short_notes

advertisement

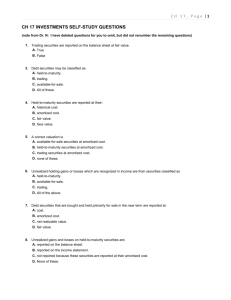

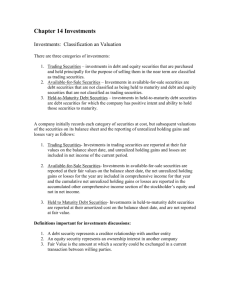

CH 17: Accounting for Investments A. Fair Value Method of accounting for Investments (Chapter 17) -Accounting for debt securities (HTM, AFS, TDS) -Accounting for equity securities (AFS, TDS) B. Equity method of accounting for Investment (Chapter 17) C. Consolidation (Covered in Acct 420) A. Fair Value Method Debt Securities Debt Securities are instruments representing a creditor relationship with an enterprise. Debt securities include U.S. government securities, municipal securities, corporate bonds, convertible debt, commercial paper, and all securitized debt instruments. Debt securities are grouped into the following three separate categories: a. Held-to-maturity: Debt securities that the enterprise has the positive intent and ability to hold to maturity. HTMs are accounted for at amortized costs. b. Trading: Debt securities bought and held primarily for sale in the near term to generate income on short-term price differences. TDSs are accounted for at FMV. c. Available-for-sale: Debt securities not classified as held-to-maturity or trading securities. AFSs are accounted for at FMV => Amortized costs are compared against FMV. Held-to-Maturity Debt Securities Held-to-maturity debt securities are accounted for at amortized cost, not fair value. A Held-to Maturity Securities account is used to indicate the type of debt security purchased. Available-for-Sale Debt Securities Available-for-sale debt securities are reported at fair value. The unrealized gains and losses related to changes in the fair value of available-for-sale debt securities are recorded in an unrealized holding gain or loss account. This account is reported as other comprehensive income and as a separate component of stockholders’ equity until realized. A valuation account called “Securities Fair Value Adjustment (Available-for-Sale)” is used instead of debiting or crediting the Available-for-Sale Securities account to enable the company to maintain a record of its amortized cost. The realized gain or loss is reported in the Other Revenues and Gains section or the Other Expenses and Losses section of the income statement. Trading Securities Trading securities are reported at fair value, with unrealized holding gains and losses reported as part of net income. Any discount or premium is not amortized. A holding gain or loss is the net change in the fair value of a security from one period to another, exclusive of dividend or interest revenue recognized but not received. A valuation account called “Securities Fair Value Adjustment (Trading)” is used instead of debiting or crediting the Trading Securities account. Amortization on Bond Investments The effective-interest method is required to amortize premium or discount unless some other method—such as the straight-line method—yields a similar result. The effectiveinterest method is applied to bond investments in a fashion similar to that described for bonds payable. The effective-interest rate or yield is computed at the time of investment and is applied to its beginning carrying amount (book value) for each interest period to compute interest revenue. The investment carrying amount is increased by the amortized discount or decreased by the amortized premium in each period. Equity Securities Equity securities are described as securities representing ownership interest such as common, preferred, or other capital stock. They also include rights to acquire or dispose of ownership interests at an agreed upon or determinable price such as warrants, rights, and call options or put options. The degree to which one corporation (investor) acquires an interest in the common stock of another corporation (investee) generally determines the accounting treatment for the investment subsequent to acquisition. Investments by one corporation in the common stock of another and the accounting method to be used can be classified according to the percentage of the voting stock of the investee held by the investor: Holding Method a. Less than 20% Fair Value Method (HTM, AFS & TDS) b. Between 20% and 50% Equity Method c. More than 50% Consolidated Statements B. Equity Method When an investor has a holding interest of between 20% and 50% in an investee corporation, the investor is generally deemed to exercise significant influence over operating and financial policies of the investee. In instances of “significant influence,” the investor is required to account for the investment using the equity method. Under the equity method the investment’s carrying amount is periodically increased (decreased) by the investor’s proportionate share of the earnings (losses) of the investee and decreased by all dividends received by the investor from the investee. The investor must record as separate components the amount of ordinary and extraordinary income as reported by the investee.