A. Introduction - Pacific Gas and Electric Company

advertisement

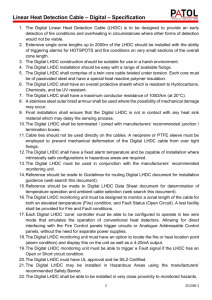

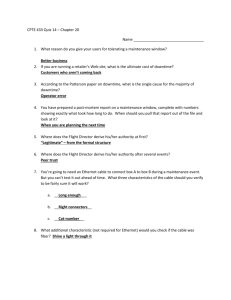

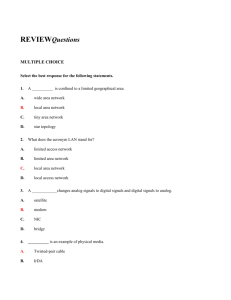

(PG&E-4) PACIFIC GAS AND ELECTRIC COMPANY CHAPTER 6 UNDERGROUND ASSET MANAGEMENT 1 2 3 4 A. Introduction 1. Scope and Purpose 5 The purpose of this chapter is to demonstrate that Pacific Gas and 6 7 Electric Company’s (PG&E or the Company) expense and capital 8 expenditure forecasts for electric underground asset management activities 9 related to the Company’s primary distribution system are reasonable and 10 should be adopted by the California Public Utilities Commission (CPUC or 11 Commission). PG&E’s electric underground distribution system consists of 12 13 approximately 24,700 circuit miles of primary distribution cable and 14 associated vaults, enclosures, splices, cable connectors and other 15 equipment. Work within the Underground Asset Management Program 16 primarily consists of replacing cable. Other activities include cable injection, 17 validating underground asset information and replacing cable terminations 18 (splices and elbow connectors). Commission adoption of the expense and capital expenditures that 19 20 PG&E is forecasting for the Underground Asset Management Program is 21 necessary to ensure safe and reliable operation of the Company’s 22 underground assets. 2. Summary of Dollar Request 23 PG&E requests that the Commission adopt its forecasts for the 24 25 Underground Asset Management Program of: (1) capital expenditures of 26 $25.7 million in 2005, $65.4 million in 2006, $64.2 million in 2007, and 27 $63.7 million in both 2008 and 2009; and (2) a 2007 operations and maintenance (O&M) expense forecast of $100,000. [1] 28 The capital expenditure forecast for 2007 is $47.8 million more than the 29 recorded 2004 expenditures and $54.7 million more than 2003 30 [1] These capital and expense costs are stated in current year (or nominal) SAP dollars, as are all dollars referenced in this chapter unless stated otherwise. 6-1 (PG&E-4) 1 expenditures. The 2007 expense forecast is slightly higher than PG&E’s 2 expenditures in 2004. 3 4 3. Support for Request PG&E’s capital and expense forecasts for the Underground Asset 5 Management Program are reasonable and fully justified because the 6 Company must: 7 Meet compliance requirements; 8 Replace vertical runs of paper insulated lead covered (PILC) cable within 9 10 11 indoor substations; Replace aging tie-cable circuits in San Francisco and East Bay Divisions; and 12 Address the increasing number of underground cable failures. 13 The forecasts are reasonable because the Company: 14 15 16 17 18 19 20 21 Effectively uses centralized program management to ensure high priority work is completed at reasonable costs; Continues to remedy safety and compliance-related asset conditions and address reliability performance; and Is collecting data that will increase its ability to identify and prioritize future cable replacement work. 4. Organization of the Remainder of This Chapter The remainder of this chapter is organized as follows: 22 Program Management Process; 23 Estimating Method; 24 Activities and Costs by Major Work Category (MWC); 25 Translation of Program Expenses to Federal Energy Regulatory 26 27 Commission (FERC) Accounts; and Cost Tables. 6-2 (PG&E-4) 1 B. Program Management Process 1. Objectives 2 The key objectives of the Underground Asset Management Program are 3 4 to ensure safe facilities, meet regulatory compliance, maintain or replace 5 deteriorated facilities in a cost-effective manner, and provide reliable 6 service. In administering its Underground Asset Management Program, 7 PG&E: 8 Replaces aging and/or deteriorated cables; 9 Replaces cables that do not comply with G.O. 128 due to severe concentric neutral deterioration; 10 Replaces deteriorated brick and mortar vaults (and associated aging cable) 11 to address employee and public safety concerns; 12 Uses silicon[2] injection for cables without significant concentric neutral 13 deterioration to cost-effectively extend the useful service life; and 14 Validates the age and types of cables in PG&E’s underground primary 15 distribution system. 16 2. Challenges of the Underground System 17 a. 18 Overview of PG&E’s Underground Assets 19 Underground cable consists of conductors covered with insulation. 20 There are approximately 57,500 miles of underground primary cable in 21 22 PG&E’s system, consisting of the following approximate single wire cable lengths by insulation type:[3] 23 1,540 miles of paper insulated lead covered (PILC); 24 12,000 miles of high molecular weight polyethylene (HMWPE); 25 40,000 miles of cross link polyethylene (XLP); and 26 4,000 miles of ethylene polypropylene rubber (EPR). [2] [3] PG&E uses the term “silicon,” but it is actually a proprietary fluid mixture that includes silicon and other components. PG&E used a 1999 evaluation to approximate these values. The values are miles of cable, not circuit miles. The value on p. 6-1 of this chapter is circuit miles. 6-3 (PG&E-4) 1 PG&E estimates that the majority of PILC cables are 40 or more 2 years old. While PILC cable is dependable and has a very long service 3 life, it is no longer a standard cable type because of its costly and time- 4 consuming splicing requirements and material composition. The 5 majority of PILC cable in PG&E’s system is located in San Francisco 6 and Oakland. PG&E is currently replacing vertical runs of PILC cables 7 within indoor substations and selected tie-cable circuits in San 8 Francisco and Oakland (see Section D.1.b.(1) Tie Cable Circuits for a 9 description of tie cable circuits). The majority of PG&E’s tie-cable 10 circuits include PILC cable. As the design of underground cable evolved, and cable insulation 11 12 moved from paper wrapping to plastic compounds, underground 13 distribution systems became more prevalent. Early cable designs and 14 applications (based on specifications used throughout the industry 15 during the late 1960s and early 1970s) exhibit the following 16 characteristics: 17 Certain HMWPE and XLP cables experience high failure rates due 18 to “treeing.” Treeing is an insulation breakdown condition caused 19 primarily by the presence of water, manufacturing impurities, and 20 the applied operating voltage. Treeing weakens the insulation level 21 and leads to cable failures. 