Condemnation & Salvage: Government Store Disposal

advertisement

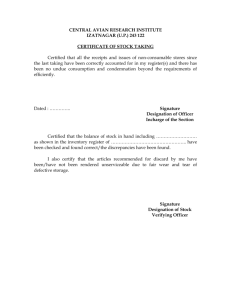

CONDEMNATION BOARD AND SALVAGE STORES The term ‘Stores’ used in this Chapter applies generally to all articles and materials purchased or otherwise acquired for the use of Government including not only expendable and issuable articles in use or accumulated for specific purposes but also articles of dead stock of the nature of Plant, Machinery, Instruments, Furniture, Equipments, fixture and livestock etc. DECLARATION OF STORES AS UNSERVICEABLE AND SCRAP Board of Survey will be constituted for examination and declaration of stores as unserviceable or scrap. The DGBR Delhi in respect of formation directly under him will convene the Board of Survey every quarter under the orders of the CE in respect of Task Forces and units under them and. The CE/DGBR will decide the composition of the Board, which may consist of Officers only, or at least one Officer together with one or more JCO or equivalent. The Board should be presided over by an Officer not below the rank of Executive Engineer or equivalent rank. No Condemnation Board is necessary in Field Workshop in the case of scrap of non-retrievable items such as unserviceable rubber parts, pins, brushes, Oil seal etc. POWERS The following Authorities shall be competent to accept the recommendation of the survey Board or Court of Inquiry in respect of stores and scrap relating to vehicle, machinery and connected spares parts bridging etc. and declare them unserviceable/scrap to the extent indicating against each :Competent Authority Cases due to fair Wear and tear. 1. DGBR 2. Chief Engineer Rs.1 LAKH Rs.75,000/- Cases not due to fair Wear and tear. Rs.15000/Rs. 5000/- All cases not covered above will be referred to the Govt.of orders. -2The following Authorities shall be competent to accept the recommendation of the survey Board on each occasion in respect of stores relating to Clothing, Construction Stores, Category ‘B’ Stores and declare stores as unserviceable/scrap to the extent indicating against each provided stores become unserviceable/scrap due to fair, wear and tear. Competent Authority 1.Chief Engineer 2. Commander Task Force 3. Commander Gref Center Amount Rs.1 lakh Rs.15000/Rs.5000/- NO LOSS STATEMENT No loss statement will be prepared where the stores become unserviceable /scrap due to fair wear and tear. Cases where the stores are found to be unserviceable owing to negligence etc. of the individual concerned shall be treated as loss and shall be dealt with accordingly. Depreciated Value/Assessed Value The limit indicated in paragraph above represent the book value i.e. depreciated value of the stores of each category at the time of the condemnation and assessed value in the case of scrap. By the term “each category” is meant each item of stores listed under Category A and B. SALVAGE LEDGER After the proceeding of the Board of Survey are finalized, the quantities declared unserviceable/scrap will be struck off charge in the relevant ledger and brought to account in Salvage Ledger. The quantities permitted to be retained will be accounted for as Expendable Stores. GENERIC HEADINGS All identifiable unserviceable articles and those valuable stores like Tents, Tarpaulins, Lamps, Stoves etc. which for any reasons have lost their identity will be brought on charge by generic headings both by numbers and weights. -3UTILISATION OF UNSERVICEABLE STORES 10% of salvage arising of clothing tentage and other textile items may be appropriated for conversion to rags for purpose of cleaning of Plant and Machinery and for repair of clothing. SCRAP WOOD Scrap-wood unserviceable timber may be issued instead of fire wood ration where admissible at the scale of 500kgs of firewood equal to 1800 kgs scrap wood / unserviceable timber. BASE WORKSHOPS All scrap occurring out of various jobs undertaken in different section of the Base Workshops will be vouchered over monthly on IAFZ 2096 to the Salvage Section duly supported with the condemnation Report on IAFD 931 The Condemnation material will be taken on charge in the ledger according to the category of the scraps-ferrous or non-ferrous. The condemned material, which could be used in the Base Workshop, will be sent to the Expense Section of the Store Group on regular voucher. The procedure for the disposal of the rest of the unserviceable materials shall be the same as per stores in general. Scrap of non-retrievable items such as unserviceable rubber parts, pin brushes, oil seal etc. will be vouchered over by weight to the salvage park supported by a certificate from the officer-in-charge of the section that the stores are not retrievable or reclaimable. No condemnation board is necessary in such cases. DISPOSAL Disposal of stores declared unserviceable scrap will be conducted through auctioneers on the approved panel of the Ministry of Defence. Where, however stores are located in forward areas or inaccessible areas, they may -4be disposed of locally under the orders of the Chief