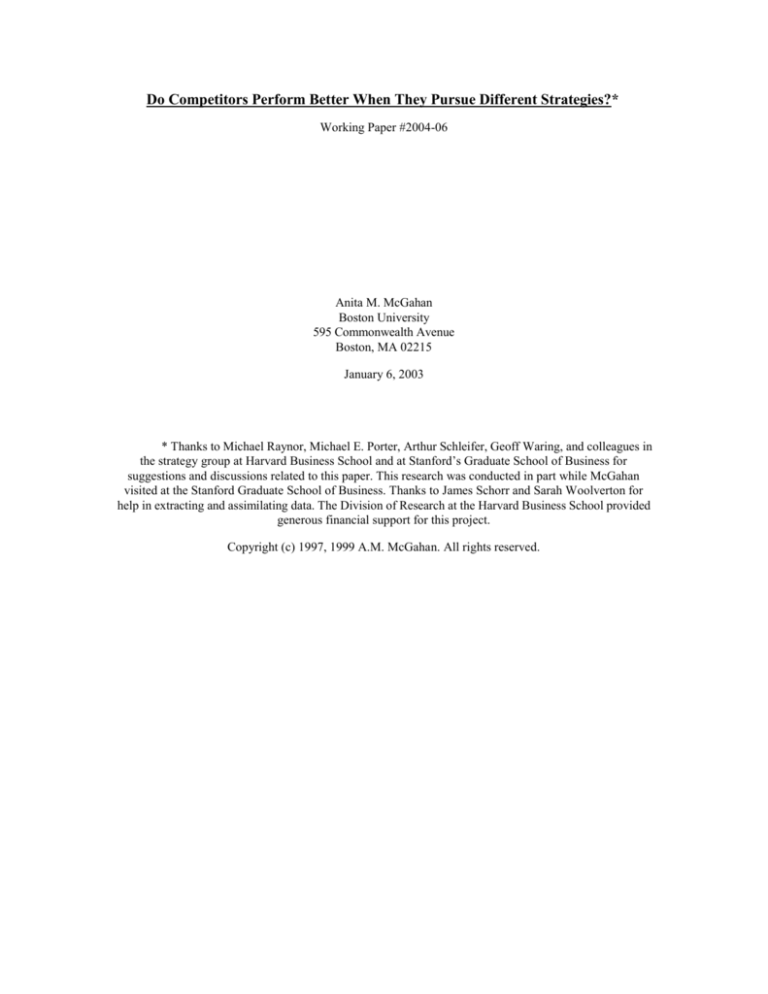

Do Competitors Perform Better When They Pursue Different Strategies?*

Working Paper #2004-06

Anita M. McGahan

Boston University

595 Commonwealth Avenue

Boston, MA 02215

January 6, 2003

* Thanks to Michael Raynor, Michael E. Porter, Arthur Schleifer, Geoff Waring, and colleagues in

the strategy group at Harvard Business School and at Stanford’s Graduate School of Business for

suggestions and discussions related to this paper. This research was conducted in part while McGahan

visited at the Stanford Graduate School of Business. Thanks to James Schorr and Sarah Woolverton for

help in extracting and assimilating data. The Division of Research at the Harvard Business School provided

generous financial support for this project.

Copyright (c) 1997, 1999 A.M. McGahan. All rights reserved.

1

Abstract

This paper describes the relationships between industry-average performance and strategic diversity among a

broad cross-section of firms in the American economy from 1981 to 1997. Industry-average performance is

measured using Tobin’s q and accounting profitability. Diversity in strategy among direct competitors is

characterized by differences in size, operating margin, asset composition, asset utilization, and focus. The

results indicate that competitors in high-performance industries are diverse in both their fixed characteristics

and in their tendencies to converge to the industry norm. However, contrary to the theoretical tradition of

“perfect competition,” the results also associate strategic diversity with low-performance industries. As a

whole, the study suggests that research is needed to understand the structural factors that attract firms into

industries with consistently low performance.

28

While the results weakly support the isolationist view of high-performance industries, they do not

provide evidence of widespread “perfect competition” in low-performance industries. Contrary to

prediction, competitors in the low-performance industries differ significantly in the measures most

important to the theory: asset composition and asset utilization. A number of candidate explanations for

the diversity among competitors in the low-performance industries arise. First, some efficient businesses

may have become locked into poor positions that had once delivered better results. Second, entry barriers in

some low-performance industries may allow inefficient leaders to continue operations. Third, some

businesses may be engaged in investment programs and may be weathering low returns for future reward.

