Chapter 15: Capital Structure: Basic Concepts

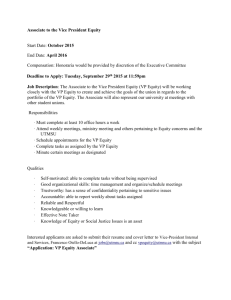

advertisement

Chapter 16: Capital Structure: Basic Concepts

16.1

a.

Since Alpha Corporation is an all–equity firm, its value is equal to the market value of its

outstanding shares. Alpha has 5,000 shares of common stock outstanding, worth $20 per share.

Therefore, the value of Alpha Corporation is $100,000 (= 5,000 shares * $20 per share).

b.

Modigliani–Miller Proposition I states that in the absence of taxes, the value of a levered firm

equals the value of an otherwise identical unlevered firm. Since Beta Corporation is identical to

Alpha Corporation in every way except its capital structure and neither firm pays taxes, the value

of the two firms should be equal.

Modigliani–Miller Proposition I (No Taxes):

VL =VU

Alpha Corporation, an unlevered firm, is worth $100,000 = VU.

Therefore, the value of Beta Corporation (VL) is $100,000.

c.

The value of a levered firm equals the market value of its debt plus the market value of its equity.

VL = B + S

The value of Beta Corporation is $100,000 (VL), and the market value of the firm’s debt is

$25,000 (B).

The value of Beta’s equity is:

S= VL – B

= $100,000 – $25,000

= $75,000

Therefore, the market value of Beta Corporation’s equity (S) is $75,000.

d.

Since the market value of Alpha Corporation’s equity is $100,000, it will cost $20,000 (= 0.20 *

$100,000) to purchase 20% of the firm’s equity.

Since the market value of Beta Corporation’s equity is $75,000, it will cost $15,000 (= 0.20 *

$75,000) to purchase 20% of the firm’s equity.

e.

Since Alpha Corporation expects to earn $35,000 this year and owes no interest payments, the

dollar return to an investor who owns 20% of the firm’s equity is expected to be $7,000 (= 0.20 *

$35,000) over the next year.

While Beta Corporation also expects to earn $35,000 before interest this year, it must pay 13%

interest on its debt. Since the market value of Beta’s debt at the beginning of the year is $25,000,

Beta must pay $3,250 (= 0.13 * $25,000) in interest at the end of the year. Therefore, the amount

of the firm’s earnings available to equity holders is $31,750 (=$35,000 – $3,250). The dollar

return to an investor who owns 20% of the firm’s equity is $6,350 (= 0.20 * $31,750).

f.

The initial cost of purchasing 20% of Alpha Corporation’s equity is $20,000, but the cost to an

investor of purchasing 20% of Beta Corporation’s equity is only $15,000 (see part d).

Answers to End-of-Chapter Problems

B-

214

In order to purchase $20,000 worth of Alpha’s equity using only $15,000 of his own money, the

investor must borrow $5,000 to cover the difference. The investor must pay 13% interest on his

borrowings at the end of the year.

Since the investor now owns 20% of Alpha’s equity, the dollar return on his equity investment at

the end of the year is $7,000 ( = 0.20 * $35,000). However, since he borrowed $5,000 at 13% per

annum, he must pay $650 (= 0.13 * $5,000) at the end of the year.

Therefore, the cash flow to the investor at the end of the year is $6,350 (= $7,000 – $650).

Notice that this amount exactly matches the dollar return to an investor who purchases 20% of

Beta’s equity.

Strategy Summary:

1. Borrow $5,000 at 13%.

2. Purchase 20% of Alpha’s stock for a net cost of $15,000 (= $20,000 – $5,000 borrowed).

16.2

g.

The equity of Beta Corporation is riskier. Beta must pay off its debt holders before its equity

holders receive any of the firm’s earnings. If the firm does not do particularly well, all of the

firm’s earnings may be needed to repay its debt holders, and equity holders will receive nothing.

a.

A firm’s debt–equity ratio is the market value of the firm’s debt divided by the market value of a

firm’s equity.

The market value of Acetate’s debt $9 million, and the market value of Acetate’s equity is $30

million.

Debt–Equity Ratio = Market Value of Debt / Market Value of Equity

= $9 million / $30 million

= 0.03

Therefore, Acetate’s Debt–Equity Ratio is 30%.

b.

The cost of Acetate’s equity is:

rS = rf + S{E(rm) – rf}

= 0.07 + 0.85( 0.21 – 0.07)

= 0.189

The cost of Acetate’s equity (rS) is 18.9%.Assume a cost of debt of 14%(missing in the statement

of the problem).

Acetate’s weighted average cost of capital equals:

rwacc = {B / (B+S)} rB + {S / (B+S)}rS

= ($9 million / $39 million)(0.14) + ($30 million / $39 million)(0.189)

= (0.23)(0.14) + (.77)(0.189)

= 0.1777

Therefore, Acetate’s weighted average cost of capital is 17.77%.

Answers to End-of-Chapter Problems

B-

215

c.

According to Modigliani–Miller Proposition II (No Taxes):

rS = r0 + (B/S)(r0 – rB)

Thus:

0.189= r0 + (9/30)(r0 – 0.14)

Solving for r0:

r0 = 0.1777

Therefore, the cost of capital for an otherwise identical all–equity firm is 17.77%.

This is consistent with Modigliani–Miller’s proposition that, in the absence of taxes, the cost of

capital for an all–equity firm is equal to the weighted average cost of capital of an otherwise

identical levered firm.

16.3

Since Unlevered is an all–equity firm, its value is equal to the market value of its outstanding

shares. Unlevered has 10.4 million shares of common stock outstanding, worth $76 per share.

Therefore, the value of Unlevered is $790.4 million (= 10.4 million shares * $76 per share).

Modigliani–Miller Proposition I states that, in the absence of taxes, the value of a levered fir

equals the value of an otherwise identical unlevered firm. Since Levered is identical to Unlevered

in every way except its capital structure and neither firm pays taxes, the value of the two firms should be

equal.

Modigliani–Miller Proposition I (No Taxes):

VL =VU

Therefore, the market value of Levered, Inc. should be $790.4 million also.

Since Levered has 4.8 million outstanding shares, worth $98 per share, the market value of Levered’s

equity is $470.4 million. The market value of Levered’s debt is $275 million.

The value of a levered firm equals the market value of its debt plus the market value of its equity.

Therefore, the current market value of Levered, Inc. is:

VL

=B+S

= $275 million + $470.4 million

= $745.4 million

The market value of Levered’s equity needs to be $515 million, $44.6 million higher than its current

market value of $470.4 million, for MM Proposition I to hold.

Since Levered’s market value is less than Unlevered’s market value, Levered is relatively underpriced

and an investor should buy shares of the firm’s stock.

16.4

a.

Plan I:

Answers to End-of-Chapter Problems

B-

216

The earnings after interest will be:

$9,500 – $12,000(0.1) = $8,300

EPS = $8,300 / 900 shares = $9.22/share

Plan II:

The earnings after interest will be:

$9,500 – $15,000(0.1) = $8,000

EPS = $8,000 / 650 shares = $12.31/share

All equity: EPS = $9,500 / 1,100 shares = $8.63/share

Plan II has the highest EPS.

b.

Plan I:

The earnings after interest will be:

($9,500 – $12,000(0.1)) (1–.25) = $6,225

EPS = $6,225 / 900 shares = $6.91/share

Plan II: The earnings after interest will be:

($9,500 – $15,000(0.1) )(1–.25) = $6,000

EPS = $6,000 / 650 shares = $9.23/share

All equity: EPS = $95,000 (1–.25) / 1,100 shares = $6.47/share

Plan II has the highest EPS.

