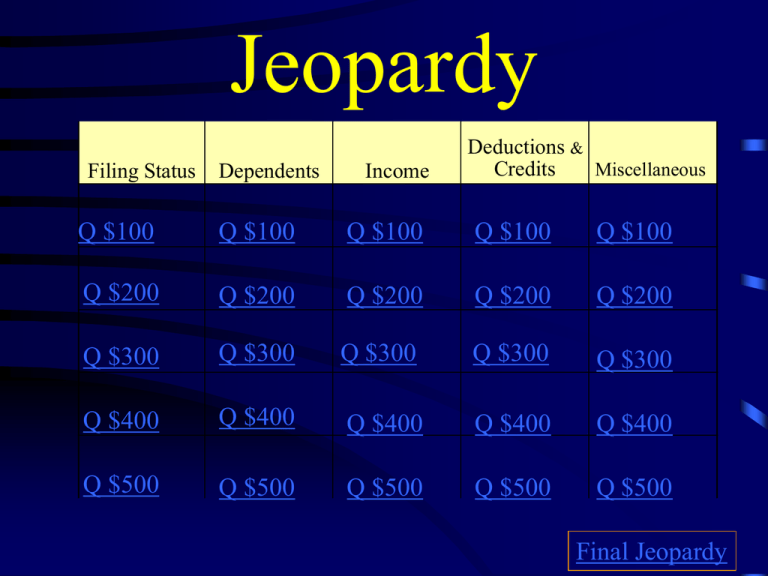

Jeopardy - Earn It! Keep It! Save It!

advertisement

Jeopardy Filing Status Dependents Income Deductions & Credits Miscellaneous Q $100 Q $100 Q $100 Q $100 Q $100 Q $200 Q $200 Q $200 Q $200 Q $200 Q $300 Q $300 Q $300 Q $300 Q $300 Q $400 Q $400 Q $400 Q $400 Q $400 Q $500 Q $500 Q $500 Q $500 Q $500 Final Jeopardy $100 Question from H1 There are this many different filing statuses $100 Answer from H1 What is: 5 $200 Question from H1 This Filing Status is out of scope for VITA $200 Answer from H1 What is: Married Filing Separately $300 Question from H1 A qualifying person for Head of Household must be related to the Taxpayer in one of these two ways $300 Answer from H1 What is: Blood or Marriage $400 Question from H1 List the filing statuses from most beneficial to least beneficial $400 Answer from H1 •Married Filing Joint •Qualifying Widow w/Dependent Child •Head of Household •Single •Married Filing Separately $500 Question from H1 Name one tax calculation affected by Filing Status $500 Answer from H1 •Calculation of income tax •Standard deduction •Eligibility for certain credits/deductions $100 Question from H2 If a dependent is not a US citizen or resident, they must live in one of these two foreign countries $100 Answer from H2 What is: Mexico or Canada $200 Question from H2 Name the two types of dependents $200 Answer from H2 •Qualifying Child •Qualifying Relative $300 Question from H2 This relative is not included in the list of relatives who may be claimed as a dependent even if they don’t live with the taxpayer $300 Answer from H2 What is: Cousins $400 Question from H2 The difference in residency requirements between the two types of Dependents $400 Answer from H2 •Qualifying child must live with TP for more than half the year •Qualifying relative must live with TP all year as member of household (if not covered under “relatives who do not have to live with you” 4012 Table 2 pg C-5) $500 Question from H2 Name one tax benefit that is linked to the dependency exemption $500 Answer from H2 •Head of Household •Child Tax Credit •Earned Income Tax Credit •Child and Dependent Care Credit $100 Question from H3 This type of taxable income is reported on a W-2 $100 Answer from H3 What is: Wages $200 Question from H3 If this is a taxpayer’s only income, it is not taxable $200 Answer from H3 •Social Security benefits •Public Assistance (TANF, welfare) •Veteran’s Benefits •Other- see 4012 Table B pg D-1 $300 Question from H3 Gambling winnings are reported as this type of income, on this line of the 1040 $300 Answer from H3 What is: Other Income, line 21 $400 Question from H3 This “cheat sheet” in the 4012 can help a preparer figure out where to input income on TaxWise $400 Answer from H3 What is: Pub. 4012, Yellow Tab 2, page 2-1 $500 Question from H3 Taxpayers who are paid in cash or receive Form 1099-MISC for nonemployee compensation are usually required to file this tax schedule $500 Answer from H3 What is: Schedule C/EZ, Net Profit from Business $100 Question from H4 For most people, the standard deduction is based on this $100 Answer from H4 What is: Filing Status Age and/or Blindness may increase Standard Deduction Amount $200 Question from H4 This credit is automatic for a dependent child under 17 who lived with the taxpayer more than half the year $200 Answer from H4 What is: Child Tax Credit $300 Question from H4 This is the best clue that a taxpayer may benefit from itemizing their deductions $300 Answer from H4 Taxpayer owns a home and paid mortgage interest $400 Question from H4 To claim the EITC, taxpayers and all qualifying children must have one of these $400 Answer from H4 What is: Valid Social Security Numbers $500 Question from H4 Explain the difference between a tax deduction and a tax credit $500 Answer from H4 •Deductions decrease taxpayer’s AGI and reduce amount of income that is taxed •Credits decrease the amount of tax that is paid and can be refundable $100 Question from H5 Main reference materials used by VITA tax preparers to determine and apply the tax law correctly $100 Answer from H5 • Pub. 4012, Volunteer Resource Guide • Pub. 17, Tax Guide for Individuals $200 Question from H5 This form must be completed by the taxpayer and reviewed by the VITA tax preparer for each tax return prepared at the site $200 Answer from H5 What is: Form 13614-C, Intake and Interview Sheet $300 Question from H5 After starting a new return in TaxWise, this is the first input screen $300 Answer from H5 What is: The Main Information sheet $400 Question from H5 A taxpayer must provide this information in order to receive their refund through Direct Deposit $400 Answer from H5 •Routing Transit Number •Bank Account Number Suggested that Taxpayer bring actual check with them to ensure correct Routing and Account numbers $500 Question from H5 VITA volunteers who help Quality Review returns must be certified to this Tax Law certification level $500 Answer from H5 What is: Intermediate Final Jeopardy According to a quote by Supreme Court Justice Oliver Wendell Holmes Jr., “taxes are what we pay for…” what? Final Jeopardy Answer “Civilized society”