Andrew J. Dane

advertisement

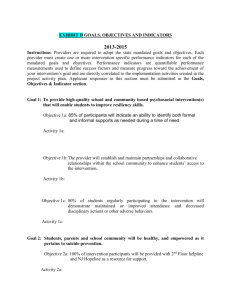

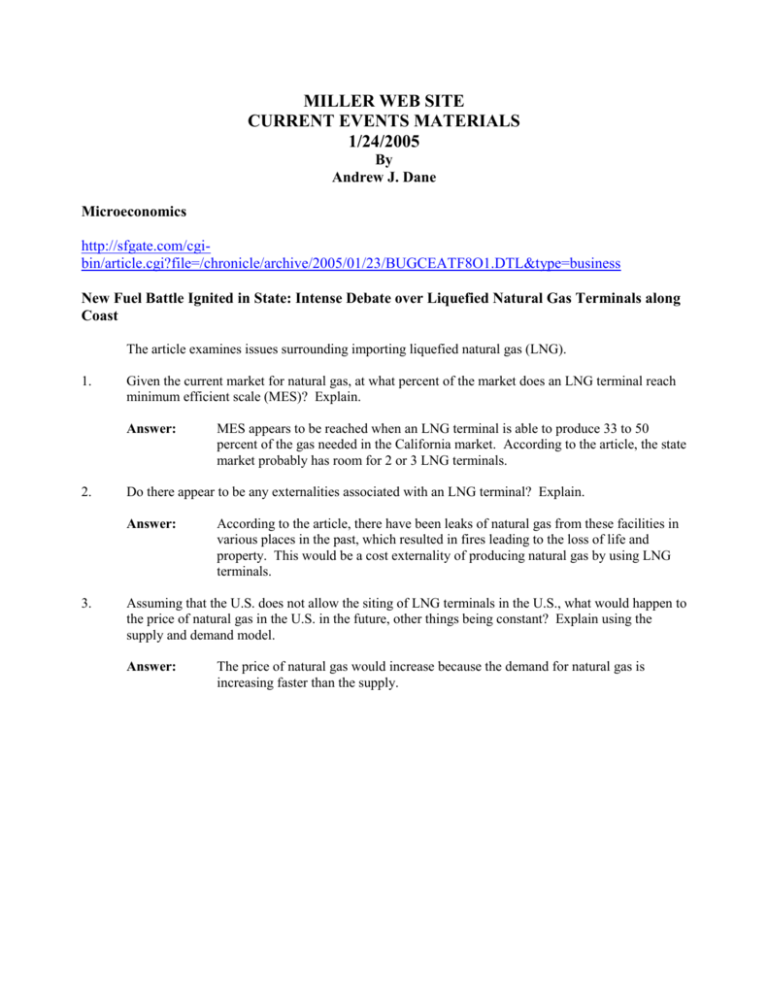

MILLER WEB SITE CURRENT EVENTS MATERIALS 1/24/2005 By Andrew J. Dane Microeconomics http://sfgate.com/cgibin/article.cgi?file=/chronicle/archive/2005/01/23/BUGCEATF8O1.DTL&type=business New Fuel Battle Ignited in State: Intense Debate over Liquefied Natural Gas Terminals along Coast The article examines issues surrounding importing liquefied natural gas (LNG). 1. Given the current market for natural gas, at what percent of the market does an LNG terminal reach minimum efficient scale (MES)? Explain. Answer: 2. Do there appear to be any externalities associated with an LNG terminal? Explain. Answer: 3. MES appears to be reached when an LNG terminal is able to produce 33 to 50 percent of the gas needed in the California market. According to the article, the state market probably has room for 2 or 3 LNG terminals. According to the article, there have been leaks of natural gas from these facilities in various places in the past, which resulted in fires leading to the loss of life and property. This would be a cost externality of producing natural gas by using LNG terminals. Assuming that the U.S. does not allow the siting of LNG terminals in the U.S., what would happen to the price of natural gas in the U.S. in the future, other things being constant? Explain using the supply and demand model. Answer: The price of natural gas would increase because the demand for natural gas is increasing faster than the supply. http://chronicle.com/cgi2bin/printable.cgi?article=http://chronicle.com/prm/weekly/v51/i17/17b01201.htm How Should Public Colleges Price Their Product? The article examines the issue of how public universities should price their product—educational services—to increase net tuition revenue. 1. According to the article, public universities that wish to increase enrollment and generate maximum revenue at the least cost must identify the “price sensitivity” of potential students. What do economists call “price sensitivity” as the term is used in the article? Explain using information from the article. Answer: 2. Are universities price takers? Explain. Answer: 3. Economists refer to “price sensitivity” as price elasticity of demand. According to the article, universities must learn “how consumers react to prices.” For example, the article suggests that if the price (tuition) is set too high, net revenue may fall, i.e. the demand is price elastic (higher price decreases revenue). No. It is clear from the article that universities can set their own prices. In fact they must try to find a revenue maximizing price and even charge different prices— tuition minus financial aid—to different students. How could it be possible that overall universities that have increased tuition discounts—that is have lowered price—have not had expanded enrollments? (Hint: From information in the article, have the price cuts been across the board or on a student-by-student basis? Why would this matter?) Answer: The price cuts, or tuition discounts, have been on a student-by-student basis. It appears