Malawi Limestone Project Summary

advertisement

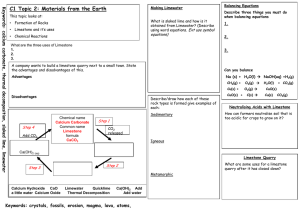

Malawi Limestone Project Mining and Lime Manufacturing Feasibility Study Summary G.W.P.MALUNGA page i ______________________________________________________________ SUMMARY OF THE BWANJE VALLEY LIMESTONE FEASIBILITY STUDY ______________________________________________________________ P::943/WP/VOLUME4.FES/PROMO/SECTIONS1 MET-CHEM April 1997 Malawi Limestone Project Summary Mining and Lime Manufacturing Feasibility Study Page 1 ________________________________________________________________________ 1.0 INTRODUCTION 1.1 Presentation of the Study The present summary covers MET-CHEM's assessment recommendations of the technical, financial, environmental and economic viability of establishing a limestone mining and limeworks at Bwanje Valley,Ntcheu district, Malawi. 1.2 Limestone Resources of Malawi and Production Figures Limestone is currently the most valuable mineral commodity extracted in Malawi. It is mainly used in the production of cement. Limestone is also the raw material for lime used in the construction and agricultural industries. Several types of limestone occurrences have been documented, of which the most important are marble bands in the basement complex gneisses. Large occurrences exist also in carbonates and sedimentary rocks (Table 1.2). The marble bands are mainly dolomitic and pure calcitic have been observed only at Changalumi, Chikowa - Liivwezi and Bwanje Valley (near Golomoti). The Changalumi marble is the only source of limestone for cement production in Malawi. Cement production is around 130,000 tonnes per year. For quality reasons, some limestone has been extracted from Chenkumbe to blend with that from Changalumi. About 20,000 tonnes per year of cement are officially imported into Malawi. Unofficial figures, however, are estimated to be closer to 50,000 tpy. Chikowa - Livwezi calcite marbles occur to the Northeast of Kasungu Boma. Shayona Cement Company have Mining Rights there but seem to have financial and technical problems which are delaying the development of a cement factory. The main lime producing areas in Malawi are concentrated in the Middle Shire area within Chenkumbi - Ulongwe and Lirangwe - Kholombidzo areas. On average, it is reported that 3,000 tonnes of lime are produced annually. A general decline in lime production has been noted over the last ten years, attributed to the scarcity of fuelwood from these lime-producing areas. Dolomite production in this area is heavily dependent on demand in the construction industry. An average production of 2,000 tonnes has been noted. Table 1.3. gives picture of limestone production figures between 1989 and 1993. _______________________________________________________________________ P:|\ 94334\WP\VOLUME4.FES\PROMO\SECTIONS 1 MET-CHEM April 1997 Malawi Limestone Project Summary Mining and Lime Manufacturing Feasibility Study Page 2 _________________________________________________________________ 1.3 General Overview of the Mineral Resources of Malawi Mineral exploration in Malawi started with industrial minerals. Among these industrial minerals are vermiculite, kaolin, iron sulphides, graphite, kyanite, apatite, coal and limestone. Most of these minerals require more quantification to justify the heavy capital investment (Table 1.1) required for exploitation. 1.4 Institutional Framework of the Mining Sector The institutional framework for mineral development in Malawi comprises: Ministry of Energy and Mining; Department of Geological Survey; Department of Mines; Malawi Development Corporation and the Malawi Promotion Agency. Mining Investment and Development Corporation Limited is charged with the task of spearheading mining in Malawi. Its role includes the initiation of technofinancial feasibility studies of selected mining opportunities and to promote, mediate and initiate mining investment. Malawi Development Corporation has, as part of its mission, the mandate to develop the mineral resources of Malawi through joint ventures with both local and foreign investors. The Corporation is currently producing Portland Cement through its subsidiary the Portland cement Company of Malawi. It has also formed a Consortium with INDE Bank, which is operating Mchenga Coal Mines Ltd. located in Northern Malawi. Malawi Investment Promoting Agency undertakes investment promotion from both within and outside Malawi and is also charged with facilitating mining investment by local and foreign investors. _____________________________________________________________________________ P:\9434\WP\VOLUME4.FES\PROMO\SECTIONS 1 MET-CHEM April 1997 Malawi Limestone Project Summary Mining and Lime Manufacturing Feasibility Study Page 3 _________________________________________________________________ TABLE 1-1 -THE LEVEL OF EVALUATION OF MALAWI'MINERAL DEPOSITS (Source: Ministry of Forestry & Natural Resources Brochure & Malunga,1992) MINERAL LOCATION ANALYSES Bauxite Mulanje Mountain Ceramic clays Linthipe AI 203-43.9% Free Quartz-13.3% AI 203-33.8% SiO2-46.7% Coal Mchenga Mwabvi Graphite Ngana Katengeza Tuinchi Heavy sands Kyanite Limestone Chimutu Tengani Salima Kapiridima Chikowa/ Livwezi Chenkumbi Niobium Phos[phate PROBABLE RESERVES Chilwa Is. Iilomba Nanthache Nanthache Chingale Mlindi Chilwa Is kangankunde 0.37% Nb2O3 15 - P2O5 3.7% - P2O5 7.8% - P2O5 2.5% - P2O5 2.8% - P2O REMARKS Md Fs 1.4Mt 5Mt Ps 2.2Mt 150Mt. Ps 70Mt. Ps Fs 15.5 Mt. C-4.2PSD (>.25mm) -63.2 C-6.0 PSD (>.25mm) 75% Rutile - 3.% Iimenite - 3.0% POSSIBLE RESERVES 60Mt. 14.1Mt Ash-14% CV-Kcal/Kg 7226 Ash - 40% MC-Kcal/Kg 4100 Ash-40% CV-Kcal 4799 15% 51.0 CaO 0.7 Mgo 46.1%CaO 6.3% MgO 53.6%CaO 1.4%MgO 0.95 Nb2O3 0.30% Nb2O3 Malowa PROVEN RESERVE 28.8 Mt. .03Mt. Ep Ep Ps .3Mt. 2.5Mt. 67Mt. >1 Mt. 30,000t 10.0 Mt 314,000T 10.0Mt 300Mt. Fs 0.5Mt. 3.0Mt. Fs 375,000 t 104,000 t (ore) 9000,000 t 1.25 Mt. Ps 0.9 Mt. 8.75 Mt. 2.4 Mt. Fs Fs Fs Fs Ep Ep Ep _______________________________________________________________________ P:\9434\WP\VOLUME4.FES\PROMO\SECTIONS I MET-CHEM April 1997 Malawi Limestone Project Summary Mining and Lime Manufacturing Page 4 Feasibility Study _______________________________________________________________________ MINERAL LOCATION Pyrite/Pyrrohitie Chisepo Malingunde Nkhanyu Kadamasana Kangankunde Nanthache Songwe Rare earths Strontianite Talc Uranium Vermiculite Kangankunde Muso Joshua Mzimba IIombo Kayerekera ANALYSES PROVEN RESERVES 8.4 S10.7% S 8.0% S 10.0% S 34.0 Mt. 10.0 REO 7.0 % REO 1.7% REO 0.3 Mt. 0.6Mt. 1.4 Mt. 17.9% 58,078t PROBABLE RESERVES 32.0 Mt 10.0Mt. POSSIBLE RESERVES 4.5 Mt. 4,000 t 2,000 t 511g/t eU3O8 0.17%U 53,000 t 10,000 t Ps Ps Fs Ep Fs Fs Fs Fs Fs Ep Ps Md Feremu area Mlindi REMARKS Fs 5.0 120 Kg/m3 DBD 9.0% 125 Kg/m3 DBD 1.5 Mt. 450,000 t Ps Table 1.2 Main Limestone Occurrences in Malawi GROUP Basement Complex Sovite Carbonatite +Karroo LOCATION Changalumi Chilwa Island Mwesia ESTIMATED QUANTITY 100 million Very large Large quantity Nigana Very large P:/94341/WP/VOLUME4.FES/PROMO/SECTIONS1 MET-CHEM REMARKS MgO<1% MgO<1% MgO <2% Total Carbonate 43 - 55% variable MgO content Total Carbonate 72 - 82% Apri1997 Malawi Limestone project Summary Mining and lime Manufacturing Page 5 Feasibility Study ______________________________________________________________________ Table 1.3 Limestone Production Figures (tonnes) in Malawi, 1989 - 1993 YEAR Dolomite Cement Lime 1989 1,003 122,545 3,456 1990 2,483 138,630 4,096 P:9434/WP/VOLUME4.FES/PROMO/SECTIONS 1 1991 3.06 173,103 5,329 1992 1,747 179,404 3,280 MET-CHEM 1993 2,789 120,000 2,468 April 199 Malawi Limestone Project Summary Mining and Lime Manufacturing Feasibility Study Page 6 _________________________________________________________________ 2.0 PROJECT BACKGROUND 2.1 Project Description The Feasibility study presented by MET-CHEM consists of a comprehensive technico-economic evaluation of an operation of limestone mining and lime manufacturing based on the Bwanje valley limestone deposit. The drilling and chemical; analyses were executed by Malawi Geological Survey based on the programme established by MET-CHEM geologists. Metallurgical tests were performed by several laboratories in North America and Europe in order to select the most suitable calcination technology. The study presents the optimal capacity of the limeworks operation to produce the products with specifications based on the findings of the market survey. The overall aim of the study is to determine the followings: a, the optional production of the operation which includes pulverised lime requirements as well as hydrated lime and other specific products. b, The products and specifications which can be produced using the Bwanje Valley limestone. c, The technical and financial viability of different possible scenarios. d, the benefit which could accrue to Malawi from this limestone operation. The study covers all aspects of the projects such as the market, transportation of the product, limeworks location, ore reserves evaluation and mining, limeworks process and economic profitability, personnel requirements, operating agency and construction schedule, concluding with the overall project justification and recommendations. 