10. Decision Making and Reporting

advertisement

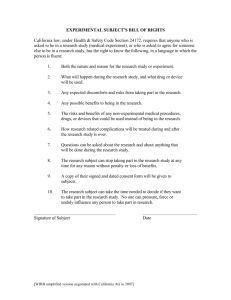

Item No. City of Westminster Decision-maker Date CABINET MEMBERS 14 FOR February Transport & 2003 Infrastructure and Street Environment CLASSIFICATION: FOR GENERAL RELEASE Title of Report Re-letting Strategy for the Highways and Transportation Contracts Report of Director of Planning & Transportation Director of Environment & Leisure Wards Involved Policy Context All Civic Renewal Aims : City Investment Customer First Financial Summary There are no financial implications arising directly from this report 1. Summary 1.1 The recommendations of the recent Best Value Review for Transportation Programme Delivery included a Re-let Strategy for the various contracts that are used to deliver Transportation Services in Westminster. Appendix 1 lists the current contractual arrangements. 1.2 The findings and recommendations of the Best Value Review have been considered and endorsed by the Overview and Scrutiny Committees for Transport & Infrastructure and City Management. The Contracts Review Board has also approved the Re-let Strategy, which was part of those recommendations. 1.3 The purpose of this report is to set out the programme for the Re-let process and to highlight for Cabinet the timing of key decisions. It discusses any risk associated with these decisions and how they will impact on service delivery. 2. RECOMMENDATIONS 2.1 It is recommended that the Cabinet Members: 2.1.1 Note and approve the re-let strategy and process; 2.1.2 Consider and agree a streamlined structure for managing the decision making process as suggested in Section 10. 1 2.2 The decisions identified in paragraph 2.1 aim to ensure that the timetable set for the re-let strategy can be adhered to and that a robust structured approach is agreed and adopted for the negotiation of the contracts. The first critical step is to issue the OJEC notice for the contract(s), preferably by mid February if the targets in the programme are to be met. 3. Background to the Re-let Strategy 3.1 The recommendation of the Best Value Review Project Board, following discussion with DCB and CRB, is that the re-let of the Transportation Consultancy and Work Contracts should: comprise up to four packages, possibly covering – Highways Maintenance, Street Lighting, Bridges and Structures, Highways and Traffic Projects. However, the tendering process would allow tenderers to bid for combinations of, or all, packages; use contract(s) structured as “operator” contract(s) – merging the consultant and contractor roles; incorporate Partnering Agreements and be based on the New Engineering Contract (NEC); be for a minimum of 5 or 10 years with the facility to roll on (subject to satisfactory performance and continuous improvement) to fifteen or more years; consider a negotiated tender route; and incorporate co-location of key elements of the client, consultant and contractor staff. 3.2 Subsequently, the re-let team (see Appendix 2) has developed this strategy into a plan for implementation. This has raised a number of issues that Members need to be aware of and there are a number of key decision points within the process where Members’ views will be needed. This report to Cabinet members is included in the Council’s Forward Plan of Key Decisions for January to April 2003 and is the first key decision point in the re-let process. 3.3 Appendix 3 sets out the programme for re-let and identifies the key decision points. These are addressed in turn in this report and the risks associated with each discussed. 3.4 Members will note from this report that the re-let strategy is for the award of the contract(s) to take place by the end of April 2004. The successful Contractors would then be expected to commence mobilisation over a lead-in period and to commence work at the beginning of October 2004. Members should note that all of the existing contracts are due to expire prior to October 2004 and accordingly, will need to be extended in order for the re-let strategy to be implemented and officers are in the process of seeking to arrange such extensions. The extensions are discussed in more detail in Section 9 below. 3.5 The options considered and the reasons for adopting the recommended approach have been dealt with in previous reports on the Best Value Review. 2 4. The Negotiated Procedure Legal Advice 4.1 In the report to CRB of 15th October 2002, officers had outlined the following issues as possible grounds for using the Negotiated Procedure: Under the existing contractual structure, the City Council has found it difficult to integrate financial and management information with the existing contracts and the co-ordination of works programmes is a significant problem. A key requirement for the future contracts is, therefore, integration of suppliers’ systems with those of the City Council; As explained earlier in this report, four contract packages are to be offered and the tendering process should allow tenderers to bid for combinations of, or all, packages. Whilst it is clear that this will have significant implications for the way in which the work will be delivered, it is impossible to specify these implications at the pre-tender stage; The City