22 Early cables were manufactured without an outer protective jacket. 23 Without the jacket, the early cables experience faster deterioration, 24 have a higher chance of concentric neutral deterioration, and are 25 more difficult to remove for replacement. 26 Early cable systems were installed as either direct buried (which 27 means they were laid in a trench and buried) or cable-in-conduit 28 installation (consisting of cable in a flexible conduit that was laid into 29 a trench and buried). Unlike the rigid conduit systems PG&E uses 30 today, it is necessary to either re-trench or use directional boring to 31 replace direct buried cable. PG&E also re-trenches or uses 32 directional boring for many of the cable-in-conduit applications due 6-4 (PG&E-4) 1 to physical restrictions of the flexible conduit, which prohibit simpler 2 replacement by re-pulling cable. Figure 6-1 illustrates the approximate installation history of plastic cable in PG&E’s service territory.[4] 3 4 5 6 7 8 FIGURE 6-1 PACIFIC GAS AND ELECTRIC COMPANY UNDERGROUND ASSET MANAGEMENT PROGRAM PLASTIC CABLE INSTALLATION HISTORY 3500 Plastic Cable Installation History Local Loop Cable in Circuit Miles 3000 2500 EPR (Duct) Mainline XLP (CIC and Duct) HMWPE (Duct) 2000 HMWPE (CIC) 1500 HMWPE (DB) 1000 500 0 '62-66 '67-71 '72-76 '77-81 '82-86 '87-91 '92-96 '97-01 Year From an overall system perspective, underground primary 9 11 distribution failures are not a significant contributor to the Company’s SAIDI and SAIFI reliability indices.[5] However, underground failures 12 are increasing and, ultimately, system reliability performance will 13 deteriorate as these assets age. 10 [4] [5] The majority of cable installed since 2001 is EPR in duct. SAIDI: System Average Interruption Duration Index. SAIFI: System Average Interruption Frequency Index. In 2004, underground cable failures contributed 9.4 minutes to SAIDI and 0.06 customer interruptions to SAIFI. 6-5 (PG&E-4) Figure 6-2 illustrates the increasing trend of underground cable 1 failures during the last ten years. 2 3 4 5 6 FIGURE 6-2 PACIFIC GAS AND ELECTRIC COMPANY UNDERGROUND ASSET MANAGEMENT PROGRAM CABLE FAILURES, 1994 TO 2004 600 Sustained Outages 500 400 300 Plastic Paper and Lead Linear (Plastic) 200 100 7 20 04 20 03 20 02 20 01 20 00 19 99 19 98 19 97 19 96 19 95 19 94 0 b. KEMA and ABB Analysis of PG&E Underground Assets 8 PG&E expects (and industry experience indicates) that the failure 9 rates of cable systems will increase over time. This belief is validated 10 by separate analyses performed by ABB and KEMA, consultants PG&E 11 hired in 2005 to examine underground system failures and their likely 12 effect on system reliability indices in the future. Both ABB and KEMA 13 conclude that increasing underground failures will negatively affect 14 system reliability in the future. 15 KEMA’s analysis indicates that cable failures will increase by a 16 factor of ten during the next 30 years. They estimate that an increase in 17 failures of this magnitude will cause SAIDI to increase by almost 18 70 percent. KEMA claims that proactive cable replacement has the 19 potential to mitigate the impact of aging cables. Specifically, the KEMA 6-6 (PG&E-4) 1 report states “…that about 400 miles of proactive replacement per year 2 is required over the next 35 years to prevent a noticeable worsening of reliability indices.”[6] However, KEMA acknowledges that the 400 mile 3 5 per year value can be lower if more complete cable installation data is available.[7] Accumulating additional information regarding cable 6 installations data is an initiative PG&E is currently pursuing, and the 7 8 Company has included expenses to accelerate this activity in the Company’s forecast.[8] The workpapers supporting this chapter include 9 a copy of the KEMA report. 4 The analysis conducted by ABB indicates the contribution to SAIFI 10 11 and SAIDI values due to underground cable failures will increase on the 12 order of 30 percent in the next ten years. ABB states that the 13 “…cumulative extent (mile-years) of cable exposure could be held 14 steady by replacement of 321 miles of XLPE cable per year and 15 16 miles of PILC cable per year.” ABB recommends that PG&E 16 continue to improve the Company’s inventory of installed cable. The 17 workpapers supporting this chapter include a copy of the ABB report. 18 19 The proactive cable replacement scenarios that KEMA and ABB discuss in their reports are significant.[9] However, PG&E’s 2007 GRC 20 expenditure forecast does not reflect their scenarios. This is because 21 PG&E agrees with KEMA and ABB that more complete cable 22 installation data will allow PG&E to better focus future expenditures and [6] [7] [8] [9] The annual cost of replacing 400 miles per year is approximately $211.2 million per year (assuming a replacement cost of $528,000 per mile, which is $100 per foot). It is possible that more complete data may indicate that a value more than 400 miles per year is appropriate. The point regarding additional data is that it provides information that will allow PG&E to better focus cable replacement expenditures. The alternative is a “shot-gun” approach of replacing more than what is likely necessary, in order to ensure replacement of a portion of highly suspect cable. The expense expenditures are forecasted in MWC GE – Operate Distribution System - Electric Mapping (see Chapter 14 of this exhibit). See also Section D.2 MWC GB and the Cable Validation Project of this chapter for additional information. PG&E also notes that the consultant reports are reliability-centered and do not consider cable replacement work due to deteriorated concentric neutrals or other G.O. 128 compliance issues. 6-7 (PG&E-4) 1 therefore optimize the number of miles of proactive replacement. 2 Consequently, it is premature to forecast expenditures for the level of 3 cable replacement KEMA and ABB describe in their reports. 4 Nevertheless, PG&E recommends that the Commission view the KEMA 5 and ABB reports as support for the Company’s expenditure forecast to 6 address aging underground assets. It is clear from their analyses that 7 proactive spending to replace underground cables will need to increase 8 in the future. PG&E views its 2007 GRC forecast for the Underground Asset 9 10 Management Program as an interim step that accomplishes the 11 following important objectives: 12 Accelerates the accumulation of cable installation data in order to 13 construct a model that will guide future cable replacement 14 expenditures; 15 Allows the Company time to ramp-up expenditures and refine the 16 processes necessary to efficiently manage a large scale cable 17 replacement program; 18 Forecasts spending for work that is clearly necessary such as 19 replacing aging tie-cables, vertically installed runs of PILC cables 20 and underground facilities with known safety and compliance 21 issues; and 22 Forecasts spending to address underground cables that are 23 negatively affecting reliability. 