2.2 Project Location Bwanje Valley marble deposit lies to the South -western arm of Lake Malawi. The nearest Trading Centre to the deposit is Golomoti and is about 7 kilometres to the West. The deposit lies around the intersection between Longitude 34o 40' and latitude 14o 25' South (FIG. 2.1). p:\94341\WP\VOLUME4.FES\PROMO\SECTIONS MET-CHEM April 1997 Malawi Limestone Project Mining and Lime Manufacturing Feasibility Study Summary Page 7 Bwanje Valley marbles rise from an altitude of about 480 metres to an altitude of 520 metres. The Valley is a continuation of the southwestern arm of Lake Malawi and extends between Bilila Fault Scarp in the West and the Nothern Chiripa Plateau in the East. A Lake shore road (M17) and rail line are about six (6) kilometres from the marble deposit. The road starts from the Blantyre - Lilongwe road, near Balaka, and joins to the Northern Corridor road at Mzuzu. The rail line goes as far as Lilongwe and Mchinji near the Zambian Border and provides access to the port of Nacala in Mozambique. The distance between Zomba and Bwanje Valley Marble is 173 Kilometres while from Lilongwe it is 209 Kilometres. Access to Bwanje limestone deposit (Malowa hill) is very difficult during the rainy season because the area around becomes water logged or marshy. __________________________________________________________________________________________________ P:\9434\WP\VOLUME4.FES\PROMO\SECTIONS1 MET-CHEM April 1997 Malawi Limestone Project Summary Page 8 Mining and Lime Manufacturing Feasibility Study _______________________________________________________________________ Figure 2.1. P:/9434/WP/VOLUME4.FES/PROMO/SECTIONS MET-CHEM April 1997 Malawi Limestone Project Summary Mining and Lime Manufacturing Feasibility Study 3.0 Page 9 GEOLOGY AND CARBONATE ROCKS RESOURCES The marble deposit occur in the Bwanje Valley, about 7-9 Kms east of Golomoti in Ntcheu district, in an area near the main Lilongwe-Blantyre highway and the railway line which links Balaka and Salima. The deposit consist of four hills, the most important ones being Malowa and Khungule Hills. The hills are found in the centre of a dambo, which consists mainly of a flat lying area of clay and silt size material which are cracked during the dry season and waterlogged in the rainy season. The mining concession is of irregular shape and covers an area of 2.8 km2. 3.1 1995-1996 Exploration Program The 1995-1996 exploration program resulted in a 2,500 metre drilling campaign on the Malowa and BAB hills with core description and sampling, followed by physical and chemical analyses. In the addition to the drilling and analyses, geological mapping has been undertaken so as to better understand the geology. 3.2 Drilling Program The drilling program was designed based on core drilling using NX size core, was undertaken by the Geological Survey of Malawi using two boring machines. A total of 79 holes have been drilled between October 1995 and December 1996 representing a meterage of 2483 meters. On the main of Malowa Hill (particularly in the North part between L1 and L10) drill holes have been more or less drilled according to a 60m x 30m pattern in calcitic zones and in BAB Hill area, the spacing was increased as the drilling was only done for indication purposes. A total of 663 samples totalling 1351 metres have been analysed for CaO, MgO, SiO2, Fe2O3, SO3, P2O5, K2O, Na2O, insoluble, and L.O.I. In addition, core recovery percentage, as well as Rock Quality Design (RQD) index, have been evaluated for each rock unit segment. 3.3 Carbonate Rocks Resources for Malowa Based on the geology interpreted from the surface mapping and the drill holes, a 3-D block model have been built which had served to evaluate the area resources. The overall undiluted carbonate rocks resources for the Malowa main , L1 to L14, have been evaluated at 14.85 millions tons @ 46.83% CaO, 1.36% MgO inside the calcitic rocks bands (Lcode =2) and 17.53 millions tons @ 36.61% CaO, 7.14% MgO inside the dolomitic and impure rock bands (Lcode =3). This includes all resources, regardless of the category, without any external dilution; but a P:/9434/WP/VOLUME4.FES/PROMO/SECTIONS 1 MET-CHEM April 1997 Malawi Limestone Project Summary Page 10 Mining and Lime Manufacturing Feasibility Study deduction of 23% have been applied to account for the cavities. The density used is 2.66 t/m3. Summary of the resources as well as categories are presented in the table 3.1. 