Council is seeking to work in partnership to provide management and procurement expertise to deliver the services. Whilst it may be possible to specify what work needs to be done under the contract, the way in which this may be done could vary considerably; Two separate departments will undertake management of the contract(s). Fundamental to the success of this will be the arrangements that are put in place for co-location. This is again impossible to specify at the pretender stage and will be a key consideration for the tender evaluation process; Following the Restricted Procedure in this particular exercise would very likely reduce the scope for innovation. This in turn is likely to limit the opportunities for cost reductions over the life of the contract(s). Other advantages of taking the negotiated route are that it will provide opportunities to re-engineer the service interface with the CSi better understand the balance between cost and quality in the tenders 4.2 Officers sought the advice of Sharpe Pritchard on whether the award of the contract(s) could be negotiated rather than procured through the Open or Restricted Procedures in these circumstances and on the risks associated with this approach. 4.3 Sharpe Pritchard has advised that, under Regulation 10(2)(c) of the EU Regulations (Works), exceptionally where the nature of the works are such as not to permit overall pricing, it may be permissible to use the Negotiated Procedure. They have also advised that the process needs to be robustly managed, even-handed and transparent. 4.4 Having taken account of Sharpe Pritchard’s advice (and following further consideration of the re-let strategy and the drafting of the service prospectus) officers are confident that there are sufficient grounds to justify the use of the 3 Negotiated Procedure. This is based on the inability of the City Council to predetermine arrangements for the management of the contracts, partnering, packaging (whether 1, 2, 3 or 4 lots) and co-located working, as well as difficulty in specifying how the services are to be co-ordinated and paid for. Officers consider the circumstances to be exceptional and that they do not permit prior overall pricing. Discussions with Sharpe Pritchard are continuing to ensure that, through the adoption of a robust negotiation process, the risk of challenge is minimised. However, Sharpe Pritchard have confirmed that the risk is low. Other issues 4.5 Apart from the risk that use of the negotiated procedure could be challenged, there is a further possible risk that in certain circumstances the negotiated route can lack focus. In this case it is proposed to minimise this risk by strict management of the process. As explained in the following sections of this report, a four-stage process is proposed that concentrates, initially, on reducing the number of potential bidders through a series of quality sieves. This process of reduction is subject to EU regulation and the selection of the ultimate bidders from the parties who originally express an interest will of course be conducted in accordance with those regulations. The third stage will include a decision on the number of packages to be tendered, prior to the final negotiation stage. 4.6 This tightly controlled process will mean that the specification for the services will evolve through the negotiations, with changes only being made at defined points and being carefully documented. The final specification for the future services will emerge before the submission of Best and Final Offers (BAFO) from tenderers. 4.7 A summary of the pros and cons around the negotiated and restricted routes is shown in Appendix 4. 5. 5.1 Select Long List (by Spring 2003) Companies that respond to the OJEC Notice will be sent a Prospectus that describes the Council’s approach to the re-let. They will be asked to complete a Pre Qualification Questionnaire. This will include the usual range of questions relating to: Financial strength and capacity Quality procedures and processes Environmental policies and procedures Health and Safety policies and procedures Equal opportunity policies and procedures Technical competence and strength Information Technology competence and strength These questions will be used as “hurdles” to identify companies that meet the Council’s minimum requirements for the packages applied for. 5.2 A further filter will be applied at this stage through a question on the companies’ general approach to partnering and the management of the services. The responses to this question will be used to limit the number of 4 companies included on the long list to a maximum of 5 per package. Interested parties will also be asked to give their views on the pros and cons of amalgamating some or all of the four service packages. This will be used to help inform the Council’s ultimate decision on this issue and will not form any part of the evaluation procedure. 5.3 There are no significant risks associated with this decision. However, there are possible implications for maintaining existing services if any of the main contractors or consultants is not amongst those chosen for the long list. This is a problem that will impact on each decision stage. 6. 