Engineer to the best advantage of the State. GUIDING PRICE The CE has full powers of fixing guiding or ceiling prices for unserviceable scrap items. The Supervising Officer may accept bids upto 30% below this price. SALE ACCOUNT On completion of sale, a Sale Account on IAFA 58 will be prepared by the Officer-in-charge of the disposal in quadruplicate/quintuplicate (in the case of Salvage section/sub depot) and forward the original, duplicate, triplicate copies duly signed by the competent officer together with the under mentioned documents to the ACDA/AO(P) and will be completed in accordance with the instructions on the form. The stores shall be struck off charge in the ledger on the basis of the Sale Account. The sale account will bear the Treasury Receipt No. and date and name of the Treasury into which the amount was deposited. Copies of the Sale Accounts will be submitted to the Accounts Officer with the following documents: (i) Receipted copies of the MROs (ii) One copy of the Sale Release Order receipted by the purchaser and endorsed with relevant Gate Pass No. and Date. (iii) Letter if any, from the sanctioning authority altering the reserve price original noted in the approved auction catalogues; (iv) The letter of acceptance from the purchaser in case of stores sold by private treaty by local authorities; (v) Comparative statements showing the names of tenders, the rate tendered and the rates accepted in the case of stores sold by local authorities by inviting tenders; On receipt of the Sale Account (IAFA 58) the three copies will be prepared and the duplicate copies duly checked in all respects sent to the DGS&D where applicable. -5The triplicate copies of the Sale Account will be retained by the ACDA (P) for purpose of linking The original copies together with the treasury receipts will be retained and the remaining documents (in original) referred to item (ii) to (v) above returned to the units from which they were received. A copy of the sale Release Order duly receipted by the purchaser and endorsed with the relevant pass no. and date (the date of gate pass being the date on which the stores have actually been removed from the site in the case of sale of surplus salvage stores) will be submitted to Accounts Officer. No.5 copies of the issue voucher duly receipted by the purchaser and endorsed with the relevant gate pass no. and date (the date of gate pass being the date on which the stores have actually been removed from the site) along with the sale release l order in the case of surplus stores will be sent to Accounts Office. Audit of Sale Accounts It will be seen that: (i) (ii) (iii) (iv) (v) The sale account has been signed by the competent Officer; The tendering of the sale account has not been delayed. The no. and date of the TR as also the name of the Treasury has been quoted in the sale account; The authority for sale and the method of disposal of stores have been shown. In the case of the private treaty sales; the following certificate has been furnished; “Sold by private treaty after failure to obtain reasonable price in auction.” (vi) The name of the purchaser has been given; (vii) In the case of stores sold by auction, the amount shown in the sale accounts agrees with the bid accepted at the auction sales which is shown in auction catalogues; (viii) The accepted bid shown in the sale account does not fall below the “reserve price” shown in the auction catalogue. It would be seen -6(ix) (x) (xi) that the sanction of the competent authority viz. CE exist where the bid has been accepted below the reserve price and Stores have been removed within the stipulated time as indicated in the sale release order and if not ground rent where due has been Recovered correctly with reference to the documents referred to in clauses (vi) and (vii) at above. No Condemnation without fixing Life In accordance with the provision contained in Note II below Rule 124 (1) GFR Ministries/Department may prescribe the “Life Period” of stores in consultation with the manufacturers. Where the life period has been prescribed or stipulated and is already over, it should normally be taken as enough ground for declaring the item obsolete and unserviceable. However, the condition of the item should still be thoroughly examined to see whether the item could be put to further use in terms of Rule 124 (1) (ii)GFR. The following item of Stores are required to be disposed off through DGS&D New Delhi in terms of Rule 124 (2) GFR. 1. Regular Defence ‘B’ Vehicles. 