FINANCE1200CHAPTER6withANSWERS

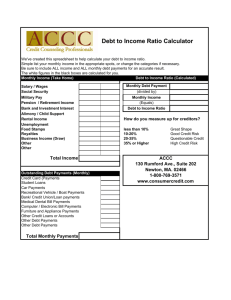

advertisement

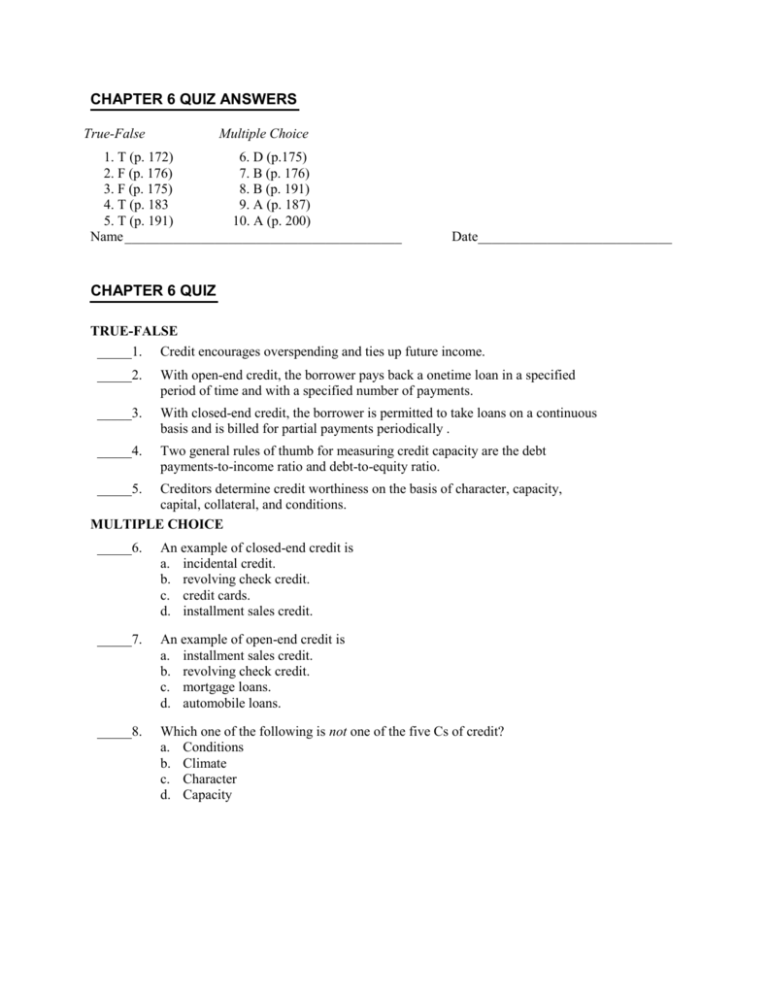

CHAPTER 6 QUIZ ANSWERS True-False Multiple Choice 1. T (p. 172) 6. D (p.175) 2. F (p. 176) 7. B (p. 176) 3. F (p. 175) 8. B (p. 191) 4. T (p. 183 9. A (p. 187) 5. T (p. 191) 10. A (p. 200) Name ________________________________________ Date____________________________ CHAPTER 6 QUIZ TRUE-FALSE _____1. Credit encourages overspending and ties up future income. _____2. With open-end credit, the borrower pays back a onetime loan in a specified period of time and with a specified number of payments. _____3. With closed-end credit, the borrower is permitted to take loans on a continuous basis and is billed for partial payments periodically . _____4. Two general rules of thumb for measuring credit capacity are the debt payments-to-income ratio and debt-to-equity ratio. _____5. Creditors determine credit worthiness on the basis of character, capacity, capital, collateral, and conditions. MULTIPLE CHOICE _____6. An example of closed-end credit is a. incidental credit. b. revolving check credit. c. credit cards. d. installment sales credit. _____7. An example of open-end credit is a. installment sales credit. b. revolving check credit. c. mortgage loans. d. automobile loans. _____8. Which one of the following is not one of the five Cs of credit? a. Conditions b. Climate c. Character d. Capacity _____9. Most of the information in your credit file may be reported for only __________ years. a. 7 b. 15 c. 20 d. 23 _____10. Which federal law provides specific cost disclosure requirements for the annual percentage rate and the finance charge as a dollar amount? a. Truth in Lending Act b. Fair Credit Reporting Act c. Fair Credit Billing Act d. Equal Credit Opportunity Act 11. A few years ago, Michael Tucker purchased a home for $100,000. Today, the home is worth $150,000. His remaining mortgage balance is $50,000. Assuming that Michael can borrow up to 80 percent of the market value, what is the maximum amount he can borrow? Present market value of Michael’s home = $150,000. Michael can borrow up to 80 percent of the market value, or $120,000. Michael still owes $50,000 mortgage on his home. Therefore, he can borrow a maximum of $70,000 ($120,000 - $50,000). 12. Calculating Debt Payments – to - Income Ratio. Suppose that your monthly net income is $2,400. Your monthly debt payments include your student loan payment, a gas credit card and they total $360. What is your debt payments – to – income ratio? Monthly net income = $2,400 Total monthly debt payments = $360 Debt-payments-to-income ratio = $360 ÷ $2,400 = 0.15 or 15%