6.1 Select Short List (by Early Summer 2003) Stage 2 of the evaluation process will reduce the long list to the short list of companies that will be invited to negotiate for the four packages. Evaluation of the competing bids would again at this stage be based on quality and may include an element of pricing by asking for “cost-plus” information. This could request information on the level of overhead that would be applied to basic labour, plant and material costs. A breakdown of these overhead costs would allow identification of Corporate Overheads, IT expenditure, staff training investment, property costs, etc. This could also provide an early opportunity to gauge the financial case for the number of packages. 6.2 The quality submissions required will focus on the companies’ managerial culture and competence and will be structured around seven elements of the Business Excellence Model: Leadership People Management Partnership and Resources Processes Customer Satisfaction Staff Satisfaction Impact on Society 6.3 The first four of these are identified as enablers and are the “things a company does” to achieve success. The last three are results and relate to how the company measures its success. For the enablers, companies will be asked to describe their approach to leadership, people management, etc. and then to describe how they would apply (or deploy) this approach to the delivery of the City Council’s services. 6.4 For the results, companies will be asked to explain how they measure their own performance and to indicate how well that performance compares with other companies or national averages. 6.5 The scores for the seven criteria will be weighted to arrive at an overall quality score. On the basis of these scores, possibly in conjunction with weighted price score, the long lists will be reduced to a maximum of 3 per package. 6.6 Again the only significant risk is that associated with the exclusion at this stage of existing contractors or consultants. 5 7. Agree Preferred Bidders and Packaging (by Late Summer 2003) 7.1 The third stage evaluation will reduce the short lists to preferred bidders (a maximum of two per package). However, it will also be the stage at which the City Council will finalise the packaging of the services – whether four, three, two or one. 7.2 For this stage, the evaluation will focus on price and the companies’ ideas for developing partnering and innovation. These factors will be key to the assessment of the packaging options and will be used to develop the specification(s) for the final packaging of the services. 7.3 In advance of this decision the Council will need to have clarified its approach to pricing and payment. A key philosophy of the re-let strategy is that the Council should use the NEC form of contract and enter into a Partnering Agreement with the Contractor(s). A key objective of Partnering is the commitment of all partners to Continuous Improvement. This approach is also enshrined in Rethinking Construction that argues that driving down costs and achieving value for money is not achieved through low tender prices. 7.4 The Construction Task Force, which produced the Rethinking Construction Report, was set up to advise on, from the client’s perspective: the opportunity to improve the efficiency and quality of delivery of UK construction; to reinforce the impetus for change; and make the industry more responsive to customer needs. It concluded that the Construction Industry needed to modernise to tackle the severe problems facing it: Low, unreliable rate of profitability. Poor rate of investment in R&D and capital. A crisis in training. Too many clients equating price with cost and selecting designers and constructors almost exclusively on tendered price. This latter point was widely seen as one of the greatest barriers to improvement, with the public sector as the biggest culprit. 7.5 Pricing Strategy - What is clear from our industry consultation and comparison visits is that there are a wide variety of pricing approaches being adopted under Partnering Agreements and the Rethinking Construction Initiative. In developing a Pricing Strategy, a balance needs to be struck between ensuring that the contractor(s) receive a fair reward for their efforts and are continually achieving improvements against cost and quality targets. Thereby ensuring that the Council realises whole life, value for money. 7.6 Traditional pricing methods have used schedules of rates; percentage fees and lump sums, all of which transfer a degree of risk to the contractor. It is a moot point, given the nature of the work covered by these contracts, whether the council should seek to transfer risk to its suppliers. It may be that attempting to transfer risk will just lead to that risk being priced into bids (particularly by suppliers who do not currently work with the City Council). It 6 may be that adopting a cost plus approach, allied to the use of target costs and performance indicators, may be an appropriate way forward. As well as being in tune with the principles of Partnering it could simplify the pricing and the evaluation process. The negotiated process will provide the opportunity for the Council to explore these alternatives. 