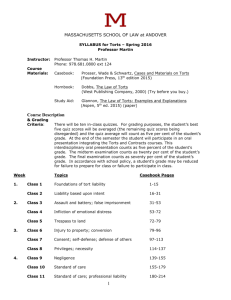

Torts, Epstein 7th - Internet Legal Research Group

advertisement