Notes 14A to 14B

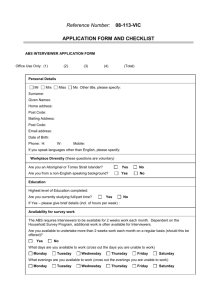

advertisement

Note 14A: Reconciliations to ABS GFS measures The following tables provide a reconciliation of key fiscal aggregates on the face of the financial statements where the amounts reported differ from the corresponding key fiscal aggregates measured under the ABS GFS manual as at 1 July 2013(a). (a) Reconciliation to GFS net operating balance General Public non- financ ial Government c orporations 2015 2014 2015 2014 $m $m $m $m Public financ ial c orporations 2015 2014 $m $m Eliminations and netting 2015 2014 $m $m Australian Government 2015 2014 $m $m 165 Notes to the financial statements Ne t re sult from tra nsa c tions - ne t ope ra ting ba la nc e re porte d in S ta te me nt of Compre he nsive Inc ome (37,415) (40,587) (1,788) (1,398) 957 9,456 (2,575) (1,730) (40,821) (34,259) Conve rge nc e diffe re nc e s: Unwinding of c onc essional interest c osts(b) (47) (146) (47) (146) Conc essional interest c osts(b) 860 1,061 860 1,061 Seigniorage(c ) (111) (112) (111) (112) Defenc e weapons platforms and inventory(d) Under ABS GFS Manual applic able to 2013- 14 (1,712) (1,712) Under ABS GFS Manual applic able to 2014- 15 162 162 Movement in deferred tax assets and deferred tax liabilities 111 8 8 1 (119) (9) Issue and surrender of free c arbon permits(e) Capital grant to the RBA(e) 8,800 - (8,800) Dividends to GGS from other sec tors(f) (110) (222) (2,198) (1,319) 2,308 1,541 Tota l c onve rge nc e diffe re nc e s 864 7,891 1 (214) (2,190) (10,118) 2,189 1,532 864 (909) G FS Ne t ope ra ting ba la nc e (3 6 , 5 5 1) (3 2 , 6 9 6 ) (1, 7 8 7 ) (1, 6 12 ) (1, 2 3 3 ) (6 6 2 ) (3 8 6 ) (19 8 ) (3 9 , 9 5 7 ) (3 5 , 16 8 ) (a) Under AASB 1049, the financial statements are reconciled to the ABS GFS manual effective at the beginning of the comparative reporting period (1 July 2013).The amounts reported may differ to the aggregates subsequently reported by the ABS in the 2014-15 GFS publication because of changes in methodology, differences in interpretation and/or updated information availability subsequent to the release of the financial statements. (b) The financial statements discount concessional loans by a market rate of a similar instrument whereas the ABS GFS manual does not discount as no secondary market is considered to exist. (c) The financial statements treat the profit between the cost and sale of circulating coin (seigniorage) as revenue whereas the ABS GFS manual treats circulating coin as a liability and the cost to produce the coins as an expense. (d) For 2014-15, this impact reflects the difference between depreciation reported in the financial statements and the consumption of fixed capital reported for statistical purposes. (e) The 2013-14 financial statements treated a capital payment to the RBA as a capital grant expense for the GGS and revenue for the PFC sector. The ABS GFS manual treats this as an equity injection which would not appear on the operating statement. (f) The financial statements treat dividends to the GGS as a distribution to owners whereas the ABS GFS manual treats dividends to owners as an expense. Reconciliation to GFS total change in net worth General Public non- financ ial Government c orporations 2015 2014 2015 2014 $m $m $m $m Tota l c ha nge in ne t worth be fore tra nsa c tions with owne rs in the ir c a pa c ity a s owne rs a s re porte d in S ta te me nt of Compre he nsive Inc ome Conve rge nc e diffe re nc e s: Relating to net operating balanc e Relating to c hange in treatment of defenc e weapons and inventory (a) Relating to other ec onomic flows Relating to transac tions with owners Tota l c onve rge nc e diffe re nc e s