7.7 The approach suggested will allow a cost comparison to be made between the different packaging options. What will be less simple will be to compare existing costs with possible future cost. In any event, the market conditions have changed significantly since these contracts were last let. With a significant increase in transportation related expenditure, staff resources are a significant problem. This is likely to be reflected in the prices the council will receive. 7.8 There may be a perceived risk of delaying a decision on packaging to this stage of the evaluation process, but it provides a clear opportunity to assess the price implications of different packaging before committing to one particular strategy. 8. Select Contractors (by Spring 2004) 8.1 A final round of negotiation will be used to develop the partnering approach and, through a series of workshops, assess the cultural compatibility of the preferred bidders with the client. It will also be used to develop the final specification against which Best and Final Offers will be made. Evaluation of these BAFOs will be against a mix of price and an assessment of cultural compatibility gained from the workshop sessions. 9. Extension of the Current Contracts 9.1 A consequence of the relet strategy is that it will be necessary to extend some of the existing contracts for periods of between 6 and 18 months so that a single termination date is created (30 Sept 2004). The reasons for this are: The consultancy and works contracts need to be co-terminus in order to permit the proposed packaging. To allow time for any protracted negotiations as part of the relet process. All current contracts except 4 are extendable under the terms and conditions of the existing contracts. Where no provisions exist, officers will negotiate the necessary extensions, in line with the legal requirements. 9.2 On 19th November, CRB approved the strategy to extend the various contracts as required, and in doing so carefully considered the current performance of each contractor. It was agreed that with the exception of the Highways Maintenance Management Contract (Babtie ) and the E6 Maintenance of Street Lighting contracts (D Websters), performance on all contracts had been acceptable and in accordance with the requirement of individual specifications. Since submission of a report to CRB in July 2002 on the problems around the Babtie contract, considerable progress has been made in delivering an action 7 plan of improvements and building sound relationships for the remainder of the contract. Progress has been most marked around financial management. There are still however significant weaknesses to be resolved and progress will be monitored by CRB quarterly. An earlier report to CRB outlined the detailed problems with the Webster contract together with an improvement plan. It was noted that the contractor had responded positively and delivered improvements around for example planned scouting, repair response times and the introduction of better qualified staff to work on the contract. Effort to resolve longer-term issues will continue and progress will be monitored quarterly through CRB. 9.3 The risks to the Council of continuing with the 2 weaker contractors as opposed to retendering for the short term or alternatively bringing the services back in house have been considered as follows: To retender any or all of the contracts for such a short period would risk attracting a significant premium and value for money would be jeopardised. The existing contracts are considered to offer competitive prices. To continue with the weaker contracts will mean that the Council could face further difficulties during the 18 months. However to put this in perspective it should be noted that these contractors are not weak in all areas, and risk is being managed by focus on the action plans. To bring the weaker services (or all service back in house) would require a major input of resources at a time when these are needed for the relet of the new contract packages. To take on a further major contracting activity would jeopardise the award of the new contracts and impact on day to day delivery of services. Notwithstanding that an element of the workforce would transfer under TUPE, there would be considerable uncertainty as to the labour force on day 1 of the new arrangements. The Council would not be able to undertake the works contract without access to Depots and capital equipment. On balance based on the acceptable performance of most contractors and consultants, and the action plans in place to improve and monitor progress on the two weaker contracts, it is considered that extension of the contracts as agreed by CRB represents a low risk to the Council. However the views of Cabinet Members are sought. 10. Decision Making and Reporting 10.1 Given the cross-departmental and cross cabinet portfolio nature of these contracts, it is essential that streamlined decision making and reporting systems are put in place. A cross-departmental Project Board (Appendix 1) has been established that includes both Directors. Your views on putting in place a similar arrangement at Cabinet member level are requested. In addition, in parallel with this report a similar report was considered by the two 8 Overview and Scrutiny Committees (Transport & Infrastructure Feb 5 th and City Management Feb 10th). The Committees agreed to set up a joint working group to provide a scrutiny role for the re-let programme. 