Saving Ratio and gross disposable income brief

advertisement

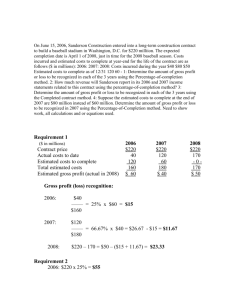

Office for National Statistics Household saving ratio and gross disposable income 2012 Quarter Four The household saving ratio (seasonally adjusted) in 2012 Q4 was 6.7 %, compared with 7.9% in 2012 Q3. This fall is because of higher growth in household final consumption than in household resources. Household total resources fell by -0.1%, whilst final consumption increased by 1.2 %. Table 1: Households and non-profit institutions serving households (seasonally adjusted) £ billion Period on period growth (per cent) Disposable Total Final Gross Disposable Total Final Gross income resources consumption saving income resources consumption saving 2007 2008 2009 2010 2011 2012 Saving ratio (%) 872.4 904.6 933.6 972.5 1007.3 1055.8 911.3 932.4 960.1 1007.7 1044.1 1091.5 896.1 911.8 896.3 941.5 975.9 1013.6 15.2 20.6 63.8 66.2 68.2 77.9 3.3 3.7 3.2 4.2 3.6 4.8 4.3 2.3 3.0 5.0 3.6 4.5 5.4 1.8 -1.7 5.0 3.7 3.9 -34.4 35.5 209.8 3.6 3.1 14.3 1.7 2.2 6.6 6.6 6.5 7.1 2009 Q1 2009 Q2 2009 Q3 2009 Q4 226.1 234.4 235.3 237.8 230.8 240.8 242.9 245.6 223.7 221.2 223.6 227.8 7.1 19.6 19.3 17.8 -1.7 3.7 0.4 1.1 -2.1 4.4 0.9 1.1 -0.8 -1.1 1.1 1.9 -30.5 177.2 -1.5 -7.9 3.1 8.2 8.0 7.2 2010 Q1 2010 Q2 2010 Q3 2010 Q4 239.3 241.8 245.6 245.8 247.3 250.0 254.9 255.4 230.1 235.3 236.6 239.5 17.2 14.7 18.3 15.9 0.7 1.0 1.6 0.1 0.7 1.1 1.9 0.2 1.0 2.3 0.5 1.2 -3.5 -14.3 24.4 -13.0 6.9 5.9 7.2 6.2 2011 Q1 2011 Q2 2011 Q3 2011 Q4 247.3 251.0 253.1 256.0 255.5 260.4 261.5 266.7 242.1 242.6 244.2 246.9 13.4 17.7 17.3 19.8 0.6 1.5 0.9 1.1 0.0 1.9 0.4 2.0 1.1 0.2 0.6 1.1 -16.1 32.4 -2.2 14.0 5.2 6.8 6.6 7.4 2012 Q1 2012 Q2 2012 Q3 2012 Q4 255.2 264.9 266.9 268.8 266.5 272.9 276.2 276.0 249.2 252.5 254.5 257.4 17.3 20.4 21.7 18.5 -0.3 3.8 0.7 0.7 -0.1 2.4 1.2 -0.1 0.9 1.3 0.8 1.2 -12.4 17.7 6.6 -14.8 6.5 7.5 7.9 6.7 Household gross disposable income rose by £1.9 billion (0.7 %) to £268.8 billion in 2012 Q4. Gross disposable income (quarter on quarter growth) % 5 4 3 In 2012, gross disposable income was £1,055.8 billion, an increase of £48.5 billion (4.8 %) compared with 2011. 2 1 0 -1 -2 -3 2002 Q1 2002 Q3 2003 Q1 2003 Q3 2004 Q1 2004 Q3 2005 Q1 2005 Q3 2006 Q1 2006 Q3 2007 Q1 Latest estimates 2007 Q3 2008 Q1 2008 Q3 2009 Q1 2009 Q3 2010 Q1 2010 Q3 2011 Q1 2011 Q3 2012 Q1 Previous estimates Saving ratio (quarterly) % 2012 Q3 Gross saving was £18.5 billion in 2012 Q4, a decrease of £3.2 billion (-14.8 %) compared with 2012 Q3. 10 In 2012 gross saving was £77.9 billion; a rise of £9.7 billion (14.3 %) compared with 2011. 8 6 4 2 The saving ratio for 2012 was 7.1 % compared with 6.5 % in 2011. 0 -2 2002 Q1 2003 Q1 2004 Q1 2005 Q1 2006 Q1 2007 Q1 Latest estimates 2008 Q1 2009 Q1 Previous estimates 2010 Q1 2011 Q1 2012 Q1 Gross disposable income (annual growth) % 30 25 20 15 10 5 0 1949 1952 1955 1958 1961 1964 1967 1970 1973 1976 1979 1982 1985 1988 1991 1994 1997 2000 2003 2006 2009 2012 Gross disposable income grew by 4.8 % in 2012. This is the highest growth since 2001 when gross disposable income grew by 6.5 %. Saving ratio (annual) % 14 12 10 8 6 4 2 0 -2 -4 1949 1952 1955 1958 1961 1964 1967 1970 1973 1976 1979 1982 1985 1988 1991 1994 1997 2000 2003 2006 2009 2012 The saving ratio was 7.1% in 2012. The last time the household saving ratio was higher was in 1997 at 8.1%. Gross and real disposable income (quarter on quarter growth) % 5 4 3 2 1 0 -1 -2 -3 2002 Q1 2003 Q1 2004 Q1 2005 Q1 2006 Q1 2007 Q1 2008 Q1 Gross Disposable Income 2009 Q1 2010 Q1 2011 Q1 2012 Q1 Real Disposable Income In 2012 Q4, gross disposable income rose by 0.7% compared with the previous quarter. Real disposable income decreased by 0.1%. Real gross disposable income is calculated using the implied deflator for household