2. ASC packing material like Ghee tins, barrels, jerricans, drums and jute bags in respect of Defence Stores only, having their book value of more than Rs.50000/3. Serviceable tentage, clothing, tyres tubes and used engine oil in respect of Defence Stores only above the book value of Rs.50000/CONDEMNATION OF STEEL FURNITURE The life of the Steel articles and wooden furniture’s have been fixed by the E-in-Cs Branch, New Delhi letter No:-87139/E2 Plg. Dated 28.1.1975 as under: (a) Steel Furniture 40 years (b) Charpoy wooden 5 years -7(c) Other wooden furniture 16 years In accordance with the provision contained in BRDB New Delhi letter No.BRDB/01/128/BEA dt.11-7-2001 the condemnation and disposal of Typewriter and other Office Machine are as under :Condemnation and Disposal of Office Machine Name of the Machine Expendtiure Repair of Type Writer Rs.250/- per year per machine by Head of the Office. Rs.250 to Rs.350/per year per machine by DGBR Delhi Above Rs.350/per year per machine by the Ministry The price of the spare parts replaced will be payable in addition to the limits mentioned above subject to the following conditions The costs of the parts involved per type writer should not exceed Rs.2000/during the life time of the machine. (ii) in the case of other Office Machine, the cost of parts involved per machine should not exceed Rs.2000/-in any one year. Note : The limit of Rs.2000/-is exclusive of Sale Tax. Cases not covered above will be referred by the Head of the Office to DGBR for his consideration as to whether Machine should be repaired or otherwise authorize condemnation due to Un-economical of repairs of type writers and other Office Machines. In accordance with the provision contained in BRDB New Delhi letter No.02/236/98/BEA dated 25.5.2004 the life of the Machinery and Equipments have been fixed both in KMs and in Hours as per Annexure ‘A’ and ‘B’. The same may invariably be achieved before declaring the same for condemnation. -8MEDICAL FACILITIES UNDER CS(MA) RULES The Gref personnel are entitled for their Medical facilities under CS(MA) Rules 1944. However provision of emergency medical facilities to the GREF personnel (Self only) at remote and difficult localities through Armed Forces Medical Services (AFMS). EMERGENCY MEDICAL CARE In the event of emergency, the GREF personnel may receive treatment from the Gref MI Room in the first instance. He may be further referred to the nearest Armed Forces Medical Unit (Border Static Hospitals/Field Amb/MI Rooms) subject to the following conditions :No civil Hospital exists in the Station/Locality. Non availability of the accommodation in the Civil Hospital subject to the following conditions:Produce the requisite certificate from the Civil Hospital that the accommodation is not available and that the admission cannot be delayed without danger to his health until accommodation becomes available. During admission the GREF personnel will be entitled to receive treatment to the extent facilities are available from the AFMS Unit sources at the Station. HOSPITAL STOPAGE The Hospital Stoppages will be charged at the rates in force in accordance with the rules as per Para 298 of RMSAF-1983. The Hospital stoppages shall cover charges for the bed/accommodation, diet, linen, consultations and treatment including drugs and routine laboratory investigations. Rates for Hospital Stoppages. All cost intensive investigations like CAT Scan, Bone Scan, MRI etc. if carried out in a Service Hospitals/Civil institutes, the rates shall be as per the -9rates to be recovered shall be as laid down by the CGHS for their beneficiaries. The drugs/consumables purchased locally will be charged on cost to cost basis. The BRO shall ensure the availability of funds for arranging such investigations/purchases of drugs and consumables from local market/civil institutes. Hospital Stoppages and other bills will be sent to the Unit of the patient for settling the same through Book transactions under intimation to all concerned. Recovery of Hospital Stoppage in respect of all categories personnel will commence from the day following day of admission in the Service Hospital and continue upto and including the day of discharge of the individual there from. The patient admitted in Hospital after 1400 Hrs on a day and discharged on the same day no hospital stoppage will be recovered but when a patient is admitted before 1400 Hrs and is discharged on the same day, a fraction of the authorized rate of Hospital Stoppage will be levied and the fraction will be decided by the OC Hospital concerned. Transfer of Patients In case of emergency conditions when the transfer to another service Hospital is recommended as stated above, the patients will be transferred by the Service’s transport by Rail. If air, evacuation is requisitioned by the treating Medical Officer the cost of the same will be charged to BRO. All expenditure incurred by the Armed Forces Medical Units for transport, which is not covered by the Hospital Stoppage rates will be borne by the BRO. The relevant vouchers will be enfaced “Debit able to BRO Projects--The Medical Boards in OPD The specialists of the Armed Forces Medical Services will give their opinion with regard to the disability and recommended medical category as per the rules of the GREF in force as OPD cases. The GREF shall arrange all sick leave review/recatagorisation medical Boards of these patients.

![You`re invited to celebrate [child`s name]`s birthday at SCRAP! What](http://s3.studylib.net/store/data/007177272_1-c15601fb9e11b26854f13f1982e634e8-300x300.png)