What does "Value-Added" mean - Department of Economics

advertisement

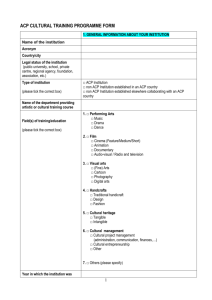

Employment Growth in Iowa's Agricultural Commodity Processing Industries, 1992-98 Iowa State University Department of Economics Authors Liesl Eathington, Research Associate Dave Swenson, Scientist Daniel M. Otto, Professor of Economics Introduction Value-added agriculture industries currently play a prominent role in Iowa's economic development strategies. Iowa's traditional strength in the production of certain commodities makes the state a logical location for many commodity processing industries. Capitalizing on this natural advantage, the state offers financial, educational, and marketing assistance to new and existing businesses that process Iowa's agricultural commodities. Processing adds value to raw agricultural commodities, and Iowa's economic development strategies are designed to capture this added value from processing within the state's borders. Rather than ship its raw commodities elsewhere, the state is working to attract and support firms at new and higher levels along the commodity processing chain. The promoters of value-added industrial development also hope these firms will increase demand for Iowa's commodities by developing new uses for them. Others believe these industries will help save Iowa's small family farms by providing new sources of income to farmers. Still others anticipate these industries will provide high-paying jobs to Iowa workers and increase the state's competitiveness in attracting new labor force members. The value-added agriculture policy and promotion push has political appeal, as well. By promoting value-added agricultural developments, leaders are advocating economic development policies that appear to benefit Iowa's farm and nonfarm sectors -- strategies that on the surface appear to enhance rural, small town, and urban economies. In a state as heavily weighted with agriculture and agricultural institutions as Iowa, one can see why promoting value-added agriculture is both popular and politically practical. Defining Value-Added Many different groups lay claim to the term "value-added agriculture" for political and promotional reasons, but there is a persistent absence of clarity in terms of just what value-added agriculture is and who receives the value. In economic terms, the “value” in value-added arises from the production process. It is the sum of payments made by industries to workers, plus profits, dividends and capital gains, and indirect business taxes paid to state and local governments. Value-added, then, is the money that remains in a region’s economy that can be used for household spending, saving, or capital investment. It represents the income and wealth available to the rest of the region's economy. Value-added agriculture strategies are concerned with increasing the local share of income and wealth that can be squeezed from a region's commodities before they are exported. As defined by Iowa's Ag Initiative 20001 consortium, "Value-added agriculture transforms commodities into 1 Members of the Ag Initiative 2000 include: Iowa Farm Bureau Federation, Agribusiness Association of Iowa, Iowa Soybean Association, Iowa Corn Growers Association, Iowa Pork Producers Association, Iowa Cattlemen’s Association, Iowa Egg Council, Iowa State University, Iowa Turkey Federation, Iowa Poultry Association and the Iowa Department of Economic Development. 2 products worth more to the world marketplace, resulting in increased job opportunities and income for Iowa residents." Defining value-added agriculture as a concept is much easier than defining it as a set of industries. When people use the term "value-added agriculture," they might be describing value added to the region's economy through improved production of agricultural commodities. Others might be describing value added to the economy through additional commodity processing. Some people use the term to describe both. Adding to the confusion, the term "value-added agriculture" often describes the value added to the commodities themselves, rather than value added to the region's economy. These distinctions might seem trivial, but they matter when identifying specific industries engaged in value-added agriculture activities. Because the term "value-added agriculture" is ambiguous, it is important to clarify our terminology and carefully throughout this report. define the industries discussed This paper describes employment changes in a subset of industries frequently associated with value-added agriculture. These industries, which we call "Agricultural Commodity Processing" (ACP) industries, manufacture agricultural commodities into various food and industrial products. We define our list of ACP industries below, but we begin by describing two sets of industries not included in our definition. Farm Industry To some, value-added agriculture refers simply to enhancements or additions to a product that result in higher returns to the commodity seller, who is often the farmer. These generally come in two forms: "Input value-added" enhancements reduce costs of production, thus returning value to the farmer. Technological