16.5

a.

To purchase 5 percent of Knight’s equity, the investor would need:

Knight investment = .05($1,714,000) = $85,700

And to purchase 5 percent of Veblen without borrowing would require:

Veblen investment = .05($2,400,000) = $120,000

In order to compare dollar returns, the initial net cost of both positions should be the same.

Therefore, the investor will need to borrow the difference between the two amounts, or:

Amount to borrow = $120,000 – 85,700 = $34,300

An investor who owns 5 percent of Knight’s equity will be entitled to 5 percent of the firm’s

earnings available to common stock holders at the end of each year. While Knight’s expected

operating income is $300,000, it must pay $60,000 to debt holders before distributing any of its

earnings to stockholders. So, the amount available to this shareholder will be:

Cash flow from Knight to shareholder = .05($300,000 – 60,000) = $12,000

Veblen will distribute all of its earnings to shareholders, so the shareholder will receive:

Answers to End-of-Chapter Problems

B-

217

Cash flow from Veblen to shareholder = .05($300,000) = $15,000

However, to have the same initial cost, the investor has borrowed $34,300 to invest in Veblen, so

interest must be paid on the borrowings. The net cash flow from the investment in Veblen will be:

Net cash flow from Veblen investment = $15,000 – .06($34,300) = $12,942

For the same initial cost, the investment in Veblen produces a higher dollar return.

b.

16.6

Both of the two strategies have the same initial cost. Since the dollar return to the investment in

Veblen is higher, all investors will choose to invest in Veblen over Knight. The process of

investors purchasing Veblen’s equity rather than Knight’s will cause the market value of

Veblen’s equity to rise and/or the market value of Knight’s equity to fall. Any differences in the

dollar returns to the two strategies will be eliminated, and the process will cease when the total

market values of the two firms are equal.

Before the restructuring the market value of Grimsley’s equity was $6,750,000 (= 150,000 shares * $45

per share). Since Grimsley issues $900,000 worth of debt and uses the proceeds to repurchase shares, the

market value of the firm’s equity after the restructuring is $5,850,000 (= $6,750,000 – $900,000).

Because the firm used the $900,000 to repurchase 20,000 shares, the firm has 130,000 (150,000 – 20,000)

shares outstanding after the restructuring. Note that the market value of Grimsley’s stock remains at $45

per share (= $5,850,000 / 130,000 shares). This is consistent with Modigliani and Miller’s theory.

Since Ms. Cannon owned $13,500 worth of the firm’s stock, she owned 0.2% (= $13,500 / $6,750,000) of

Grimsley’s equity before the restructuring. Ms. Cannon also borrowed $2,500 at 17% per annum,

resulting in $425 (= 0.17 * $2,500) of interest payments at the end of the year.

Let Y equal Grimsley’s earnings over the next year. Before the restructuring, Ms. Cannon’s payout, net of

personal interest payments, at the end of the year was:

(0.002)($Y) – $425

After the restructuring, the firm must pay $153,000 (= 0.17 * $900,000) in interest to debt holders at the

end of the year before it can distribute any of its earnings to equity holders. Also, since the market value

of Grimsley’s equity dropped from $6,750,000 to $5,850,000, Ms. Cannon’s $10,000 holding of stock

now represents 0.231% (= $13,500 / $5,850,000) of the firm’s equity. For these two reasons, Ms.

Cannon’s payout at the end of the year will change.

After the restructuring, Ms. Cannon’s payout at the end of the year will be:

(0.00231)($Y – $153,000) – $425

which simplifies to:

(0.00231)($Y) – $776.9

In order for the payout from her post–restructuring portfolio to match the payout from her pre–

restructuring portfolio, Ms. Cannon will need to sell 0.031% (= 0.00231 – 0.002) of Grimsley’s equity.

She will then receive 0.2% of the firm’s earnings, just as she did before the restructuring. Ignoring any

personal borrowing or lending, this will change Ms. Cannon’s payout at the end of the year to:

Answers to End-of-Chapter Problems

B-

218

(0.002)($Y – $153,000)

which simplifies to:

(0.002)($Y) – $306

Therefore, Ms. Cannon must sell $1,800 (= 0.00031 * $5,850,000) of Grimsley’s stock and eliminate any

personal borrowing in order to rebalance her portfolio. Her new financial positions are:

Ms. Cannon

Grimsley Shares Borrowing Lending

$

11,700 $

- $

-

Since Ms. Finley owned $58,500 worth of the firm’s stock, she owned 0.866% (= $58,500 / $6,750,000)

of Grimsley’s equity before the restructuring. Ms. Finley also lent $6,000 at 17% per annum, resulting in

the receipt of $1,020 (= 0.17 * $6,000) in interest payments at the end of the year.

Therefore, before the restructuring, Ms.Finley’s payout, net of personal interest payments, at the end of

the year was:

(0.00866)($Y) + $1,020

After the restructuring, the firm must pay $153,000 (= 0.17 * $900,000) in interest to debt holders at the

end of the year before it can distribute any of its earnings to equity holders. Also, since the market value

of Grimsley’s equity dropped from $6,750,000 to $5,850,000, Ms. Finley’s $58,500 holding of stock

now represents 1% (= $58,500 / $5,850,000) of the firm’s equity. For these two reasons, Ms. Finley’s

payout at the end of the year will change.

After the restructuring, Ms. Finley’s payout at the end of the year will be:

(0.01)($Y – $153,000) + $1,020

which simplifies to:

(0.01)($Y) – $510

In order for the payout from her post–restructuring portfolio to match the payout from her pre–

restructuring portfolio, Ms. Finley will need to sell 0.134% (= 0.01 – 0.00866) of Grimsley’s equity. She

will then receive 0.866% of the firm’s earnings, just as she did before the restructuring. Ignoring any

personal borrowing or lending, this will change Ms. Finley’s payout at the end of the year to:

(0.00866)($Y – $153,000)

which simplifies to:

(0.00866)($Y) – $1,324.98

Answers to End-of-Chapter Problems

B-

219

In order to receive a net cash inflow of $1,020 at the end of the year in addition to her 0.866% claim on

Grimsley’s earnings, Ms. Finley will need to receive $2,344.98 {= $1,020 – (–$1,324.98)} in personal

interest payments at the end of the year. Since Ms. Finley can lend at an interest rate of 17% per annum,

she will need to lend $13,794 (= $2,344.98 / 0.17) in order to receive an interest payment of $2,344.98 at

the end of the year. After lending $13,794 at 17% per annum, Ms. Finley’s new payout at the end of the

year is:

(0.00866)($Y – $153,000) + $2,344.98

which simplifies to:

(0.00866)($Y) + $1,020

Therefore, Ms. Finley must sell $7,839 (= 0.00134 * $$5,850,000) of Grimsley’s stock and add $7,839

more to her lending position in order to rebalance her portfolio. Her new financial positions are:

Ms. Finley

Grimsley Shares Borrowing Lending

$

50,661 $

- $ 7,839

Since Ms. Lease owned $23,580 worth of the firm’s stock, she owned 0.349% (= $23,580 / $6,750,00) of

Grimsley’s equity before the restructuring. Ms. Lease had no personal position in lending or borrowing.

