PowerPoint

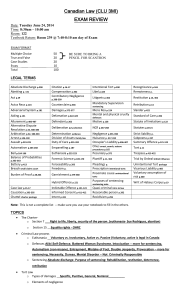

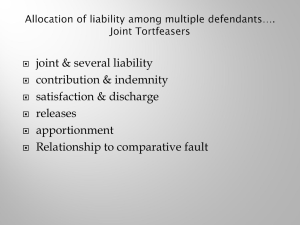

advertisement

Problems in Canadian Business Law Pol/Soc Sci 3165 6.0A Tuesdays, 2:30-5:30 pm Simon Archer sarcher@torys.com Administrative items Papers Marking on both writing ability and content Advice: choose a topic covered in the term For e.g., business associations, securities, corporate rights, intellectual property, etc. questions leave to next term Last class Tort law introduction Law of negligence or unintentional harms to others Duty of care, standard of care, causation, injury, defences Remedies … Economic loss Hedley Byrne v. Heller (p. 76 Willes’) Negligent misstatement and pure economic loss (no “injury”, purely lost profits not directly causally related to action of D) Bank makes wrong call on customer, advertising agency loses $$ Professional negligence grows from this case Cf. fiduciary duties (later in term) • Key difference is limiting doctrines – defences and remedies • No remoteness doctrine in equity, or fiduciary duties Remedies for negligence Theory: to restore the injured party to the original state as far as possible Vs. contract – forward looking – as if contract had been fulfilled Vs. criminal – penal – punish and deter Practice: money Damages (money compensation for loss) Special – relating to a loss but not direct General – the measure of the loss Nominal – where no loss (trespassing) Punitive – unusual, contra theory Remedies cont’d General damages Injury – physical • The meat chart (since 600/700 AD) Injury – non-physical, emotional, etc. • What is the measure? The damages trilogy in 1978: cost of care, cost of lost earnings, special costs, and nonpecuniary loss • Caps general damages at $100k indexed (now 300?) Remedies cont’d P also has the burden of proving the quantum of damages P is under an obligation to act reasonably in all circumstances of the case to mitigate his losses. D has the burden of proving that P failed to do so. D is allowed to set off against P's damage claim any parallel expenditures that P would have incurred had the tort not been committed Remedies cont’d At common law, damages are awarded in a lump sum to compensate P for all the losses he has suffered and will likely suffer in the future. However, this lump sum cannot always anticipate future needs or high inflation rates. If a loss turns out to be far greater or smaller than that calculated at trial, there is no means of reassessment. Although lump sum awards are non-taxable, the interest it generates when invested is taxable. As a result, periodic payments are a central feature of the increasing number of structured settlements being reached by parties. In most cases, D's insurer purchases an annuity designed to generate periodic payments for P's life. Remedies cont’d In a jury trial it is the jury's responsibility to assess damages (questions of fact). Council cannot mention to the jury the amount of general damages s/he feels is appropriate. Expert witnesses, while allowed to comment on the extent of P's injuries, cannot suggest a monetary value for these losses. A judge may not express his opinion on the quantum of damages. Nor may previous awards in similar cases be mentioned. All these rules lead to a problem of consistency in damage awards. However, the Courts of Justice Act, S.O. 1984, c.11, s.130, as amended by S.O. 1989, c.67, s.4, allows the parties and the judge to inform the jury on general damages awards. No other jurisdiction has taken this step. Hot issue: auto insurance The system: no fault insurance Regardless of fault, your insurer pays Must have insurance Limitations on ability to sue Rarely a “pure” no fault system, but hybrids Two completely no-fault jurisdictions in Canada - Manitoba and Quebec Auto insurance cont’d Details contained in an Insurance Act -determines the fault given default rules • • • • • Faster, no lawyers, mandatory insurance Focus on rehabilitation (14 days to payout) In hybrid systems usually property not covered Policy (read: profit) in tort? Allows insurers to raise premiums to recoup costs Election issue across Canada: cost of auto insurance premiums/public auto insurer: single provider to cap costs (would be a non-profit insurer) Public insurers in B.C., Sask, Man. Specific applications Occupier’s liability (last class) Professional liability (last class) Manufacturer’s liability (last class) Strict liability Vicarious liability Strict liability Liability for injury or loss based on factual cause alone Can apply to inherently, obviously very risky activities products liability (res ipsa loquitur?) keeping of wild or ferocious animals abnormally dangerous activities (e.g., storing, transporting, or using explosives in a populated area) Vicarious liability In some circumstances, one person is liable for the tortious in/actions of another Usually seen in employment context Must be committed in course of employer’s business Cf. partnership (next spring) By statute: drivers of your car Professional liability Special duties and standards of care (discussed above) Concurrent liability in equity (fiduciary relationships) Special torts: negligent misstatements & misrepresentation Hedley Byrne v. Heller – pure economic loss Manufacturer’s liability Since Donoghue case Effectively a strict liability standard, subject to available defences Must show some negligent aspect of the manufacture Often a battle over warnings – were they sufficient to warn of risks associated with use of product? Risk shifting in theory … an example Important because much law-and-economics based on this kind of analytics In U.S. v. Carroll Towing Co., (1947) Judge Learned Hand considered a case in which a tugboat had broken away from a barge, the barge later sank: ... the owner's duty, as in other similar situations, to provide against resulting injuries is a function of three variables: (1) The probability that she will break away; (2) the gravity of the resulting injury, if she does; (3) the burden of adequate precautions. Possibly