RGoodenLtalk

advertisement

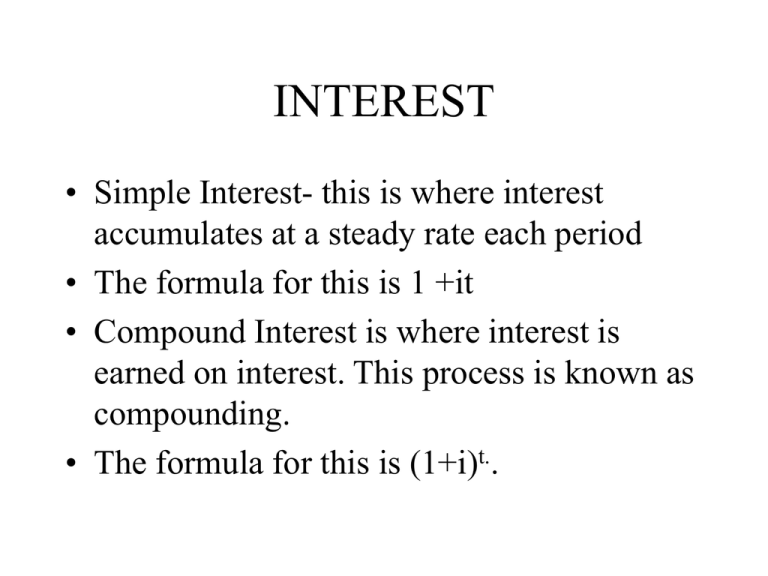

INTEREST • Simple Interest- this is where interest accumulates at a steady rate each period • The formula for this is 1 +it • Compound Interest is where interest is earned on interest. This process is known as compounding. • The formula for this is (1+i)t.. • Different components • Principal is the original amount that was invested. • i is the effective rate of interest per year. • t is the time period in which the principal was invested. • Accumulated Value is what your principal … • • • • has grown to, denoted A(t). Therefore …. Interest = Accumulated Value-Principal Compound Interest is the most important to remember due to the fact that it is used mostly in situations. It has exponential growth whereas simple interest has linear growth. • Example – Someone borrows $1000 from the bank on January 1, 1996 at a 15% simple interest. How much does he owe on January 17, 1996? • Solution – Exact simple interest would give you 1000[1+(.15)(16/365)]=1006.58. • However….. • Banker’s rule uses 360 days, which gives a different result. • Solution – 1000[1+(.15)(16/360)]=1006.67, which is slightly higher. • Canada uses exact simple interest. Example - Jessie borrows $1000 at 15% compound interest. How much does he owe after two years? • Solution = 1000(1.15)2=1322.50. • Assuming a 3% rate of inflation $1 now will be worth 1.033 or $1.09 in three years. • Example – How much was $1000 worth 4 years ago assuming a 3% inflation rate? • Solution – It is worth 1000(1.03)-4, which is equal to $888.49. • Nominal rate of interest is a rate that is convertible other than once per year. • i(m) is used to denote a nominal rate of interest convertible m times per year, which implies an effective rate of interest i(m) per mth a year, so the effective rate of interest is • i=[1+ (i(m)/m)]m-1. • Example – Find the accumulated value of $1000 after three years at a rate of interest of 24% per year convertible monthly. • Solution- i=[1+(.24/12)]36-1=.26824. • So the answer to the problem is 1000(1.26824)3=2039.88. • Also, this is just something to remember. • Suppose XXY credit card is offering 12% convertible monthly and Spragga Dap credit card is offering 12% convertible semiannually, which has the best deal. • Solution- XXY has an effective annual interest rate of [1+(.12/12)]12-1=.12683. • In the case of the Spragga Dap credit, the annual effective rate of interest is • i=[1+(.12/2)]2-1=.1236, which is lower than the XXY credit card. • So, the rule to remember is, given the same nominal rate, the effective annual rate of interest will be higher if it is compounded more. • Suppose we wanted to find a nominal rate of interest compounded continuously, which is the force of interest. • There is a formula for this: ln(1+i). • Example Suppose i was fixed at .12 and we wanted to find i(m), we would use the formula i=.12=[1+ (i(m)/m)]m-1 and solve for i(m). We will see that • • • • • i(2)=.1166 i(5)=.1146 i(10)=.1140 i(50)=.1135 …and if the nominal rate of interest is compounded continuously, then it would be • ln(1.12)=.11333. ANNUITIES • An annuity is a stream of payments. • The present value of a stream of payments of $1 is an. • The formula for an is: (1-vn)/i……where v=(1/1+i) • Suppose we were to take out a $50000 from the Spragga Dap bank. If the mortgage rate is 13% convertible semi-annually, what would the monthly payment be to pay off this mortgage in 20 years? • Solution: • First, we find i, which is (1.065)(1/6)-1, then we proceed to set up the problem. • 50000=X.a240 • An=[1-(1/1.01055)240]/.01055=87.1506 so… • X=50000/87.1506=573.72 • Here’s a tricky one! • Suppose Haskell Inc. supplies you with a loan of $5000 that is supposed to be paid back in 60 monthly installments. If i=.18 and the first payment is not due until the end of the 9th month, how much should each one of the 60 payments be? • Solution – first we convert i into a monthly rate, which is 1.18(1/12)-1. • Then we have to account for the fact that the $5000 earned interest in the 1st 8 months. The new amount is 5000(1.013888)8 which is 5583.29 so………. • 5583.29=X.a60 • a60=[1-(1/1.013888)60]/.013888=40.5299 • Finally, 5583.3/40.5299=137.76 • So we would need 60 payments of $137.76 to pay it off in 60 monthly installments. • Note: If we were supposed to take out a loan which was repaid starting immediately, we would use a “double-dot” which is an(1+i). BONDS • Investing in bonds is a good way to utilize your dollar. It is as simple as this. For a sum of money today, you will get interest annuity payments as well as another sum of money, known as redemption value, when the time period has elapsed. • There are a few key components to get familiar with when analyzing bonds. • F is the face value or par value of the bond. • r is the coupon rate per interest period. Normally, bonds are paid semi-annually. • C is the redemption value of the bond. The phrase “redeemable at par” describes when F=C. • i is the yield rate per interest period • n is the number of interest periods until the redemption date. • P is the purchase price of the bond to obtain the yield rate i. • The price of the bond can be obtained by solving this formula: • P=Fr.an+C(1+i)-n • Example – A bond of $500, redeemable at par in five years, pays interest at 13% per year convertible semi-annually. Find a price to yield an investor 8% effective per half a year. • • • • Solution: F=C=500, r=.065, i=.08, n=10. So the price of this bond is: 32.5a10+500(1.08)-10=449.67. Example: Spragga Dap Corporation decides to issue 15-year bonds, redeemable at par, with face amount of $1000 each. If interest payments are to be made at a rate of 10% convertible semi-annually, • And if the investor is happy with a yield of 8% convertible semi-annually, what should he pay for one of these bonds? • F=C=1000, n=30, r=.05 and i=.04 • so the price is 50.a30+1000(1.04)-30=1172.92