Notes on Cost-Benefit Analysis

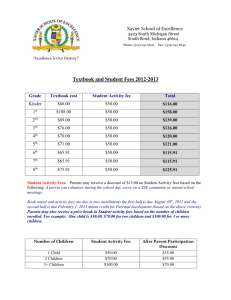

advertisement

Notes on Public Sector Cost-Benefit Analysis Introduction Private sector test for a project investment is “Invest if Present Value of the investment > 0”, where present value is given by the formula: PV = Σ (Rt-Ct)/(1+dt)t t with Σ indicating the sum over time (t) for the length of the project’s time horizon, t Rt being the revenue generated by the project in the tth time period, (or for public investments Bt for benefits), C being the costs generated by the project in the tth time period, and t dt being the discount rate (%), the cost of funds invested in the project in the tth time period. Public sector investment decisions are more complicated (and sometimes made more complicated than they should be) because: Externalities (positive and negative) must be considered, e.g., congestion, pollution, safety. There may be general equilibrium effects through impacts on markets, price changes, exchange rate implications, growth and spin-off developments Changes in consumer surplus and thus social welfare may occur if prices are changed. There are valuation issues: shadow prices, valuation of externalities, treatment of inflation. The selection of the appropriate discount rate can be uncertain. There may be debate about what should be included as benefits and costs, especially through the incorrect inclusion of redistributional effects, treatment of employment generated, and multiple counting of benefits Other social goals may be considered, equity, income distribution, access, etc. Payment transfers across levels of government produce multiple perspectives in the calculation of costs. Constraints - regulatory, political, limits on available funding - must be considered. The boundaries of the project or program are not well defined. A. Use of shadow prices, rather than market prices If non-competitive markets exist for inputs, e.g., monopolistic pricing or regulated pricing, then use estimated marginal cost of inputs rather than actual prices. For labour inputs, if there is significant unemployment of types of labour to be used, then the opportunity cost of that labour = 0. Recommended Notes on Cost-Benefit Analysis © Brian Christie, November 2006 practice is to estimate the percentage of jobs that will be filled by unemployed workers and discount the labour costs by that percentage. B. Externalities How to value negative externalities? There are two common approaches, both based on asking those affected to state a monetary value: Equivalent variation: the willingness of consumers to pay to stop or avoid the negative externality. Compensating variation: the compensation that consumers would be willing to accept for permitting the negative externality to continue. Normally in consumer surveys, the value of the equivalent variation of a particular negative externality is greater than that of the compensating variation. For positive externalities, only one measure can be estimated: how much consumers would be willing to pay to benefit from the positive externality. It can be expected that in such surveys consumers will overstate the value of a negative externality and understate the value of a positive externality. Other means, such as tolls paid by consumers on similar roadways or bridges or the decrease in property values from noise or air pollution can be used to produce estimates of the value of externalities. C. Consumer Surplus If the project results in a reduced price for some consumer good or service, perhaps because supply increases, and, as a result, consumers purchase more of the product, then an increase in consumer surplus occurs. Valuing this increase may be difficult if other changes occur simultaneously, such as an increase in demand for the product (i.e. a rightward shift in the demand curve, not to be confused with an increase in quantity demanded because of the price decrease, the latter involving movement along the demand curve.) D. Treatment of Inflation The treatment of inflation must be consistent. Inflationary effects should be factored into all or none of the cost and benefit values. (If the inflation rate is the same for costs and benefits and is assumed to be constant over the project time horizon, then the calculated present value will be the same, whether inflationary effects are included or excluded from the costs, benefits and discount rate.) If the values of all benefits and costs are expressed in today’s (constant) dollars, with no allowance for inflation, then the discount rate must be a real rate of return, i.e., with the effect of inflation removed also. Notes on Cost-Benefit Analysis 2 © Brian Christie, November 2006 Interest rates that are normally quoted in the marketplace are nominal rates that compensate investors for both the use of their funds and the loss of purchasing power associated with inflation. The relationship is the following: (1+ n) = (1+r) (1+ p.) where n is the nominal rate of interest, r is the real rate of interest, and p. is the inflation rate, all expressed as a percentage. Thus if funds cost 6% in the marketplace and the rate of inflation is 2%, the real rate of interest can be calculated (1.06/1.02 = 1.039) as 3.9%. (Note that for small values only, a reasonably close estimate of the real rate can be obtained by subtracting the inflation rate from the nominal or market rate.) If the