and nonprofit institutions serving households (NPISH) final consumption. This accounts for the effects of changes in the price. Total resources and final consumption (quarter on quarter growth) % 5 4 3 2 1 0 -1 -2 -3 2002 Q1 2003 Q1 2004 Q1 2005 Q1 2006 Q1 2007 Q1 Total resources 2008 Q1 2009 Q1 2010 Q1 2011 Q1 2012 Q1 Final Consumption The saving ratio increases if total resources grow faster than consumption. In the latest quarter total resources fell by 0.1 %, whilst final consumption recorded growth of 1.2 %. The negative growth in total resources compared to final consumption resulted in a decrease in the saving ratio when compared to the previous quarter, from 7.9% to 6.7 % (see Table 1). Net lending / borrowing (quarterly) £ billion 15 10 5 0 -5 -10 -15 -20 -25 2000 Q1 2001 Q1 2002 Q1 2003 Q1 2004 Q1 2005 Q1 2006 Q1 2007 Q1 2008 Q1 2009 Q1 2010 Q1 2011 Q1 2012 Q1 Net lending / net borrowing is calculated as ‘total change in liabilities and net worth’ minus ‘gross capital formation’ and ‘acquisitions less disposals of non-produced / financial assets’. In 2012 Q4, householders were net lenders of £5.2 billion. In 2009 Q2 households became net lenders after an extensive period of being net borrowers £ billion Components of total change in liabilities and net worth: change between 2012 Q3 and 2012 Q4 1 0.7 0.4 0.1 -0.2 -0.5 -0.8 -1.1 -1.4 -1.7 -2 -2.3 -2.6 -2.9 -3.2 -3.5 Gross saving Investment grants Other capital transfers Capital transfers receivable Capital taxes Other capital transfers Capital transfers payable In the latest quarter, changes in liabilities and net worth decreased by £3.2 billion between 2012 Q3 and 2012 Q4, due mainly to a decrease in ‘gross saving’ of £3.3 billion. Gross disposable income components £ billion 1500 1000 500 0 -500 2003 2004 2005 2006 2007 2008 2009 2010 2011 Compensation of employees Gross Operating Surplus and Mixed Income Net Social Contributions Net Social Benefits Net Property Income Taxes on Income and Wealth Net misc. transfers Gross Dispoable Income 2012 Between 2011 and 2012 Gross disposable income is estimated to have risen from £1007.3 billion to £1055.8 billion Gross saving components £ billion 1500 1000 500 0 -500 -1000 -1500 2003 2004 2005 2006 2007 2008 2009 2010 2011 Final consumption Taxes Wages and Salaries Net Benefits Gross Operating Surplus and Mixed Income Net Property Income Net misc. transfers Gross Saving 2012 Between 2011 and 2012, gross saving is estimated to have risen from £68.2 billion to £77.9 billion. Loans secured on dwellings £ billion 1200 1000 800 600 400 200 0 2005 2005 2005 2006 2006 2006 2006 2007 2007 2007 2007 2008 2008 2008 2008 2009 2009 2009 2009 2010 2010 2010 2010 2011 2011 2011 2011 2012 2012 2012 2012 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Banks and building societies In 2012 Q4, £1,035.9 billion of loans secured on dwellings were by banks and building societies % Contributions to quarter on quarter gross disposable income growth: 2012 Q4 0.8 0.6 0.4 0.2 0.0 -0.2 -0.4 -0.6 Net misc. transfers Taxes on Income Compensation of and Wealth employees Net Property Income Gross Operating Surplus and Mixed Income Net Social Contributions Net Social Benefits Gross Dispoable Income Gross disposable income increased by 0.7 % in 2012 Q4. The largest positive contribution came from a 0.6 % increase in ‘net social benefits’ and small positive growth from most other contributing factors, offset by a negative growth of -0.5 % in ‘net miscellaneous transfers’. Contributions to quarter on quarter growth in gross saving: 2012 Q4 % 10 5 0 -5 -10 -15 Final consumption Net misc. transfers Taxes Wages and Salaries Net Benefits Net Property Income Gross Operating Surplus and Mixed Income Gross Saving Gross saving decreased by 14.8 % in 2012 Q4. The largest contribution to this