enhancements, labor-saving steps, or any other innovation that allows the producer to produce more of a commodity at a lower cost fit into this group. "Output value-added" enhancements enable farmers to sell their product for a premium. These enhancements could entail growing specialty grains or animals, or engaging in strategic marketing 3 of commodities and animals. These output value-added activities are associated with a growing trend toward "identity-preserved" agricultural products. Industries and technologies improving the production and marketing of Iowa's commodities probably most deserve the label of "value-added agriculture," and Iowa's innovations in these areas. economic development strategies support However, growth in these industries doesn't necessarily increase the proportion of Iowa's raw commodities processed within the state. So, having described these activities, we now exclude them from our analysis. In this paper, we focus on those Iowa industries adding value to agricultural commodities after they are produced. Nonfarm, Non-Manufacturing Industries We also exclude a large group of agriculture-related service and other industries from our list. Many non-manufacturing industries in Iowa have close ties to agriculture. Examples include agricultural services industries such as crop and veterinary services; transportation industries such as trucking; wholesaling industries such as grain elevators and livestock auctions; retailing industries such as farmers markets and grocery stores; and financial services industries such as crop insurance and farm credit. While these industries facilitate the commodity production and distribution process, they don't substantially alter the commodities themselves. In other words, they don't transform the commodities into products worth more in the world marketplace. In addition, some of these industries compete with each other, shifting income and profits around the region without adding net new value to the economy. Manufacturing Industries Manufacturing firms engaged in the processing of agricultural commodities add income and profits to the region's economy while they add value to the agricultural commodities themselves. These industries most closely match 4 the description of value-added agriculture in Iowa's economic development literature. They transform crops and livestock into products worth more in the world marketplace, and opportunities to Iowa residents. they provide employment and income This report describes characteristics of employment and employment change in Iowa's agricultural commodity processing industries. Selection of Agricultural Commodity Processing Industries Even within the manufacturing sector, an assortment of traditional industries, like meatpacking, and emerging industries, like biotechnology, can be placed in the agricultural commodity processing category. Many of the emerging, high-technology industries differ strongly from the more traditional food processing industries in terms of the kinds of jobs created, the kinds of people attracted to the jobs, earnings levels, the volume of commodity inputs required, and the location preferences of firms. When describing the contributions of agricultural commodity processing industries to Iowa's economy, it is therefore important to further refine and segregate our list of industries. To study the employment growth patterns and average earnings in Iowa's ACP industries, we developed an unambiguous set of criteria to identify them. We traced the use of beef, pork, poultry, dairy, food and feed grains, soybeans, and other commodities through several stages of processing, creating a list of industries related to Iowa agriculture. We measured the relationships using industry-by-industry requirements tables published by the Bureau of Economic Analysis (BEA). The BEA tables can be used to find the dollar value of commodities and other inputs required for each dollar of output in a given industry. While commodities produced in Iowa are used in hundreds of products and manufacturing processes, the amounts used often are very small relative to the value of the final product produced. For example, pharmaceutical 5 industries add value to animal by-products by transforming them into drugs. However, the value of animal by-products used for production is just a tiny fraction of the total cost of producing drugs and pharmaceuticals. To initially limit the pool of ACP industries in this analysis, we set the following criteria: if at least one penny from every dollar's worth of final product could be traced back to a commodity in our list, we classified that industry as an ACP. While this may appear to be a very generous classification scheme, only 59 individual industries fit the criteria. These industries are listed in Appendix One. Description of ACP Industries The ACP industries described in this study fall into three major manufacturing categories: Food & Kindred Products, Chemicals & Allied Products, and Leather & Leather Products. Food & Kindred Products Food & Kindred Products represents the vast majority of ACP employment in Iowa. these In 1998, almost 95 percent of the state's ACP jobs were found in industries. This category includes 35 individual industries manufacturing food for humans or other animals. Some of these industries provide intermediate processing of commodities. That means their finished products are used as ingredients by other food processing and manufacturing industries. Two groups of intermediate food processing industries are of special interest in Iowa. Jobs in meat processing and grain processing industries represent more than 70 percent of all food processing jobs in Iowa. The meat processing industry group includes meat packing plants; sausages and other prepared meats; and poultry slaughtering and processing. 