inflation rate is expected to vary substantially over the time horizon of the project and/or vary significantly between major cost and benefit items, then price changes should be worked into the cost-benefit calculation with estimates of future (“current”) dollar values and the nominal rate(s) of return being employed. E. The Discount Rate In a private sector cost-benefit analysis, the discount rate is the cost of funds, often the cost of borrowing through a bond or debenture issue or, for smaller amounts, a bank loan. Firms may sell equity (shares) to finance projects, especially small start-up firms; the cost of such funds involves the loss of some share of future earnings for current owners and is thought to be the most expensive financing method. Going concerns may use retained earnings (the share of profits not distributed as dividends to owners); this may be the cheapest financing method. In the public sector, major projects are typically financed by government debt (usually at rates somewhat below corporate borrowing costs in the market) and by tax revenue (perhaps foregoing a tax reduction or a pay-down of existing debt). Crown corporations may have some retained earnings but usually their borrowing costs are the same as the government’s and the retained earning are employed at the expense of increased government revenue. Alternative theories of the discount rate for public sector projects: Use the social rate of time preference (Marglin) – the premium that society requires to defer a dollar’s worth of consumption to next year. The argument is that private investors are myopic, not considering the interests of future generations. More interested in near-term returns they discount future benefits more heavily than they should. Thus concerns Notes on Cost-Benefit Analysis 3 © Brian Christie, November 2006 for future generations are not reflected in the market rates of interest. Governments should consider future generations and, therefore, use a discount rate that is less than the market rate of interest. The difficulty is determining this social rate of time preference: how much is it less than market rates? Use the opportunity cost of capital (Baumol) – the return on investments in the private sector, before taxes. The argument is that if government invests in projects that return less than this market rate, inefficiency results and social welfare is reduced: national income and social welfare could be increased if the government project is not undertaken and instead the funds are used for (marginal) private projects that would earn the private sector rate of return (or just a bit less). If, in the application of this theory, it becomes evident that obviously good public projects are not occurring, it can be argued that this is because the cost of funds for private sector projects is too high, or taxes on the returns from private sector projects are too high, and therefore monetary policy and/or fiscal policy should be adjusted to lower the opportunity cost of capital for both sectors. Marglin has suggested that a trade-off between these two theories might be to use the social rate of time preference as the discount rate to avoid the myopic view but then require a benefit-cost ratio somewhat greater than one to ensure more efficient uses of capital by the private sector are not squeezed out. But what ratio is appropriate? Multi-objective analysis seems to provide an answer: use different discount rates for different costs and benefits, e.g., the opportunity cost of capital for market-priced and national income benefits and costs and the social rate of time preference for regional development and environmental quality benefits and costs that will affect the following generations to a greater degree. (This still begs the question of how much long-term debt current generations store up for future taxpayers.) The difficulty with picking and choosing among the various approaches is that the competing analysts can justify very different conclusions with relatively small variations in the discount rate. But then this perhaps points to a weakness in this whole methodology. F. Decision Criterion Three competing criteria or tests are often identified for deciding whether a project or program should proceed or for selecting which eligible projects should be undertaken: 1) Present value > 0 2) Benefit-cost ratio >1 3) Internal rate of return > the cost of funds. Notes on Cost-Benefit Analysis 4 © Brian Christie, November 2006 The benefit-cost ratio is given by: [Σ Bt/(1+dt)t] / [Σ Ct/(1+dt)t] t t Thus the first two tests are arithmetically equivalent. The internal rate of return is the value of the rate of return, r, for the project that solves the equation: PV = Σ (B -C )/(1+r)t = 0 t t t While the rate of return test is often cited as the private sector test, it is in fact flawed. If a project does not have a stream of early negative net benefits (i.e. costs), followed by a consistent stream of positive net benefits, then the equation above can have more than one solution. Regardless, the rate of return test can result in different choices than the first two, valid rules if the solution, r, differs significantly from the cost of funds, d. The appropriate rules are the following: 1. If funds are unlimited, or at least sufficient to fund all available projects, then undertake all that have a present value greater than 0 (or B-C ratio greater than 1). 