fall came from ‘final consumption’ (-13.7 %). Revisions to gross disposable income components: 2012 Q3 £ billion 2.0 1.5 1.0 0.5 0.0 -0.5 -1.0 Gross Operating Surplus and Mixed Income Net Social Contributions Compensation of Taxes on Income employees and Wealth Net misc. transfers Net Social Benefits Net Property Income Gross Dispoable Income In 2012 Q3, gross disposable income was revised up by £0.4 billion to £268.8 billion. The largest contribution to this revision was an upward revision to ‘net property income’ (£1.3 billion). . Revisions to gross saving components: 2012 Q3 £ billion 3 2 1 0 -1 Wages and Salaries Final consumption Gross Operating Surplus and Mixed Income Taxes Net misc. transfers Net Benefits Net Property Income Gross Saving The components making the largest contribution to the gross saving revision (£0.5 billion) were ‘net benefits’ (£1.3 billion) which was offset by a negative contribution of - £0.6 billion to ‘wages and salaries’. Contributions to the gross saving revision: 2012 Q3 Per cent 15 10 5 0 -5 Wages and Salaries Final consumption Gross Operating Surplus and Mixed Income Taxes Net misc. transfers Net Property Income Net Benefits Gross saving revision The level of gross saving was revised up by 2.4 % for 2012 Q3, ‘net benefits’ (3.9 %) was the largest positive contribution, offset by ‘wages and salaries’ which was revised down by 4%. BACKGROUND NOTES 1) All data contained in this briefing are seasonally adjusted where appropriate as recommended. 2) Revisions Details of revisions are available in the Quarterly National Accounts first release: http://www.ons.gov.uk/ons/rel/naa2/quarterly-national-accounts/q4-2012/index.html Gross saving In 2011 Q1, gross saving was revised down by £4.7 billion to £13.4 billion. The main component to this revision was a downward revision of £3.4 billion in net benefits. In 2011 Q2, gross saving was revised up by £0.53 billion to £17.7 billion. The main component to this revision was an upward revision of £3.4 billion in net property income receipts In 2011 Q3, gross saving was revised down by £1.8 billion to £17.3 billion. The main component to this revision was a downward revision of £2.1 billion in net property income receipts. In 2011 Q4, gross saving was revised up £1.09 billion to £19.8 billion. The main component to this revision was an upward revision of £2.9 billion in net property income receipts. In 2012 Q1, gross saving was revised down by £3 billion to £17.3 billion. The main component to this revision was an downward revision of £3.6 billion in wages and salaries. In 2012 Q2, gross saving was revised down by £0.8 billion to £20.4 billion. The main component to this revision were downward revisions of £1.4 billion in wages and salaries and £1.4 in gross operating surplus and mixed income In 2012 Q3, gross saving was revised up by £0.5 billion to £21.7 billion. The main component to this revision was an upward revision of £1.3 billion in net property income receipts Saving ratio 3) In 2011 Q1, the saving ratio was revised down 0.4 percentage points (to 5.2 %) In 2011 Q2, the saving ratio was revised down 0.1 percentage points (to 6.9 %) In 2011 Q3, the saving ratio was not revised and remained (6.6 %) In 2011 Q4, the saving ratio was revised up 0.2 percentage points (to 7.2 %) In 2012 Q1, the saving ratio was revised down 0.5 percentage points (to 6.5 %) In 2012 Q2, the saving ratio was revised up 0.1 percentage points (to 7.4 %) In 2012 Q3, the saving ratio was revised up 0.2 percentage points to (7.7 %) Pensions The treatment of pensions in the National Accounts is complicated. For the purposes of this release the following needs to be borne in mind. For funded social schemes (mostly occupational defined contribution schemes), contributions (employers’ and employees’) count towards