3.4 Resources Categories per Market Class In addition to its classification according to lithology, (inside the identified rock bands) the resources of Malowa Main have been classified according to the following table, which takes the market requirements into consideration. The classes are based on the chemical composition variation of calcite, dolomite and non-carbonate materials. The codes (ORE) used here under correspond to the seven (7) rocks codes (market types) identified in the 3-D blocks model. Chemical Composition A. Name Code CaCO3 >80% a. CaCO3 >93% Ultra High Calcium Rock 1 b. 90% < CaCO3 <93% High Calcium Rock 2 c. 80% <CaCO3 <90% Medium Calcium Rock 3 B. MgCO3 >20% Dolomitic Calcium Rock 4 C. All other carbonate rocks Impure marble 5 D. Carbonates <50% Non-carbonate Rock 6 E. Not codified 7 Based on this classification, the Malowa Main area contains 12.29 million of calcitic rocks (ORE 1,2,3) and 3.69 million of dolomitic rocks (ORE 4). Figure 3.2 is a summary of the results. P/:9434/WP/VOLUME4.FES/PROMO/SECTIONS1 MET-CHEM April 1997 Malawi Limestone Project Summary Page 11 Mining and Lime Manufacturing Feasibility Study Figure 3.1 Carbonate Rocks Resources by Lithology a. Carbon >50% Calcitic Rocks (Lcode =2) Tonnage x 000's CaO Dolomitic Rocks (Lcode =3 MgO SiO2 Tonnage x 000's CaO MgO SiO2 Measured Indicated Inferred 3,806 5,844 5,194 48.70% 47.46% 44.74% 1.50% 1.43% 1.18% 6.65% 8.19% 1932% 1,265 6,415 9,981 36,65% 38.70% 35.26% 9.14% 6.49% 7.32% 12.25% 12.91% 14.98% Total 14,844 46.83% 1.36% 11.69% 17,661 36.61% 7.15% 14.03% Carbonate Rocks Resources a. Carbon >80% Dolomitic Rocks (Lcode =3) Tonnage x 000's CaO MgO SiO2 Dolomitic Rocks (Lcode =3) Tonnage x 000's CaO MgO SiO2 Measured Indicated Inferred 3,303 4,893 3,363 50.33% 49.00% 47.71% 1.49% 1.45% 1.22% 5.92% 6.58% 16.55% 746 4,136 4,887 39.99% 41.69% 38.45 9.91% 7.24% 7.76% 9.31% 10.22% 11.14% Total 11.559 49.01% 1.39% 9.29% 9,770 39.94% 7.70% 10.61% Note: Carbon = 1.79*CaO + 2.1* MgO P:/9434/WP/VOLUME4.FES/PROMO/SECTIONS 1 MET-CHEM April 1997 Malawi Limestone Project Summary Page 12 Mining and Lime Manufacturing Feasibility Study FIG 3.2 CARBONATE ROCKS RESOURCES BY MARKET CLASSES Total Resources Ore Class 1 2 3 Sub-total 4 Tonnes x 000's CaO MgO SiO2 LOI AI2O3 Fe2O3 2,396 2,445 7,447 52.72% 51.23% 47.57% 52.72 0.93% 1.67% 5.24% 5.97% 9.75% 41.34% 40.44% 39.04% 0.64% 1.72% 4.18% 0.34% 4.37% 0.66% 12,288 49.30% 1.38% 8.12% 39.77% 3.00% 1.34% 3,686 35.54% 12.18% 9.68% 40.66% 2.54% 0.63% Measured and Resources Ore Class Tonnes x 000's CaO MgO SiO2 LOI AI2O3 Fe2O3 1 2 3 2,004 2,074 5,248 52.77% 51.27% 47.65% 1.05% 0.93% 1.77% 4.70% 5.72% 8.38% 41.35% 40.40% 39.29% 0.58% 1.39% 3.58% 0.33% 0.44% 0.64% Sub-total 9,325 49.37% 1.46% 7.13% 39.91% 2.56% 0.54% 4 2,157 36.21% 12.99% 8.60% 41.35% 1.55% 0.65% P:9434/WP/VOLUME4.FES/PROMO/SECTIONS1 MET-CHEM April 1997 Malawi Limestone Project Summary Page 13 Mining and Lime Manufacturing Feasibility Study 4.0 Market Study 4.1 Introduction The Malawi Government has been showing concern over the supply of limestone and lime products to various consumers within in the country. Demand has been steadily increasing and there has been no indication of any new, local producer of lime which could meet this demand. Indeed, there is a continued increase in lime imports. The existing small-scale lime burning operations have been besieged by costly increases inn energy and their output is on the decline. Most of these local operations are at Balaka in Machinga district and Lirangwe in Blantyre district. In an effort to increase the quantity and improve the quality of local production, the government sought assistance through (Intermediate Technology Development Group), ITDG, to test and build appropriate technology kilns. Two such kilns were originally constructed - one at Uliwa in Karonga district and the other in Balaka. Although these kilns demonstrated improved technologies, they have not had any impact on local production. The one in Karonga has been inoperative for the past three years and the other in Balaka has performed dismally, both due to management problems. A second kiln was built at Balaka, based on the experiences of the other two. Although this kiln was fully equipped to produce up to 3 TPD of high-grade lime, the venture was unsuccessful and the local private company folded up in 1992. The kiln and the related infrastructure have since been sold for other purposes. As part of this Feasibility Study, the current drilling programme has shown an increase in the reserves suitable for a limeworks. See Volume 1, Section 3. The proposed limeworks should satisfy the local demand and have export potential, thus allaying the concerns of the Malawi Government. 4.2 LIMESTONE USES There are many uses of crushed or pulverised limestones and they must meet certain physical and/or chemical properties. The following is the list of the applications for limestone products that are relevant to the Malawi and regional markets. Agriculture, cement manufacturing, chemical and metallurgical industries, aggregate, coal mining and dimension stones. P:/9434/WP/VOLUME.FES/PROMO/SECTIONS1 MET-CHEM April 1997 Malawi Limestone Project Summary Page 14 Mining and Lime Manufacturing Feasibility Study 4.3 Lime Uses Lime is used in a wide range of applications. The tradition building and agriculture applications have greatly been overtaken by its uses in the chemical and metallurgical industries. Listed below are some of the more important