Therefore, before the restructuring, Ms. Lease’s payout at the end of the year was:

(0.004)($Y)

After the restructuring, the firm must pay $153,000 (= 0.17 * $900,000) in interest to debt holders at the

end of the year before it can distribute any of its earnings to equity holders. Also, since the market value

of Grimsley’s equity dropped from $6,750,000 to $5,850,000, Ms. Lease’s $23,580 holding of stock now

represents 0.403% (=$23,580 / $5,850,000) of the firm’s equity. For these two reasons, Ms. Lease’s

payout at the end of the year will change.

After the restructuring, Ms. Lease’s payout at the end of the year will be:

(0.00403)($Y – $153,000)

which simplifies to:

(0.00403)($Y) – $616.59

In order for the payout from her post–restructuring portfolio to match the payout from her pre–

restructuring portfolio, Ms. Lease will need to sell 0.054% (= 0.00403 – 0.00349) of Grimsley’s equity.

She will then receive 0.349% of the firm’s earnings, just as she did before the restructuring. This will

change Ms. Lease’s payout at the end of the year to:

(0.00349)($Y – $153,000)

which simplifies to:

(0.00349)($Y) – $533.97

Answers to End-of-Chapter Problems

B-

220

In order to receive no net cash flow at the end of the year other than her 0.349% claim on Grimsley’s

earnings, Ms. Lease will need to receive $533.97 {= $0 – (–$533.97)} in interest payments at the end of

the year. Since Ms. Lease can lend at an interest rate of 17% per annum, she will need to lend

$3,141(=$533.97 / 0.17) in order to receive an interest payment of $533.97 at the end of the year. After

lending $3,141 at 17% per annum, Ms.Lease’s new payout at the end of the year is:

(0.00349)($Y – $153,000) + $533.97

which simplifies to:

(0.00349)($Y)

Therefore, Ms. Lease must sell $3,159 (0.00054 * $5,850,000) of Grimsley’s stock and lend $3,141 in

order to rebalance her portfolio. Her new financial positions are:

Ms.Lease

16.7

a.

Grimsley Shares Borrowing Lending

$

20,421 $

- $ 3,141

According to Modigliani–Miller the weighted average cost of capital (rwacc) for a levered

firm is equal to the cost of equity for an unlevered firm in a world with no taxes. Since

Rayburn pays no taxes, its weighted average cost of capital after the restructuring will

equal the cost of the firm’s equity before the restructuring.

Therefore, Rayburn’s weighted average cost of capital will be 17% after the restructuring.

b.

The cost of Rayburn’s equity after the restructuring is:

rS = r0 + (B/S)(r0 – rB)

= 0.17 + ($1,000,000 / $4,000,000)(0.17 – 0.11)

= 0.185

Therefore, Rayburn’s cost of equity after the restructuring will be 18.5%.

In accordance with Modigliani–Miller Proposition II (No Taxes), the cost of Rayburn’s equity

will rise as the firm adds debt to its capital structure since the risk to equity holders increases with

leverage.

c.

Rayburn’s weighted average cost of capital after the restructuring will be:

rwacc =

=

=

=

{B / (B+S)} rB + {S / (B+S)}rS

( $1,000,000 / $5,000,000)(0.11) + ($4,000,000 / $5,000,000)(0.185)

(1/5)(0.10) + (4/5)(0.20)

0.17

Consistent with part a, Rayburn’s weighted average cost of capital after the restructuring remains

at 17%.

Answers to End-of-Chapter Problems

B-

221

16.8

a.

Strom is an all–equity firm with 300,000 shares of common stock outstanding, where each share

is worth $20.

Therefore, the market value of Strom’s equity before the buyout is $6,000,000 (= 300,000 shares

* $20 per share).

Since the firm expects to earn $810,000 per year in perpetuity and the appropriate discount rate to

its unlevered equity holders is 13%, the market value of Strom’s assets is equal to a perpetuity

of $810,000 per year, discounted at 13%.

Therefore, the market value of Strom’s assets before the buyout is $6,230,769.23 (= $810,000 /

0.135).

Strom’s market–value balance sheet prior to the announcement of the buyout is:

Assets =

Total Assets =

b.

Strom, Inc.

########### Debt =

Equity =

########### Total D + E =

$

###########

###########

1. According to the efficient–market hypothesis, Strom’s stock price will change immediately to

reflect the NPV of the project. Since the buyout will cost Strom $300,000 but increase the

firm’s annual earnings by $120,000 into perpetuity, the NPV of the buyout can be calculated as

follows:

NPVBUYOUT= –$342,500+ ($126,000 / 0.13)

= $626,730.77

Remember that the required return on the acquired firm’s earnings is also 13% per annum.

The market value of Strom’s equity will increase immediately after the announcement to

$6,857,500 (= $6,230,769.23 + $626,730.77).

Since Strom has 300,000 shares of common stock outstanding and the market value of the firm’s

equity is $6,857,500, Strom’s new stock price will immediately rise to $22.858333 per share

$6,857,500 / 300,000 shares) after the announcement of the buyout.

According to the efficient–market hypothesis, Strom’s stock price will immediately rise to

$22.858333 per share after the announcement of the buyout.

2. After the announcement, Strom has 300,000 shares of common stock outstanding, worth

$22.858333 per share.

Therefore, the market value of Strom’s equity immediately after the announcement is $6,857,500

(= 300,000 shares * $$22.858333per share).

The NPV of the buyout is $626,730.77.

Strom’s market–value balance sheet after the announcement of the buyout is:

Answers to End-of-Chapter Problems

B-

222

Old Assets =

NPVBUYOUT =

Total Assets =

Strom, Inc.

$ 6,230,769.23 Debt =

$ 626,730.77 Equity =

$ 6,857,500.00 Total D + E =

$

$ 6,857,500.00

$ 6,857,500.00

3. Strom needs to issue $342,500 worth of equity in order to fund the buyout. The market value

of the firm’s stock is $22.858333 per share after the announcement.

Therefore, Strom will need to issue 14,983.5946 shares (=$342,500 / $22.858333per share) in

order to fund the buyout.

4. Strom will receive $342,500 (= 14,983.5946 shares * $22.858333 per share) in cash after the

equity issue. This will increase the firm’s assets by $342,500. Since the firm now has

315,589.8659 (= 300,000 + 14,983.5946 ) shares outstanding, where each is worth $22.858333,

the market value of the firm’s equity increases to $7,200,000 (=314,983.5946 shares *

$22.858333 per share).

Strom’s market–value balance sheet after the equity issue will be:

5. When Strom makes the purchase, it will pay $342,500 in cash and receive the present value of

its competitor’s facilities. Since these facilities will generate $126,000 of earnings forever,

their present value is equal to a perpetuity of $126,000 per year, discounted at 13%.

Old Assets =

Cash =

NPVBUYOUT =

$ 6,230,769.23 Debt =

$

342,500 Equity =

Total Assets =

$ 7,200,000.00 Total D + E =

$

$ 7,200,000.00

$626,730.77

$ 7,200,000.00

PVNEW FACILITIES = $126,000 / 0.13

= $969,230.77

Strom’s market–value balance sheet after the buyout is:

Old Assets =

PVNEW FACILITIES =

Total Assets =

Strom, Inc.

$ 6,230,769.23 Debt =

$ 969,230.77 Equity =

$ 7,200,000.00 Total D + E =

$

$ 7,200,000.00

$ 7,200,000.00

6. The expected return to equity holders is the ratio of annual earnings to the market value of the

firm’s equity.

Strom’s old assets generate $810,000 of earnings per year, and the new facilities generate

$126,000 of earnings per year. Therefore, Strom’s expected earnings will be $936,000 per

year. Since the firm has no debt in its capital structure, all of these earnings are available to

equity holders. The market value of Strom’s equity is $7,200,000.

