true-false

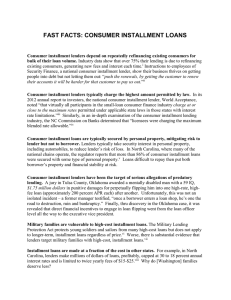

advertisement

Finance 1200 Spring 2016 Chapter 6 TRUE-FALSE _____1. Credit encourages overspending and ties up future income. _____2. With open-end credit, the borrower pays back a onetime loan in a specified period of time and with a specified number of payments. _____3. With closed-end credit, the borrower is permitted to take loans on a continuous basis and is billed for partial payments periodically . _____4. Two general rules of thumb for measuring credit capacity are the debt payments-to-income ratio and debt-to-equity ratio. _____5. Creditors determine credit worthiness on the basis of character, capacity, capital, collateral, and conditions. MULTIPLE CHOICE _____6. An example of closed-end credit is a. incidental credit. b. revolving check credit. c. credit cards. d. installment sales credit. _____7. An example of open-end credit is a. installment sales credit. b. credit cards. c. mortgage loans. d. automobile loans. _____8. Which one of the following is not one of the five Cs of credit? a. Conditions b. Climate c. Character d. Capacity Finance 1200 Spring 2016 Chapter 6 _____9. Most of the information in your credit file may be reported for only __________ years. a. 7 b. 15 c. 20 d. 23 _____10. Which federal law provides specific cost disclosure requirements for the annual percentage rate and the finance charge as a dollar amount? a. Truth in Lending Act b. Fair Credit Reporting Act c. Fair Credit Billing Act d. Equal Credit Opportunity Act