Ch 19 Suppose that the demand for apples is perfectly elastic and

advertisement

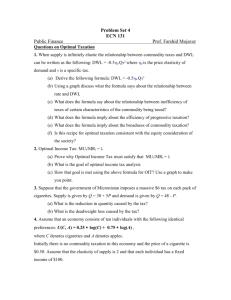

Midterm 2 ECN131: Public Finance 20 Nov 06 Prof. Farshid Mojaver Name:_________ (pts 15) 1- Suppose that the demand for apples is perfectly elastic and the government levies a tax on the producers of apples. Assume that the supply of apples is neither perfectly elastic nor perfectly inelastic. a. How will the price paid by consumers change? Is this change bigger or smaller than the price change that would result if the demand for apples were not perfectly elastic? b. How will the quantity of apples consumed change due to the tax? Is this change in quantity larger or smaller than the change that would result if the demand for apples were not perfectly elastic? c. Explain the significance of your answers in both part a and part b in terms of how the tax affects the welfare of consumers in the apple market Ans) a. The price paid by consumers will not change at all. If the demand for apples is perfectly elastic, it means that consumers have perfect substitutes for apples and will buy another product (and be no worse off) if the price goes up at all. Consequently, apple producers bear the entire burden of the tax. In contrast, if the demand for apples were not perfectly elastic, the price paid by consumers would rise and consequently the consumers would bear some of the tax burden. b. The quantity of apples will fall dramatically. If the demand for apples were neither perfectly elastic nor perfectly inelastic (and if supply were neither perfectly elastic or perfectly inelastic), then the quantity would fall but by less than it falls when the demand for apples is perfectly elastic. c. Only price changes caused by the tax affects the welfare of the consumers in the market. Since in this case the price paid by consumers does not change, consumers are made no better or worse off because of the tax, even though they consume fewer apples. The reason for this is that the perfectly elastic demand curve for apples implies that consumers are indifferent between consuming apples at that price and consuming other goods at that price. Consequently, although people shift consumption to another good, they are no better or worse off for it. (pts 6) 2- Empirical findings on labor supply a. What are the empirical findings on the elasticity of labor supply for primary income earners? b. What about the secondary income earners? Ans) a. The empirical studies show that the primary income earners are not very responsive to changes in their wages. For every 10% change in their after-tax wages, primary earners work about 1% fewer hours (the elasticity is 0.1). b. The studies show that the secondary earners are much more responsive to wages. The elasticity of labor supply for this group is between 0.5% and 1%. (pts 20) 3-When supply is infinitely elastic the relationship between commodity taxes and DWL can be written as the following: DWL = -0.5dQ 2 where d is the price elasticity of demand and is a specific tax. a. Using a graph discuss what the formula says about the relationship between rate and DWL b. What does the formula say about the relationship between inefficiency of taxes of certain characteristics of the commodity being taxed? c. What does the formula imply about the efficiency of progressive taxation? d. What does the formula imply about the broadness of commodity taxation? e. Is this recipe for optimal taxation consistent with the equity consideration of the society? Ans) a. The formula illustrates that DWL increase exponentially with tax rate. b. The magnitude of DWL is directly related to the demand elasticity of the commodity in question. The higher the elasticity the higher the DWL. c. The formula implies that progressive taxation is not efficiency. d. Since DWL increases exponentially with tax rate for given revenue target it is better to have low tax rates on many goods than very high taxes on a few. e. The formula implies that commodities with low demand elasticities should be taxed most. But some of these good might be necessity goods consumed by low income families. This is certainly inconsistent with equity considerations of the society. (pts 10) 4. Ramsy optimal taxation: a. State the formula and write what it says b. Suppose we have two goods F (food from grocery) and R (food from restaurant), suppose price elasticity of demand for F is 0.5 and that of R is 2. What is the optimal tax ratio of R to F? Ans) a. Here is the Ramsy rule for optimal taxation: MDWLi/MRi = , or ,/d The formula says that the government should set taxes across commodities so that the ratio of marginal DWL to marginal revenue raised is equal across commodities. , is the Lagrangian multiplier in the optimization problem. Here it can be interpreted as the value of additional government revenue, or marginal benefit of the revenue. MDWLi/MRi can be interpreted as the marginal cost of the revenue raised in terms of efficiency loss. b. Ramsy rule implies that R FF /R = 0.5/2 = 1/4 (pts 8) 5. Optimal Income Tax: MUi/MRi = a. What is the goal of optimal income tax analysis b. How that goal is met using the above formula for OIT? Use a graph to make you point. Ans) a. Here the goal is to maximize social well being (measured by a social welfare function) subject to a revenue target. This goal implicitly reconciles both efficiency and equity concerns of the society. b. The OIT rule implies different tax rates for different groups. The groups might differ in their income and the elasticity of their labor supply. This implies progressive taxation (for MU/MR to be equal across the rich and the poor tax rate on the rich must be higher). MUi MU/MR MUi Poor MUi Rich MUMU/MRpoor = MU/MRRich MU P R MUiTax Rate (pts 21) 6- Questions on the EITC program (a & b 6 pts each, c 9 pts) a. Describe the EITC program using a graph b. Theoretically speaking what kind of effects do we expect to see on the labor supply of the EITC recipients and why? c. What are the empirical findings: i. On the effect of the program on the labor supply of single mothers not in the labor force? ii. What about the people that are already in the labor force iii. What is the impact of the program on the labor supply of married women Ans) a. The Earned Income Tax Credit (EITC) is a federal income tax policy that subsidizes the wages of low-income earners. The EITC presents a 40% wage-subsidy, by offering a refundable tax credit, and when earnings are sufficiently high, the credit is reduced at a tax rate of 21%. b. The figure shows four distinct groups: - For those out of the labor force, located at point A, the EITC unambiguously increases labor force participation through the substitution effect. - For those at points like B, the subsidy creates ambiguous effects on hours of work. The substitution effect increase work, while the income effect decreases it. - For those at points like C, the subsidy decreases hours of work because of the income effect. There is no substitution effect. - For those at points like D, the phase-out region, the income and substitution effects both decrease labor supply. c. The conclusions from a number of quasi-experimental studies about the EITC show that: - Labor force participation increased for single mothers. - Conditional on work, the EITC does not seem to much affect hours of work. - Since the EITC is computed based on family income, married couples are likely to fall into the phaseout range. Eissa and Hoynes (1998) find a modest reduction in labor supply among married women in response to the EITC. (pts 8) 7- Inflation, Taxation and Savings a. What is the effect of inflation on the amount of tax collected by the government in the current U.S. tax system? b. What is the effect of inflation of individual savings? Ans) a. In the current U.S. tax system inflation leads to higher tax collected by the government. b. The effect on individual saving is negative (pts 12) 8- Tax-preferred retirement savings c. What are three ingredients of all tax-preferred retirement saving programs? d. What are their effects on personal savings? National savings? e. What is the effect of such programs on national welfare? Ans) a. All Tax-preferred retirement savings (1) avoid paying income tax on their contribution, (2) Earnings accumulate at the before-tax rate of return. (3) withdrawals are taxed as ordinary income (not capital) tax rate, (4) they all have the potential to withdraw the money when a person is in a lower tax bracket b. Empirically it is not clear what the effects of these programs on personal savings are but they certainly reduce public savings because of the subsidies. c. The programs increase national savings because it provides saving options to people with various saving incentives (retirement, self control and precautionary).