social_security

advertisement

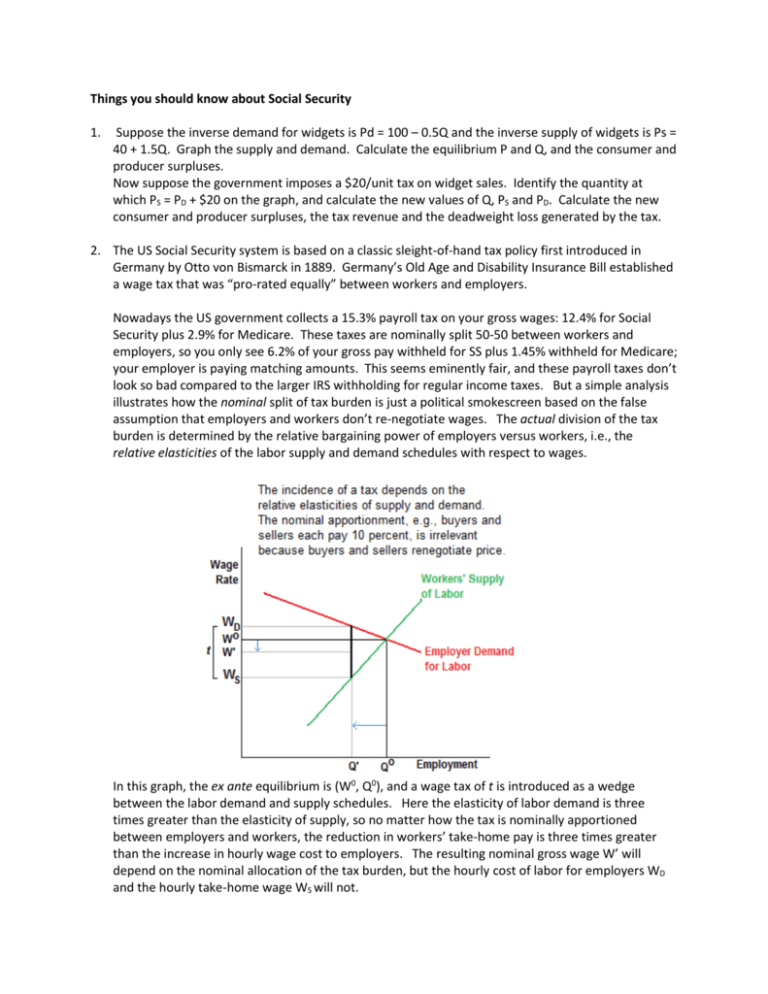

Things you should know about Social Security 1. Suppose the inverse demand for widgets is Pd = 100 – 0.5Q and the inverse supply of widgets is Ps = 40 + 1.5Q. Graph the supply and demand. Calculate the equilibrium P and Q, and the consumer and producer surpluses. Now suppose the government imposes a $20/unit tax on widget sales. Identify the quantity at which PS = PD + $20 on the graph, and calculate the new values of Q, PS and PD. Calculate the new consumer and producer surpluses, the tax revenue and the deadweight loss generated by the tax. 2. The US Social Security system is based on a classic sleight-of-hand tax policy first introduced in Germany by Otto von Bismarck in 1889. Germany’s Old Age and Disability Insurance Bill established a wage tax that was “pro-rated equally” between workers and employers. Nowadays the US government collects a 15.3% payroll tax on your gross wages: 12.4% for Social Security plus 2.9% for Medicare. These taxes are nominally split 50-50 between workers and employers, so you only see 6.2% of your gross pay withheld for SS plus 1.45% withheld for Medicare; your employer is paying matching amounts. This seems eminently fair, and these payroll taxes don’t look so bad compared to the larger IRS withholding for regular income taxes. But a simple analysis illustrates how the nominal split of tax burden is just a political smokescreen based on the false assumption that employers and workers don’t re-negotiate wages. The actual division of the tax burden is determined by the relative bargaining power of employers versus workers, i.e., the relative elasticities of the labor supply and demand schedules with respect to wages. In this graph, the ex ante equilibrium is (W0, Q0), and a wage tax of t is introduced as a wedge between the labor demand and supply schedules. Here the elasticity of labor demand is three times greater than the elasticity of supply, so no matter how the tax is nominally apportioned between employers and workers, the reduction in workers’ take-home pay is three times greater than the increase in hourly wage cost to employers. The resulting nominal gross wage W’ will depend on the nominal allocation of the tax burden, but the hourly cost of labor for employers WD and the hourly take-home wage WS will not. Try working through a numerical example. Assume the elasticity of employer demand for labor with respect to wages is %ΔQ/%ΔWD = +1.5, the elasticity of employee supply is %ΔQ/%ΔWS = –0.5, and the ex ante equilibrium is Q0 = 100 million workers employed at an average wage W0 = WD = WS = $10 per hour. Now suppose the government imposes a 20% wage tax where employers pay 10% on their payrolls, and withhold 10% of gross wages from employees’ paychecks. Calculate the ex post equilibrium level of employment Q’, the new gross wage rate W’, the employer wage cost 1.1W’ and the take-home wage 0.9W’. Calculate the total tax revenue and deadweight loss generated by this tax. 3. Now try working the reverse analysis with real numbers. With the 15.3% payroll tax in place, the US currently has about 150 million workers employed at an average reported hourly wage of about $16.80. Assume the elasticity of demand for US labor with respect to wages is -1.0, and the elasticity of labor supply with respect to wages is +0.5. Calculate what US employment and the average hourly wage would be in the absence of Social Security and Medicare taxes. Calculate the aggregate deadweight loss generated by these taxes. Some criticisms of Social Security: Social Security taxes are euphemistically called “contributions” as if you are voluntarily contributing to your own retirement, but there’s nothing voluntary about them. Your “contributions” are being spent on today’s retirees, and by the time you retire the system as currently designed would be bankrupt. As US life expectancies continue to increase and the baby boom generation retires, the ratio of workers to SS recipients will keep falling. In the 1930’s there were about 11 workers per SS recipient versus a little over 3 workers per SS recipient today. Don’t expect any bold reforms from Congress: seniors vote, and the AARP and the other lobbying groups for seniors are too powerful. Congress will have to make occasional tweaks in the program to keep it solvent: it will probably keep increasing the minimum ages at which people can receive SS benefits, make all earnings taxable (currently any earnings over $102,000 are exempt from SS taxes), make all benefits taxable, reduce benefits to the wealthiest seniors, etc. The bigger political challenge will be to keep Medicare solvent. Don’t fall for the sob-story about seniors living on “fixed” incomes. Social Security benefits have an annual cost-of-living adjustment (COLA) indexed to average wages. Recent COLA’s were 4.1% in 2006, 3.3% in 2007 and 2.3% in 2008. Average wages typically increase faster than prices (the CPI), so real SS benefits actually increase over time. And average (mean) wages—along with SS benefits—have been increasing faster than median wages. The SS tax is regressive because incomes over the taxable threshold ($102,000 in 2008) are exempt from the tax, while all eligible seniors including Warren Buffett collect full SS benefits. The system taxes the working poor so that millionaire retirees can buy martinis. Same thing with Medicare: workers who can’t afford their own health insurance pay Medicare taxes, so millionaire seniors get subsidized Viagra while poor children are denied critical medical care. The unfairness is compounded by the fact that rich people typically live longer and collect larger monthly SS benefits than poor people.