6 Together, these industries accounted for more than half of the state's food processing jobs in 1998. The grain processing industry group includes flour and other grain mill products; cereal breakfast foods; wet corn milling; and prepared animal feeds. These industries had just over 20 percent of all food processing jobs in 1998. The remaining 30 percent of Iowa's food processing jobs are distributed among various industries, the largest of which include dairy products, miscellaneous frozen foods, soft drinks, and bread products. Chemicals & Allied Products The ACP industries in the Chemicals & Allied Products group represent a much smaller part of Iowa's economy than the food processing industries. The group includes: agricultural surface active agents; industrial organic chemicals; chemicals; and chemical preparations2. Together, these industries account for less than one percent of Iowa's total manufacturing employment. Leather & Leather Products The Leather & Leather Products group also has a relatively small share of Iowa's manufacturing employment. This group includes: leather tanning and finishing; luggage; other leather goods; and automotive and apparel trimmings. Due to their relatively small size, we group the Chemicals & Allied Products and Leather & Leather Products categories together in the remainder of this report. 2 Surface active agents are used for wetting, emulsifying, and penetrating other substances. Industrial organic chemicals include ethanol and other ethyl alcohol products. Chemical preparations include oils, gelatins, and sizes. 7 The Role of ACP Industries in Iowa's Economy Together, the ACP industries manufacturing jobs in the state. nonfarm jobs in Iowa. in Iowa account for one-fifth of all This is slightly less than 4 percent of all Figure 1 illustrates the relative size of ACP employment in Iowa's overall nonfarm economy. Figure 1 also shows ACP employment by category within Iowa's manufacturing sector. Figure 1 The Role of ACP Industry Employment in Iowa's Nonfarm Economy, 1998 Agricultural Commodity Processing Meat Processing Grain & Soybean Processing Other Food Processing All Other ACP Industries All Other Nonfarm Employment Total Nonfarm Employment All Other Manufacturing Employment Total Manufacturing Employment Comparison of a standard indicator of an industry’s activity, such as jobs, with state totals gives us an idea of the overall contribution of the industry to the state’s economic fortunes. Along with jobs, we chose two other measures for comparing ACP industrial outcomes relative to the rest of the Iowa economy -- industrial output and value-added. Industrial output is a measure of the overall value of products that are produced by an industry in a given year whether they are produced for sale or for inventory. Value-added is the sum of labor income, returns to investors, and indirect tax payments made to state and local governments 8 (primarily sales, use, & excise taxes). It is the money that workers, owners, investors, and state and local governments extract from the price of the goods that are sold (its industrial output) in the industry we are studying. Jobs measure the number of positions in the industries, not the number of employed persons. instance. Part-time and full-time jobs count the same in this Comparisons of these three measures are contained in the following two graphs. Figure 2 compares ACP industries with all agriculture and agriculture services industries and with all other manufacturing industries using the three measures described earlier. Agriculture and ag services perform similarly across all three measures. They account for 7.3 percent of jobs, 7.5 percent of value-added, and 8.7 percent of industrial output in the state. Figure 2 ACP and Other Industry Contributions to the State Economy, 1997 25.0% 23.4% Jobs Value Added Percent of State Total 20.0% 16.8% Industrial Output 15.0% 12.3% 11.2% 10.0% 8.7% 7.3% 7.5% 4.4% 5.0% 2.9% 0.0% Agriculture & Ag Services Industries All Other Manufacturing Industries Agricultural Commodity Processing Industries 9 Agricultural commodity processing industries display widely divergent shares. These industries collectively produce 12.3 percent of the state’s industrial output, but only 4.4 percent of the state value-added, and just 2.9 percent of the state’s jobs. ACP’s share of industrial output in Iowa in 1997 is more than four times its share of jobs. All other Iowa manufacturing accounts for 23.4 percent of the state’s industrial output, nearly 17 percent of its value-added, and 11.2 percent