The expected return to Strom’s equity holders is 13% (= $936,000 / $7,200.000).

Answers to End-of-Chapter Problems

B-

223

Therefore, adding more equity to the firm’s capital structure does not alter the required return

on the firm’s equity.

7. Strom’s weighted average cost of capital after the buyout is:

rwacc=

=

=

=

{B / (B+S)} rB + {S / (B+S)}rS

( $0/ $7,200,000)(0) + $7,200,000/ $7,200,000)(0.13)

(1)(0.13)

0.13

Therefore, Strom’s weighted average cost of capital after the buyout is 13 if Strom issues equity

to fund the purchase.

c.

1. After the announcement, the value of Strom’s assets will increase by the $626,730.77, the net

present value of the new facilities. Under the efficient–market hypothesis, the market value of

Strom’s equity will immediately rise to reflect the NPV of the new facilities.

Therefore, the market value of Strom’s equity will be $6,857,500 (= $6,230,769.23 +

$626,730.77) after the announcement. Since the firm has 300,000 shares of common stock

outstanding, Strom’s new stock price will be $22.858333 per share per share (=$$6,857,500 /

300,000).

Strom’s market–value balance sheet after the announcement is:

Old Assets =

NPVBUYOUT =

Total Assets =

Strom, Inc.

$ 6,230,769.23 Debt =

$ 626,730.77 Equity =

$ 6,857,500.00 Total D + E =

$

$ 6,857,500.00

$ 6,857,500.00

2. Strom will receive $342,500 in cash after the debt issue. The market value of the firm’s debt

will be $342,500.

Strom’s market–value balance sheet after the debt issue will be:

3. Strom will pay $342,500 in cash for the facilities. Since these facilities will generate $126,000

of earnings forever, their present value is equal to a perpetuity of $126,000 per year, discounted

Old Assets =

Cash =

NPVBUYOUT =

Total Assets =

Strom, Inc.

$

6,230,769 Debt =

$

342,500 Equity =

$ 626,730.77

$ 7,200,000.00 Total D + E =

$

342,500.00

$ 6,857,500.00

$ 7,200,000.00

at 13.5%.

PVNEW FACILITIES = $126,000 / 0.13

= $969,230.77

Strom’s market–value balance sheet after the buyout will be:

Answers to End-of-Chapter Problems

B-

224

Old Assets =

PVNEW FACILITIES =

Total Assets =

Strom, Inc.

$ 6,230,769.23 Debt =

$969,230.77 Equity =

$ 7,200,000 Total D + E =

$

342,500

$ 6,857,500.00

$ 7,200,000.00

4. The expected return to equity holders is the ratio of annual earnings to the market value of the

firm’s equity.

Strom’s old assets generate $810,000 of earnings per year, and the new facilities generate

$126,000 of earnings per year. Therefore, Strom’s earnings will be $936,000 per year. Since

the firm has $342,500 worth of 11% debt in its capital structure, the firm must make

$37,675 (= 0.11 * $342,500) in interest payments. Therefore, Strom’s net earnings are only

$898,325 (= $936,000 – $37,675). The market value of Strom’s equity is $6,857,500.

The expected return to Strom’s equity holders is 13.099% (= $898,325 / $6,857,500).

Therefore, adding more debt to the firm’s capital structure increases the required return on the

firm’s equity. This is in accordance with Modigliani–Miller Proposition II.

5. Strom’s weighted average cost of capital after the buyout will be:

rwacc= {B / (B+S)} rB + {S / (B+S)}rS

= ( $342,500 / $7,200,000)(0.11) + ($6,857,500/ $7,200,000)(0.13099)

= 0.13

Therefore, Strom’s weighted average cost of capital after the buyout will be 13% regardless of

whether the firm issues debt or equity.

16.9

a.

Without the power plant, Yukon Power expects to earn $34 million per year into perpetuity.

Since Yukon is an all–equity firm and the required rate of return on the firm’s equity is 11%, the

market value of Yukon’s assets is equal to the present value of a perpetuity of $34,000,000 per

year, discounted at 11%.

PV(Perpetuity) = C / r

= $34,000,000 / 0.11

= $309,090,909.10

Therefore, the market value of Yukon’s assets before the firm announces that it will build a new

power plant is $309,090,909.10. Since Yukon is an all–equity firm, the market value of Yukon’s

equity is also $309,090,909.10.

Yukon’s market–value balance sheet before the announcement of the buyout is made is:

Assets

Total Assets =

Answers to End-of-Chapter Problems

Yukon Power

$ 309,090,909.1

Equity

$ 309,090,909.1 Total D + E =

$ 309,090,909.1

$ 309,090,909.1

B-

225

Since the market value of Yukon’s equity is $309,090,909.10 and the firm has 13 million shares

outstanding, Yukon’s stock price before the announcement to build the new power plant is

$23.7762 per share (=$309,090,909.10 / 13 ,000,000 shares).

b.

1. According to the efficient–market hypothesis, the market value of Yukon’s equity will change

immediately to reflect the net present value of the project. Since the new power plant will cost

Yukon $20 million but will increase the firm’s annual earnings by $3 million in perpetuity, the

NPV of the new power plant can be calculated as follows:

NPVNEW POWER PLANT = –$25 million + ($5 million/ 0.11)

= $20.4545 million

Remember that the required return on the firm’s equity is 11% per annum.

Therefore, the market value of Yukon’s equity will increase to $329.5454 million (=

$309.0909 million + $20.4545 million) immediately after the announcement.

Yukon’s market–value balance sheet after the announcement will be:

Yukon Power

Old Assets

NPVPOWER PLANT

Total Assets =

$309,090,909.10

$

$

20,454,545.45 Equity =

329,545,454.55 Total D + E =

$329,545,454.55

$329,545,454.55

Since Yukon has 13 million shares of common stock outstanding and the total market value of

the firm’s equity is $329.5454 million , Yukon’s new stock price will immediately rise to

$25.35 per share (=$329.5454 million / 13 million shares) after the firm’s announcement.

2. Yukon needs to issue $25 million worth of equity in order to fund the construction of the power

plant. The market value of the firm’s stock will be $25.3496 per share after the announcement.

Therefore, Yukon will need to issue 986,193.29 shares (= $25 million / $25.34965per share) in

order to fund the construction of the power plant.

3. Yukon will receive $25 million (=986,193.29 shares * $25.34965 per share) in cash after the

equity issue. Since the firm now has 10,986,193.29 (= 13 million + 986,193.29) shares

outstanding, where each share is worth $25.3496, the market value of the firm’s equity

increases to $354,545,454.55 (=13,986,193.29 shares * $25.34965 per share).

Yukon’s market–value balance sheet after the equity issue will be:

Old Assets =

Cash =

NPVPOWER PLANT =

Total Assets =

Answers to End-of-Chapter Problems

Yukon Power

############# Debt =

$ 25,000,000.00 Equity =

$ 20,454,545.45

############# Total D + E =

$

354,545,454.55

$

354,545,454.55

B-

226

4. Yukon will pay $25,000,000 in cash for the power plant. Since the plant will generate $5

million in annual earnings forever, its present value is equal to a perpetuity of $5 million per

year, discounted at 11%.