it serves to bring this notion into relief to state it in algebraic terms: if the probability be called P; the injury, L; and the burden, B; liability depends upon whether B is less than L multiplied by P: i.e., whether B < P × L Risk shifting in theory … an example This is one of the few reported judicial decisions in the USA that contains an equation. After the loss, L, has occurred, it is easy to identify the specific measure(s) that allegedly should have been taken to prevent the loss and focus on just one or two lossprevention measures Before the loss, there are N possible losses, L1, L2, L3, L4, ... Lnth, each of which can be prevented by measures that cost less than the probability of injury times the amount of loss. But, the manufacturer or service provider might have an uneconomical product or service if all N loss-prevention measures were taken Really a problem of all normative economics: descriptive utility, prospective futility Negligence flow chart Is there an injury? Is there a duty owed? Was the standard discharged? Did the act/omission cause the injury? Are there any defences? What are the types of damage? What quantum? Questions Do professionals have duties to third parties? Why do we consider public policy issues in nuisance, but sometimes not in negligence? Professional liability Where a professional can reasonably foresee third parties relying on their acts (e.g., the issuance of financial statements for certain purposes), there is likely a duty of care not to make negligent errors to that third person Courts will be wary of extending this duty to all third parties, and will probably circumscribe it Public policy in nuisance In nuisance cases the remedy to the individual may also have direct impact on the community, and both interests are weighed by a court Shutting down a smelly plant may lose jobs Do we treat negligence differently? Should we? Sample problem D operates a small food stand at an open air market where farmers in close proximity to each other set up makeshift stalls or tables to display their produce. To protect themselves from the sun or rain, most have canvas canopies over their stalls. D has several small propane stoves on her stall to prepare food, which is done in oil. While service a customer, a kid about 16 years old turns up the flame and the oil catches fire. In an attempt to put out the fire, she throws the pot and splashes the kid, whose clothes catch on fire and burn his skin. The pot lands in a farmer’s stall and sets fire to the canopy. The farmer kicks it into another stall, where it sets fire to paper food wrapping. By the time the fires are put out, three stalls are destroyed, and D and the kid have been to hospital. What are the rights and remedies of the parties? Sample answer To whom was a duty owed? Kid? Farmer next door? Second, third farmers? By whom? What content of duty? Kid? Should it be less for kids? Farmer next door? Other farmers? Sample answer cont’d Is causation an issue? Did D cause injury to second and third farmer? Does she have a defence? What injury? Injury to kid: is there a defence? Loss of property Loss of income Others? Tort II: Nuisance Cause of action is an “interference with use and enjoyment of land” Generally includes smells or noises, sometimes light, sightlines, views, etc. Derives from property rights: right to exclude others from your property (e.g., tort of trespass) An aside on property and law Aside: fundamental or core legal concepts facilitating market economies Contract: freedom of, and freedom from contract Rights of private property: not only to own, but to exclude others from using Expressions of a political arrangement: ownership of the combination of labour and capital will belong to the property-owner, not the labourer No inherent “legal” reason for this arrangement See also privacy rights Derived in one theory from trespass Are privacy rights human rights? Limiting doctrines for nuisance The cause gets restricted in several ways: acceptable community standards reasonable or ordinary purposes public policy or desirable actions Remedies Remedies include injunction or damages Rogers, 1888 - ringing of chruch bells found to be within community standard. No express malice or intent on part of ringer Shuttleworth v. Vancouver Hospital, 1927 BCSC - Anticipatory injunction by neighbour of proposed disease hospital; not considered cause of action because no “widespread belief or proof in fact” that disease will spread Miller v Jackson, 1977, HL, cricket as public good. Injunction sought. Probability of injury cited as limiting plaintiff case, utility of cricket, precedence of site over housing development, and offer of damage payment ‘adequate’ for risk Spur v. Webb 1972, Ariz. SC - Feed lot near a new subdivision has injunction against it for loss of sales (not by residents) by developer. Injunction reversed by SC. Video Tort III: Intentional torts Interference with the person with a person’s reputation with property Often concurrent with criminal sanction (e.g., assault) Assault and battery Willes discusses, not really business law Consent Assault: intent to injure Battery: touching without consent Explicit and implicit (say, a fight) False imprisonment also an intentional tort – requires only threat of same to establish Libel and slander Defamation/tort against reputation Libel (written) Slander (oral) Defences Truth of statement Privilege • qualified – letters of reference – a defence if you believed them to be true • absolute – elected officials Interference with property Trespass entering on land without consent act must be intentional (lack of voluntariness is a defence) Conversion Wrongful taking of goods Willful damage to same Some intentional torts Slander of goods, title Breach of confidence Same as defamation where business has the same “asset” of a good name Esp. in negotiations where secrets traded etc. Conspiracies in restraint of trade Deceit Fraudulent conversion of goods Unfair business practices Next class Law of Obligations II: contracts