24 After completing the work to accumulate cable installation data 25 (projected completion in 2010), PG&E will have addressed significant 26 portions of vertically installed runs of PILC and aging tie-cables. In 27 essence, PG&E is addressing one set of assets in the short-term 28 (tie-cables and vertically installed runs of PILC) while collecting data on 29 another set of assets (primarily plastic cable). After accumulating the 30 data, the Company can use that information to develop a targeted 31 replacement plan and begin to transition resources from replacing tie- 32 cables and vertically installed PILC cables to other aging underground 6-8 (PG&E-4) 1 assets, with the idea of performing the amount of work necessary to 2 maintain system reliability indices at a constant level. c. 3 Comparison to SCE PG&E’s underground system is not unique with respect to cable 4 5 types, ages, types of construction and failure modes and rates. 6 7 Southern California Edison’s (SCE) 2006 GRC testimony and the information in this chapter are similar in the following ways: [10] 8 Cable types (pp. 25-26); 9 Failure modes (pp. 26-27); 10 Trends in circuit interruptions due to cable failure (p. 30); and 11 Increased expenditure forecasts to replace cables (p. 31). Electric utilities in California and across the country are facing an 12 13 increasing need to address aging underground cable systems. In light 14 of the increasing number of failures at PG&E and indications of similar 15 issues with other underground distribution systems throughout the 16 industry, PG&E believes its forecasts for 2005 through 2009 are 17 reasonable. PG&E anticipates it will continue to forecast significant 18 levels of spending in future rate cases to address its aging underground 19 infrastructure. d. Cable Validation Project 20 22 As the KEMA and ABB reports state, the availability of data is an important element in better understanding underground assets. [11] 23 PG&E understood this even before hiring KEMA and ABB and initiated 24 the Cable Validation Project in 2003. The Cable Validation Project is 25 collecting important information regarding underground cables and 26 updating the Company’s Centralized Electric Distribution System Assets 27 database (C-EDSA). 21 While C-EDSA contains data on the vast majority of underground 28 cable in PG&E’s system, the data in C-EDSA is most often just the 29 [10] [11] Page references are to SCE-3, Volume 3, Part III, Section I.D.9. KEMA report, PG&E Aging Cable Modeling and Scenario Analysis, dated July 6, 2005, pp. 30-32. ABB report, Statistical Failure Analysis of Underground Cables, dated June 16, 2005, pp. 51-52. 6-9 (PG&E-4) 1 cable length, conductor size and relative location in the circuit. 2 Approximately 81 percent of the underground line sections in C-EDSA 3 do not indicate the year of installation or cable type, particularly for 4 pre-1990 installations. Year of installation and cable type are critical 5 pieces of information to effectively manage underground assets and 6 7 create prioritization models. The cable validation project will update C-EDSA by gathering the following data:[12] 8 Year of installation; 9 Primary conductor insulation type and size; 10 Construction installation type; and 11 Line length. While the lack of certain data is unfortunate, it is understandable 12 13 when viewed in the context of the creation of C-EDSA. What is known 14 today as C-EDSA began in the late 1960s, well before the development 15 of the asset management concepts PG&E and other utilities use today. 16 Then, as now, it served as a primary distribution connectivity model. 17 The Company uses C-EDSA for a variety of purposes such as 18 distribution load flows, protection studies, franchise tax purposes and 19 outage reporting. Consequently, the focus was on connectivity, not 20 asset management. Indeed, if a cable section failed in the 1980s and 21 was replaced like-for-like, it is very possible that no year-of-installation 22 entry was made in C-EDSA because the connectivity information in the 23 database was unaffected. PG&E is not unique with respect to the unavailability of certain data 24 25 regarding underground assets. As part of the work it performed for 26 PG&E, KEMA surveyed other large utilities in North America. Of the 27 utilities responding to KEMA’s survey, less than half report having data 28 regarding the age of their underground cables. Even within PG&E, the 29 unavailability of data for asset management purposes is not unique to 30 cable. For example, to better understand its pole assets, PG&E [12] PG&E anticipates it will gather most of this data by reviewing existing facility maps and original construction documentation the Company has at its operating centers. 6-10 (PG&E-4) 1 conducted a pole inventory program. To better understand and analyze 2 substation equipment, substation personnel have created databases 3 with extensive information. PG&E plans on completing the Cable Validation Project in 2010. 4 5 The data it collects will allow PG&E to more effectively manage its 6 underground assets. PG&E will be able to better identify, analyze and 7 prioritize underground asset work. See Section D for additional details. 3. Planning and Budgeting Process 8 The Underground Asset Management Program primarily consists of: 9 10 (1) capital investment for cable replacement work; and (2) minor 11 expense-related activities and the Cable Validation Project (a MWC GE 12 expense item). Capital investment in this program includes cable 13 replacement by re-pulling new cable within the existing infrastructure, 14 trenching and installing new distribution facilities, and injecting silicon into 15 the cable to restore its insulation strength. Upgrades of switches, 16 transformers and other equipment can also occur with cable replacement 17 projects. This program’s expense work includes: (1) replacing splices and elbow 18 19 connectors, testing new underground fault indicators and cable diagnostic 20 technologies and monitoring the gas consumption of low-pressure, gas-filled 21 cable; and (2) validating the age, type and construction of existing 22 underground cables to better identify, analyze and prioritize underground 23 asset work. 24 25 The Underground Asset Management Program does not include upgrading underground assets to increase capacity.