PVNEW POWER PLANT = $5 million / 0.11

= $45.4545 million

Yukon’s market–value balance sheet after the construction of the power plant will be:

Old Assets =

PVPOWER PLANT =

Total Assets =

Yukon Power

############# Debt =

$ 45,454,545.45 Equity =

############# Total D + E =

$

#############

#############

5 Since Yukon is an all–equity firm, its value will equal the market value of its equity.

Therefore, the value of Yukon Power will be $354.5454 million if the firm issues equity to

finance the construction of the power plant.

c.

1. Under the efficient–market hypothesis, the market value of the firm’s equity will immediately

rise to $$25.34965 million following the announcement to reflect the NPV of the power plant.

Therefore, the total market value of Yukon’s equity will be $$329.5454 million (= $309.0909

million + $20.4545 million) after the firm’s announcement.

Yukon’s market–value balance sheet after the announcement will be:

Old Assets =

PVPOWER PLANT =

Total Assets =

Yukon Power

$ 309,090,909.10 Debt

$ 20,454,545.45 Equity =

$ 329,545,454.55 Total D + E =

$329,545,454.55

$329,545,454.55

Since Yukon has 13 million shares of common stock outstanding and the total market value of

the firm’s equity is $329.5454 million , Yukon’s new stock price will immediately rise to

$25.34965 per share (=$329.5454 million / 13 million shares) after the firm’s announcement.

2. Yukon will receive $25 million in cash after the debt issue. The market value of the firm’s debt

will be $25 million.

Yukon’s market–value balance sheet after the debt issue will be:

Old Assets =

Cash =

NPVPOWER PLANT =

Total Assets =

Yukon Power

############# Debt =

$ 25,000,000.00 Equity =

$ 20,454,545.45

############# Total D + E =

$ 25,000,000.00

#############

#############

3. Yukon will pay $25 million in cash for the power plant. Since the plant will generate $5 million

of earnings forever, its present value is equal to a perpetuity of $5 million per year, discounted

at 11%.

Answers to End-of-Chapter Problems

B-

227

PVPOWER PLANT = $5 million / 0.11

= $45.4545 million

Yukon’s market–value balance sheet after it builds the new power plant is:

Old Assets =

NPVPOWER PLANT =

Total Assets =

Yukon Power

$309,090,909.10 Debt =

$ 45,454,545.45 Equity =

$ 354,545,454.55 Total D + E =

$ 25,000,000.00

$ 329,545,454.55

$ 354,545,454.55

4. The value of a levered firm is the sum of the market values of the firm’s debt and equity. Since

the market value of Yukon’s debt will be $25 million and the market value of Yukon’s equity

will be $329.5454 million, the value of Yukon Power will be $354.5454 million if the firm

decides to issue debt in order to fund the outlay for the power plant.

Therefore, the value of Yukon Power will be $354.5454 million regardless of whether the firm

issues debt or equity to fund the construction of the new power plant.

5. The required return on Yukon’s levered equity is:

rS = r0 + (B/S)(r0 – rB)

= 0.11 + ($25 million / $329.5454 million)(0.11 – 0.07)

= .11303 or 11.303%

Therefore, the required return on Yukon’s levered equity is 11.303%.

6. Yukon’s weighted average cost of capital after the construction of the new power plant

is:

rwacc = {B / (B+S)} rB + {S / (B+S)}rS

= ($25 million / $354.5454 million)(0.07) + $329.5454 / $354.5454)(0. 11.303)

= 0.11

Therefore, Yukon’s weighted average cost of capital will be 11% following either debt or equity

financing.

16.10

False. A reduction in leverage will decrease both the risk of the stock and its expected return.

Modigliani and Miller state that, in the absence of taxes, these two effects exactly cancel each other

out and leave the price of the stock and the overall value of the firm unchanged.of debt in a firm’s capital

structure will increase the required return on the firm’s equity.

16.11

a.

Before the announcement of the stock repurchase plan, the market value of the Locomotive’s

outstanding debt is $8.5 million. The ratio of the market value of the firm’s debt to the market

value of the firm’s equity is 40%.

The market value of Locomotive’s equity can be calculated as follows:

Since B = $8.5 million and B/S = 40%:

($8.5 million / S)= 0.40

Answers to End-of-Chapter Problems

B-

228

S = $21.25 million

The market value of the firm’s equity prior to the announcement is $21.25 million.

The value of a levered firm is equal to the sum of the market value of the firm’s debt and the

market value of the firm’s equity.

The market value of Locomotive Corporation, a levered firm, is:

VL

=B+S

= $8.5 million + $21.25 million

= $29.75 million

Therefore, the market value of Locomotive Corporation is $29.75 million prior to the stock

repurchase announcement.

According to MM Proposition I (No Taxes), changes in a firm’s capital structure have no effect

on the overall value of the firm. Therefore, the value of the firm will not change after the

announcement of the stock repurchase plan

The market value of Locomotive Corporation will remain at $29.75 million after the stock

repurchase announcement.

b.

The expected return on a firm’s equity is the ratio of annual earnings to the market value of the

firm’s equity.

Locomotive expects to generate $4 million in earnings per year.

Before the restructuring, Locomotive has $8.5 million of 8.5% debt outstanding. The firm was

scheduled to pay $722,500 (= $8.5 million * 0.085) in interest at the end of each year.

Therefore, annual earnings before the stock repurchase announcement are $3,277,500 (=

$4,000,000 – $722,500).

Since the market value of the firm’s equity before the announcement is $21.25 million, the

expected return on the firm’s levered equity (rS) before the announcement is 0.1542

(= $4 million – .722500 million / $21.25 million).

The expected return on Locomotive’s levered equity is 15.42% before the stock repurchase plan

is announced.

c.

According to Modigliani–Miller Proposition II (No Taxes):

rS = r0 + (B/S)(r0 – rB)

In this problem:

rS = 0.1542

rB = 0.085

B = $8.5 million

S = $21.25 million

Answers to End-of-Chapter Problems

B-

229

Thus:

0.1542= r0 + ($8.5 million / $21.25 million)(r0 – 0.085)

0.1542 = r0 + (0.40)(r0 – 0.085)

Solving for r0:

r0 = 0.1344

Therefore, the expected return on the equity of an otherwise identical all–equity firm is

13.44%.

This problem can also be solved in the following way:

r0 = Earnings Before Interest / VU

Locomotive generates $4,000,000 of earnings before interest. According to Modigliani–Miller

Proposition I, in a world with no taxes, the value of a levered firm equals the value of an

otherwise–identical unlevered firm. Since the value of Locomotive as a levered firm is $29.75

million (= $8.5 + $21.25) and since the firm pays no taxes, the value of Locomotive as an

unlevered firm (VU) is also $29.75 million.

r0 = $4 million / $29.75 million

= 0.1344

= 13.44%

d.

The expected return on Locomotive’s levered equity after the stock repurchase announcement is:

rS = r0 + (B/S)(r0 – rB)

= 0.1344+ (0.55)(0.1344 – 0.085)

= 0.1591

Therefore, the expected return on Locomotive’s equity is 15.91% after the stock repurchase

announcement.

16.12

a.

The expected return on a firm’s equity is the ratio of annual after–tax earnings to the market value

of the firm’s equity.

Green expects $1,500,000 of pre–tax earnings per year. Because the firm is subject to a

corporate tax rate of 36%, it must pay $540,000 worth of taxes every year. Since the firm has

no debt in its capital structure and makes no interest payments, Green’s annual after–tax expected

earnings are $960,000 (= $1,500,000 – $540,000).

The market value of Green’s equity is $14,000,000.

Therefore, the expected return on Green’s unlevered equity is 6.857% (= $960,000 /

$14,000,000).

