Chapter 6: Feb. 5

advertisement

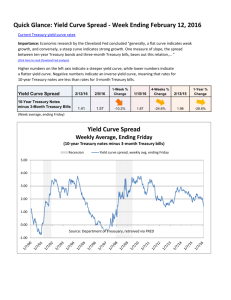

CHAPTER 6 Interest Rates Determinants of interest rates The term structure and yield curves Investing overseas 6-1 Why are these rates different? 3-month Treasury Bill 5-year Treasury Note 5-year A Corporate Bond 10-year Treasury bond 10-year A Corporate Bond 30-year Treasury bond 5.15% 4.71% 5.33% 4.83% 5.78% 4.92% 6-2 What four factors affect the level of interest rates? Production opportunities Time preferences for consumption Risk Expected inflation 6-3 “Nominal” vs. “Real” rates r = represents any nominal rate r* = represents the “real” risk-free rate of interest. Like a T-bill rate, if there was no inflation. Typically ranges from 1% to 4% per year. rRF = represents the rate of interest on Treasury securities. 6-4 Determinants of interest rates r = r* + IP + DRP + LP + MRP r = r* = IP = DRP LP = MRP required return on a debt security real risk-free rate of interest inflation premium = default risk premium liquidity premium = maturity risk premium 6-5 Premiums added to r* for different types of debt IP S-T Treasury L-T Treasury S-T Corporate L-T Corporate MR P DR P LP 6-6 Yield curve and the term structure of interest rates Term structure – relationship between interest rates (or yields) and maturities. The yield curve is a graph of the term structure. The November 2005 Treasury yield curve is shown at the right. Yield (%) 6 5 4 3 2 1 0 0.25 0.5 2 5 10 30 Maturity (years) 6-7 Recent Yield Curve (T-sec’s) 6-8 Hypothetical yield curve Interest Rate (%) 15 Maturity risk premium 10 Inflation premium 5 Real risk-free rate 0 1 10 An upward sloping yield curve. Upward slope due to an increase in expected inflation and increasing maturity risk premium. Years to 20 Maturity 6-9 Treasury yield curves vs. corporate bond yield curves Corporate yield curves are higher than that of Treasury securities, though not necessarily parallel to the Treasury curve. The spread between corporate and Treasury yield curves widens as the corporate bond rating decreases. 6-10 Illustrating the relationship between corporate and Treasury yield curves Interest Rate (%) 15 BB-Rated 10 AAA-Rated 5 Treasury 6.0% Yield Curve 5.9% 5.2% Years to 0 Maturity 0 1 5 10 15 20 6-11 Pure Expectations Hypothesis The PEH contends that the shape of the yield curve depends on investor’s expectations about future interest rates. If interest rates are expected to increase, L-T rates will be higher than S-T rates, and vice-versa. Thus, the yield curve can slope up, down, or even bow. 6-12 Assumptions of the PEH Assumes that the maturity risk premium for Treasury securities is zero. Long-term rates are an average of current and future short-term rates. If PEH is correct, you can use the yield curve to “back out” expected future interest rates. 6-13 An example: Observed Treasury rates and the PEH Maturity 1 year 2 years 3 years 4 years 5 years Yield 6.0% 6.2% 6.4% 6.5% 6.5% If PEH holds, what does the market expect will be the interest rate on one-year securities, one year from now? Three-year securities, two years from now? 6-14 One-year forward rate 6.0% 0 x% 1 2 6.2% (1.062)2 1.12784/1.060 6.4004% = (1.060) (1+x) = (1+x) =x PEH says that one-year securities will yield 6.4004%, one year from now. Notice, if an arithmetic average is used, the answer is still very close. Solve: 6.2% = (6.0% + x)/2, and the result will be 6.4%. 6-15 Three-year security, two years from now 6.2% 0 1 x% 2 3 4 5 6.5% (1.065)5 = (1.062)2 (1+x)3 1.37009/1.12784 = (1+x)3 6.7005% = x PEH says that three-year securities will yield 6.7005%, two years from now. 6-16 Conclusions about PEH Some would argue that the MRP ≠ 0, and hence the PEH is incorrect. Most evidence supports the general view that lenders prefer S-T securities, and view L-T securities as riskier. Thus, investors demand a premium to persuade them to hold L-T securities (i.e., MRP > 0). 6-17 Other factors that influence interest rate levels Federal reserve policy Federal budget surplus or deficit Level of business activity International factors 6-18 Risks associated with investing overseas Exchange rate risk – If an investment is denominated in a currency other than U.S. dollars, the investment’s value will depend on what happens to exchange rates. Country risk – Arises from investing or doing business in a particular country and depends on the country’s economic, political, and social environment. 6-19 Country risk rankings Top 5 countries (least risk) Ran Country k Score 1 Switzerland 95.2 2 Luxembourg 93.9 3 United States 93.7 4 Norway 93.7 5 United Kingdom 93.6 Bottom 5 countries (most risk) Ran Country k Score 169 Afghanistan 11.0 170 Liberia 9.4 171 Sierra Leone 9.3 172 North Korea 8.9 173 Somalia 8.2 Source: “Country Ratings by Region,” Institutional Investor, www.institutionalinvestor.com, September 2004. 6-20