[13] Replacing 26 underground cable to increase capacity is managed in the Electric 27 Distribution Capacity Program (MWC 06) described in Chapter 7 of this 28 exhibit. The Underground Asset Management Program also does not fund 29 the immediate repairing or replacing of assets that fail in the field resulting in 30 customer outages. Those activities are managed by the Emergency 31 Recovery Program described in Chapter 12 of this exhibit. However, the [13] Occasionally, a MWC 56 project replaces a cable that is both aged/ deteriorated and overloaded. 6-11 (PG&E-4) 1 program does cover the repair or replacement of underground assets that 2 fail but do not require immediate replacement or repair as part of an 3 emergency outage restoration. 4 a. Five-Year Plan 5 PG&E determined its forecasts for the Underground Asset 6 Management Program as part of the Company’s five-year planning 7 process. That process entails the following steps: 8 The 18 local planning groups identify work requirements based on field test results, historical component performance, and ongoing or 9 previously identified projects; 10 11 Local planners create cost estimates using unit costs or costs of similar projects and engineering judgment; 12 13 The prioritization of projects and expenditures; and 14 The Program Manager works with the Transmission and Distribution 15 (T&D) Finance Team to determine a funding level based on the 16 amount of safety-related work identified, historical spending, 17 reliability performance, system priorities relative to other programs, 18 and professional judgment. PG&E’s program directors and the 19 T&D Finance and Resource Teams revise the plan as needed 20 before submission to the T&D Board and PG&E senior 21 management for approval in the fall (as discussed in Chapter 1, 22 Distribution Operations Policy, of this exhibit). b. Budgeting Changes in MWC 56 Since the 2003 GRC 23 25 The vast majority of PG&E’s electric distribution system consists of radial circuits.[14] Underground radial circuits have two basic 26 components: main lines and laterals. The main line, as the phrase 27 indicates, is the portion of the circuit that carries the bulk of the load. 28 Main lines exist to provide power to laterals and to interconnect with 24 [14] Radial circuits have only one path between each customer and the distribution substation. A circuit interruption results in a loss of power to the customers. PG&E’s radial circuits are typically interconnected, but operate radially by open points (typically switches) at various points on the circuit. PG&E also have network and tie-cable circuits in San Francisco and Oakland. 6-12 (PG&E-4) 1 main lines from other radial circuits (via normally open switches). 2 Laterals connect to the main line and carry smaller portions of power 3 from the main line to customers. Underground laterals come in 4 two varieties: radial and looped. An underground radial tap is a spur 5 from the main line that feeds one or more distribution line transformers. 6 An underground radial tap has one source of power from the main line. 7 An underground loop is two (or more) spurs from a main line that tie 8 together. Therefore, an underground loop has at-least two sources of 9 power from the main line. 10 Underground cable failures occur on both main lines and laterals. 11 When a main line failure occurs, PG&E restores service to as many 12 customers as possible by switching, replaces the failed section of cable 13 and completes the service restoration process. There are usually no 14 feasible alternatives when a section of main line fails—the failed section 15 requires immediate replacement. The method for dealing with failures 16 on underground radial taps is the same as main lines. Immediate 17 replacement is necessary because there is only one source of power 18 and customers are without service until the damaged section is 19 repaired. 20 A failure on an underground loop provides more flexibility for service 21 restoration than a main line or radial tap failure. Since a loop has two 22 sources from the main line, it is sometimes possible to restore service 23 without having to immediately replace or repair the failure. Figure 6-3 24 illustrates these loop restoration concepts. 6-13 (PG&E-4) 1 2 3 4 5 FIGURE 6-3 PACIFIC GAS AND ELECTRIC COMPANY UNDERGROUND ASSET MANAGEMENT PROGRAM CABLE FAILURE IN LOCAL LOOP SYSTEM Figure 6-3 is a simplified diagram of a local loop system. The local 6 loop system in this diagram serves six transformers. Under normal 7 operating conditions (the top diagram), switch #1 feeds three 8 transformers (Tx 1, Tx 2 and Tx 3) and switch #2 feeds the other three 9 (Tx 4, Tx 5 and Tx 6). There is a normal open switch between these 10 two groupings of transformers (switch #3). In this example an 11 underground cable failure occurs between transformers 2 and 3. To 12 restore service (the bottom diagram), PG&E personnel isolate the cable 13 between transformers 2 and 3. Switch # 3 is closed to restore service to 14 transformer 3. After completing this work, switch #1 is serving two 15 transformers (Tx 1 and Tx 2) and switch # 2 is serving four transformers 16 (Tx 3, Tx 4, Tx 5 and Tx 6). 17 When failures on underground loops occur and the nature of the 18 failure requires immediate replacement/repair, that work is charged to 19 MWC 17 – Emergency Response or BH – Corrective Maintenance. 6-14 (PG&E-4) 1 When a failure on an underground loop occurs and immediate repair is 2 not necessary, as described in the preceding paragraph and illustrated 3 in Figure 6-3, the failed cable is placed on the Equipment Requiring 4 Repair (ERR) list and becomes an “ERR Cable Replacement Project.” 5 Assigning work of this nature to the ERR list allows PG&E to schedule 6 and perform the necessary corrective action during normal business 7 hours. 8 9 Prior to 2005, the expenditures for ERR Cable Replacement work were charged to MWC 57 – Capital Preventive Maintenance by an 10 Electric Preventive and Corrective Maintenance tag (EPCM tag), and 11 managed by the Company’s Electric Distribution Maintenance Program. 