of jobs. By comparison, then, these other manufacturing industries account for twice the industrial output as ACP industries, and just under four times as much value-added and jobs. The significant difference in industrial output shares and job or value-added shares in the ACP and the other manufacturing groups indicates that, all other things equal, these firms tend to be capital intensive. Figure 3 gives us additional insights into the contributions of specific kinds of ACP industries to the state economy. Meat processing accounted for 5 percent of the state industrial output, but just 1.4 percent of its jobs and 1.3 percent of its value-added. Foods production was 3.5 percent of state industrial output, 1.4 percent of its value-added and 0.8 percent of its jobs. Grain processing amounted to 3.4 percent of output, 1.5 percent of valueadded, and 0.5 percent of jobs. Finally, all of the other ACP firms in Iowa made up 0.5 percent of its total industrial output, 0.3 percent of its valueadded, and 0.2 percent of its jobs. 10 Figure 3 Selected ACP Industry Contributions to the State Economy Jobs Value Added Industrial Output 6% 5.0% Percentage of State Total 5% 4% 3.5% 3.4% 3% 2% 1.5% 1.4% 1% 1.4% 1.3% 0.8% 0.5% 0.2% 0.3% 0.5% 0% Foods Grain Meat ACP Industry Group Other ACP It is also instructive to compare Iowa's ACP jobs to the rest of the nation. Economic development officials tend to focus on two measures of comparative performance -- earnings and competitive advantage. The next two graphs put Iowa's ACP employment levels and earnings into national perspective3. Figure 4 illustrates 1998 average earnings per job in Iowa's food and kindred product processing industries. These average earnings were slightly below Iowa's average earnings per job in all other manufacturing industries. They were, however, comparable to the national averages for food processing industries. In the aggregate, Iowa's compensation levels are on par with the rest of the nation. 3 These comparisons were made using Iowa and U.S. data from the Bureau of Economic Analysis. Earnings and employment data for Iowa's non-food ACP industries were unavailable in sufficient detail for comparison with U.S. averages, so Figures 4 and 5 illustrate comparisons for food & kindred products industries only. 11 Figure 4 Average Earnings per Job in Manufacturing Industries, Iowa and the United States USA, All Other Mfg. USA, Food & Kindred Iowa, All Other Mfg. Iowa, Food & Kindred $- $10,000 $20,000 $30,000 $40,000 $50,000 1998 Average Earnings per Job The state's employment levels in these industries exceed the national average. Iowa has almost 20 percent of its manufacturing jobs in food and kindred products industries. percent. Nationally, this average is just below 10 Iowa's competitive advantage in food and kindred products manufacturing is apparent in Figure 5, which shows the state's shares of national employment in these and all other manufacturing industries. 12 Figure 5 Iowa's Shares of Manufacturing Employment in the United States, 1992-1998 3.5% Percent of National Totals 3.0% 2.5% 2.0% Food & Kindred Products All Other Manufacturing 1.5% 1.0% 0.5% 0.0% 1992 1993 1994 1995 1996 1997 1998 Iowa has almost 3 percent of the nation's employment in food and kindred products industries. It's share of all other manufacturing employment is just over 1 percent. Iowa's share of food and kindred products employment has eroded slightly in recent years, while its share of all other manufacturing has been steadily climbing. Still, compensation and employment levels in Iowa's food and kindred products manufacturing compare favorably with the rest of the nation. 13 Distribution of ACP Employment Within Iowa Statewide, about one in five manufacturing jobs is found in agricultural commodity processing industries. However, the distribution concentration of ACP employment varies across the state. and This variation occurs by type of county, and also geographically by region. When we study the distribution of employment within the state, we often use population size to group the counties. This grouping gives us an urban hierarchy. Comparisons by county type allow us to study how different kinds of firms are more or less attracted to the larger labor pools, transportation networks, or other firms found in larger places. In this report, we use four county groups: metropolitan, large urban, small urban, and rural4. We can also study the distribution of employment by major geographic region. For these comparisons, we grouped Iowa's counties into nine regions coinciding with the state's USDA crop reporting districts. The regional groupings help illustrate differences in employment concentrations and regional specialization in commodity processing activity. The multi-county groupings are necessary, as well, because administrative rules prevent us from reporting these data at the county level, to avoid the accidental disclosure of the characteristics of individual firms. Appendix Two lists Iowa's 99 counties and identifies their population size group and geographic regional group assignments. Distribution of Employment by County Type Iowa’s metropolitan counties account for most of the ACP jobs in Iowa, as is shown in Figure 6. In 1998, 22,700 ACP jobs were in the metro counties, 4 Iowa has 10 metropolitan counties, nine large urban counties, 60 small urban counties, and 20 rural counties. Metropolitan counties contain a central city of at least 50,000. Large urban counties are smaller than metropolitan counties, but have a central city of 20,000 or more. Small urban counties have a city of 2,500 or more. The remaining counties are the rural counties. 