Use your Edge format where appropriate (I haven`t got a

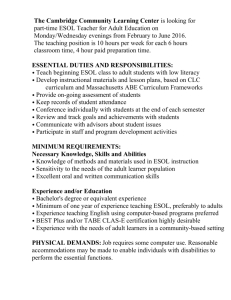

advertisement

K2L Limited - Business Plan:executive summary Vision: K2L will transform the English language learning experience through the use of technology by commercialising two highly innovative products for the fastgrowing digital English language learning market. Products: 1. ESOL (English to Speakers of Other Languages) - an SQA qualification that can be achieved entirely online on iPad or windows devices, delivered via K2L’s collaborative learning platform which includes: low cost web-conferencing app for live online teaching and assessment c 100 + hours of multimedia, interactive digital content system for tracking student progress. additional integrated technologies – recording/playback function, grammar guide, dictionary, email, forum and e portfolio The new National 4 ESOL qualification, required for British citizenship, is assessed by SQA Approved Centres such as colleges and schools. K2L has also been certified as an approved SQA teaching centre to deliver the course directly to the end user and for e-assessment. Endorsement by SQA of the course material was completed on 10.7.14. 2. ProTalk - an innovative software pronunciation app with greater analytical capacity and user engagement than any current product. Current status: market-leading position confirmed by independent market research. product development assisted by £100k Technology Strategy Board (TSB) funding through an R&D project with Napier University second round funding for £250k also been secured through TSB: no issues foreseen over the licensing of TSB derived technology SMART grant for £70k under negotiation. Resources: The company’s founder, a RSE Enterprise Fellow Ann Attridge, with over twenty years experience in language education and research, is supported by an experienced non-executive chairman. Technology advice, IT skills, development and implementation provided by contracted business and original shareholder, Robert Rennie. Contracted Business Development Director, Gordon McKeown, who understands and believes in the market concept, leads marketing, sales and commercialisation efforts. Financial management and facilities provided by the Strathclyde University Incubator Unit whose manager is also a director of the company. K2L currently has a team of five digital designers/developers to drive its vision of exploiting technology for the learning market. The imminent completion of the core product, the recent addition of two graduates with a greater range of skills and outsourcing programming work will provide a sufficient team to support the planned products with minimal additional resource. Annual accounts and TSB reports prepared by Campbell Dallas and legal advisors are Wright Johnston Mackenzie. Contract work: The combined skills of the team have already attracted interest from others needing digital learning programmes e.g. International Correspondence School, SQA International, ecancer, Oracle Academy, School for CEOs, Skills Development Scotland and an Online Skills Pilot with the DWP/BIS. These options provide contract work opportunities that will take second place to the development of the ESOL and ProTalk products and product application derivations identified under sales prospects. Sales prospects: Sales will start from Q4 2014 and are planned to be developed as follows, the first orders having already been achieved: YEAR 1 A. By targeting clearly defined segments within the global ESOL market: National 4 ESOL course 1. Scottish FE colleges with a high proportion of ESOL students 2. The B2C market -as an Approved Centre, K2L can deliver the course directly to students with a range of flexible differentiated versions of the National 4 course: Self –paced individual learning – LEVEL 1 Collaborative learning LEVEL 2 Written tutor support for individuals LEVEL 3 Written tutor support for groups LEVEL 4 The full SQA qualification LEVEL 5 3. Global digital markets through iTunes with interactive ESOL textbook. ProTalk 4. Launching the product on the appstore and google play YEAR 2 National 4 ESOL course 1. Continuing with the development of the above activities and scaling all where there is commercial traction. 2. Entering the English college market where there is a high proportion of ESOL students 3. Partnering with SQA to deliver online the National 5/Higher ESOL qualification at a level comparable to IELTS 6.5, required for entrance to undergraduate study. Protalk 4. Licensing one or more mobile network operator partners overseas 5. Licensing a white label version to leading ELT publishers 6. Licensing a white label version to the British Council. 7 Incorporating the pronunciation technology into a children’s adventure game for the overseas market Contract work Accessing two new markets: 8. Contract work in the Health Care sector 9. Contract work for the 16-21 life/employability skills sector YEAR 3 National 4 ESOL course 1. Continuing to establish K2L in the Scottish FE market. 2. Expanding sales in English colleges. 3. Expanding sales of the National 5 (C1) SQA ESOL qualification to overseas centres. 4. Targeting the international schools market and other regional government programmes with the National 4 and National 5 qualifications through: UKTI The British Council The British Education Supplies Association The International Schools Consultancy group Protalk 5. Developing sales arising from the outcomes of TSB 2 for specific language groups e.g. using the data generated to customise the app for the Japanese market/the Spanish market etc. 6. Developing a range of apps for specific users e.g. beginner/advanced/ intermediate learners, Business English, call centre employees/ Academic English, English for Tourists etc. Contract work 7. Consolidating contract work in the Health Care sector 8. Consolidating contract work for the 16-21 life/employability skills sector in Scotland 9. Expanding sales of the above to the Skills Funding Agency in England. Three year financial forecasts: Attached are forecasted profit & loss, cashflows and balance sheets for the next three years on a monthly basis based on the revenues derived from the above product sales. It is difficult to make such forecasts at this relatively early stage but these are believed to be conservative with only modest growth projections in a high growth market. Convertible loan note: As requested of Gabriel Investment Syndicate, there is a short-term bridging funding requirement estimated at £50k. Because of the delay in the preparation of the TSB report, there is a gap of £5k in July 2014, but this will be funded through a planned deferral of invoiced costs. total of £50k requested provides a small buffer £25k will be provided by Gabriel investors as agreed. balance of £25k is requested from Scottish Investment Bank. The terms of the note are as already agreed with Gabriel Investment Syndicate i.e. unsecured loan for 24 months repayable as a bullet with 1% per month interest, convertible if not redeemed at a 20% discount. It should be noted that all loan repayments will be made as planned and Director’s Loan (Ann Attridge) will be paid off in May 2016 Chairman’s Fees will be payable only as from September 2015. Agreement from Scottish Investment Bank is requested to the matched funding of £25k with availability of funds by 25.8.14.