Notice that perpetual annual earnings of $960,000, discounted at 6.857%, yields a market

value of the firm’s equity of $14,000,000 (= $960,000 / 0.06857).

Answers to End-of-Chapter Problems

B-

230

b.

Green is an all–equity firm. The present value of the firm’s after–tax earnings is $14,000,000 (=

$960,000 / 0.06875).

Green’s market–value balance sheet before the announcement of the debt issue is:

Green Manufacturing

$ 14,000,000

Equity =

$ 14,000,000 Total D + E =

Assets =

Total Assets =

$

$ 14,000,000

$ 14,000,000

Since the market value of Green’s equity is $14,000,000 and the firm has 750,000 shares of

common stock outstanding, the price of Green’s stock is $18.666 per share (= $14,000,000 /

750,000 shares) before the announcement of the debt issue.

c.

When Green announces the debt issue, the value of the firm will increase by the present value of

the tax shield on the debt. Since Green plans to issue $3,000,000 of debt and the firm is subject

to a corporate tax rate of 36%, the present value of the firm’s tax shield is:

PV(Tax Shield) = TCB

= (0.36)($3,000,000)

= $1,080,000

Therefore, the value of Green Manufacturing will increase by $1,080,000 as a result of the debt

issue.

The value of Green Manufacturing after the repurchase announcement is:

V L = V U + T CB

= $14,000,000 + (0.36)($3,000,000)

= $15,080,000

Since the firm has not yet issued any debt, Green’s equity is also worth $15,080,000.

Green’s market–value balance sheet after the announcement of the debt issue is:

Old Assets =

PV(Tax Shield) =

Total Assets =

d.

Green Manufacturing

$ 14,000,000 Debt =

$

$ 1,080,000 Equity =

$ 15,080,000

$ 15,080,000 Total D + E = $ 15,080,000

Since the market value of Green’s equity after the announcement of the debt issue is $15,080,000

and the firm has 750,000 shares of common stock outstanding, the price of Green’s stock is

$20.1066 per share (=$15,080,000 / 750,000 shares) after the announcement of the debt issue.

Therefore, immediately after the repurchase announcement, Green’s stock price will rise to

$20.1066 per share.

e.

Green will issue $3,000,000 worth of debt and use the proceeds to repurchase shares of common

stock. Since the price of Green’s stock after the announcement will be $20.1066 per

share,

Answers to End-of-Chapter Problems

B-

231

Green can repurchase 149,204.7387 shares (= $3,000,000 / $20.1066 per share) as a result of

the debt issue.

Green will repurchase 149,204.7387 shares shares shares with the proceeds from the debt issue.

Since Green had 750,000 shares of common stock outstanding and repurchased 149,204.7387

shares as a result of the debt issue, the firm will have 600,795.2613 (= 750,000 – 149,204.7387

shares) shares of common stock outstanding after the repurchase.

Green will have 600,795.2613 shares of common stock outstanding after the repurchase.

f.

After the restructuring has taken place, Green will have $3,000,000 worth of debt in its

capital structure. The value of Green after the restructuring is $15,080,000.

The value of a levered firm is equal to the sum of the market value of its debt and the market

value of its equity.

That is, the value of a levered firm is:

VL = S + B

Rearranging this equation, the market value of the Green’s levered equity after the announcement

of the debt issue is:

S = VL – B

= $15,080,000 – $3,000,000

= $12,080,000

Green’s market–value balance sheet after the restructuring is:

Old Assets =

PV(Tax Shield) =

Total Assets =

Green Manufacturing

$ 14,000,000 Debt =

$ 1,080,000 Equity =

$ 15,080,000 Total D + E =

$ 3,000,000

$ 12,080,000

$ 15,080,000

Since the market value of Green’s equity after the restructuring is $12,080,000 and the firm has

600,795.2613 shares of common stock outstanding, the price of Green’s stock will be $20.1066

per share (=$12,080,000/ 600,795.2613 shares) after the restructuring.

Therefore, Green’s stock price will remain at $20.1066 per share after the restructuring has

taken place.

g.

The required return on Green’s levered equity after the restructuring is:

rS = r0 + (B/S)(r0 – rB)(1 – TC)

= 0.06857+ ($3,000,000 / $12,080,000)( 0.06875 – 0.0465)(1 – 0.36)

= 0.0721

Therefore, the required return on Green’s levered equity after the restructuring is 7.21%.

16.13

a.

If the firm were financed entirely by equity, the value of the firm would be:

Answers to End-of-Chapter Problems

B-

232

VU

= V L – T CB

= $1,900,000 – (0.34)($600,000)

= $1,696,000

Therefore, the value of this firm would be $1,696,000 if it were financed entirely by equity.

b.

While the firm generates $386,000 of annual earnings before interest and taxes, it must make

interest payments of $72,000 (= $600,000 * 0.12). Interest payments reduce the firm’s taxable

income.

Therefore, the firm’s pre–tax earnings are $314,000 (= $386,000 – $72,000).

Since the firm is in the 34% tax bracket, it must pay taxes of $106,760 (= 0.34 * $314,000) at the

end of each year.

Therefore, the amount of the firm’s annual after–tax earnings is $207,240 (=$314,000–

$106,760). These earnings are available to the stockholders.

The following table summarizes this solution:

EBIT

Interest

Pre-Tax Earnings

Taxes at 34%

After-Tax Earnings

16.14

$386,000

72,000

314,000

106,760

207,240

Since the firm is an all–equity firm with 200,000 shares of common stock outstanding, currently worth

$20 per share, the market value of this unlevered firm (VU) is $4,000,000 (= 200,000 shares * $20 per

share).

The firm plans to issue $1,200,000 debt and is subject to a corporate tax rate of 31%.

The market value of a levered firm is:

V L = V U + T CB

= $4,000,000 + (0.31)($1,200,000)

= $4,372,000

The value of a levered firm is equal to the sum of the market value of its debt and the market value of its

equity.

That is, the value of a levered firm is:

VL = S + B

Rearranging this equation, the market value of the firm’s levered equity, S, is:

S = VL – B

= $4,372,000– $1,200,000

Answers to End-of-Chapter Problems

B-

233

= $3,172,000

Therefore, the market value of the firm’s equity is $3,172,000 after the firm announces the stock

repurchase plan.

16.15

a.

The value of Strider Publishing is:

VU = [(EBIT)(1–TC)] / r0

= [($1,800,000)(1 – 0.36)] / 0.18

= $6,400,000

Therefore, the value of Strider Publishing as an all–equity firm is $6,400,000.

b.

The value of Strider Publishing will be:

V L = V U + T CB

= $6,400,000 + (0.36)($750,000)

= $6,670,000

Therefore, the value of Strider Publishing Company will be $6,670,000if it issues $750,000

of debt and repurchases stock.

c.

Since interest payments are tax deductible, debt lowers the firm’s taxable income and creates a

tax shield for the firm. This tax shield increases the value of the firm.

d.

The Modigliani–Miller assumptions in a world with corporate taxes are:

– There are no personal taxes.

– There are no costs of financial distress.

– Perpetual cash flow

– No transaction costs

– Individuals and corporations can borrow at the same rate

– Complete information

Both personal taxes and costs of financial distress will be covered in more detail in a later

chapter.

16.16

a.

The value of Robson as an unlevered firm:

VU = [(EBIT)(1–TC)] / r0

= [($1,600,000)(1 – 0.34)] / 0.14

= $7,542,857.14

The value of Robson if it were an all–equity firm is $7,542,857.14.

