III. Project Context - Global Environment Facility

advertisement

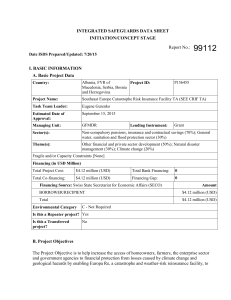

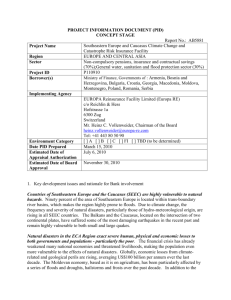

. Document of The World Bank . FOR OFFICIAL USE ONLY PROJECT CONCEPT NOTE ON A . PROPOSED GRANT IN THE AMOUNT OF US$5.0 MILLION FROM THE SPECIAL CLIMATE CHANGE FUND (ADMINISTERED BY THE GLOBAL ENVIRONMENT FACILITY) TO EUROPA REINSURANCE FACILITY (EUROPA RE) FOR THE KAZAKHSTAN: SOUTHEAST EUROPE AND CENTRAL ASIA CATASTROPHE RISK INSURANCE FACILITY July 22, 2014 . Vice President: Laura Tuck Country Director: Saroj Jha Sector Manager: Aurora Ferrari Sector Director: Gloria Grandolini Task Team Leader: Eugene Gurenko This document has a restricted distribution and may be used by recipients only in the performance of their official duties. Its contents may not otherwise be disclosed without World Bank authorization. . PCN DATA SHEET . Southeast Europe and the Central Asia Catastrophe Risk Insurance Facility . PROJECT CONCEPT NOTE . Europe and Central Asia Region . Basic Information Date: July 22, 2014 Sectors: Financial Sector / Insurance; Climate Change and DRM Country Director: Saroj Jha Themes: Other financial and private sector development (50%); Natural disaster management (20%); Climate change (30%) Sector Manager/Director: Aurora Ferrari EA Category:: B Project ID: TBD Lending Instrument: Adaptable Program Loan Team Leader(s): Eugene N. Gurenko Joint IFC: No Project Implementation Period: Start Date: March 1, 2015 End Date: December 31, 2018 . Project Financing Data [ ] Loan [ X ] Grant [ ] Credit [ ] [ ] Other Guarantee For Loans/Credits/Others (US$M): Total Project Cost : $5.0 $5.0 Total Cofinancing : Total GEF/SCCF Financing : $5.0 0.0 Financing Gap : 0 . Financing Source Amount (US$ Million) BORROWER/RECIPIENT IBRD IDA: New IDA: Recommitted Others GEF/SCCF 5.0 Financing Gap Total 5.0 . Borrowers: Europa Re Responsible Agency: Europa Re Contact: Mr. Heinz ChristianVollenweider Telephone No.: +(41) 41 728 63 63 . Title: Europa Re, Delegate of the BoD and CEO Email: Heinz.Vollenweider@Europa-Re.com SOUTHEAST EUROPE AND CENTRAL ASIA Southeast Europe and Central Asia Catastrophe Risk Insurance Facility . I. Introduction and Context A. Country Context 1. Globally, economic losses from climate-related and geological perils are rising, exceeding US$100 billion per annum over the last decades. In 2013, the economic losses caused by natural disasters amounted to US$ 125 billion, while the average economic loss for period from 1980 to 2012 was US$ 115 billion1. In addition to the economic toll, natural disasters have been the source of death, disability, and loss of physical and productive assets. 2. Kazakhstan is vulnerable to natural hazards including earthquakes, floods, landslides/ mudslides/debris flows, and steppe winds. Climate change is expected to exacerbate disasters caused by the impact of natural hazards associated with hydro-meteorological conditions, with associated damage particularly impacting homeowners, small and medium business (SMEs), and farmers. With a total area of agricultural land of 222.6 million hectares, agriculture plays a prominent role in the national economy but also making the country highly vulnerable to the risk of climate change. In 2012, for instance, the country experienced a 54 percent fall in wheat production due to an unprecedented drought. The individual natural disaster risk profile of Kazakhstan is summarized below. 3. Historically, Kazakhstan has experienced highly damaging earthquakes, which tend to occur every 80 to 100 years. The last highly damaging period of seismic activities was 1885-1911, when several large earthquakes struck at Verneskoye (1887), Chilik (1889) and Keminskoye (1911). During these earthquakes, the city of Almaty was almost flattened. The more recent Zhambyl province earthquake in May 2003 killed 3 people and affected 36,626 others. 4. Floods, landslides and steppe winds also pose significant hazards in Kazakhstan. In the plains, spring floods fed by rain and snowmelt occur and mountainous regions suffer mud flows triggered by rainfall or breaches of glacial lakes. Analysis of disaster data shows that the country suffers from frequent floods. Flood events include the June 1993 flood in the Embinskyi-Kzylkoginskyi region, which killed 10 people, affected 30,000 others and caused an economic loss of $36.5 million. The April 2000 flood in the DenisovskyZhitikarinsky region affected 2,500 people and caused an economic loss of $1.5 million and the March 2005 flood in the Shiyeli-Syr Dariya region affected 25,000 people and caused an economic loss of $7.6 million. The March 2004 landslide in Talgar district 1 Munich RE NatCatSERVICE, 2014 (http://www.munichre.com/site/corporate/get/documents_E833834344/mr/assetpool.shared/Documents/0_Corporate%20Website/6_Media%20Rela tions/Press%20Releases/2014/natural-catastrophes-2013-wold-map_en.pdf) reportedly killed 48 people2. 5. 