14 followed by 17,500 jobs in the state’s 60 small urban counties. The large urban counties had 11,100 ACP jobs, and the rural counties had just under 2,400. Similar numerical distributions are in evidence for all other manufacturing jobs. The metros had the most (83,100), followed in turn by the small urban counties (74,200), the large urban counties (36,600), and the rural counties (13,300). Figure 6 Composition of Iowa's Manufacturing Employment by County Type in 1998 Rural Small Urban Large Urban 13,300 2,400 74,200 17,500 36,600 11,100 83,100 Metropolitan - 22,700 20,000 40,000 60,000 80,000 100,000 Jobs ACP All Other Manufacturing Although their share of state total ACP employment is the highest, the metropolitan counties have the lowest concentration of ACP jobs when measured as a percentage of all nonfarm employment. This is because metro counties have a disproportionately higher share of non-manufacturing jobs than the remaining county types. In the metropolitan counties only three jobs per 100 nonfarm jobs were related to ACP in 1998. The large urban counties and small urban counties had around 5 percent of their nonfarm jobs in ACP industries. The rural counties had about 4 percent of all 15 nonfarm jobs in ACP industries. By county grouping, there appears to be no overwhelming concentration or deficit of ACP jobs relative to other nonfarm jobs. Measured as a percentage of manufacturing employment alone, the ACP employment ratios are highest in the metropolitan and large urban county groups. Both groups average more than 20 percent of their manufacturing employment in ACP jobs. The small urban counties average slightly less than 20 percent of manufacturing in ACP jobs, and the rural counties average about 15 percent. Figure 7 shows ACP jobs as a percentage of total manufacturing employment by county type. Figure 7 Composition of Iowa's Manufacturing Employment by County Type in 1998 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% Metropolitan Large Urban Meat Processing Other ACP Small Urban Rural Grain & Soybean Processing All Other Manufacturing When we look at the industrial composition of ACP jobs across the county groups, equal. we see the average percentage of meat processing jobs is nearly Meat processing jobs represent about 10 percent of total 16 manufacturing employment in the four county groups. Concentrations of grain processing and other value-added industries, however, are not consistent across the county groups. Iowa's metropolitan and large urban counties have relatively more of their manufacturing jobs in these industries than the small urban and rural counties. The differences in ACP employment concentrations by industry and county group indicate the ACP industries have varying degrees of preference for larger places. Figure 8 compares the percentage of Iowa's meat processing jobs, grain processing jobs, and other ACP jobs that were located in the metropolitan and large urban counties, the small urban counties, and the rural counties in 1998. Figure 8 Shares of Iowa's ACP Employment by Category and County Type in 1998 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% Metropolitan & Large Urban Meat Processing Small Urban Grain & Soybean Processing Rural Other ACP Together, the metropolitan and large urban county groups have almost 80 percent of Iowa's grain and soybean processing jobs, and about 60 percent 17 of the jobs in meat processing and other ACP industries. The concentration of ACP jobs in Iowa's 19 largest counties is notable, especially when we consider that value-added agriculture opportunities for Iowa's smaller counties. is frequently promoted for its In the past, at least, the ACP industries have demonstrated a preference for larger places. Distribution of Employment by Region Not by coincidence, Iowa's metropolitan and large urban counties are located along major rivers, railways, or highways. The physical characteristics of a region, whether natural or built, help determine the number of people and firms that locate there. Differences in the physical characteristics of Iowa's counties have contributed to regional concentrations of ACP employment. For example, the 10 counties bordering the Mississippi River have more than 20 percent of Iowa's ACP jobs. Table 1 shows how Iowa's ACP jobs are distributed geographically around the state. The table also shows the distribution of all other manufacturing jobs. Each region contains a group of nine to 12 counties, corresponding with Iowa's nine USDA crop reporting districts. Table 1. Percentage Shares of State Employment by Region ACP Manufacturing All Other Manufacturing 12% 6% 5% 8% Northeast 15% 16% West Central 12% 4% Central 18% 20% East Central 21% 26% Southwest 