Since Robson’s pre–tax cost of debt is 7% per annum and the firm makes interest payments of

$250,000 per year, the value of the firm’s debt must be $3,571,428.57 (= $250,000 / 0.07). As a

check, notice that 7% annual interest on $3,571,428.57 of debt yields $250,000 (= 0.07 *

$3,571,428.57) of interest payments per year.

The current value of Robson’s debt is $$3,571,428.57.

Answers to End-of-Chapter Problems

B-

234

Thus:

VU = $7,542,857.14

TC = 0.34

B = $3,571,428.57

The total market value of Gibson is:

V L = V U + T CB

= $7,542,857.14 + (0.34)( $3,571,428.57)

= $8,757,142.85

Therefore, the total market value of Gibson is $8,757,142.85

16.17

b.

If there are no costs of financial distress or bankruptcy, increasing the level of debt in a firm’s

capital structure will always increase the value of a firm. This implies that every firm will want

to be financed entirely (100%) by debt if it wishes to maximize its value.

c.

This conclusion is not applicable in the real world since it does not consider costs of financial

distress, bankruptcy, or other agency costs that might offset the benefit of increased leverage.

These costs will be discussed in further detail in later chapters.

a.

The value of Appalachian if it were unlevered is:

VU = [(EBIT)(1–TC)] / r0

= [($6,000,000)(1 – 0.35)] / 0.14

= $27, 857, 142.86

The value of Appalachian if it were an all–equity firm is $27, 857, 142.86.

Appalachian currently has $9,000,000 of debt in its capital structure and is subject to a corporate

tax rate of 35%.

The value of Appalachian is:

V L = V U + T CB

= $27, 857, 142.86+ (0.35)($9,000,000)

= $31,007,142.86

Therefore, the value of Appalachian is $31,007,142.86.

b.

The required return on Appalachian’s levered equity is:

rS = r0 + (B/S)(r0 – rB)(1 – TC)

= 0.14 + ($9,000,000 / $22,007,142.86)(0.14 – 0.11)(1 – 0.35)

= 0.148

Therefore, the cost of Appalachian’s levered equity is 14.8%.

Answers to End-of-Chapter Problems

B-

235

c.

Appalachian’s weighted average cost of capital is:

rwacc= {B / (B+S)}(1 – TC) rB + {S / (B+S)}rS

= ($9,000,000 / $31,007,142.86)(1 – 0.35)(0.11) + ($22,007,142.86/ $31,007,142.86)(0.148)

= 0.1258

Therefore, Appalachian’s weighted average cost of capital is 12.58%.

16.18

a.

If Williamson’s debt–to–equity ratio is 3.5:

B / S = 3.5

Solving for B:

B = (3.5 * S)

The above formula for rwacc uses the following ratio: B / (B+S)

Since B = (3.5 * S):

B/ (B+S) = (3.5 * S) / { (3.5 * S) + S}

= (3.5 * S) / (4.5 * S)

= (3.5 / 4.5)

= 0.777

Williamson’s debt–to–value ratio is 77.8%

The above formula for rwacc also uses the following ratio: S / (B+S)

Since B = (3.5 * S):

Williamson’s equity–to–value ratio = S / {(3.5*S) + S}

= S / (4.5 * S)

= (1 / 4.5)

= 0.222

Williamson’s equity–to–value ratio is 22.2%.

In order to solve for the cost of Williamson’s equity capital (rS), set up the following equation:

rwacc

0.146

= {B / (B+S)}(1 – TC) rB + {S / (B+S)}rS

= (0.778)(1 – 0.35)(0.098) + (0.222)(rS)

rS = 0.4344

Therefore, the cost of Williamson’s equity capital is 43.44%.

b.

In order to solve for the cost of Williamson’s unlevered equity (r0), set up the following equation:

rS = r0 + (B/S)(r0 – rB)(1 – TC)

Answers to End-of-Chapter Problems

B-

236

0.4344= r0 + (3.5)(r0 – 0.098)(1 – 0.35)

r0 = 0.2007

Therefore, Williamson’s unlevered cost of equity is 20.07%.

c.

If Williamson’s debt–to–equity ratio is 0.75, the cost of the firm’s equity capital (rS) will be:

rS = r0 + (B/S)(r0 – rB)(1 – TC)

= 0.2007+ (0.75)( 0.2007– 0.098)(1 – 0.35)

= 0.2508

If Williamson’s debt–to–equity ratio is 0.75:

B / S = 0.75

Solving for B:

B = (0.75 * S)

A firm’s debt–to–value ratio is: B / (B+S)

Since B = (0.75 * S):

Williamson’s debt–to–value ratio = (0.75 * S) / { (0.75 * S) + S}

= (0.75 * S) / (1.75 * S)

= (0.75 / 1.75)

= 0.4286

Williamson’s debt–to–value ratio is 42.86%

A firm’s equity–to–value ratio is: S / (B+S)

Since B = (0.75 * S):

Williamson’s equity–to–value ratio = S / {(0.75*S) + S}

= S / (1.75 * S)

= (1 / 1.75)

= 0.5714

Williamson’s equity–to–value ratio is 57.14%.

Williamson’s weighted average cost of capital (rwacc) is:

rwacc= {B / (B+S)}(1 – TC) rB + {S / (B+S)}rS

= (0.4286)(1 – 0.35)(0.098) + (0.5714)( 0.2508)

= 0.1706

Therefore, Williamson’s weighted average cost of capital (rwacc) is 17.06% if the firm’s debt–

to–equity ratio is 0.75.

Answers to End-of-Chapter Problems

B-

237

If Williamson’s debt–to–equity ratio is 1.5, then the cost of the firm’s equity capital (rS) will be:

rS

= r0 + (B/S)(r0 – rB)(1 – TC)

= 0.2007 + (1.5)(0.2007 – 0.098)(1 – 0.35)

= 0.3008

If Williamson’s debt–equity ratio is 1.5:

B / S = 1.5

Solving for B:

B = (1.5 * S)

A firm’s debt–to–value ratio is: B / (B+S)

Since B = (1.5 * S):

Williamson’s debt–to–value ratio = (1.5 * S) / { (1.5 * S) + S}

= (1.5 * S) / (2.5 * S)

= (1.5 / 2.5)

= 0.60

Williamson’s debt–to–value ratio is 60%

A firm’s equity–to–value ratio is: S / (B+S)

Since B = (1.5 * S):

Williamson’s equity–to–value ratio = S / {(1.5*S) + S}

= S / (2.5 * S)

= (1 / 2.5)

= 0.40

Williamson’s equity–to–value ratio is 40%.

Williamson’s weighted average cost of capital (rwacc) is:

rwacc= {B / (B+S)}(1 – TC) rB + {S / (B+S)}rS

= (0.60)(1 – 0.35)(0.098) + (0.40)(0.3008)

= 0.1585

Therefore, Williamson’s weighted average cost of capital (rwacc) is 15.85% if the firm’s debt–

to–equity ratio is 1.5.

16.19

a.

The value of General Tools (GT) as an unlevered firm is:

VU = [(EBIT)(1–TC)] / r0

= [($210,000)(1 – 0.36)] / 0.23

= $584,347.82

Answers to End-of-Chapter Problems

B-

238

The value of General Tools is $584,347.82 as an all–equity firm.

b.

If GT borrows $210,000 and uses the proceeds to purchase shares, the firm’s value will be:

V L = V U + T CB

= $584,347.82 + (0.36)($210,000)

= $659,947.82

Therefore, the value of General Tools will be $659,947.82 if the firm adds $21,000 of debt to

its capital structure.