6. To address the impact of natural disasters on homeowners and SMEs, the government is introducing a new Law on Compulsory Catastrophe Insurance. Preparations for the draft law are currently underway under a separate program of Bank technical assistance financed by FIRST.3 A risk insurance scheme for agriculture was introduced in 2004 as a traditional policy response to deal with catastrophic and weather. However, according to a recent report4, the current crop insurance scheme in Kazakhstan requires a major overhaul to improve its performance and a better disaster insurance framework should be developed to deal with natural disasters in agriculture sector. B. Sectoral and Institutional Context 7. Despite the high vulnerability to natural disasters and climate change, catastrophe and weather insurance among homeowners SMEs is currently underdeveloped in Kazakhstan. The catastrophe insurance products that do exist are either not viable in terms of price and coverage or restricted only to selected clients as companies ration the availability of catastrophe coverage through higher prices or simply decline to cover weather and earthquake related risks. As a result, less than 2 percent of insurable properties are currently insured and fewer SMEs. To address the problem, the government is introducing a national program of compulsory catastrophe insurance for homeowners and SMEs. To this effect, the Bank is assisting the government with the preparation of the Disaster Insurance Law and development of actuarially sound premium rates under a separate TA program financed by FIRST and JERP. Yet, the establishment of a proper national catastrophe insurance program requires a highly advanced catastrophe insurance market infrastructure (innovative catastrophe risk insurance products, automated underwriting an pricing insurance services, advanced insurance IT systems to support sales and claims management, public awareness of catastrophe and weather risk, and other technical insurance specific functions) which is currently not in place. 8. Relying on the global experience in designing national and regional catastrophe and weather-risk insurance programs, with the aim of increasing the number of insured against weather related risks, jointly with the United Nations International Strategy for Disaster Reduction (UNISDR), the Swiss Secretariat for Economic Affairs (SECO) and the Global Environmental Facility (GEF), in 2011, the World Bank launched a catastrophe and weather risk reinsurance program entitled SEEC CRIF. The main rationale of SEEC CRIF is to promote the development of local catastrophe and weather risk insurance markets in disaster prone emerging economies that will increase access of local businesses and population to reliable and fairly priced catastrophe and weather risk insurance products which currently cannot be found in the commercial insurance market. Based on such an approach, SEEC CRIF, in cooperation with country stakeholders has already financed the development of catastrophe insurance market infrastructure for 2 Disaster Risk Management Initiative (CAC DRMI) Risk Assessment for Central Asia and Caucasus Desk Study Review 3 4 Financial Sector Reform and Strengthening Initiative OECD Review of Agricultural Policies, Kazakhstan 2013 Albania, Serbia and Macedonia, which are now launching the sales of innovative catastrophe products supported by the most advanced insurance technologies and public disaster risk awareness building educational tools. 9. Based on the valuable experience and specialized insurance expertise developed under the SEEC CRIF in designing effective catastrophe and weather insurance market infrastructure and national catastrophe insurance markets, the Bank now would like to extend the outreach of the program to Kazakhstan and, at a later stage, to other countries of Central Asia. Phase II of SEEC CRIF Program – Southeast Europe and Central Asia Catastrophe Insurance Facility (SEECA CRIF) - aims to provide comprehensive technical support to the government of Kazakhstan in preparing the launch of the national program on compulsory catastrophe insurance for homeowners and SMEs and providing further assistance in developing effective weather insurance solutions for agriculture to enable the country’ economy better adapt to the growing risk of climate change. C. Relationship to SCCF and GEF Strategies and CPS 10. Of the current Country Partnership Strategies (CPS) for Kazakhstan, disaster risk management and adaptation to climate change were addressed through a stand-alone project during the CPS period and identified as government priorities in future programming. Disaster risk financing, including catastrophe and weather-risk insurance, is one of the main pillars of the Bank Group’s Disaster Risk Mitigation Strategy. The Kyoto Protocol, the UN Framework Convention on Climate Change and the Bali Action Plan all call for risk sharing and transfer mechanisms such as insurance as a means of protecting populations from the adverse effects of climate change. II. Proposed PDO/Results A. Proposed Development Objective(s) 11. The Project Development Objective (PDO) is to assist Kazakhstan with developing modern catastrophe insurance market infrastructure that will support the launch and successful implementation of the national catastrophe insurance program covering climate risk and geo-hazards. 