10.2 Appendix 3 also indicates the decision-making responsibilities and the briefing/reporting points during the re-let programme. The early qualitative sieving process would be carried out by the Project Team and approved by the Project Board. The final decision on packaging, preferred bidders and the future contractors would be taken jointly by the Cabinet Members for Transport & Infrastructure, Street Environment and Finance following observations from the Overview and Scrutiny Working Group. 10.3 Cabinet Members and the joint Overview and Scrutiny Working Group would be briefed on progress, not only of long listing and short listing, but also of the development of the pricing strategy and employer’s requirements (specifications). 11. Financial Implications 11.1 There are no immediate financial implications arising from the re-let strategy however the new contracts will raise a number of financial issues, in particular IT and systems development Legal and other support service re-let costs Contract costs could increase due to rising market rates. There could however be efficiencies from reducing the number of suppliers and in the longer term through continuous improvement. Client reorganisation will be required but the costs of the new organisation will be determined by the final decision on the number of contracts to be awarded. 12. Legal Implications 12.1 The legal implications of the re-let centre on the use of the negotiated procedure, as discussed in section 5 above. 13. Staffing Implications 13.1 There are no staffing implications arising from the review in the short term, however the role and structure of the new clienting arrangement following the re-letting of the contracts will need to be reviewed and put in place before the start date of April 2004. Staff consultation will be carried out in accordance with agreed procedures nearer that time and as part of the planned change management process. 14. Performance Plan Implications 14.1 The re-let strategy supports the delivery of City Investment and Customer First programmes under Civic Renewal. 9 15. Consultation 15.1 There has been no formal consultation on this report although the re-let strategy was the subject of extensive consultation during the Best Value Review. A similar version of this report is on the agendas for the City Management and the Transport and Infrastructure Overview and Scrutiny Panels on 30 January 2003 and 5th February 2003 respectively. 16. Crime and Disorder Act 16.1 There are no direct implications for Crime and Disorder arising from this report. 17. Co-operation with Health Authorities 17.1 The re-let strategy has no implications for Sections 26 and 27 of the Health Act 1999. 18. Human Rights Act 1998 18.1 There are no implications for the re-let strategy in connection with the Human Rights Act 1998. 19. Conclusion 19.1 As part of the recent Best Value Review, a re-let strategy for the Council’s Transportation Contracts has been developed. Options for the way in which these contracts should be structured and the form of contract to be used was the subject of a robust option testing and risk assessment process and has previously been reported on. The recommendation relating to the use of the negotiated procedure has been arrived at following discussion with the Council’s Legal Advisers and the Contract Review Board. The alternative is to adopt the Restricted Procedure. This is not recommended because it would restrict the opportunity for the Council to give detailed consideration to the pros and cons of a range of contract packages, innovative management approaches and alternative payment methods to ensure that the contract(s) build in mechanisms for continuous improvement. IF YOU HAVE ANY QUERIES ABOUT THIS REPORT OR WISH TO INSPECT ANY OF THE BACKGROUND PAPERS, PLEASE CONTACT Derek Barnden on 020 7641 2694, email dbarnden@westminster.gov.uk Fax 020 7641 2658 Or Martin Low on 020 7641 1975, email mlow@westminster.gov.uk Fax 020 7641 2658 BACKGROUND PAPERS The documents used or referred to in compiling the report were: - 10 Report on Re-let Strategy for Transportation Services Contracts to Contracts Review Board. (15th October 2002) T&I O&S Committee and City Management O&S Committee Reports – Best Value Review of Transportation Programme Delivery: Report on Outcomes of Review and the Continuous Improvement Plan (16 th October 2002 and 26th November 2002) Report to Contracts Review Board 19th November 2002 – Reletting for Transportation Programmes – Supplementary Report on Contract Extensions and Performance Issues ……………………………………………………………………………… 11 For completion by Cabinet Member Declaration of Interest I have no interest to declare in respect of this report Signed ……………………………. Date ……………………………… NAME: I have to declare an interest State nature of interest ……..