that financial aid has been offered to students who would have come to a given university even without financial aid, or for as much aid as was offered, leaving fewer resources available for lowering price to all students by enough to attract significantly more needy students. Macroeconomics http://www.economist.com/finance/displayStory.cfm?story_id=3561492 Leading Economic Indicators: Divining the Future The article looks at the use of leading economic indicators as a forecasting tool. 1. How would a leading indicator provide a forecast of a recession? Answer: 2. The article suggests that leading indicators can also signal economic slowdowns that will not necessarily turn into recessions. How is this possible? Answer: 3. A leading indicator would begin to decrease before the recession started and would continue to fall for a sustained period of time. Instead of decreasing, the growth rate of the indicators would decrease for a sustained period. Since they are related to overall economic activity, a slowdown in the growth rate of these indicators would signal a slowdown in economic activity. According to the article, ECRI’s leading indicators have been more accurate in predicting downturns in economic activity than have those published by the Conference Board. Why? Answer: ECRI’s leading indicators are broken down by how long they lead economic activity, while those of the Conference Board are not. Thus, the Conference Board’s long-term indicators may be falling while the ones with a short-term lead are still increasing. The result can be that the increases in the indicators with short-term leads cancel out the effects of the falling indicators that have a long-term lead. With the ECRI approach, the longer-term and short-term indicators are analyzed separately, and the Conference Board’s problem is avoided. http://story.news.yahoo.com/news?tmpl=story&cid=66&ncid=66&e=18&u=/bw/20050121/bs_bw/ nf200501212742db053 An Older, Poorer World The article examines the impact an aging population has on the world economy. 1. Why would declining birth rates and longer life spans have the effect of slowing down the growth saving and capital formation? Answer: 2. What effect would declining birth rates have on economic growth rates? Explain. Answer: 3. Less saving will occur as more persons retire, live longer, and draw down past savings. Total saving will decrease compared to the current levels. Thus, there will be less capital investment. Declining birth rates will decrease the rate of growth of the population and thus of the labor force. Other things being constant, a slower growing labor force will result in a slower growth rate than will a faster growing one. Why does the article argue that growing productivity is unlikely to solve the problem of lower growth due to declining birth rates and an ageing population, at least in the U.S.? Answer: Increases in productivity lead to higher real incomes. Higher real incomes should result in increased saving rates and thus increased capital investment. In the U.S. over the past 15 years, growth in productivity has not led to increased savings rates.