12. By facilitating and increasing access to financial protection, the Global Environmental Objective (GEO) will have been achieved, namely the reduction of economic vulnerability for homeowners, the enterprise sector, and government agencies to the adverse impact of natural disasters and climate change. The proposed project activities support GEF’s focus on climate change and more specifically, GEF’s objectives on climate change adaptation. By increasing access to sound catastrophe and weather risk insurance products, SEECA CRIF is also in line with the GEF strategy on adaptation. By supporting proper catastrophe risk management and risk transfer, SEECA CRIF reduces economic losses at both local and national level from extreme weather related events, thereby reducing economic vulnerability and creating a more climate resilient country. 13. SEECA CRIF activities are also cross-cutting and collaborative, ensuring the engagement of major stakeholders in Kazakhstan, including several ministries, the National Bank, insurance sector and agriculture. Moreover, because much of the technical work will be focused on establishing complex catastrophe insurance infrastructure and systems, stakeholders will gain the requisite skills and knowledge to better understand catastrophe risk and effectively adapt to such risks and climate change. Furthermore, public awareness of climate change and the benefits of catastrophe and weather risk insurance will be raised through information campaigns and the new law on compulsory Disaster Insurance and supporting its regulations, resulting in increased demand for catastrophe and weather risk insurance products. B. Key Results 14. The most important result of SEECA CRIF in Kazakhstan is the increased access to sound and affordable weather risk coverage and catastrophe insurance for millions of people and thousands of SMEs, including agricultural producers. The modern catastrophe insurance infrastructure developed under the SEECA CRIF will support the launch of the forthcoming national catastrophe insurance program that will increase catastrophe and weather-risk insurance penetration among homeowners and enterprise sector in Kazakhstan from the current 1-2 to 60 percent over the next 5 years. III. Project Context A. Concept a). Description 15. SEECA CRIF is a catastrophe and weather-risk insurance program established to address the problem of low catastrophe and weather insurance penetration in participating countries. The main rationale of the project is to promote the development of sound catastrophe and weather risk insurance for millions of homeowners, farmers, enterprises and government organizations against geo and weather-related risks exacerbated by climate change and reduce government fiscal risk exposure to natural disasters. 16. The main design features of SEECA CRIF closely follow the previous prototypes of national and regional catastrophe and weather-risk programs developed with direct technical and capital assistance from the Bank – the Turkish Catastrophe Insurance Pool, the Romanian Catastrophe Insurance Pool and the Caribbean Catastrophe Risk Insurance Facility. However, the program contains several innovations. These include (i) the development of innovative catastrophe insurance products which combine traditional indemnity coverage with parametric index-based elements; (ii) establishment of prudent risk management and market conduct requirements embedded in highly automated systems, (iii) development of innovative image-based claims management systems ensuring a swift return to normal life or continuation of business activities in the aftermath of a natural disaster; (iv) introduction of risk based supervision of catastrophe insurance in line with best international practices, (v) development of innovative public awareness and educational mechanisms, including highly interactive IT applications and (vi) ensuring proper financial capacity through dedicated reinsurance capacity. 17. Europa Reinsurance Facility Ltd. (Europa Re), a government-owned catastrophe reinsurance company incorporated under Swiss Law in Zug, Switzerland, will act as the SEECA CRIF project implementation agency. Over the last 3 years, in the course of implementing the GEF and SECO grants under the SEEC CRIF program in Albania, FYR of Macedonia and Serbia, Europa Re developed extensive and in-depth expertise in retaining and successfully managing specialized providers of insurance services in accordance with the World Bank procurement and financial management guidelines. In the case of SEE, the GEF and SECO grants in the amount of $10 million were used to develop innovative catastrophe insurance products and underlying them hazard risk models, procure web-based automated pricing, underwriting and policy origination platform, claim management systems and provide regulatory support to local insurance regulators. Given the importance of providing reinsurance capacity to local insurance companies involved in sales of catastrophe insurance products developed under the SEECA CRIF program, Europa Re also will stand ready to provide, if required, reinsurance support to the Kazakh insurance companies that will be participating in the national catastrophe insurance program and, if requested, directly to the Kazakhstan Catastrophe Insurance Pool (KCIP). 