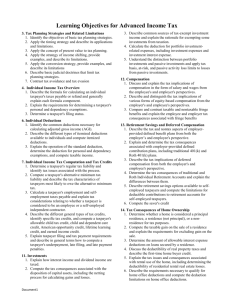

Income Taxation Outline Spring 2001

advertisement