uses of lime. Iron and steel, non-ferrous metallurgy, environment control, manufacture of chemicals, bleach power, sugar industry, agriculture, water treatment, sewage treatment, building and construction, glass industry, etc. In sugar lime is used in beet sugar and cane sugar refining. Lime removes the phosphatic and organic acid compounds from the sugar containing juice. The compounds are then removed by filtration. From purifying beet sugar 0.25 tonnes of lime are required for 1 tonnes of sugar. Similarly 0.002 to 0.004 tonnes of lime are required for 1 tonnes of sugar. Similarly 0.002 to 0.004 tonnes of lime are required for 1 tonne of cane sugar. Most of the agricultural liming utilises ground limestone. Some farmers or farming institutions still use lime - quicklime or hydrated. Lime is more expensive than limestone but reacts faster, neutralising soil acidity rapidly. This added cost is persistent magnesium deficiencies. Lime is also used as detergent in whitewashing dairy barns, for composting, chicken litters, etc. High grade lime is used in the treatment of municipal potable water and industrial process water. Lime is used to remove temporary bicarbonate hardness from the water. When there are both temporary and permanent (sulphate) hardness, lime is used along with soda ash. The high pH of 11.5 from lime in water acts as sterilising agent since retention for 3 to 10 hours at this pH will destroy 99 + % of the bacteria and most viruses. The pH is lowered to accepted levels by introduction of CO2, precipitation lime solution as a carbonate sludge. 4.4 Total Lime Supply Total lime supply from both local and imports over the last five years is shown in the table below. P:9434/WP/VOLUME4.FES/PROMO/SECTIONS1 MET-CHEM April 1997 Malawi Limestone Project Summary Mining and Lime Manufacturing Feasibility Study Page 15 YEAR LIME TABLE - TOTAL LIME SUPPLY 1990 - 1994 1990 1991 1992 1993 7,522 7,981 8,150 3,491 1994 10,521 A part from the anomaly in 1993, the figures confirm the Government (Ministry of Commerce) projections that lime supply should grow by an average ten(10) percent per annum. Assuming this trend is correct then the following projections can be made: YEAR LIME 4.5 TOTAL LIME SUPPLY 1995 - 2000 1995 1996 1997 1998 1999 11,573 12,730 14,000 15,400 16,944 2000 18,640 DEMAND OF LIMESTONE AND LIME PRODUCTS 4.5.1 Limestone products The demand for limestone is reflected by the various different users. These industries include agriculture, cement manufacture, chemical industries and paint manufacture. Table below summarises the demand for limestone. TABLE - CURRENT DEMAND FOR LIMESTONE INDUSTRY COMPANY CONSUMPTION MIPA CEMENT Portland 28,000 Grain Mill 540 Rab Processors 110 Veterinary Services 300 Optichem 1,200 Press 100 CHEMICALS Lever Brothers 1,650 PAINT Dulux 300 Rainbow 100 Valmore 300 MINING Mchenga 120 TOTAL 32,820 P:9434/WP/VOLUME4.FES/PROMO/SECTIONS 1 MET-CHEM April 1997 Malawi Limestone Project Summary Page 16 Mining and Lime Manufacturing Feasibility Study New Opportunities 1. Agriculture is and will remain the mainstay of the Malawi economy. Limestone will play a significant role in this economy. Liming of the soils is needed due to excessive use of ammonium sulphate fertilisers which identify the soil. Optichem, the company that supplies pulverised limestone for liming, estimates that an annual consumption of 40 000 tonnes is optimum if the sector is adequately sensitised. 2. Government is conscious of the prices of fertiliser being imported for the crucial agriculture sector of the economy. The country's requirements of fertilisers are 200 000 TPA, of which 40% is limestone. If the plant comes on stream this would call for 80 000 TPA of pulverised limestone. Export Potential It is not expected that there will be any export potential for limestone or dolomite due to its low value. P:/9434/WP/VOLUME4.FES/PROMO/SECTIONS1 MET-CHEM April 1997 Malawi Limestone Project Summary Page 17 Mining and Lime Manufacturing Feasibility Study 4.5.2 Lime Existing Demand The current demand pattern for lime products is as follows: INDUSTRY SUGAR COMPANY CONSUMPTION (TPA) DWANGWA SUCOMA 1,500 2,000 AGRICULTURE PRESS SABLE 100 820 SOBO 7 BATA 104 LIWONDE TANNERY 12 MIN. OF WORKS MANDALA BUILDING HARDWARE & GD CHIPIKU 40 1,500 350 600 7033 WATER SHOE LEATHER CONSTRUCTION TOTAL P:94341/WP/VOLUME4.FES/PROMO/SECTIONS1 MET-CHEM April 1997 Malawi Limestone Project Summary Page 18 Mining and Lime Manufacturing Feasibility Study New Opportunities 1. A new sugar works is on the drawing board by Candlex Limited in joint venture with a Malaysian Company. Negotiations are complete. The factory will be in Salima, which is much closer to Bwanje than the other two sugar plants. If this comes to fruition, the demand for lime for this new factory is estimated at 2500 TPA. The total demand and requirement for lime in the sugar industry is expected to remain fairly constant at 6000 TPA. Production is planned to start in 1998. 