violations compensation

advertisement

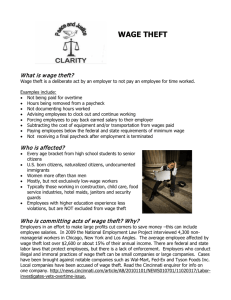

Talking points for the Wage Theft Bill – HB 1518 Misclassification The most basic assumption workers make when they show up to a job is that they will get paid for the time they spend working. But this doesn’t happen for thousands of workers across Washington state. Far too many workers are denied the fair wages they’ve earned for their labor, and their unscrupulous employers avoid paying the taxes, workers’ compensation contributions, and unemployment insurance premiums that are owed. These revenues are necessary to ensure that K-12 education is funded, and that injured workers heal and return to their jobs. Most businesses play by the rules, but those that choose to cheat the system and their employees make it harder for good corporate citizens to compete, and create jobs. By taking a stand against wage theft, the State Legislature can level the playing field for responsible employers, ensure workers get what they’ve earned, and shore up the state’s troubled General Fund. General Talking Points: MINIMUM WAGE VIOLATIONS: One of every four workers – 26 percent – had experienced being paid less than the legally required minimum wage. These violations were not trivial. Fully 60 percent of those violations involved being underpaid by more than $1 per hour. OVERTIME PAY VIOLATIONS: Three of every four workers – 76 percent – had experienced being denied legally required overtime wages. The average worker reporting this violation had put in 11 hours of overtime – hours that were either underpaid or not paid at all. TIP VIOLATIONS: 12 percent of tipped workers had experienced tip stealing by their employer or supervisor, which is illegal. Women are significantly more likely than men to experience minimum-wage violations. Foreign-born workers are nearly twice as likely as their U.S.-born counterparts to have a minimum-wage violation. Among U.S.-born workers, African-Americans had a violation rate that’s triple that of white counterparts. Talking points for Misclassification Bill This bill is intended to address the illegal under-payment or non-payment of wages, and the intentional misclassification of employees as independent contractors. To provide clarification, this bill does not eliminate the ability for a worker to be an independent contractor. It simply says that we must have a bright line – a bright line definition that allows true, bona fide, independent contractors to continue their work, but we also must appropriately classify workers who are truly employees. Our testimony today will speak directly to fiscal aspects, as this bill has direct positive fiscal impacts for: o Washington State’s revenue coffers, o Honest employers and their earning capacity, and o For the ability to help workers put earned money on the kitchen table. When employers operate in the underground economy, they force legitimate businesses to pay more than their fair share in taxes, unemployment insurance and workers’ compensation. Cheaters who rake in profits by paying little or no taxes and underpaying workers are putting additional tax burden on legitimate businesses. Cheating employers shift the cost to the state, place unnecessary burdens on the safety net and rob the state of owed revenue. States stand to recover hundreds of millions in lost revenue by addressing misclassification. o We want Washington State to be among these states recovering this owed state revenue. o New York state passed the Wage Theft Prevention Act four years ago and estimated that $427 million a year would be recovered by clamping down on illegal classification and underpayment of wages. Please pass HB 1518 to recover taxes, owed wages, and level the playing field. Resources: Independent Contractor Misclassification Imposes Huge Costs on Workers and Federal and State Treasuries, NELP, 6/2010. Partnering to Prevent Fraud and Abuse, Annual Fraud Report to the Legislature, WA State LNI, 2012. Cracking Down on Wage Theft, Progressive States Network, April 2012. Unregistered Business Study, WA State DOR, LNI, ESD, November 2007.