18. In the case of SEECA CRIF program for Kazakhstan, the proposed funding of US$5.0 million will be used for procuring insurance services and systems that will (i) pave the way for the successful launch of the KCIP’s operations upon enactment of the Disaster Insurance Law and (ii) support the development of a sustainable insurance framework for the agricultural sector through innovative insurance solutions and modern technologies. Inter alia, the activities include procurement of web-based insurance sales platform with automated pricing and risk underwriting capabilities, a modern claims management system, high-resolution weather risk data, development of customized weather insurance products for real property and agriculture, public information campaigns, interactive web-based consumer education tools, and insurance regulatory assistance. b). Description of Main Project Activities 19. The total Project cost for Kazakhstan is estimated at US$5.0. The costs will be funded by the GEF / SCCF. Under this project, the GEF funding will provide requisite technical and regulatory assistance to the government of Kazakhstan required to develop new insurance products that will increase the country’s resilience to climate change. GEF funding will support technical activities that will not only help quantify climate change in the context of catastrophes and weather-risk, but also develop insurance products to assist those at risk to adapt and become more resilient to climate change. 20. The proceeds of the GEF/SCCF grant will finance the costs of technical services incurred in connection with carrying out the preparatory work needed for the development of catastrophe weather risk insurance market in Kazakhstan. Such preparatory technical activities include but are not limited to acquisition of weather risk data, design of catastrophe risk models and high-resolution risk maps, acquisition of an automated web- based IT platform to support efficient insurance sales and claims settlement, public information campaigns, assistance to the national insurance regulators, consumer education on disaster insurance and professional training of insurance agents and insurance loss adjustors. Table 1 summarizes the main technical activities that will be financed under the project subject to confirmation and amendment during project preparation. Table 1 – Financing Overview of Main Project Activities Component Total SCCF 0.45 0.45 0.3 0.3 3. Development of catastrophe claims management system 0.4 0.4 4. Development of integrated IT web-based platform for sales and claims management 2.5 2.5 5. Development of interactive web-based portal for disaster risk assessment and public education 0.3 0.3 6. Development of promotion and public relation strategy 0.3 0.3 7. Development of risk management capabilities of KCIP 0.1 0.1 8. Regulatory assistance to National Bank 0.2 0.2 9. Project Management Costs 0.45 0.45 Total 5.00 5.00 1. Acquisition of Weather Risk Data and Development of Weather Risk Models 2. Design and pricing of catastrophe and agricultural insurance products c). Key Risks and Issues 21. The success of the project ultimately depends upon (a) enactment of the law on national compulsory property insurance and (b) proper cooperation among the main stakeholders during the implementation of the project and (c) timely and quality delivery of main elements of market insurance infrastructure envisaged under the program. Hence, the main risks faced by the project are as follows: Delays with enactment of the Law on Compulsory Property Catastrophe Insurance by the Parliament or removal of important technical provisions of the draft law in the process of Parliamentary hearings. This risk is considered moderate as it is mitigated by the strong government commitment to present the draft law to the Parliament in January 2016, as well as the ongoing World Bank TA project that will be providing the government with technical guidance and support during the process of Parliamentary hearings of the Law. Finally, the proposed 3 year timeframe for project implementation should provide sufficient risk buffer for potential delays with the enactment and implementation of the law. Failure of key project stakeholders to coordinate their actions in the process of project implementation that results in the lack of adequate government ownership for the project. The risk is considered moderate as the government already assigned the task of preparing the law to the Ministry of Economic Development and Planning which is now the main counterpart of the Bank under a separate ongoing separate TA project in support of the national catastrophe insurance program. The design of the program’s governance also envisages the representation of all key project stakeholders at the Board of Directors of the national catastrophe insurance pool. Failure of timely and quality delivery of main building blocks of market infrastructure required for the launch of the national catastrophe insurance program. This operational risk can be considered low despite extensive and complex scope of preparatory technical work required for the program launch, as the project will be managed by a highly experienced in the insurance business project implementation agency – Europa Re, which delivered on time and within budget a similar