Slides

advertisement

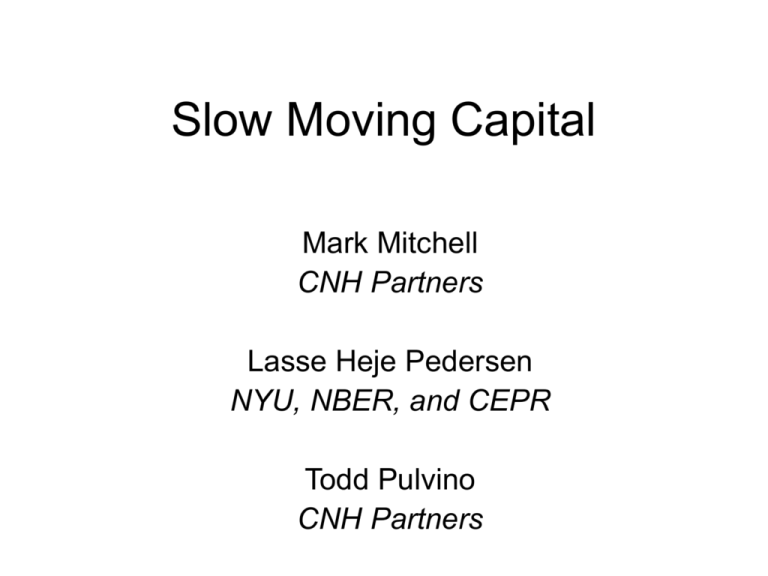

Slow Moving Capital Mark Mitchell CNH Partners Lasse Heje Pedersen NYU, NBER, and CEPR Todd Pulvino CNH Partners Motivation • Arbitrageurs normally provide liquidity by buying low and selling high • This requires capital • What happens if arbitrageurs loose capital? • Frictionless economy: – New capital arrives instantly, e.g. Lucas (1978) • Frictions matter: – Arbitrageurs depend on investors, Shleifer and Vishny (1997) – Margins may increase, Brunnermeier and Pedersen (2006) – Other traders lack infrastructure and information, Merton (1987) This Paper: Empirically Instigate the Effect of Capital Outflow from Arbitrageurs Strategy: Identify markets in which we can estimate • “Fundamental value” and market price • Capital flows to and from natural liquidity providers • Actions and realized returns of liquidity providers We Analyze Three Cases 1. Capital outflow due to redemptions: – Convertible bonds, 2005 2. Capital outflow due to exit of large trader caused by losses in other markets – Convertible bonds, 1998 3. Capital outflow due to losses – Merger arbitrage, 1987 Findings Large capital shocks can lead to: • • • • Natural liquidity providers become liquidity demanders New capital arrives only after months Prices drop -- and rebound slowly Realized returns initially negative, then turn positive Convertible Bonds • Convertible bond: – Corporate bond + call option (+ more) • Theoretical value can be inferred from – Issuer stock price – Stock price volatility – Option-implied volatility – Risk-free interest rates – Credit spreads Convertible Bond Arbitrage • Buy convertible bond if it trades at a discount • Short the issuers stock • Potentially: – Short risk-free bonds – Short non-convertible bonds (or buy CDS) – Short stock options Analysis 1: Convertible Bond Arbitrage Capital Outflows in 2005 • Natural liquidity providers: Convertible Bond Arbitrage Hedge Funds (HFs) • Capital outflows in 2005: – 2005Q1: 20% capital redeemed – 2005Q1 – 2006Q1: assets fell by half • Convert Arb HFs sold convertible bonds Convert Arb HF Assets Under Management ($B) Redemptions in 2005 70.0 60.0 50.0 40.0 30.0 20.0 10.0 0.0 2004-4 2005-1 2005-2 2005-3 2005-4 2006-1 2006-2 2006-3 Date Source: Barclay Group Adjusted Holdings of Convertible Bonds 45.0 40.0 35.0 30.0 Multi-strategy HFs 25.0 20.0 15.0 10.0 Convert Mutual Funds 5.0 Date 2006-3 2006-2 2006-1 2005-4 2005-3 2005-2 2005-1 2004-4 2004-3 2004-2 0.0 2004-1 Adj. Holdings of Convertible Bonds (Billion $) Convert Arb HFs Adjusted Holdings of Convertible Bonds Qtr Convert Arb HFs Multi-strategy HFs Convert Mutual Funds 2004-1 36.4 21.3 8.8 2004-2 38.1 18.8 8.9 2004-3 41.2 20.1 8.8 2004-4 40.4 19.8 8.9 2005-1 33.5 19.5 8.9 2005-2 32.5 25.2 8.5 2005-3 28.0 25.6 8.5 2005-4 26.3 26.9 8.1 2006-1 24.7 26.4 8.3 2006-2 22.6 25.9 8.4 2006-3 23.7 23.4 Convertible Bond Arbitrage Returns and Market Price / Theoretical Value 1.10 1.05 1.00 1.00 0.95 0.98 0.90 Market Price/Theoretical Value (left scale) 0.96 Date 0.85 Cumulative