…………………………………………… ……………………………………………………………………………….. Signed ……………………………. Date ………………………………… NAME: (N.B: If you have an interest you should seek advice as to whether it is appropriate to make a decision in relation to this matter.) For the reasons set out above, I agree the recommendation(s) in the report entitled Re-letting Strategy for the Highways and Transportation Contracts and reject any alternative options which are referred to but not recommended. Signed ……………………………………………… Cabinet Member for ………………………………. Date ………………………………………………… If you have any additional comment which you would want actioned in connection with your decision you should discuss this with the report author and then set out your comment below before the report and this pro-forma is returned to the Secretariat for processing. Additional comment: ………………………………………………………………… …………………………………………………………………………………………. …………………………………………………………………………………………. 12 NOTE: If you do not wish to approve the recommendations, or wish to make an alternative decision, it is important that you consult the report author, the Director of Legal and Administrative Services, the Chief Financial Officer and, if there are staffing implications, the Head of Personnel (or their representatives) so that (1) you can be made aware of any further relevant considerations that you should take into account before making the decision and (2) your reasons for the decision can be properly identified and recorded, as required by law. Note to Cabinet Member: Your decision will now be published and copied to the Members of the relevant Overview & Scrutiny Committee. If the decision falls within the criteria for call-in, it will not be implemented until five working days have elapsed from publication to allow the Overview and Scrutiny Committee to decide whether it wishes to call the matter in. 13 Appendix 1 The City Council’s current service is delivered through a number of consultants and contractors: The Highways Maintenance Management Service is provided by Babtie Consultants who presently manage the Highways Maintenance E term contracts (all those except E5); Hyder consultants inspect and manage the maintenance of bridges and structures through contractors FM Conway Ltd; Parkman and ten other consultants are retained as members of a Consultancy Panel for the design and supervision of the implementation of traffic and highways schemes through contractors Murphy and Carillion. Contract Name Highways Maintenance Contracts Highways Maintenance and Management Services E1 Carriageway and Footway works E2 Footways works (masons) E3 Drainage Investigation E4 Anti Skid Surfaces E6 Street Lighting Maintenance and Improvements E7 Minor Highways Work E8 Maintenance of Street Furniture E15 Painted and Thermoplastic Roadmarkings Bridge Management S1 Inspection and maintenance management of bridges E5 Maintenance of Highways Bridges and Structures Project Development and Implementation Term consultant and panel consultants P1 Highways & Environmental Improvements Contractor/Consultant Babtie Group Ringway Ltd J Murphy Ringway Ltd Colas Ltd David Webster J Murphy LP Painters Ltd Jointline Hyder Consulting Ltd FM Conway Ltd Parkman 10 panel consultants J Murphy Carillion Construction Ltd 14 Appendix 2 – Transportation Services Contract Re-let Project Board and Project Team Membership Project Board Carl Powell Joe Duckworth Derek Barnden Martin Low Kevin Goad Andrew Nisbet Project Team Derek Barnden Martin Low Kevin Goad Andrew Nisbet David Yeoell Dave Axon John Roberts Nigel Parry Lisa Lawrenson Director of Planning and Transportation Director of Environment and Leisure Director of Technical Services Head of Traffic and Transportation Business Support Manager Consultant Director of Technical Services Head of Traffic and Transportation Business Support Manager Consultant Head of Engineering and Implementation Interim Head of Scheme Development Head of Highways Street Lighting Manager Performance Review Manager 15 SWOT ANALYSIS of Negotiated v Restricted Routes Strengths NEGOTIATED Weaknesses Open book approach minimising risk of disputes and claims. Encourages co-operation + innovation and continuous improvement. Can tailor working practices and management to best advantage of client and contractor. Can mix + match bidders best ideas. Can incentivise both quality and cost improvements. Achieve a better understanding of the balance between cost and quality across tenders Can re-engineer the service interface with the CSi Opportunities Strengths Possibility of marginally higher initial cost but with longer term cost benefits. Output – based payment needs effective budget management. Legal challenge ( this will be controlled by the strict management of the process whereby changes to the specification can only be made at defined points. Threats RESTRICTED Weaknesses Straightforward pricing against fixed specification. Proven long established methodology. Certainty of outcome. Relatively less volatile budget/spend profile. Opportunities Appendix 4 Difficult to change management or client arrangements even if there are clear benefits. Pricing based on fixed risk apportionment, which will probably result in higher costs. Cost savings + innovation likely to benefit contractor not client. Difficult to tailor client arrangements to final packaging of works. Risk of abortive work + delays if transfer to Negotiated or later stage. Pricing errors leading to claims and legal costs. Threats 16