1277-1284.

Knetsch, Jack L., Fang-Fang Tang and Richard H. Thaler (2001). The endowment effect and

repeated market trials: is the Vickrey auction demand revealing? Experimental

Economics 4: 257-269.

Kőszegi, Botond and Matthew Rabin (2004). A model of reference-dependent preferences.

Working paper E04 337, Institute of Business and Economic Research, University of

California at Berkeley.

Kőszegi, Botond and Matthew Rabin (2006). A model of reference-dependent preferences.

Quarterly Journal of Economics 121: 1133-1166.

Kőszegi, Botond and Matthew Rabin (2007). Reference-dependent risk attitudes. American

Economic Review 97(4): 1047–1073.

List, John A. (2003). Does market experience eliminate market anomalies? Quarterly

Journal of Economics 118 (1): 41-71.

Loomes, Graham, Chris Starmer and Robert Sugden (2003). Do anomalies disappear in

repeated markets? Economic Journal 113: C 153-166.

27

Loomes, Graham and Robert Sugden (1987). Some implications of a more general form of

regret theory. Journal of Economic Theory 41: 270-287.

Loomes, Graham and Robert Sugden (1995). Incorporating a stochastic element into decision

theories. European Economic Review 39: 641-648.

MacCrimmon, Kenneth and Maxwell Smith (1986). Imprecise equivalences: preference

reversals in money and probability. University of British Columbia Working Paper

#1211.

Munro, Alistair and Robert Sugden (2003). On the theory of reference-dependent

preferences. Journal of Economic Behavior and Organization 50: 407-28.

Plott, Charles R. (1996). Rational individual behaviour in markets and social choice

processes: the discovered preference hypothesis. In The Rational Foundations of

Economic Behaviour, eds Kenneth J. Arrow, Enrico Colombatto, Mark Perlman and

Christian Schmidt. Basingstoke: Macmillan, pp. 225-250.

Plott, Charles R. and Kathryn Zeiler (2005). The willingness to pay–willingness to accept

gap, the ‘endowment effect’, subject misconceptions, and experimental procedures for

eliciting valuations. American Economic Review 95: 530-545.

Rabin, Matthew (2000). Risk aversion and expected-utility theory: a calibration theorem.

Econometrica 68: 1281-1292.

Savage, Leonard (1954). The Foundations of Statistics. New York: Wiley.

Schmidt, Ulrich, Chris Starmer and Robert Sugden (2008). Third-generation prospect theory.

Journal of Risk and Uncertainty 36 (2008): 203-223.

Shogren, Jason, Seung Y. Shin, Dermot Hayes, and James B. Kliebenstein (1994). Resolving

differences in willingness to pay and willingness to accept. American Economic

Review, 84: 255-270.

Sileo, Patrick (1995). Intransitivity of indifference, strong monotonicity and the endowment

effect. Journal of Economic Theory 66: 198-223.

Sugden, Robert (1993). An axiomatic foundation for regret theory. Journal of Economic

Theory 60: 159-180.

Sugden, Robert (1999). Alternatives to the neoclassical theory of choice. In Ian Bateman and

Kenneth Willis (eds), Valuing Environmental Preferences: Theory and Practice of the

28

Contingent Valuation Method in the US, EC and Developing Countries. Oxford:

Oxford University Press.

Sugden, Robert (2003). Reference-dependent subjective expected utility. Journal of

Economic Theory 111: 172-191.

Tversky, Amos and Daniel Kahneman (1991). Loss aversion in riskless choice: a referencedependent model. Quarterly Journal of Economics 106: 1039-1061.

Tversky, Amos and Daniel Kahneman (1992). Advances in prospect theory: cumulative

representation of uncertainty. Journal of Risk and Uncertainty 5: 297-32.

29

Figure 1

marginal

utility

Vh q

Uh

A

B

0

(s1)

(s1)+(s2) (s1)+(s2)

+(s3)

cumulative probability

30

1

Notes

1

Sileo (1995) proposes a rather similar hypothesis about the relationship between loss

aversion and taste uncertainty, but develops it in a theoretical direction very different from

that of the present paper.

2

In a private communication, Kahneman has confirmed that, in constructing their theory, he

and Tversky used (1) as their starting point.

3

For example: ‘Loss aversion implies that the impact of a difference on a dimension is

generally greater when that difference is evaluated as a loss than when the same difference is

evaluated as a gain’ (p. 1040). For more on the role of the basic model in TK’s theory, see

Munro and Sugden (2003).

4

KR’s model might be amended by defining a separate gain-loss function i (with

corresponding parameter i) for each characteristic i. But even with this amendment, the

model’s additively separable structure has restrictive implications for exchange aversion. For

example, suppose characteristics are identified with goods. Let goods 1 and 2 be very similar

brands of chocolate, and goods 3 and 4 be very similar brands of wine. Intuitively, one might

expect Q12 and Q34 to be close to zero. In the amended model, that would be possible only

with 1 2 3 4 1, which would imply very low exchange aversion between either brand

of chocolate and either brand of wine.

5

In an earlier version of their paper, Kőszegi and Rabin (2004) develop this approach in more

detail.

6

If characteristics are identified with goods, (WTP – WTA)/WTA = 2 – 1 if trades are

anticipated and (WTA – WTP)/WTP = 2 – 1 if they are unanticipated.

7

We treat ‘consequences’ as descriptions of subjective experiences, not tied by definition to

any particular bundle or state. Thus, a proposition of the form c(x, sh) = c(y, sg) indicates that

consuming bundle x in state sh leads to the same subjective experience as consuming y in sg.

8

RDSEUT is not the only theory of reference-dependent choice under uncertainty which

allows uncertain reference points. Schmidt, Starmer and Sugden (2008) propose a

generalisation of RDSEUT which incorporates rank-dependent decision weights. Kőszegi

and Rabin (2007) propose a theory that is similar to RDSEUT, but which takes no account of

the state-contingent juxtaposition of consequences. This feature of Kőszegi and Rabin’s

31

theory has the paradoxical implication that there can be lotteries x for which x > x | x (Schmidt

et al, 2008; De Giorgi and Post, 2008).

9

To guarantee the uniqueness properties of the three functions, some structure has to be

imposed on S and C, and preferences have to have appropriate continuity properties. Sugden

(2003) proves the representation theorem for the case in which C is the non-negative real line;

consequences are interpreted as levels of wealth. Some technical modifications are needed in

order for the theorem to apply to the case in which C is the set of possible subjective

experiences.

10

In regret theory, preferences between acts are defined relative to the set of feasible acts that

constitutes the choice problem, while in RDSEUT, preferences between acts are defined

relative to a fixed reference act. However, the regret-theoretic concept of a preference

between x and y, conditional on the feasible set being {x, y, z}, is in important respects

isomorphic with the concept of a reference-dependent preference between x and y, conditional

on the reference act being z.

11

In standard consumer theory, preferences are ordinal, and so strict convexity of preferences

corresponds with strict quasi-concavity of utility. Because the RDSEUT framework uses

cardinal utility, we have to ‘translate’ strict convexity of preferences as strict concavity of

utility.

12

Some such kink is consistent with the observed degrees of loss aversion for very small

changes in wealth or consumption (see Rabin, 2000). For this reason, prospect theory needs

to allow value functions to be kinked at zero (Kahneman and Tversky, 1979; Tversky and

Kahneman, 1992).

13