16.20

This data was collected in March, 2005 and is provided for illustrative purposes only.

BCE 2004

Long term

debt

Current

portion

Total long

term debt

Equity

Debt/Equity

9,813,030

BCE

2003

9,589,879

Magna

2004

806,000

Magna

2003

308,000

Telus

2003

5,006,112

Telus

2002

5,188,228

931,527

896,077

84,000

35,000

171,090

120,443

10,744,557

10,485,956

890,000

343,000

5,177,202

5,308,671

11,660,296

0.921

10,508,396

0.998

5,442,000

0.16

4,653,000

0.07

5,101,215

1.01

4,027,152

1.31

Magna has the lowest debt to equity ratio of the three companies. Magna is in the automotive sector

which has a higher business risk than telecommunications in Canada. In addition, the majority owner of

Magna prefers not to use debt.

Bell Canada and Telus have higher debt to equity ratios because they have a large capital asset base that

must be financed, and yet the business risk is likely lower than the automotive industry. Both of these

companies are in the telecommunications with Bell Canada being much larger and more entrenched in

Canada than Telus. Telus has a slightly higher debt to equity ratio since they are still building

infrastructure and trying to penetrate eastern Canada. Both of these companies operate in an industry that

has been rapidly changing and requiring constant capital assets improvements to build the network for the

internet and phone services provided Canada wide.

16.21

We have chosen Thomson Corp for the company since the data is available on the S&P Database.

The following information was obtained in March, 2005 and is provided for illustrative purposes only.

Income tax expense

Pre–tax net income

Effective tax rate

(267,000/1,130,000)

EBIT

(1,327,000 + 12,000+36,000)

Interest expense

Long term debt including current

Answers to End-of-Chapter Problems

$ in thousands

267,000

1,130,000

23.63%

1,375,000

245,000

4,308,000

B-

239

portion: 295,000 + 4,013,000

Average cost of debt

$245,000 / $4,308,000

Market capitalization

Debt/equity

5.69%

21,704,523

0.20

The Canadian beta is 0.63.

rs Rf ( Rm Rf ) 6.8% 0.63(3.84%) 9.22%

B

rs ro x(1 Tc) x(ro rB )

S

0.092 ro 0.20 x(1 0.2363) x(ro 0.0569)

ro 0.0875 8.75%

Vu

EBIT (1 Tc) 1,375, 000, 000(1 0.2363)

ro

0.0875

Vu 12, 001million

VL VU TC B $12,001 0.2362(4,308M ) $13,019million

Answers to End-of-Chapter Problems

B-

240

MINI CASE Danielson Real Estate Recapitalization

1.

If Danielson wishes to maximize the overall value of the firm, it should use debt to finance the

$100 million purchase. Since interest payments are tax deductible, debt in the firm’s capital structure

will decrease the firm’s taxable income, creating a tax shield that will increase the overall value of

the firm.

2.

Since Danielson is an all–equity firm with 15 million shares of common stock outstanding, worth

$32.50 per share, the market value of the firm is:

Market value of equity = $32.50(15,000,000)

Market value of equity = $487,500,000

So, the market value balance sheet before the land purchase is:

Market value balance sheet

3.

Assets

$487,500,000

Equity $487,500,000

Total assets

$487,500,000

Debt & Equity $487,500,000

a.

As a result of the purchase, the firm’s pre–tax earnings will increase by $25 million per year in

perpetuity. These earnings are taxed at a rate of 40 percent. Therefore, after taxes, the purchase

increases the annual expected earnings of the firm by:

Earnings increase = $25,000,000(1 – .38)

Earnings increase = $15,500,000

Since Danielson is an all–equity firm, the appropriate discount rate is the firm’s unlevered cost

of equity, so the NPV of the purchase is:

NPV = –$100,000,000 + ($15,500,000 / .125)

NPV = $24,000,000

b.

After the announcement, the value of Danielson will increase by $24 million, the net present

value of the purchase. Under the efficient–market hypothesis, the market value of the firm’s

equity will immediately rise to reflect the NPV of the project. Therefore, the market value of

Danielson’s equity after the announcement will be:

Equity value = $487,500,000 + 24,000,000

Equity value = $511,500,000

Market value balance sheet

Old assets

NPV of project

$487,500,000

24,000,000

Equity

Total assets

$511,500,000

Debt & Equity $511,500,000

$511,500,000

Since the market value of the firm’s equity is $511,500,000 and the firm has 15 million shares

Answers to End-of-Chapter Problems

B-

241

of common stock outstanding, Danielson’s stock price after the announcement will be:

New share price = $511,500,000 / 15,000,000

New share price = $34.10

Since Danielson must raise $100 million to finance the purchase and the firm’s stock is worth

$33.83 per share, Danielson must issue:

Shares to issue = $100,000,000 / $34.10

Shares to issue = 2,932,551

c.

Danielson will receive $100 million in cash as a result of the equity issue. This will increase

the firm’s assets and equity by $100 million. So, the new market value balance sheet after the

stock issue will be:

Market value balance sheet

Cash

$100,000,000

Old assets

487,500,000

NPV of project 24,000,000

Equity $611,500,000

Total assets

Debt & Equity $611,500,000

$611,500,000

The stock price will remain unchanged. To show this, Danielson will now have:

Total shares outstanding = 15,000,000 + 2,932,551

Total shares outstanding = 17,932,551

So, the share price is:

Share price = $611,500,000 / 17,932,551

Share price = $34.10

d.

The project will generate $25 million of additional annual pretax earnings forever. These

earnings will be taxed at a rate of 38 percent. Therefore, after taxes, the project increases the

annual earnings of the firm by $15.5 million. So, the aftertax present value of the earnings

increase is:

PV–Project = $15,500,000 / .125

PV–Project = $124,000,000

So, the market value balance sheet of the company will be:

Market value balance sheet

Old assets

PV of project

$487,500,000

124,000,000

Equity $611,500,000

Total assets

$611,500,000

Debt & Equity $611,500,000

Answers to End-of-Chapter Problems

B-

242

4.

a.

Modigliani–Miller Proposition I states that in a world with corporate taxes:

VL = VU + TcB

As was shown in Question 3, Danielson will be worth $611.5 million if it finances the

purchase with equity. If it were to finance the initial outlay of the project with debt, the firm

would have $100 million worth of 8 percent debt outstanding. So, the value of the company if it

financed with debt is:

VL = $611,500,000 + .38($100,000,000)

VL = $649,500,000

b.

After the announcement, the value of Danielson will immediately rise by the present value of

the project. Since the market value of the firm’s debt is $100 million and the value of the firm

is $649.5 million, we can calculate the market value of Danielson’s equity. Danielson’s

market–value balance sheet after the debt issue will be:

Market value balance sheet

Value unlevered

Tax shield

$611,500,000

38,000,000

Debt

Equity

$100,000,000

549,500,000

Total assets

$649,500,000

Debt & Equity $649,500,000

Since the market value of the Danielson’s equity is $549.5 million and the firm has 15 million

shares of common stock outstanding, Danielson’s stock price after the debt issue will be:

Stock price = $549,500,000 / 15,000,000

Stock price = $36.33

5.

If Danielson uses equity in order to finance the project, the firm’s stock price will remain at $34.10

per share. If the firm uses debt in order to finance the project, the firm’s stock price will rise to

$36.33 per share. Therefore, debt financing maximizes the per share stock price of a firm’s equity.

Answers to End-of-Chapter Problems

B-

243