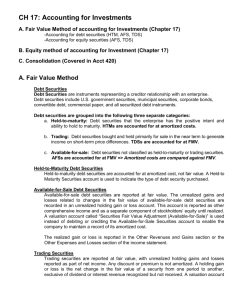

Chapter 14 Investments

advertisement

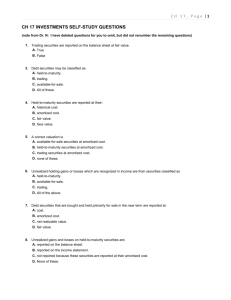

Chapter 14 Investments Investments: Classification an Valuation There are three categories of investments: 1. Trading Securities – investments in debt and equity securities that are purchased and held principally for the purpose of selling them in the near term are classified as trading securities. 2. Available-for-Sale Securities – Investments in available-for-sale securities are debt securities that are not classified as being held to maturity and debt and equity securities that are not classified as trading securities. 3. Held-to-Maturity Debt Securities – investments in held-to-maturity debt securities are debt securities for which the company has positive intent and ability to hold those securities to maturity. A company initially records each category of securities at cost, but subsequent valuations of the securities on its balance sheet and the reporting of unrealized holding gains and losses vary as follows: 1. Trading Securities- Investments in trading securities are reported at their fair values on the balance sheet date, and unrealized holding gains and losses are included in net income of the current period. 2. Available-for-Sale Securities- Investments in available-for-sale securities are reported at their fair values on the balance sheet date, the net unrealized holding gains or losses for the year are included in comprehensive income for that year and the cumulative net unrealized holding gains or losses are reported in the accumulated other comprehensive income section of the stockholder’s equity and not in net income. 3. Held to Maturity Debt Securities- Investments in held-to-maturity debt securities are reported at their amortized cost on the balance sheet date, and are not reported at fair value. Definitions important for investments discussions: 1. A debt security represents a creditor relationship with another entity 2. An equity security represents an ownership interest in another company 3. Fair Value is the amount at which a security could be exchanged in a current transaction between willing parties. Equity Method – is used for investments in equity securities when the investor has significant influence over the investee. Significant influence generally occurs when the investor owns between 20% -50% of the voting common stock of the investee. Consolidation – occurs when the investor controls the investee through an investment in equity securities. Control generally occurs when the investor owns over 50% of the voting common stock in the investee. Investments in Debt and Equity Trading Securities GAAP for investments in debt and equity securities classifies trading securities as: 1) The investment is initially recorded at cost, 2) It is subsequently reported at fair value 3) Unrealized holdings and gains are included in net income of the current period 4) Interest and dividend revenue as well as realized gains and losses on sales are included in the net income of the current period Investments in Available-for-Sale GAAP for investments in debt and equity securities classifies available-for-sale securities as: 1) The investment is initially recorded at cost 2) It is subsequently reported at fair value 3) Unrealized holding gains and losses are reported as a component of other comprehensive income 4) Interest and dividend revenue, as well as realized gains and losses on sales, are included in net income for the current period. Recording initial cost – a company records all investments in securities initially at the acquisition price of the securities plus any other costs necessary for the transaction. Recording interest revenue – a company records interest revenue as it is earned during the period Recording dividend revenue – dividend revenue is recorded when the dividends are declared by the investee company because that is the date on which the investor has the right to receive them. Investments in Held-to-Maturity Debt Securities 1) 2) 3) 4) The investment is initially recorded at cost It is subsequently reported at amortized cost Unrealized holding gains and losses are not recorded Interest revenue and realized gains and losses on sales (if any) are included in net income. Recognition and Amortization of Bond Premiums and Discounts – the amount of interest revenue recognized each accounting period is based on the effective interest rate (yield) at the time of acquisition. Therefore any premium or discount is amortized over the remaining life of the bonds in order to assign the proper amount of interest revenue to each accounting period. Amortization of Bonds acquired between interest dates – bonds may be acquired between interest dates, and if they are and any discount or premium exist, it must be amortized over the remaining life of the bonds. Sale of Investment in Bonds before Maturity – selling an investment in bonds being held to maturity should be rare because this may violate the original intent of behind acquisition and the valuation procedures underlying the intent. If such a sale occurs a company must record any gain or loss form the transaction. Also the company eliminates its Investment account and collects any interest earned since the last interest date from the purchaser. Equity Method 1) Acknowledges the existence of a material economic relationship between the investor and the investee 2) Is based upon the requirements of accrual accounting 3) Reflects the change in stockholder’s equity of the investee company. Equity Method Adjustments to investment income 1) Eliminate intercompany transactions in the determination of investor income. 2) Depreciate the proportionate share of any difference between the fair values and book values of investee depreciable assets implied by the acquisition price of the investee shares. 3) Treat the proportionate share of investee extraordinary items as investor extraordinary items. The proportionate share of investee results of discontinued operations and cumulative effects of changes in accounting principles are treated similarly. Investor Accounts for the investment and income under the equity method Investment = Acquisition Cost + Investor’s Share of - Dividends Received Investee Income Where Investor’s Share of = (Investee’s Net Income x Ownership %) – Adjustments Investee Income And Dividends Received = Total Dividends Paid by Investee x Ownership %