2. If funds impose a limit, select projects so as to maximize the sum of present values for the projects undertaken. Note: if two projects are interdependent and their present values vary depending if they are done alone or as a pair, then treatment as three separate projects: Project A, Project B, and the two projects together, A+B. G. What Constitutes a Benefit and a Cost? Benefits are new goods, services or amenities created for society by the project. Costs are opportunity costs, the real goods, services and amenities that have to be foregone because of the project. Transfers from one group to another or one geographic area to another within a society are not benefits or costs. For example, tax receipts or welfare payments simply transfer the ability to call on a society’s resources from one economic agent or group of agents to another. They are redistribution, not a creation. They should not be included in a costbenefit calculation, although if they advance a social goal such as income equity could be included in an impact assessment that looks at additional outcomes, i.e. a costeffectiveness analysis. Thus, benefits may include reduced traffic congestion and time savings from a bridge or highway or new land created by a dyke or drainage project, but not the savings in gasoline taxes for motorists in the first example or new property taxes received by a municipality in the second. Notes on Cost-Benefit Analysis 5 © Brian Christie, November 2006 Analysts should take care not to fall into the trap of double-counting benefits, e.g., a dyke may generate anticipated reductions in property damage from averted flooding, which can be estimated. But the benefits ought not to also include savings on insurance premiums for affected home-owners and increases in home values, as well. As well, benefits and costs are those associated directly with the project: if the dyke creates new land that can be built upon, include the increase in land values but not the costs and benefits of subsequent construction – those come from a different project. Also, the incomes of those employed on the project are not a benefit (they are costs!) unless they would have been otherwise unemployed. But don’t both discount the cost (see above) for the employment of previously unemployed and include their income – that’s double-counting again. Similarly, use of a multiplier to calculate income benefits generated by successive rounds of spending from the direct spending on the project is inappropriate unless the services employed in second, third, etc. rounds of spending would also have been significantly unemployed. H. Point-of –View When multiple levels of government are involved in funding a project, the more local governments are often tempted to treat funding from the other government(s) as free, i.e., not a cost. This treatment implicitly assumes that the funds would not benefit the citizens of the local jurisdiction except through the project being evaluated. This is unlikely since the funds might well be spent on another project within the local jurisdiction, or on a project in a neighbouring jurisdiction with some benefits for citizens of the local jurisdiction, or a national project, or if unspent result in lower taxes. As well, this treatment implicitly assumes that all of the spending will stay in the local jurisdiction: but what if labour or materials are imported for the project? In addition, more than local residents may benefit from the project: tourists, commuters from outside the city, neighbours who benefit from reduced air pollutions, etc. It is generally preferable to adopt the largest point-of-view reasonable for a project, e.g. the national perspective if federal funding is involved, and recognize that public funding comes from all taxpayers within that largest jurisdiction who all have an interest in the efficiency of public spending. I. Base-line A common error in cost-benefit analysis is the failure to employ a consistent base-line for alternative, competing versions of a project. Analyst should ask: What is the zero, noaction case. Then all alternatives to this case should be examined to identify how costs and benefits vary from those associated with this base-line case. J. Cost-Effectiveness Analysis Cost-benefit analysis is the preferred technique for evaluating public investments since it allows a single calculation of the efficiency implications of each alternative version of a project or program. Notes on Cost-Benefit Analysis 6 © Brian Christie, November 2006 If it is not possible to quantify or value the quantification of all benefits and costs, then the analyst may try reasonable estimates and test the extent that the results of the costbenefit analysis vary as these estimates are varied: this is called sensitivity analysis. It determines how crucial various assumptions or alternative estimates are to the conclusions of the analysis. If the results are not particularly sensitive to estimates that have a low confidence level, the analyst can still have confidence in the analysis. If reasonable estimates cannot be generated or other goals than efficiency are important to the decisions about a proposed project, then cost-effectiveness analysis in its various forms should be employed. See Weimer and Vining, ch. 14, especially pp. 338-343 and p. 351. Notes on Cost-Benefit Analysis 7 © Brian Christie, November 2006