project information document (pid) - Documents & Reports

advertisement

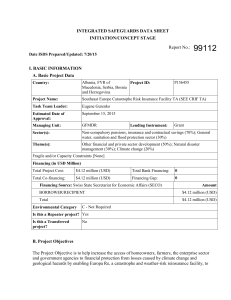

PROJECT INFORMATION DOCUMENT (PID) CONCEPT STAGE Project Name Region Sector Project ID Borrower(s) Report No.: AB5881 Southeastern Europe and Caucasus Climate Change and Catastrophe Risk Insurance Facility EUROPE AND CENTRAL ASIA Non-compulsory pensions, insurance and contractual savings (70%);General water, sanitation and flood protection sector (30%) P110910 Ministry of Finance, Governments of : Armenia, Bosnia and Herzegovina, Bulgaria, Croatia, Georgia, Macedonia, Moldova, Montenegro, Poland, Romania, Serbia Implementing Agency Environment Category Date PID Prepared Estimated Date of Appraisal Authorization Estimated Date of Board Approval EUROPA Reinsurance Facility Limited (Europa RE) c/o Reichlin & Hess Hofstrasse 1a 6300 Zug Switzerland Mr. Heinz C. Vollenweider, Chairman of the Board heinz.vollenweider@europa-re.com Tel: +41 443 80 50 90 [ ] A [ ] B [ ] C [ ] FI [ ] TBD (to be determined) March 15, 2010 July 6, 2010 November 30, 2010 1. Key development issues and rationale for Bank involvement Countries of Southeastern Europe and the Caucasus (SEEC) are highly vulnerable to natural hazards. Ninety percent of the area of Southeastern Europe is located within trans-boundary river basins, which makes the region highly prone to floods. Due to climate change, the frequency and severity of natural disasters, particularly those of hydro-meteorological origin, are rising in all SEEC countries. The Balkans and the Caucasus, located on the intersection of two continental plates, have suffered some of the most damaging earthquakes in the recent past and remain highly vulnerable to both small and large quakes. Natural disasters in the ECA Region exact severe human, physical and economic losses to both governments and populations - particularly the poor. The financial crisis has already weakened many national economies and threatened livelihoods, making the population even more vulnerable to the effects of natural disasters. Globally, economic losses from climaterelated and geological perils are rising, averaging US$100 billion per annum over the last decade. The Moldovan economy, based as it is on agriculture, has been particularly affected by a series of floods and droughts, hailstorms and frosts over the past decade. In addition to the economic toll, natural disasters have been the source of death, disability, and loss of physical and productive assets. Governments in the region have extremely limited capacity to assist their populations in regaining assets and productive capacity destroyed by natural disasters. The 2001 Bosnia floods caused damage worth 32 times the amount allocated by the Government for emergencies. The 1994 Moldova floods caused damage worth 176 times the amount allocated by the Government. In Armenia, 20 years after the Spitak Earthquake, a sizable proportion of the displaced population is still living in temporary housing. For this reason, one of the basic tenets of disaster risk mitigation is the transfer of the financial risks of disasters from the public to the private sector. Catastrophe insurance among homeowners, small and medium size businesses (SMEs) and farmers is currently almost non-existent in the region (only 1- 5 houses out of 100 currently have private catastrophe insurance coverage). Consumers often do not understand the need for such insurance, believing that the government or donations will cover their losses in case of a natural disaster. Local insurers have been reluctant to offer catastrophe insurance since risk is not well diversified on an individual country level, reinsurance for catastrophe risks is not readily available at a price supported by the local market, and risk management requirements for catastrophe risk are complex and often well beyond the technical capabilities of local insurers. Therefore, the catastrophe insurance products that do exist are usually too expensive for most homeowners and SMEs as companies ration the availability of catastrophe coverage through higher prices. Catastrophe risk insurance is one of the pillars of the Bank Group’s Disaster Risk Mitigation Strategy. The Kyoto Protocol, the UN Framework Convention on Climate Change and the Bali Action Plan all call for risk sharing and transfer mechanisms such as insurance as a means of protecting populations from the adverse effects of climate change. Catastrophe risk insurance is a means of transferring the financial and fiscal risk of disasters from government to the private sector. This not only protects the national economy as well as homeowners and SMEs, but enables more effective targeting of government assistance following a disaster, all of which become increasingly important with the global financial crisis. The World Bank has experience in facilitating the establishment of national and regional insurance pools, both disaster-related (such as the Caribbean Catastrophe Risk Insurance Facility, the Turkish Catastrophe Insurance Program, the Romanian Catastrophe Insurance Pool) or non-disaster related (the African Trade Insurance Facility). The World Bank, jointly with its regional partner, the Regional Cooperation Council, as well as the UN ISDR, is addressing the problem of low catastrophe insurance penetration in Southeastern Europe and the Caucasus through the creation of the regional Catastrophe Risk Insurance Facility (SEEC CRIF), which has been recently incorporated as “Europa Reinsurance Facility Ltd” (EUROPA RE). 