12 As Chapter 2 of this exhibit describes, the maintenance program is 13 predominantly focused on performing a high volume of work at a low 14 cost and consequently a low unit cost on a per tag basis. However, 15 cable replacement work is expensive, especially when compared with 16 typical EPCM tag work which is more frequently overhead in nature and 17 costs much less to address. Consequently, performing primary cable 18 replacement work on EPCM tags was increasing the unit cost for 19 completed EPCM tags in general. The upward pressure ERR cable 20 replacement projects were placing on the unit cost for EPCM tags 21 resulted in the unintended and undesirable behavior of division 22 personnel scheduling cable replacement tags too far out in the future. 23 The capital replacement work of ERR cable sections is identical to 24 the cable replacement work performed under MWC 56. In order to 25 provide a more uniform approach and to better align the investments for 26 underground cable assets, PG&E began charging the ERR cable 27 replacement work to MWC 56 in 2005. Transferring the responsibility of 28 managing this work from the Electric Distribution Maintenance Program 29 to the Underground Asset Management Program allows the application 30 of a more consistent prioritization scheme and will place a greater focus 31 on returning sections of cable to service sooner. 32 See Section D for specific units of work and financial information. 6-15 (PG&E-4) 1 C. Estimating Method 2 PG&E’s capital forecast for proactive cable replacement work is primarily 3 based on project cost estimates. The workpapers supporting this chapter list 4 specific projects the Company plans to construct between 2005 and 2009. The 5 project cost estimates were either based on engineering estimates of the 6 necessary work, unit cost data, costs from similar projects or a combination of 7 these elements. The forecasts for 2007 through 2009 also include expenditures 8 for projects yet to be specified (identified as such in the workpapers). The 9 majority of forecast expenditures for unidentified projects occur in 2008 and 10 2009. PG&E includes these amounts in the forecast because it is reasonable to 11 assume, based on the increasing number of cable failures (see Figure 6-2, 12 earlier in this chapter) and the KEMA and ABB analysis, that a steady stream of 13 expenditures is necessary to address the Company’s aging underground assets. 14 The capital forecast for ERR cable replacement work is based on analysis of 15 pending work, an estimated amount of future work and the application of a unit 16 cost. The expense forecast for 2007 was based on 2004 expenditures. 17 18 19 20 21 See Section D for details regarding the Company’s capital and expense forecast. D. Activities and Costs by MWC Table 6-1 shows the MWCs under the Underground Asset Management Program. 22 23 24 25 TABLE 6-1 PACIFIC GAS AND ELECTRIC COMPANY UNDERGROUND ASSET MANAGEMENT PROGRAM MAJOR WORK CATEGORIES Line No. 26 27 MWC 1 Capital MWCs 2 Capital-MWC 56 3 Expense MWCs 4 Expense-MWC GB Title Cable Replacement Splice/Connector Replacement The following section describes the work activities and expenditure forecast for each MWC. 6-16 (PG&E-4) 1. MWC 56 – Cable Replacement 1 2 Cable replacement is the non-emergency related replacement of 3 primary distribution cables by: (1) pulling new cable through the existing 4 infrastructure; or (2) trenching or boring, and installing new distribution 5 equipment. The work activities include trenching and excavation work, 6 installing new enclosures and conduits, splicing cable, and replacing other 7 distribution equipment such as transformers or switch devices. PG&E also 8 uses injection as a means of rejuvenating cable insulation and is an 9 alternative to replacement. PG&E’s 2007 GRC forecast consists of projects that replace: (a) tie- 10 11 cable circuits comprised of aging PILC and low pressure gas filled cables; 12 13 (b) vertical runs of PILC cables in indoor substations; (c) cables with severe concentric neutral deterioration or other G.O. 128 compliance issues; [15] 14 (d) cables with a history of poor reliability due to a high number of failures; 15 and (e) ERR cable replacement work as discussed in Section C.3.b, 16 Budgeting Changes in MWC 56. 17 a. Recent Expenditure Patterns in MWC 56 PG&E’s MWC 56 capital expenditures have increased steadily from 18 19 2001 to 2004. In 2001, PG&E spent $2.1 million. In 2002, the 20 Company increased spending three-fold, to $6.7 million. MWC 56 21 expenditures in 2003 were $9.5 million, a 40 percent increase over the 22 2002 value and $481,000 over the 2003 GRC test-year forecast of 23 $9.0 million. In 2004, PG&E spent $16.4 million, exceeding 2003 24 expenditures by 73 percent. Figure 6-2 shows this increasing level of expenditures.[16] 25 [15] [16] For example, in downtown Stockton, PG&E is replacing unsafe vaults made of deteriorating bricks held together with extensively cracked mortar. As part of this project, PG&E is also replacing approximately 4,000 circuit feet of cable. The values in Figure 6-4 are from Table 6-2, excluding estimated past expenditures for ERR cable replacement work. 6-17 (PG&E-4) 1 2 3 4 FIGURE 6-4 PACIFIC GAS AND ELECTRIC COMPANY UNDERGROUND ASSET MANAGEMENT PROGRAM MWC 56 CAPITAL EXPENDITURES, 1997-2004 18000 16000 14000 Costs x $1000 12000 10000 Recorded Linear (Recorded) 8000 6000 4000 2000 0 1997 1998 1999 2000 2001 2002 2003 2004 Year PG&E’s 2005 capital forecast is $25.7 million, a 56 percent increase 5 over 2004. 6 b. MWC 56 Forecast 7 Table 6-2 shows PG&E’s 2005 through 2009 forecast for MWC 56, and recorded 2000 through 2004 expenditures. [17] The table presents 8 9 10 capital expenditure data using the following categories: 11 Tie-cable circuits; 12 Vertical runs of PILC cables; 13 Compliance related (e.g., severe concentric neutral deterioration); 14 Reliability related (i.e., high number of failures, both PILC and plastic insulation); and 15 16 [17] ERR Cable Replacement. PG&E did not separately track expenditures for ERR Cable Replacement work during 2000-2004. The values in Table 6–2 are estimates. The workpapers explain the estimating methodology. 