technical program in SEE. B. Implementing Agency Assessment 22. As numerous technical activities financed by the project require highly specialized insurance and reinsurance expertise to ensure their completion on time and to the specifications, it is crucial that the implementation of the project is carried out by an experienced and technically competent (in insurance and reinsurance) project implementation agency. In addition, to achieve satisfactory compliance with the World Bank project implementation guidelines in the areas of procurement, disbursement and financial management, it is also essential that the project implementation agency has the established successful track record in managing similar Bank projects in the past. 23. To this effect, the project will be managed by Europa Re which will act as the recipient of the SCCF grant and its implementing agency. It will also act as the main Bank and government counterpart for the purposes of project execution. Europa Re, a specialized catastrophe reinsurance company established under the Swiss Law with extensive technical support from the World Bank, is currently owned by the governments of Albania, FYR of Macedonia and Serbia. Since 2012, Europa Re has been successfully acting as the project implementation agency for the US$ 5.5 million GEF and US$ 4.5 SECO grants under the SEEC CRIF program, which financed the development of catastrophe insurance market infrastructure in Southeastern Europe. Since the inception of the project in 2012, Europa Re has been consistently receiving satisfactory ratings for the high quality of its financial management and procurement operations. Europa Re employs a tested cadre of procurement and financial management professionals that ensure full compliance with the Bank Guidelines and procedures. 24. In its capacity of the project implementation agency (PIU) Europa Re will prepare technical specifications for technical services essential for the successful launch of the Kazakh national catastrophe insurance program and development of innovative catastrophe insurance products. Europa Re insurance and reinsurance professionals will then provide day-to-day oversight of the implementation of all technical activities financed under the grant to ensure their timely and professional completion. 25. Although owned by the governments, Europa Re’s governance setup ensures that the management of Europa Re is immune from potential political pressures that may adversely affect its day-to-day operations. One of the key elements of the company’s governance structure is a clear separation of the company’s business operations from the ownership of the Facility. To this effect, Europa Re has an independent professional board of directors consisting of reputable insurance/reinsurance professionals with a well-established track record in the industry and a professional highly experienced senior management team. 26. Europa Re will produce quarterly technical reports about progress made with implementation of numerous technical activities envisaged by the project and will provide annual audited financial reports on the utilization of donor trust funds. Results of the project activities will be monitored and evaluated by Europa Re on the regular basis. 27. Project procurement will be handled by Europa Re, which is handling the current ongoing project in Southeastern Europe. During procurement capacity assessment the team will review the internal controls, complaint handling and decision making process more closely. The project procurement will be mainly consultancy contracts. C. Project Stakeholder Assessment 28. The project will bring together a broad spectrum of stakeholders within the country, including, inter alia, policy makers, ministerial/institute/agency staff, insurance sector, and other. The concept of the national catastrophe insurance program has been supported by all stakeholders met thus far, including the government and the insurance industry. During the preparation of the project, consultative meetings were held at different levels where stakeholders reiterated the importance of the proposed project and the economic and social benefits that would accrue to the population and the government. 29. The Bank has maintained an ongoing dialogue with all potential stakeholders and is ensuring that project preparation and implementation will be undertaken in close consultation with potential beneficiaries. D. Overall Risk Rating Explanation 30. The overall risk rating is moderate. The decision has already been taken by the government of Kazakhstan to develop the national catastrophe insurance program, whereas the introduction of new weather risk related products for agriculture is in synch with the country’s strategic priorities. World Bank technical support with the preparation of the draft law and Europa Re technical oversight of insurance work financed under the project provide sufficient assurances that the project will be effectively implemented. E. Proposed Team Composition and Resources Team Composition and resource estimate (from preparation to approval) Staff Name Title SWs Eugene Gurenko Ignacio Jauregui TBD Galina Alagardova Nurbek Kurmanaliev Pablo Souto Thelma Aymel Rakhymzhan Assangaziyev