4% 4% South Central 4% 6% Southeast 9% 11% Region Northwest North Central 18 We can see from the table there are distinct concentrations of both ACP and other manufacturing jobs among our regions. ACP jobs are most prevalent in the east central and central regions of the state. They are the least prevalent in the southwest, south central, and north central portions of the state. These regional shares of state total ACP employment, and the proportional distributions of ACP employment by kind of industry, are displayed in Figure 9. The relative differences in total ACP employment among the regions are stark. The north central, south central, and the southwest districts account for very small amounts of ACP jobs in Iowa -- none has more than 5 percent of Iowa's ACP jobs. Not only does the relative size of ACP employment differ, but the amount of employment by industry differs from one region to the next. In 1998, more than half of Iowa’s ACP jobs were in meat processing industries, but the ratio varied regionally. In several regions the number of other food processing jobs exceeded meat industry jobs. Grain and soybean processing dominated in only one district, the east central portion of the state. 19 Figure 9 Regional Composition of ACP Employment in 1998 (Overall size of pie charts reflects the regional differences in the total number of ACP jobs.) Shares of Regional Total ACP Employment in: Meat Processing Grain and Soybean Processing Other ACP The regional concentrations of meat and grain processing employment do not necessarily align with regional concentrations of meat and grain commodity production. Figure 10 compares state shares of ACP employment and crop and livestock commodity production for all nine regions in 1998. The first chart shows livestock marketings and meat processing employment, and the second chart shows crop marketings and grain processing employment. For this analysis, commodity production was measured by the dollar value of livestock and crop marketing activity and displayed as percentages of state totals. 20 Figure 10 Shares of State Total Cash Receipts from Livestock Marketings and Meat Processing Employment in 1998 Southeast South Central Southwest East Central Central West Central Northeast North Central Northwest 0 5 10 15 20 25 Percentage of Iowa Total Meat Processing Employment Livestock Cash Receipts Shares of State Total Cash Receipts from Crop Marketings and Grain & Soybean Processing Employment in 1998 Southeast South Central Southwest East Central Central West Central Northeast North Central Northwest 0 10 20 30 40 50 60 Percentage of Iowa Total Grain & Soybean Processing Employment Crops Cash Receipts 21 In 1998, the northwest region had the largest share of livestock marketing, while the northeast region had the largest share of meat processing jobs. The central region had the largest share of crop marketing, while the east central region had the largest share of grain and soybean processing jobs. These differences suggest existing patterns of ACP employment across the state arise from more complex factors than the location of farming activity. These patterns continue to evolve as Iowa's ACP employment levels rise and fall by industry, region, and county type. Employment Change in ACP Industries The manufacturing sector contains some of Iowa's most rapidly growing industries, but the ACP industries are not among them. The agricultural commodity processing industries grew only slightly more than a third of the manufacturing sector's average rate between 1992 and 1998. Total manufacturing employment in Iowa grew 14.5 percent from 1992 to 1998. Employment in Iowa's ACP manufacturing industries grew only 5.5 percent, while all other manufacturing industry employment grew 17 percent. We would not expect brisk growth in mature industries, and many food processing industries in Iowa certainly are mature. Maturity also suggests stability, but employment growth patterns in the collection of traditional and emerging industries described in this paper were anything but stable. Rather, the changes were uneven across industries and counties. Large gains accruing to some industries and county groups were offset by large losses in others. Industries that grew contributed almost 4,900 new jobs to Iowa's economy between 1992 and 1998. These gains were substantially offset by losses of 2,100 jobs in the declining ACP industries. The net employment growth in ACP industries from 1992 to 1998 was almost 2,800 new jobs. This growth 22 represented about 8.5 percent of all new manufacturing jobs in Iowa between 1992 and 1998. The net statewide employment change in meat processing industries was only 350 new jobs from 1992 to 1998. Employment losses in meat packing plants and poultry slaughtering and processing nearly wiped out the gains in sausages and other prepared meats. Iowa experienced a net loss of more than 800 jobs in grain and soybean processing industries between 1992 and 1998. Most of these losses occurred in animal feed industries. Minor gains in milling industry employment could not make up the feed industry losses. The remaining ACP industries actually performed better as a group than the traditional meat and grain processing industries. Among those industries that grew, the category with the largest net employment gain was a collection of industries called miscellaneous food preparations. This category includes potato chips and snacks, pasta, gelatins, spices and seasonings, packaged popcorn, honey, dry mixes, and various other food products. These industries contributed about one third of Iowa's net, new ACP jobs during the period. Dairy industries contributed about 20 percent of the net job gains. 