G FS Tota l c ha nge in ne t worth Public financ ial c orporations 2015 2014 $m $m Eliminations and netting 2015 2014 $m $m Australian Government 2015 2014 $m $m (47,253) (54,423) (2,154) (1,105) 6,153 10,116 (1,296) (9,165) (44,550) (54,577) 864 7,891 1 (214) (2,190) (10,118) 2,189 1,532 864 (909) 43,760 7,016 51,640 4,387 (5,213) 2,678 (5 1, 7 4 5 ) (2,554) 4,707 2,154 - (1,692) 3,011 1,105 - (1,965) (1,998) (6,153) - 1,321 (1,319) (10,116) - 1,806 (2,709) 1,286 (10 ) 9,333 (1,692) 9,173 8 43,760 4,303 48,927 4,377 3,749 2,840 (5 1, 7 3 7 ) 166 (a) Consistent with AASB 1049, the Australian Government elected not to apply Chapter 2 Amendments to Defence Weapons Platforms of the ABS publication Amendments to Australian System of Government Finance Statistics, 2005 (ABS Catalogue No. 5514.0) — published on the ABS website on 5 April 2011 — until the 2014-15 reporting period. The 2013-14 comparatives are prepared on the previous basis. Notes to the financial statements (b) (c) Reconciliation to GFS net lending / (borrowing) General Public non- financ ial Government c orporations 2015 2014 2015 2014 $m $m $m $m Public financ ial c orporations 2015 2014 $m $m Eliminations and netting 2015 2014 $m $m Australian Government 2015 2014 $m $m 167 Ne t le nding/ (borrowing) a s re porte d in S ta te me nt of Compre he nsive Inc ome (40,121) (44,437) (4,717) (5,818) 974 8,739 (2,594) (1,778) (46,458) (43,294) Conve rge nc e diffe re nc e s: Relating to net operating balanc e 864 7,891 1 (214) (2,190) (10,118) 2,189 1,532 864 (909) Defenc e weapons and inventory - net ac quisition(a) 4,461 4,461 Defenc e weapons and inventory - deprec iation and c onsumption(a) (2,749) (2,749) Auc tion sales of spec trum(b) (1,965) (1,965) Tota l c onve rge nc e diffe re nc e s (1,101) 9,603 1 (214) (2,190) (10,118) 2,189 1,532 (1,101) 803 G FS Ne t le nding/ (borrowing) (4 1, 2 2 2 ) (3 4 , 8 3 4 ) (4 , 7 16 ) (6 , 0 3 2 ) (1, 2 16 ) (1, 3 7 9 ) (4 0 5 ) (2 4 6 ) (4 7 , 5 5 9 ) (4 2 , 4 9 1) (a) The 2013-14 comparatives show acquisitions of defence weapons platforms and inventory as an expense. (b) The financial statements recognise the disposal of spectrum licences at the point of issue whereas the ABS GFS manual recognises spectrum licences at the time of auction and the proceeds from their sale at the point of auction, reflected on the balance sheet as a receivable. Notes to the financial statements Reconciliation to GFS net worth General Public non- financ ial Government c orporations 2015 2014 2015 2014 $m $m $m $m 168 Ne t worth a s re porte d in Ba la nc e S he e t (308,454) (261,513) Conve rge nc e diffe re nc e s: Provision for doubtful debts(a) 25,076 25,761 Conc essionality on loans and investments(b) 9,435 8,688 Investment in other sec tor entities(c ) (707) (3,445) Deferred tax assets(d) Defenc e weapons platforms and inventory(e) Under ABS GFS Manual applic able to 2013- 14 (43,760) Under ABS GFS Manual applic able to 2014- 15 6,844 Dividend payable Spec ial drawing rights (SDR) Seigniorage(f) (3,861) (3,750) Deferred tax liability(d) Auc tion sales of spec trum(g) 1,965 Shares and other c ontributed c apital(h) Minority interests Tota l c onve rge nc e diffe re nc e s 36,786 (14,542) G FS Ne t worth (2 7 1, 6 6 8 ) (2 7 6 , 0 5 5 ) Public financ ial c orporations 2015 2014 $m $m Eliminations and netting 2015 2014 $m $m (40,159) (36,166) 14,846 12,293 24,802 20,651 15 (909) 13 (909) 1 (4) 8 (12) 707 913 3,445 921 648 (14,600) (14,846) - 537 (11,934) (12,293) - (24,799) (20,647) (24,802) (20,651) - (648) 39,187 40,159 - (537) 32,337 36,166 - Australian Government 2015 2014 $m $m (308,965) (264,735) 25,092 9,435 - 25,782 8,688 - (43,760) 6,844 (3,861) (3,750) 