gross saving and hence the saving ratio. Benefits (that is, pension payments) detract from saving. For unfunded schemes (mostly the state pension schemes and defined benefit schemes) it is the other way round. Contributions and benefits to and from personal pension schemes are not identified as transactions in the non-financial accounts. Contributions to a personal scheme are considered to be financial transactions and not consumption. Employers’ contributions are treated as paid by the household sector in the secondary distribution of income account; they appear as a resource in the household sector’s accounts as part of compensation of employees. We distinguish between actual and imputed employer contributions, but they are treated identically. It is worth noting that in the calculation of gross disposable income the transactions relating to funded social schemes act in the same way as do transactions for unfunded schemes. So contributions to a funded scheme detract from disposable income but not from saving. Further details can be found in the article ‘The treatment of pensions in the National Accounts’, available at: http://www.ons.gov.uk/ons/rel/elmr/economic-and-labour-market-review/no--10-october-2007/the-treatment-of-pensions-in-the-national-accounts.pdf 4) Financial Intermediation Services Indirectly Measured ONS updated the treatment of the output of financial intermediation services in Blue Book 2008. This development related to the measurement of the service charge that banks and other financial institutions make indirectly by charging customers higher rates of interest on lending compared to what they pay out in deposits. This service charge is known as Financial Intermediation Services Indirectly Measured (FISIM). The consumption of FISIM is estimated by comparing the interest paid or received against a reference rate which is closely linked to the Bank of England rate. The allocation of FISIM to consuming sectors is built up separately for loans and deposits for each sector. The impact on the household sector is divided between final consumption and intermediate consumption. FISIM on loans for house purchases are scored as intermediate consumption and deducted from the sector’s operating surplus. The remaining deposits and loans to final consumers are allocated to household expenditure, the majority of which is related to deposits. For further information on the concept of FISIM can be found in the article ‘Improving the measurement of banking services in the UK National Accounts’: http://www.ons.gov.uk/ons/rel/elmr/economic-and-labour-market-review/no--5-may-2007/improving-the-measurement-of-banking-services-in-the-uk-nationalaccounts.pdf and ‘The recording of financial intermediation services within sector accounts’: http://www.ons.gov.uk/ons/rel/elmr/economic-and-labour-market-review/no--6-june-2010/the-recording-of-financial-intermediation-services-within-sectoraccounts.pdf 5) Charts and tables To aid analysis, the many components that go towards the calculation of the saving ratio can be combined or netted off. The table ‘GSAVE’ shows one such analysis, with 4character identifiers for each category. The charts contained in this briefing and the revisions in section 2 of these notes are based on this table, some with further aggregation. An alternative analysis has also been included at the end of the briefing as table ‘GSAVE2’. The table below shows the differences between GSAVE and GSAVE2. GSAVE Total property income receipts (+) Total property income payments (-) Total social benefits receipts (+) Total social benefits payments (-) Unfunded employee social benefits – households (+) Unfunded employee social benefits – NPISH (+) Private funded social benefits (-) Miscellaneous transfers – receipts (+) Miscellaneous transfer payments (-) Employers’ contributions (+) Employers’ actual social contributions (-) Employees’ actual social contributions (-) Self contributions (-) Imputed social contributions (-) Employees actual social contributions funded pension schemes (+) Taxes on income (-) Other current taxes (-) GSAVE2 Net property income receipts (+) Unfunded social schemes – benefits (+) Net miscellaneous transfers (+) Unfunded social schemes – contributions (-) Taxes (-) Note: GSAVE was previously SAVRAT. GSAVE2 was previously SAVRAT2. 