Lead Insurance Specialist, Task Team Leader Legal Counsel Finance Officer Financial Management Specialist Procurement Specialist Consultant Senior Program Assistant Country Officer 4 1 1 1 1 4 1 2 It is estimated that a total of 15 Staff Weeks will be required from preparation to approval. This represents an estimated budget of about $80,000, including travel. Annex 1-Operational Risk Assessment Framework (ORAF) Stage: PCN 1. Project Stakeholder Risks Rating M Risk Management: This risk is considered moderate as it is mitigated by strong government commitment to present the draft law to the Parliament in January 2016, as well as the ongoing World Bank TA project that will be providing the government with technical guidance and support during the process of Parliamentary hearings of the Law. The process shall be closely monitored by the Bank and on-site missions. The proposed 3 year time-frame for project implementation provides sufficient risk buffer for potential delays with the enactment and implementation of the law. Resp: Bank, Stage: Preparation Due Date : Recurrent Status: Not Yet Due Recipient and Implementation 2. Operating Environment Risks (Note for information: this section is not disclosed at negotiation and Board presentation stages) 2.1. Country (Note for information: this section is not Rating: M disclosed at negotiation and Board presentation stages) 5 Description : Medium-term prospects are good, offering an Risk Management: Ongoing technical assistance and trainings are provided by the the IMF and Bank to excellent opportunity to bolster the policy architecture. Average address the downside risks. In view of limited progress on NPLs, the authorities have adopted an growth of 8 percent over the past decade, supported by rising increasingly proactive posture, including tax exemptions on written-off loans for banks. oil output and prices, has solidified Kazakhstan’s position as a The NFRK, in addition to ensuring intergenerational equity, could support stability by being used to arrest regional economic power. Following rapid economic recovery any sharp deceleration in growth in the event of large negative shocks. from the 2007-08 crisis, growth has decelerated but remains Reducing the economy’s dependence on oil remains a primary objective for the country. To this effect, solid, and is expected to rise slightly in 2013 to around 5¼ the government has developed a strategy of economic diversification based on prioritization of other percent. sectors of economy, including agriculture. There are some downside risks to the outlook, primarily emanating from the external environment. A potential Resp: Bank, Stage: Preparation Due Date : Recurrent Status: Not Yet Due slowdown in the global economy and lower oil prices than Recipient and Implementation currently projected would negatively affect external demand and growth. Close trade, investment, and financial links with Russia and China make Kazakhstan particularly vulnerable to shocks affecting these economies. Like other emerging market economies, Kazakhstan is also prone to reversal in short-term capital flows; however, the Resp: Bank Stage: Prep and Impl Due Date : Recurrent Status: Not Yet Due vulnerability associated with external borrowing by banks has declined markedly in recent years. Continued reliance on oil and the still unresolved NPLs issues in the banking sector are key sources of domestic vulnerabilities. Description: Delays with enactment of the Law on Compulsory Property Catastrophe Insurance by the Parliament or removal of important technical provisions of the draft law during its review by several stakeholders and/or Parliamentary hearings may pose a risk during implementation phase or after project completion. 2.2. 5 Sector/multi-sector (Note for information: this section Rating: M This section relies on the IMF’s document: Republic of Kazakhstan, 2013 Article IV Consultation is not disclosed at negotiation and Board presentation stages) Description: The development and implementation of project components requires close and effective cooperation with a spectrum of stakeholders, including, inter alia, ministerial/governmental/, insurance regulator and insurance sector. Failure of key project stakeholders to properly coordinate their actions in the process of project implementation may result in the lack of adequate government ownership for the project. 3. Implementing Agency Risks (including fiduciary) 3.1. Capacity Risk Management : The stakeholders currently engaged are aware of the importance of the national catastrophe program and Coordination has already started. To this effect, the government assigned the task of preparing the law to the Ministry of Economic Development and Planning which is now the main counterpart of the Bank under a separate ongoing separate TA project in support of the national catastrophe insurance program. The design of the program’s governance also envisages the representation of all key project stakeholders at the Board of Directors of the national catastrophe insurance pool. Resp: Rating: Bank Stage: Preparation and implementation Due Date : By PAD stage Status: Not yet due L Description : Europa Re will act as the recipient of the SCCF grant and its