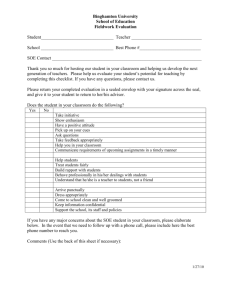

ATT00073 - The Presidency

advertisement