6-18 1 2 3 4 5 TABLE 6–2 PACIFIC GAS AND ELECTRIC COMPANY ELECTRIC DISTRIBUTION UNDERGROUND ASSET MANAGEMENT MWC 56 HISTORICAL AND FORECAST CAPITAL EXPENDITURES ($000) Line No. 1 2 3 4 5 6 MWC 56 56 56 56 56 56 Description Tie Cable Circuits Vertical Runs of PILC Cables Compliance Reliability – Plastic Reliability – Lead ERR Cable Replacement(a) 7 56 Total _______________ (a) 2000 Actual 2001 Actual 2002 Actual 2003 Actual 2004 Actual $1,125 $1,448 $1,128 2,449 246 988 $133 1,836 128 1,379 1,987 3,639 4 2,454 1,575 4,630 1,828 3,526 $5,856 2,295 3,937 2,504 1,830 2,768 $4,811 $3,476 $9,209 $13,007 $19,190 2005 Forecast 2006 Forecast 2007 Forecast 2008 Forecast 2009 Forecast $8,165 4,160 7,341 4,139 1,695 2,000 $28,390 4,785 11,511 11,643 3,671 5,425 $22,930 3,410 11,089 13,875 8,697 4,150 $15,406 2,090 13,370 15,203 13,931 3,725 $10,908 – 13,800 18,042 17,250 3,725 $27,500 $65,425 $64,150 $63,725 $63,725 The values for 2000-2004 are estimates. 6-19 (PG&E-4) (PG&E-4) The workpapers supporting this chapter provide a list of projects 1 2 that correspond to the categories in Table 6-2. The list represents 3 PG&E’s best estimate of the specific MWC 56 projects the Company 4 will perform in the coming years. The workpapers also identify the year 5 PG&E anticipates constructing a project. It is important to note that the 6 timing of a specific project can change as a result of the Company 7 identifying another MWC 56 project that is more urgent (e.g., multiple 8 outages in an area with underground facilities that was previously 9 problem free), the scope of a project changing significantly during the 10 estimating or construction process (e.g., a cable replacement project 11 encounters unforeseen asbestos mitigation work, or cables that 12 personnel can not remove and replace due to a collapsed duct ), and 13 the Company’s continuing analyses of underground asset information. 14 Such occurrences will require PG&E to re-prioritize and re-schedule the 15 projects listed in the workpapers. The following sections briefly describe each of the categories from 16 17 Table 6-2. While the categories are useful in understanding PG&E’s 18 forecast, some projects can easily fall into different categories. For 19 example, a section of line with a deteriorated neutral (a “compliance” 20 project) may also be experiencing multiple failures (a “reliability” 21 project). 22 (1) Tie Cable Circuits Tie cables are 12 kV circuits that feed other distribution 23 25 substations. The substations they feed serve customers from their own 4 kV and 12 kV radial circuits. Unlike radial or network[18] 26 circuits, tie-cable circuits do not serve customers directly (i.e., there 27 are no distribution line transformers connected to tie cable circuits). 28 Tie-cable circuits are also different from radial circuits because they 29 are operated in parallel. This means that under normal operating 30 conditions, multiple tie-cables supply the same substation such that 31 the failure of a single tie-cable will not cause an outage to the 24 [18] Portions of downtown San Francisco and Oakland are served by network groups. Network circuits provide multiple sources of power to network groups. 6-20 (PG&E-4) 2 substation it feeds. It is reasonable to think of 12 kV tie cable circuits as providing the same function as transmission lines.[19] 3 As an example, there are four tie-cables that connect Mission 4 Substation in downtown San Francisco (Mission and Eighth Streets) 5 to Station G which is located several miles away, near Ellis and 6 Broderick Streets. While these tie cables do not directly feed any 7 customers, Station G serves approximately 18,000 customers in the 8 western part of the city. 1 There are 47 tie cable circuits in PG&E’s San Francisco and 9 10 East Bay Divisions. Figure 6-5 is graphical representation of 11 tie-cable circuits and the substations they supply in San Francisco 12 Division. [19] While it is correct to think of tie cables as 12 kV transmission lines, PG&E notes that these lines do not fall under the operational jurisdiction of the California Independent System Operator and do come under the jurisdiction of the CPUC for rate making purposes. 6-21 (PG&E-4) 1 2 3 4 5 FIGURE 6-5 PACIFIC GAS AND ELECTRIC COMPANY UNDERGROUND ASSET MANAGEMENT PROGRAM SAN FRANCISCO DIVISION TIE CABLE CIRCUITS PG&E’s tie cables primarily consist of PILC cable. As noted in 6 Section B.2.a., Overview of PG&E’s Underground Assets, PG&E 7 estimates that the majority of PILC cables are 40 or more years old. 8 PG&E’s tie-cable circuits are no exception. 9 While the tie-cable systems have provided highly-reliable 10 service for many years, it is not reasonable to assume that this will 11 continue indefinitely. As KEMA’s analysis indicates, PILC cable 12 failures are increasing. Even though the number of failures is 13 increasing, the current effect of tie-cable failures on SAIFI and 14 SAIDI has been negligible because of the redundancy inherent in 6-22 (PG&E-4) 1 the system. Ultimately though, the number of failures will increase 2 and the redundant nature of the system will be insufficient to 3 preserve current levels of reliability. This concern is best expressed 4 by explaining how specific attributes of tie-cable circuits influence 5 the repair time when failures occur. Tie cable failures can take several days to repair. First, it is 6 7 necessary to locate the failure. Unlike radial circuits, which have 8 numerous switches to facilitate load transfers and other operating 9 needs, most tie-cable circuits have few, if any, switches because it 10 was not necessary (nor required) to design tie-cable circuits to allow 11 direct load transfers. This means repair crews must go into 12 13 manholes and break-apart the tie-cable to apply fault finding devices.[20] Second, it usually takes more time to replace or repair 14 PILC cable than it does plastic cable. Whether the crew replaces 15 the failed PILC cable section with plastic cable or installs a new 16 17 section of PILC cable, it can take a day or more to pull the cable and construct the necessary splices.