implementing agency. Risk of Insufficient Project Management Capacity: The risk is low as Europa Re has already gained experience through implementation of a similar project in other countries Albania, FYR Macedonia and Serbia and has been successfully acting as the project implementation agency for the US$ 5.5 mm GEF and US$ 4.5 SECO grants under the SEEC CRIF program, which financed the development of catastrophe insurance market infrastructure in these countries. Since 2012, Europa Re has been consistently receiving satisfactory ratings for the high quality of its financial management and procurement operations. Risk of Insufficient Technical Capacity: As numerous technical activities financed by the project require highly specialized insurance and reinsurance expertise to ensure their completion on time and to the specifications, the overall project implementation will be managed by Europa Re with successful track record in managing similar Bank projects in the past through a highly qualified team of experts in areas of insurance, reinsurance, agriculture, catastrophe and weather risk modelling, actuarial, information technology, risk and financial management and other relevant areas pertaining to the project. Therefore, failure of timely and quality delivery of main building blocks of market infrastructure required for the launch of the national catastrophe insurance program can be considered low, despite the extensive and complex scope of Risk Management : Since 2012, Europa Re has been consistently receiving satisfactory ratings for the high quality of its financial management and procurement operations. Europa Re employs a tested cadre of procurement and financial management professionals that ensure full compliance with the Bank standards. It is envisaged that Europa Re will continue to maintain the same level of expertise and professionalism in full compliance with Bank procurement and financial management standards. Europa Re will build on its positive experience to implement the project by employing a qualified team of experts in areas of insurance, reinsurance, agriculture, catastrophe and weather risk modeling, actuarial, information technology, risk and financial management and other relevant areas pertaining to the project. Resp: Bank, Recipients Stage: Implementation Due Date : Recurrent Status: Not Yet Due preparatory technical work required for the program launch. FM: Input from specialist to be received. 3.2. Governance Description: Europa Re has an independent professional board of directors consisting of reputable insurance/reinsurance professionals with a well-established track record in the industry and a professional highly experienced senior management team.The implementing agency’s setup ensures a high level of professionalism, independence and immunity from potential pressures that may adversely affect its day-today operations. Fraud & Corruption (sub-category of Governance risk) (Note for information: this section is not disclosed at negotiation and Board presentation stages, except the risk Management measures which will be merged with those on 3.2 Governance) Description: There is little likelihood that this risk will materialize due to the very nature of the company’s organization and ongoing monitoring by various stakeholders. 4. Rating: L Risk Management : One of the key elements of the implementing agency’s governance structure is a clear separation of the company’s business operations from the ownership. Furthermore, the governance and operational procedures are subject to ongoing monitoring by the Bank. Resp: Bank Stage: Implementation Due Date : Recurrent Status: Not Yet Due Rating: L Risk Management : Europa Re is managed according to the rules and procedures established by the company’s Operations Manual (which was approved by the Bank). GEF funds will be subject to the same Operations Manual. Furthermore, company has established the internal audit function and is subject to an annual external audit, Swiss regulator’s, shareholders’, and Bank supervision by the FM and procurement teams. Resp: Bank, Stage: Preparation Due Date : Recurrent Status: Not yet due Governments and implementation Project Risks 4.1. Design Description: A risk may arise due to insufficient understanding of specific country requirements during the design of specific project components by the implementing agency. The risk of flawed design is moderate although the project is highly complex. Europa Re has acquired valuable expertise and experience in designing similar projects which have been implemented effectively in other countries. 4.2. Social & Environmental Description : The program is designed to improve access to catastrophe and weather-risk insurance products for homeowners and SMEs by transferring the financial risk to the private sector, thus Rating: M Risk Management: To address the risk, the implementing agency will use the already gained experience from other similar projects and establish close communication with relevant country stakeholders to incorporate country specific requirements into project design. Resp: Recipients Bank, Stage: Prep and Impl Due Date : Recurrent Status: Not Yet Due Rating: L Risk Management : Social: No environmental risks. Social issues include affordability/coverage of the poorest and most vulnerable populations. The affordability of insurance coverage for the most socially vulnerable groups will be addressed through a special insurance voucher program financed by the government. enabling the government to better target post disaster assistance to the socially vulnerable groups. Due to the compulsory nature of the program, the insurance premium rates are expected to be highly affordable. 