2. The water supply in district centres other than Blantyre and Lilongwe use soda ash with a consumption of 100 TPA. This would also be the consumption of lime should the Ministry revert to lime in the face of escalating prices of imported soda ash. If good quality lime was available the district water treatment centres would switch to lime. Of course this consumption is insignificant but in the long term there are planned to be more surface water sources, for instance dams, hence the need for treatment. As population grows with a commensurate urban growth, demand for treated water will increase. But water treatment by lime faces competition from polymers as shown by the two water boards of Blantyre and Lilongwe. This market for polymers may not survive for long especially if it is supported by an abundant supply of foreign exchange for imports as opposed to locally, available, affordable, good quality lime. 3. Plans are already at an advanced stage to put up a bottling plant by the Southern Bottlers Company inn Mzuzu in 1996. Consumption of lime is expected to increase only marginally depending upon increasing demand of products. 4. A pulp and paper factory has been on the drawing board for many years and the project has been modified several times. There strong indications that this project will eventually be realised. Should this come to fruition it will call for an estimated extra 2 000 TPA of high grade lime. Export Opportunities 1. A limited amount of work has been done on opportunities existing in the neighbouring countries. 2. There are fair amounts of imports from Zambia. The country has been Malawi's traditional supplier of lime. It produces sufficient quantities for its chemical industry. Zambia would not be a natural target for Bwanje lime. Zambia's export opportunities give a good indication as to where market opportunities lie. P:94341WP/VOLUME4..FES/PROMO/SECTIONS1 MET-CHEM April 1997 Malawi Limestone Project Summary Mining and Lime Manufacturing Feasibility Study Page 19 3. Mozambique has just come out of internal instability and civil war. There is a lot of scope for reconstruction and a subsequent demand for raw materials. During the civil war all limeworks ceased operations. They have not yet been restarted. With peace, opportunities will abound for their rehabilitation. Activities in the mineral sector have also risen generally. It is a market that should be looked at in detail in the short to medium term, particularly around the towns of Tete province which include the Moatize coal mines. 4. Tanzanian lime production has been declining steadily from 3000 tonnes in 1988 to 870 tonnes in 1992 showing increasing imports to sustain consuming industries. Figures are not available for the past two years. The impression at SADC MINING COODINATING UNIT (MCU) is that the lime industry is in the decline. This is market worth investigating in greater detail, particularly the Southern part close to Malawi. 5. Lime in Zimbabwe is being produced by a number of companies both small and large. There also exist a large number of identified limestone deposits which are untapped. Unfortunately, they have high impurities of silica, iron and phosphorous. A number of industries in Zimbabwe need high grade lime which is not available locally and is imported from South Africa and Zambia. The main users of imported lime are ZIMALLOY, water treatment plants, and sugar industry. 4.6 CONCLUSION AND RECOMMENDATION On a year to year basis, lime production, imports and consumption have increased only marginally in unison with the economy over the last four years. The manufacturing sector averaged 13.3% of GDP over the years 1990 to 1994. The growth in this sector is mainly from agro-processing industries, particularly sugar and tobacco, fertiliser and chemical manufacture. In the medium term manufacturing is expected to grow at 3.8%. In the past ten years, the agriculture sector has averaged 34% of real GDP. Any fluctuations in GDP are due to agriculture fluctuations. This sector is expected in the medium term, to grow, ahead of population growth, by an average 10.7% per annum. Limestone, dolomite and lime products are associated with the agricultural sector and hence have a similar potential for growth. In general the economy is expected to perform positively with growth rates between 4.3 and 4.5% in the medium term. P:/94341/WP/VOLUME4.FES/PROMO/SECTIONS1 MET-CHEM April 1997 Malawi Limestone Project Summary Mining and Lime Manufacturing Feasibility Study Page 20 The current imports will remain until a local supply source is developed. There does not