Further theoretical and empirical research is needed to understand the prevalence of these and other

explanations for low industry performance.

References

Abreu, Dilip (1986), “Extremal Equilibria of Oligopolistic Supergames,” Journal of Economic Theory 39,

pp. 191-225

Axelrod, Robert (1984), The Evolution of Cooperation (New York: Basic Books, Inc.)

Bain, Joe S. (1956), Barriers to New Competition (Cambridge, MA: Harvard University Press)

Baldwin, John R. (1995), The Dynamics of Industrial Competition: A North American Perspective

(Cambridge, UK: Cambridge University Press)

Baker, Jonathan B. (1989), “Identifying Cartel Policing Under Uncertainty: The U.S. Steel Industry, 19331939,” Journal of Law and Economics 32, pp. S47-S76

Bresnahan, Timothy F. (1987), “Competition and Collusion in the American Automobile Market: The 1955

Price War,” Journal of Industrial Economics (June), pp. 457-482

Caves, Richard E., Michael E. Porter and A. Michael Spence (1980), Competition in the Open Economy: A

Model Applied to Canada (Cambridge, MA: Harvard University Press)

Cubbin, J. and P. Geroski (1987), "The Convergence of Profits in the Long Run: Inter-firm and Interindustry Comparisons," Journal of Industrial Economics 35 (June), pp. 427-442

Ellison, Glenn (1994), “Theories of Cartel Stability and the Joint Executive Committee," Rand Journal of

Economics 25:1, pp. 37-57

Ghemawat, Pankaj (1991), Commitment: The Dynamic of Strategy (New York: Free Press)

Lang, Larry H.P. and Rene M. Stulz (1994), “Tobin’s q, Corporate Diversification, and Firm

Performance,” Journal of Political Economy 102:6, pp. 1248-1280

McGahan, Anita M. (1995), “Cooperation in Prices and Capacities: Trade Associations in Brewing After

29

Repeal,” Journal of Law and Economics (October)

McGahan, Anita M. (1999a), “Competition, Strategy, and Business Performance,” California Management Review

(Spring)

McGahan, Anita M. (1999b), “The Performance of U.S. Corporations: 1981-1994,” Journal of Industrial

Economics (forthcoming)

McGahan, Anita M., and Michael E. Porter (1997a), “How Much Does Industry Matter, Really?”, Strategic

Management Journal (Summer Special Issue)

McGahan, Anita M. and Michael E. Porter (1997b), “The Emergence and Sustainability of Abnormal Profits,”

working paper, Harvard Business School

McGahan, Anita M. and Michael E. Porter (1997c), “The Components of Accounting Profit,” working paper,

Harvard Business School

McGahan, Anita M. and Michael E. Porter (1999), “The Persistence of Shocks to Profitability,” Review of

Economics and Statistics (Spring)

Mueller, Dennis C. (1977), "The Persistence of Profits Above the Norm," Economica 44 (November), pp. 369-380

Mueller, Dennis C. (1986), Profits in the Long Run (Cambridge, UK: Cambridge University Press)

Nickell, Stephen(1981), “Biases in Dynamic Models with Fixed Effects,” Econometrica 49:6 (November), pp. 14171426

Porter, Michael E. (1996), “What is Strategy?,” Harvard Business Review (November-December 1995)

Porter, Robert H. (1983), “A Study of Cartel Stability: The Joint Executive Committee, 1880-1886,” Bell Journal of

Economics 14, pp. 416-426

Rumelt, Richard P. (1991), "How Much Does Industry Matter?," Strategic Management Journal 12, pp. 167-85

Schmalensee, Richard (1985), “Do Markets Differ Much?,” American Economic Review 75, pp. 341-351

Tirole, Jean (1988), “Dynamic Price Competition and Tacit Collusion,” chapter 6 in The Theory of Industrial

Organization (Cambridge, MA: MIT Press)

Troy, Leo (1981-1998), Handbook of Business and Financial Ratios (Rutgers University Annual)

Waring, Geoffrey F. (1996), “Industry Differences in the Persistence of Firm-Specific Returns,” American Economic

Review (September)

Wernerfelt, Birger and Cynthia A. Montgomery (1988), "Tobin's q and the Importance of Focus in Firm

Performance," American Economic Review 78, pp. 246-250