4.3. Program & Donor Description : Lack of donor funding for necessary technical work required for project implementation and public awareness campaigns will pose a risk. 4.4. Delivery Monitoring & Sustainability Description: There is a risk of project outcomes being unsustainable upon completion of grant financing and inadequate monitoring of project outcomes. Resp: Bank, Recipient Stage: Implementation Due Date : Recurrent Status: Not Yet Due Rating: L Risk Management: The SCCF grand will cover the cost of main activities required for the project implementation. Resp: Bank, Stage: Preparation Due Date : Recurrent Status: Not Yet Due Recipient and Implementation Rating: M Risk Management: To mitigate the sustainability risk, the national catastrophe insurance law (which is being developed under another Bank’s TA) establishes the KCIP as an ongoing concern and imposes clear fit and proper criteria for executive management of the KCIP and its technical service providers. The risk of sustainability is low, as the KCIP will be established as a going concern by the law and will rely on the constant of insurance premium to finance its costs. The risk of inadequate monitoring is addressed by Europa Re’s clear operating procedures and technical experience with delivering similar projects on time and within budget to required technical specifications. Resp: Recipient Bank, Stage: Implementation Due Date : Recurrent Status: Not Yet Due Non-disclosable Information for Management Attention (Optional) (Note for information: this section is not disclosed at negotiation and Board presentation stages) Comments: 5. Project Team Proposed Rating Before Review 5.1. Preparation Risk Rating: Low Comments: There is a risk of delayed or poorly conceived project preparation. The risk of inadequate project preparation is low due to an experienced project preparation team and government commitment to the launch of the national catastrophe insurance program within the earliest time-frame. Cooperation with country stakeholders and on-site missions will complement the desk preparation work to ensure that the project is prepared on time and in compliance with relevant Bank procedures. 6. Risk Team 6.1. Preparation Risk Rating 5.2 Implementation Risk Rating: Moderate Comments: The overall project implementation will be managed by Europa Re with successful track record of managing similar Bank projects in the past. The company employs an experienced team of experts in areas of insurance, reinsurance, agriculture, catastrophe and weather risk modelling, actuarial, information technology, risk and financial management and other relevant areas pertaining to the project. To mitigate implementation risks, the implementing agency will clearly define responsibilities of all project stakeholders, ensure effective cooperation towards the completion of the project on time and to the specifications. 6.2 Implementation Risk Rating 7. Comments: Comments: Overall Risk Following Review 7.1. Preparation Risk Rating: Comments: 7.2 Implementation Risk Rating: Comments: Note: Include on average no more than 3 Risk Management Measures per Risk Category Annex II Preparation Schedule and Resources . Preparation Schedule Milestone Basic AIS Release 2014 Concept Review (IW) August 6, 2014 Concept Review (SCCF) Forecast Actual August 6, 2014 August 6, 2014 August 8, 2014 Auth Appr/Negs (in principle) Bank Approval October 2014 October 2014 December 2014 December 2014 . Sector Unit Estimate of Resources Required from Preparation through Approval Estimate of Resource Requirements (USD) Preparation Expenses to Date (USD) Source of Funds Fixed Variable Bank Budget 0 50,000 30,000 Trust Funds 0 0 0 . Team Composition Bank Staff Name Title Specialization Unit UPI Eugene Gurenko Task Team Leader Insurance GFMDR 82643 Rakhymzhan Assangaziyev Country Officer Operations ECCKZ Thelma Aymel Program Assistant Administrative support GFMDR Pablo Souto Consultant Financial sector Galina Alagardova Financial Management Specialist Financial Management GGODR Nurbek Kurmanaliev Procurement Specialist Procurement GGODR TBD Disbursement Specialist Financial Management Ignacio Jauregui Legal Counsel Legal LEGLE Non Bank Staff Name Title Office Phone City Attachment III: Description of Co-financed /Parallel Activities and Their Implementation and Coordination Arrangements Activity Development of the draft insurance law for the national catastrophe insurance program and development of actuarial pricing for EQ risk. Collection of data on historic budgetary outlays on natural disasters Budgetary planning for emergencies Funding FIRST Kazakhstan Ministry of Economic Development and Planning JERP Ministry of Economic Development and Planning Ministry of Economic Development and Planning GFDRR