seem to be any improvement in sight from the current local small producers to meet the high grade technical requirements. Unfortunately the small producers are also hindered by energy and technology problems which will eventually squeeze them out of the industry creating shortages of low grade products as well. In addition, there are new projects, particularly the new sugar factory and the paper and pulp project, both of which will consume significant quantities of lime. It is vital for Malawi to be outward looking and participate in external markets. The Bwanje project provides a great opportunity for export development and it must be developed with a major aim to export lime and any other products that would attract external markets. The lime plant would be designed so that it can easily increase its capacity as market evolve from the initial 15 000TPA. The national economy may be able to absorb this level of production in the short to medium term in the absence of a fixed export market. P:/94341/WP/VOLUME4.FES/PROMO/SECTIONS1 MET-CHEM April 1997 Malawi Limestone project Summary Mining and Lime Manufacturing Feasibility Study 5.0 FINANCIAL EVALUATION 5.1 Introduction Page 21 The purpose of this financial evaluation is to measure the financial results and profitability of MIDCOR's proposed mine manufacturing facility for Bwanje limestone and lime products, under the present conditions in Malawi and based on the technical data and costs elements developed during this feasibility study. The financial analysis has been performed using the model COMFAR III of UNIDO the financial modelling and economic evaluation of capital investment project. The model projects the statements of profit and loss and sources and applications of fund. In addition, the criteria of the project are evaluated, including the internal rate of return (IRR) and the return on equity. Sensitivity analyses are also generated on the key variables of the project such as the total revenues, the operating costs and the investment costs. Cash flow tables, net income statement and the balance sheet with some pertinent performance ratios are also generated by the model. 5.2 Bases of the Analyses 5.2.1 Annual Production The proposed manufacturing facility will produce at a rated capacity of 33,750 tonnes per year with a product mix indicated as follows: - Hydrated lime: 18,750 tonnes; - Agricultural limestone 9,000 tonnes; - Pulverised limestone: 6,000 tonnes. Maximum capacity will be attained in operating year 1. 5.2.2 Period of the Analyses The project is analysed over a period of 17 years starting from year one, with the first two years corresponding to the construction period by 15 years of operation. P:94341/WP/VOLUME4.FES/PROMO/SECTIONS1 MET-CHEM April 1997 Malawi Limestone Project Summary Mining and Lime Manufacturing Feasibility Study 5.2.3 Page 22 Investment Costs The estimates of the investment costs are presented in section 2.0 of volume II of the feasibility study. The model includes all capital costs estimates as summarised as follows: - Mine equipment: $US 678,029; - Crushing/screening plant: $US 1,173,358; - Calcination plant: $US 5,075,746; - Hydration/Bagging plant: $US 1,374,900; - Indirect expenditures: $US 3,541,927. Initial Capital Expenditures Disbursement schedule is assumed over the construction period as follows: 5.2.4 - Year 1: 40% of total project cost; - Year 2: 60% of total project cost. Capital Structure The analyses assumes that 70% of the investments costs shall be financed through long term debt while the remaining 30% shall be contributed by equity participation. The debt financing cost is assumed to be an average of 9%, based on a mix of favourable financing through development institutions such as the African Bank and commercial supplier credits. The interest is capitalised during the 2 year construction period and fully amortised over 10 years as for the rest of long-term debt with a 5 year grace period. The repayment method is based on an annual constant payment of interest and principal. 5.2.5 Regulatory and Tax Issues - Import duty: exempt. All foreign sourced machinery and equipment are duty- P:/94341/WP/VOLUME4.FES/PROMO/SECTIONS1 MET-CHEM April 1997 Malawi Limestone Project Summary Page 23 Mining and Lime Manufacturing Feasibility Study - 5.2.6 Corporate tax calculation: A constant tax rate of 30% on taxable income has been assumed with a tax exemption for the first five (5) years after production start-up. Revenue Assumptions The revenues are projected on the basis of an annual sales of the total quantities produced of 18,750 tonnes of hydrated lime and 15,000 tonnes of limestone products. Sales of finished products are assumed to be for local consumption at the following equivalent prices: 5.2.7 - Hydrated lime: $US 150 / tonne; - Agricultural limestone: $US 50 / tonne; - Pulverised limestone: $US 50 / tonne. Depreciation and Amortisation Depreciation of plant and machinery and amortisation of pre-operating expenses and capitalised interests during construction have been calculated on the Straight Line Method (SLM) based on the life indicated below. There is no consideration for equipment replacement of the period of the analysis. 