2. Proposed objective(s) The Project Development Objective (PDO) is to increase homeowners’, farmers’ and SMEs’ access to financial protection from losses associated with natural disasters. The PDO will be achieved through supporting the creation of the SEEC CRIF – a specialized regional reinsurerwhich in turn will enable a rapid expansion of climate change and catastrophe insurance penetration among homeowners and SMEs in participating countries. The SEEC CRIF will provide reinsurance and technical assistance services to primary insurers in risk pricing, underwriting and catastrophe risk management. These services will be offered in supplement to those which may be offered by the private sector, or in cooperation with the private sector. 3. Preliminary description The project is designed as a horizontal and vertical APL that would provide funding for individual countries to participate in EUROPA RE as shareholders. Although the project focuses on the countries of Southeastern Europe and the Caucasus which have active World Bank portfolios, membership in EUROPA RE is open to other countries in the region which have already joined the European Union. EUROPA RE is designed as a regional insurance pool to benefit from economies of scale, diversify the risks, increase the market and lower the prices for catastrophe insurance products. Risk modeling and development of insurance products is time-consuming and expensive. Individual countries present relatively small markets and undiversified risks, making them unattractive to providers of catastrophe insurance and reinsurers. By pooling the risks and resources across a larger region: (a) investments in insurance risk modeling become more effective; (b) there is a larger potential market for catastrophe insurance products; (c) the risks are diversified, making the provision of such products both less expensive for consumers and more attractive to insurers; and (d) insurance policies can more easily be packaged for coverage by the global reinsurance market. In addition, this approach mirrors the trans-boundary character of most natural disasters, which often affect a number of neighboring countries. Many governments are already cooperating on a regional basis to mitigate the risks and effects of disasters and this approach has been supported by the Regional Cooperation Council and the Disaster Prevention and Preparedness Initiative. The project comprises the following two components: Component 1: Participation in the SEEC CRIF. The project will support SEEC countries’ efforts to join SEEC CRIF by financing their equity contributions into the reinsurance Facility. SEEC CRIF will be set up as a genuine Public-Private Partnership. Component 2: Technical assistance for supporting legislative framework: The project will support technical assistance to help countries ensure appropriate regulatory, legislative and policy frameworks to support catastrophe risk insurance. Institutional Arrangements: In its initial stage, the Facility will be owned and governed by member countries, due to the critical importance of governments in creating and supporting the demand for catastrophe insurance among homeowners and SMEs. SEEC CRIF will be managed by a competitively-selected, special purpose, privately-owned insurance services firm that will provide underwriting, pricing and risk management support to the local primary insurers, as well as placing reinsurance on behalf of SEEC CRIF and, if necessary, entering into alternative risk financing arrangement with risk capital providers. Governance Structure: To ensure that the management of SEEC CRIF is immune from potential political pressures that may adversely affect its operational and financial performance, one of the key elements envisaged by the business plan is a clear separation of the company’s business operations from the government ownership of the Facility. To this effect, EUROPA RE has an independent professional board of directors consisting of reputable insurance/reinsurance professionals with a well established track record in the industry. Overall strategic oversight and policy advice will remain with the company’s shareholders (the Ministries of Finance of the member countries) and exercised through the Annual Meetings of Shareholders and the Advisory Policy Board. The government shareholders will be able to sell up to 30% of their shares in 3 years from the commencement of SEEC CRIF operations and up to 100% within 5 years to private investors. EUROPA RE will be domiciled and regulated in Switzerland which has a highly advanced and sound insurance regulatory regime. 4. Safeguard policies that might apply Safeguard Policies Triggered Environmental Assessment (OP/BP 4.01) Natural Habitats (OP/BP 4.04) Forests (OP/BP 4.36) Pest Management (OP 4.09) Physical Cultural Resources (OP/BP 4.11) Indigenous Peoples (OP/BP 4.10) Involuntary Resettlement (OP/BP 4.12) Safety of Dams (OP/BP 4.37) Projects on International Waterways (OP/BP 7.50) Projects in Disputed Areas (OP/BP 7.60) Yes No X X X X X X X X X X 5. Tentative financing Source: BORROWER/RECIPIENT International Bank for Reconstruction and Development International Development Association (IDA) Total 6. Contact point Contact: Alison C. N. Cave Title: Senior Urban Development Specialist Tel: (202) 473-3952 Email: Acave@worldbank.org ($m.) 0 32 19.5 51.5 TBD