1,965 (212) (244) 37,297 (11,320) (2 7 1, 6 6 8 ) (2 7 6 , 0 5 5 ) (a) The financial statements treat provisions for doubtful debts as an offset to the asset in the balance sheet. The ABS GFS manual does not consider the creation of a provision to be an economic event and therefore excludes it from the balance sheet. (b) The financial statements discount concessional loans by a market rate of a similar instrument whereas the ABS GFS manual does not discount as no secondary market is considered to exist. (c) The financial statements apply AASB 13 to the valuation of the GGS’s investment in public corporations whereas the ABS GFS manual values public corporations at their net assets unless the shares in a public corporation are publicly traded. A convergence difference arises where the application of AASB 13 results in a valuation other than net assets. (d) Deferred tax assets and deferred tax liabilities are reported in the financial statements whereas the ABS GFS manual does not recognise these items. (e) Consistent with AASB 1049, the Australian Government elected not to apply Chapter 2 Amendments to Defence Weapons Platforms of the ABS publication Amendments to Australian System of Government Finance Statistics, 2005 (ABS Catalogue No. 5514.0) — published on the ABS website on 5 April 2011 — until the 2014-15 reporting period. The ABS GFS Manual recognises defence weapons platforms and inventory as assets at market value. Prior to the 2011 amendment, acquisitions of defence weapons platforms were treated as an expense at the time of acquisition. The 2014-15 impact reflects the difference between the carrying value reported in the financial statements at cost (as detailed in Note 1) and the market value calculated by the ABS for statistical purposes. The amount reported may differ to the value subsequently reported by the ABS in the 2014-15 GFS publication because of revisions made as new information becomes available. (f) The financial statements treat the profit between the cost and sale of circulating coin (seigniorage) as revenue whereas the ABS GFS manual treats circulating coin as a liability and the cost to produce the coins as an expense. (g) The financial statements recognise the disposal of spectrum licences at the point of issue whereas the ABS GFS manual recognises spectrum licences at the time of auction and the proceeds from their sale at the point of auction, reflected on the balance sheet as a receivable. (h) The financial statements treat shares and other contributed capital in public corporations as part of net worth whereas the ABS GFS manual deducts shares and other contributed capital in the calculation of net worth (with net worth calculated as assets less liabilities less shares and other contributed equity). Notes to the financial statements (d) Notes to the financial statements The ABS GFS manual measures inventory at market value (rather than the lower of cost and net realisable value). It also does not recognise the provision for decommissioning/restoration costs. The above reconciliation has not been adjusted for these items on the basis of materiality and information availability. Reconciliation to GFS cash surplus/(deficit) is disclosed on the face of the cash flow statement. Note 14B: Reconciliation to original budget The following tables provide a comparison of the original 2014-15 Budget to the final actual results for the GGS. Explanations are provided for major variances, which are typically those amounts greater than $1 billion. The Australian Government does not present budgets at the whole of government level, and therefore, only the GGS is presented in this note. The Budget is not audited. 169