5.2.8 - Plant and machinery: 15 years; - Mining equipment: 10 years; - Pre-production expenditures: 10 years; - Capitalised interest: 10 years. Projections of Operating Costs The basis for estimating the operating costs is presented in section 3.0 of volume II and the average costs are summarised below; - Hydrated lime: $US 39.61 / tonne; - Agriculture limestone: $US 17.10 / tonne; - Pulverised limestone: $US 17.10 / tonne. P:/94341/VOLUME4.FES/PROMO/SECTIONS1 MET-CHEM April 1997 Malawi Limestone Project Summary Mining and Lime Manufacturing Feasibility Study 5.2.9 Page 24 Discount Factor The discounted cash flow has been calculated using a discounting rate of 10%. This rate is higher than the interest cost and will give a conservative Net Present Value for the project for the purpose of decision making on the investment and project implementation. 5.2.10 Initial Working Capital The working capital is the amount of cash which must be available to cover accounts payable, accounts receivable, and maintain a constant inventory of supplies and spare parts, raw material either in the production facility, being processed or finished products in storage, and other cash requirements, including cash-in-hand. The COMFAR MODEL assumes that when possible, the working capital requirements will be funded by internal cash flow. When the capital requirements are not met, a revolving short-term domestic loan facility is used. This type of loan is paid back immediately as surplus cash becomes available. The criteria used for the calculation of the working capital requirements is as follows: - Inventory Raw materials: 10 days Factory supplies: 15 days Work in progress: 5 days Finished products: 5 days - Accounts receivable 5 days - Cash-in-hand 2 days - Accounts payable: 10 days P:/94341/WP/VOLUME4.FES/PROMO/SECTIONS1 MET-CHEM April 1997 Malawi Limestone Project Summary Mining and Lime Manufacturing Feasibility Study Page 25 5.2.11 Inflation and Escalation A 0% inflation rate and escalation rate have been assumed throughout the years of the financial evaluation. The analyses are done based on constant money terms. 5.3 Interpretation of Results The financial projections were performed only in constant dollar terms based on the assumptions presented above. On the basis of this projections, the internal rate of return on the investment is established at about 17.0% on an after tax basis assuming 100% of equity financing. This rate represents the absolute profitability of the project and with such a level is high enough to justify the project implementation in view of normal international standards for this type of industrial project, provided that the Malawi business environment does not present any abnormal investment risk. With the assumption of debt financing accounting for 70% of the total investment the internal rate of return on equity is established at about 28.0% after tax and financial charges. This value should be sufficiently high enough to attract private investment from the Malawi and foreign business community to the project. The net present value with a discount interest rate of 10% is established at $US 4,476,690 dollars. This positive net present value confirms the profitability of this Bwanje limestone project. The payback period, which represents the required time for the project cumulative generated cash flows to be positive, is established at 7 years from the construction start up. The payback from the production start-up is only 4 years. The sensitivity analysis of the project IRR to changes in the major elements of the cash flow, (capital expenditures, operating costs and production sales prices) have been examined. The results of this analysis are included graphically after the summary sheets at the end of section 4 of volume II. This makes it possible to estimate the effect on the IRR produced by variation of any one or any combination of the key project variables. The project seems to be more sensitive to variations in revenues and moderately sensitive to the operating and capita costs. Under the conditions of these financial projections the Bwanje Valley Limestone feasibility study confirmed the viability of the project based on an positive IRR and the ability of the project to generate sufficient cash to cover operating and expenses and debt repayments. P:/94341/WP/VOLUME4.FES/PROMO/SECTIONS1 MET-CHEM April 1997