[21] Factors such as traffic and 18 the difficulty of working in the confined space of a manhole 19 contribute to the amount of time it takes to make repairs. Failures can also occur when the tie-cable system is abnormally 20 21 configured to facilitate necessary work. This concept is illustrated 22 by an event that occurred on December 17, 2004. The FY-1 tie 23 cable between Larkin Substation and Marina Substation (Station F 24 in Figure 6-5) was de-energized to allow construction personnel to 25 rearrange tie cable circuits as part of a project that is addressing 26 seismic issues at Station I. While personnel were performing their [20] [21] Installing switches might provide some benefit, but is not a complete answer because the manholes where the switches must be installed are often space constrained. Another downside to this is the addition of more components (additional PILC cable, perhaps to plastic-to-lead transition splices and the switch) that can potentially fail. Because tie-cables do not serve customers directly, the ideal situation is to install them from substation to substation with as few devices and splices as possible since each component is a potential source of future failure. Splicing PILC cable is a craft that involves the application of molten lead and other material. 6-23 (PG&E-4) 1 work, the FY-2 cable failed. This resulted in an outage to over 2 13,000 customers. Ultimately, because of the time it takes to repair 3 tie-cable failures, the likelihood of multiple failures resulting in an 4 outage to customers increases as the failure rate of PILC cable 5 increases. 6 Between 2002 and 2004 PG&E spent $8.4 million to replace 7 aging tie-cables. PG&E’s forecast for MWC 56 includes a total of 8 $85.8 million to replace aging tie cables million between 2005 and 9 2009 (see the workpapers supporting this chapter for details). 10 Considering the age of the cables (over 70 years old in some 11 instances), the increasing failure rates, and the number of 12 customers these facilities serve in densely populated urban areas 13 (tens of thousands customers in San Francisco, Oakland and 14 Berkeley), refurbishing the tie-cable systems is a reasonable and 15 necessary first step to address aging underground assets in a 16 significant manner. 17 18 (2) Vertical Runs of PILC Cables On December 20, 2003, a cable failure inside of Mission 19 Substation in San Francisco caused a fire that led to the interruption 20 of service to over 100,000 customers. PG&E’s investigation of the 21 event found that, over time, the particular application of PILC cable 22 (40 years in a vertical position) caused the cable to lose its 23 insulating capability. This caused the cable to fail and was the 24 initiating event of the fire. Based on laboratory analysis, the cable 25 failed due to degraded insulation in the oil-impregnated paper 26 separating the conductors inside the cable. The degraded 27 insulation led to an electrical arc, which exploded through the 28 copper and lead sheath around the cable. 29 In response to this finding, PG&E is replacing vertically installed 30 runs of PILC cable in other indoor substations. PG&E spent 31 $2.3 million to perform this work in 2004 and estimates it will spend 32 an additional $14.4 million between 2005 and 2008. 6-24 (PG&E-4) 1 2 (3) Compliance PG&E’s forecast for MWC 56 includes projects that address 3 known compliance and safety issues. Most of the projects in this 4 category address deteriorating concentric neutrals. The 5 deterioration of a concentric neutral is a G.O. 128 violation and 6 possible safety hazard. 7 Another compliance issue is cover. Primary cable with less 8 than 24 inches of cover is also a G.O. 128 violation. Some of the 9 compliance projects PG&E includes in its forecast are for instances 10 where erosion has reduced the minimum amount of necessary 11 cover. 12 In addition to projects relating to meeting G.O. 128 13 requirements, this category also includes an ongoing project in 14 downtown Stockton where PG&E is replacing unsafe vaults made of 15 deteriorated bricks held together with extensively cracked mortar. 16 As part of this project, PG&E is also replacing cable and converting 17 some sections of primary from 4 kV to 12 kV. The deteriorated 18 vaults will be filled with sand after the new infrastructure is 19 constructed. 20 PG&E spent $3.9 million performing compliance related work in 21 2004 and estimates it will spend a total of $57.1 million between 22 2005 and 2009. 23 (4) Reliability 24 This category provides PG&E’s forecast for replacing cable 25 because of age and type (e.g., the HMWPE cable discussed earlier 26 in this chapter or aging PILC cable on radial circuits), multiple 27 failures, or a combination of these factors and other influences such 28 as splice and connector failures. Projects in this category are 29 identified by distribution engineers who are knowledgeable about 30 the performance of underground facilities in their division. 31 This category also includes cable-injection related work. Cable 32 injection involves injecting a fluid between the conductor and the 33 insulation to fill voids created by “treeing” conditions. The injection 34 fluid polymerizes with the water in the insulation and fills the “tree” 6-25 (PG&E-4) 1 condition, restoring its insulating properties. PG&E is not 2 forecasting a significant amount of cable injection because the 3 Company is identifying more work that requires cable replacement. 4 PG&E’s forecast includes two cable injection projects in 2005 for 5 approximately $335,000. 6 PG&E spent $4.3 million performing reliability related work in 7 2004 and estimates it will spend a total of $108.1 million between 8 2005 and 2009 (5) ERR Cable Replacement 9 As described in Section B.3.b “Budgeting Changes in MWC 56 10 11 Since the 2003 GRC,” PG&E is now charging expenditures for ERR 12 cable replacement work in MWC 56. Prior to 2005, these 13 expenditures were charged to either MWC 17 or MWC 57. PG&E 14 anticipates that this change will facilitate a more consistent 15 prioritization scheme and will place a greater focus on returning 16 sections of cable to service sooner. Prior to 2005, PG&E did not separately track expenditures for 17 18 this cable replacement work. Consequently, it was necessary to 19 estimate historical expenditures for this work. PG&E estimated past 20 expenditures by analyzing Electric Preventive and Corrective 21 Maintenance (EPCM) tags from the years 2000 to 2004. Table 6-2 22 contains the results of this analysis (the workpapers include a 23 detailed description of the analysis and supporting data). To develop the forecast for 2005 and beyond, PG&E identified 24 26 the number of pending ERR cable replacement tags that will now be charged to MWC 56.