Return Cumulative Return (right scale) 200412 200501 200502 200503 200504 200505 200506 200507 200508 200509 200510 200511 200512 200601 200602 200603 200604 200605 200606 200607 200608 200609 Market Price / Theoretical Value 1.02 Interpretation • Prices drop and rebound • Price-to-fundamentals lowest around redemption notices (45 days before end of June and end of December) • Returns negative, then positive • Response by other traders: – Multi-strategy hedge funds – Mutual funds The Case of Amaranth • In 2005, Amaranth had – Losses in convertible bonds – Profits in energy trading – Overall profit and no capital problems • Decided to liquidate convertible bonds at time of significant cheapness • Collapsed in 2006 due to losses in energy Analysis 2: LTCM Blowup in 1998 - Implications for Convertible Bonds • Large hedge fund LTCM had losses due to Russian default, option positions, etc. • Had to liquidate large position in convertible bonds Convertible Bond Arbitrage Returns and Market Price / Theoretical Value 1.03 1.25 1.20 1.00 1.10 1.05 1.00 0.98 0.95 0.90 Market Price/Theoretical Value (left scale) 0.95 Date 0.85 0.80 Cumulative Return 1.15 199712 199801 199802 199803 199804 199805 199806 199807 199808 199809 199810 199811 199812 199901 199902 199903 199904 199905 199906 199907 199908 199909 199910 199911 199912 Market Price / Theoretical Value Cumulative Return (right scale) Analysis 3: Merger Arbitrage and the 1987 Crash • In a merger, “target” is bought at a premium. • At announcement, target increases in value, typ. 20-30% • But, there remains a “deal spread,” typically around 3% offer valu e – target price deal spread target price • Due to – Risk of deal failure – Selling pressure: Mutual funds sell after announcement • Merger arbitrageurs buy target – Stock deal: hedge by shorting acquirer – Cash deal: no hedge 30% 1.20 Median Deal Spread (left scale) 25% Cumulative Return (right scale) 15% 1.00 10% 0.90 5% 0.80 -10% 19871228 19871211 19871127 19871112 19871029 -5% 19871015 0% 0.70 0.60 Prop Desk Net Purchases (left scale) -15% 0.50 Date Cumulative Return 1.10 20% 19871001 Median Merger Arbitrage Deal Spread, and Net Purchases as % of Long Market Value Merger Arbitrage and the 1987 Crash Interpretation • Oct. 14-16: U.S. House Ways and Means Committee proposed legislation • Oct. 19 (Black Monday) and 20: crash • Oct: 21-31: – Stock market rebounds – Congress backs off proposed legislation – But, prop traders kept selling • Berkshire Hathaway Annual Report (Warren Buffett): “During 1988 we made unusually large profits from [risk] arbitrage … the trick, a la Peter Sellers in the movie, has simply been ‘Being There.’ ” Conclusion: The Speed of Arbitrage • Findings – – – – • Liquidity providers can become demanders New capital arrives slowly (new and old arbitrageurs) Prices drop and rebound Realized returns are initially negative and later turn positive and large Conclusions: – – – Frictions matter The process of arbitrage is far from instantaneous Effect could be due (in part) to reduced market liquidity