6) Data Quality In the financial account the household sector is treated as a residual sector for many of the transaction lines. This is because of well known difficulties in obtaining accurate data from household surveys about detailed financial transactions. We often make use of a control total and totals for other sectors that we can obtain from administrative data and business surveys, and assume that the household sector is responsible for the difference. 7) Reliability The saving ratio depends on the relatively small difference between two large estimates, namely total household and NPISH resources and final consumption expenditure. Therefore revisions to either of these large estimates can have relatively big impacts on the saving ratio. Care should be taken before interpreting recent estimates of the saving ratio, especially for quarters. Estimates for the most recent quarters are provisional and, as usual, are subject to revisions in the light of updated source information. ONS now publishes analyses of past revisions of headline published data, comparing original published estimates with the equivalent estimate three years later. Such an analysis is therefore not included in this Release. Details of ONS policy on standards for presenting revisions in time series First Releases can be found at: http://www.ons.gov.uk/ons/rel/elmr/economic-trends--discontinued-/no--604-march-2004/ons-policy-on-standards-for-presenting-revisions-in-time-series-firstreleases.pdf ONS has a website dedicated to revisions to economic statistics which brings together ONS work on revisions analysis, linking to articles analysis and key documentation from the Statistics Commission’s report on revisions. The webpage can be found at: http://www.ons.gov.uk/ons/guide method/methodquality/specific/economy/revisions/economic-statistics/index.html 8) National Accounts The data in this briefing are consistent with the Quarterly National Accounts First Release published on 27 March 2013. 9) Additional information More information on the household saving ratio can be found at: http://www.ons.gov.uk/ons/rel/elmr/economic-and-labour-market-review/no--3-march-2008/economic---labour-market-review.pdf http://www.ons.gov.uk/ons/rel/elmr/economic-and-labour-market-review/no--5-may-2010/recent-developments-in-the-household-saving-ratio.pdf 10) 11) Next Publication To reflect user demand it is planned that the data within this note will be incorporated into future National Accounts publications. Until then, these data will be published on the ONS website as a response to requests. Statistical Contact Gareth Clancy Email: Gareth.Clancy@ons.gov.uk Tel: 01633 455889 © Crown copyright 2013 Index to Tables Estimates from Quarterly National Accounts Breakdown of components of gross saving (current prices)……………………………...GSAVE Alternative breakdown of components of gross saving (current prices)…………………GSAVE2 Breakdown of components of gross disposable income (current prices)………………GDIncome Revision tables (differences from previous release of the Quarterly National Accounts) Breakdown of components of gross saving (current prices)………………………………GSAVE Alternative breakdown of components of gross saving (current prices)…………………GSAVE2 Breakdown of components of gross disposable income (current prices)……………….GDIncome