[22] In addition to this pending work, the 27 Company estimates that approximately 60 new ERR cable 28 replacement tags will occur each year. PG&E used this volume of 29 work and a unit cost of $43,000/tag to calculate the forecasted 30 amounts in Table 6-2. The unit cost is based on cost-estimates 31 PG&E prepared for projects the Company plans to construct in 32 2005. 25 [22] As of June 2005, there are 144 ERR cable replacement projects pending. 6-26 (PG&E-4) 2. MWC GB and the Cable Validation Project 1 This section of testimony describes Underground Asset Management 2 3 program expense activities. It also provides additional details regarding the 4 previously discussed Cable Validation Project (the costs for the Cable 5 Validation Project are captured in MWC GE, which is covered in Chapter 14 6 of this exhibit). Table 6-3, at the end of this section, shows the expense 7 forecast for MWC GB for 2005 through 2007 and the 2000 through 2004 8 actual expenses. 9 a. MWC GB – Splice/Connector Replacement MWC GB encompasses the expense activities in the Underground 10 11 Asset Management Program. The work in MWC GB has historically 12 consisted of replacing underground splices and connectors. In 2002 13 through 2004, splice and connector performance did not require the 14 Company to incur significant expenses to proactively replace these 15 components. Consequently, PG&E’s spending in MWC GB was less 16 than $100,000 per year during 2002 to 2004. 17 PG&E’s 2007 GRC forecast for MWC GB is $100,000 per year for 18 2005 through 2007 and is consistent with 2004 actual expenses. This 19 20 forecast will cover expenses to monitor the gas consumption of low-pressure, gas-filled tie-cables,[23] purchase and test new 21 underground fault indicators, evaluate diagnostic tools that assess cable 22 condition and proactively replace cable terminations such as elbows 23 and splices. b. Cable Validation Project 24 25 As PG&E explained in Section B.2.d., “Cable Validation Project” 26 earlier in this chapter, the Cable Validation Project updates underground 27 cable information in C-EDSA, the Company’s primary distribution 28 system database. Obtaining and entering data relating to the year of [23] As previously described, most of the tie cables in San Francisco and East Bay Divisions are PILC. However, there are a small number of cables that are low-pressure, gas-filled. Low-pressure, gas-filled cables use nitrogen as part of their overall insulation system and represent a sub-category of the PILC cable family. These cables require a constant feed of nitrogen gas and PG&E monitors gas consumption at various locations. 6-27 (PG&E-4) 1 installation and cable type (and other pieces of information) are critical 2 for managing underground assets and creating prioritization models. 3 To do this work, division mapping personnel are using circuit maps 4 to systematically compare and validate the data in C-EDSA. They 5 conduct the validation, circuit-by-circuit, until all of the characteristics of 6 the underground primary cable are validated via local maps and job 7 files. 8 9 Through 2004, 18 percent of the system has been validated. Chapter 14 of this exhibit forecasts an additional $1.4 million (in 10 MWC GE) in 2007 to accelerate this effort. PG&E anticipates the entire 11 Validation Project will cost $6.2 million. Increasing the level of spending 12 will allow PG&E to finish by 2010. PG&E believes this increase is 13 reasonable in light of the trends in underground failures and the 14 conclusions ABB and KEMA reached in their reports. Completing this 15 work sooner will allow the Underground Asset Manager to analyze, 16 identify and prioritize cable replacement projects with greater precision. 6-28 TABLE 6–3 PACIFIC GAS AND ELECTRIC COMPANY ELECTRIC DISTRIBUTION UNDERGROUND ASSET MANAGEMENT EXPENSES BY MAJOR WORK CATEGORY ($000) Line No. 1 2 MWC GB Description 2000 Actual 2001 Actual 2002 Actual 2003 Actual 2004 Actual 2005 Forecast 2006 Forecast 2007 Forecast UG Expense Activities $487 $211 $79 $83 $98 $100 $100 $100 Total $487 $211 $79 $83 $98 $100 $100 $100 1 6-29 (PG&E-4) (PG&E-4) 1 E. Translation of Program Expenses to FERC Accounts As discussed in Exhibit (PG&E-1), Chapter 2, PG&E’s program managers 2 3 manage their program costs using the SAP view of cost information, not the 4 FERC account view. Thus, for presentation in this GRC, certain SAP dollars 5 6 must be translated to FERC dollars. This is not an issue for capital costs where the SAP and FERC views are identical.[24] For O&M expenses, however, the 7 SAP dollars include certain labor-driven adders such as employee benefits and 8 payroll taxes that are charged to separate FERC accounts. These labor-driven 9 adders must be removed from the SAP dollars for O&M expenses to present them by FERC account. 10 Tables 6-6 and 6-7 show how the SAP expense dollars in the Underground 11 12 Asset Management Program translate to the appropriate FERC accounts. 13 Table 6-6 shows dollars stated in current year dollars (i.e., nominal dollars). 14 Table 6-7 shows dollars stated in base year dollars (i.e., 2004 dollars). The 15 calculations used to deflate the nominal dollars to 2004 dollars (which requires 16 segregating them into their labor and non-labor components) are shown in the 17 workpapers supporting this chapter. The O&M expenses shown by MWC in 18 Table 6-5 are summarized in Exhibit (PG&E-2), Chapter 2 on a base year FERC 19 dollar basis. The capital expenditures shown by MWC in Table 6-4 are 20 summarized in Exhibit (PG&E-2), Chapter 8. 21 F. Cost Tables The capital and expense requests for the Underground Asset Management 22 23 Program are summarized in the following tables: 24 Table 6-4 lists the capital work by MWC showing the recorded 2004 capital expenditures and the 2005 through 2009 forecasts; 25 Table 6-5 lists the expense MWC GB, showing 2004 recorded expense and the 26 27 2005 through 2007 forecasted expense in SAP dollars stated in current year 28 dollars; [24] Capital costs are typically shown in rate case filings with overheads (i.e., SAP “adders”) included, such as capitalized employee benefits and payroll taxes. 6-30 (PG&E-4) 1 Table 6-6 displays the translation of the expense MWC GB to appropriate FERC 2 accounts, showing 2004 recorded expense and 2005 through 2007 3 forecasted expense stated in current year dollars; and 4 Table 6-7 displays the translation of the expense MWC GB to appropriate FERC 5 accounts, showing 2004 recorded expense and 2005 through 2007 6 forecasted expense stated in 2004 base year dollars. 6-31