1998. Iowa's non-food ACP industries also grew between 1992 and Together, the chemicals and allied products and the leather and leather products groups contributed about 20 percent of Iowa's new ACP jobs. The employment gains in the ACP industries were slight, when compared to the growth in the rest of Iowa's manufacturing sector. Figure 11 summarizes the employment changes by major ACP category and compares the magnitude of ACP employment change to the growth occurring in all other manufacturing industries during the same time period. 23 Figure 11 Composition of Iowa's Manufacturing Employment Change from 1992 to 1998 All Other Manufacturing Other ACP Grain & Soybean Processing Meat Processing (5,000) - 5,000 10,000 15,000 20,000 25,000 30,000 35,000 Jobs Employment Change by County Group The most rapid ACP employment growth occurred in Iowa's 60 small urban counties. The total number of ACP jobs in these counties increased by almost 18 percent. The increase in rural county ACP employment was just short of 5 percent. The metropolitan county increase was 1 percent, and the large urban counties actually lost about 1 percent of their ACP employment. The gains by county group, like the statewide gains, should be compared to gains in all other manufacturing to keep them in perspective. In every case, gains in other manufacturing were substantially more than ACP gains. Large urban county jobs in all other manufacturing grew by 15 percent, and metro jobs grew by 9 percent. In the small urban group, all other manufacturing grew by 28 percent -- 10 percentage points higher than the ACP growth rate. In the rural counties, all other manufacturing grew by 21.2 percent -- over four times faster than ACP industry jobs. 24 Figure 12 compares the magnitude of employment gains and losses among the county groups in three different manufacturing categories: meat and grain processing industries, other ACP industries, and all other manufacturing industries. Figure 12 ACP and All Other Manufacturing Employment Change by County Type Rural Small Urban Large Urban Metropolitan (5,000) - 5,000 Meat & Grain Processing 10,000 All Other ACP 15,000 20,000 All Other Mfg. The small urban counties differed strongly from the other three county groups in their patterns of ACP employment growth. The small urban county group had the largest share, as well as the most rapid rate, of total ACP employment growth. This growth was split almost evenly between the categories of meat and grain processing and all other ACP industries. The patterns of ACP employment change in the metropolitan, large urban, and rural county groups resembled each other in pattern, although they differed in magnitude. These groups all lost jobs in meat and grain 25 processing industries, but gained nearly equivalent numbers of new jobs in all other ACP industries. In the metropolitan and rural county groups, ACP employment gains slightly exceeded the losses. However, ACP employment gains in the large urban counties were insufficient to offset their losses. The large urban counties ended the 1992-98 period with a slight decline in total ACP employment. In Figure 13, we illustrate the distribution of statewide ACP employment change again, this time to highlight the differences by industry. The chart shows how Iowa's statewide gains and losses in four ACP manufacturing categories were distributed among the county groups. It also shows the distribution of gains in the "all other manufacturing" category. Figure 13 County Group Shares of Manufacturing Employment Change by Category, 1992 to 1998 All Other Mfg. Non-food ACP Other Food Processing Grain Processing Meat Processing -100% -50% Metropolitan 0% Large Urban 50% Small Urban Meat processing employment grew in only one county group. 100% Rural The small urban counties posted employment gains totaling almost 1,400 net new jobs. 26 Net losses in the metropolitan, large urban, and rural county groups totaled almost 1,050 jobs. Gains to the small urban group in meat processing, then, came largely at the expense of the other county groups. The grain processing industries were less selective. In all four types of counties, losses in these industries matched or exceeded any gains, resulting in overall net declines in employment. The metropolitan counties experienced the greatest share of these losses. Other food processing industries grew in all four county groups. The metropolitan and small urban county groups had nearly equal shares of these new jobs. The non-food ACP industries, which include chemical and leather manufacturers, grew everywhere except the large urban counties. The small urban counties had the largest share of these non-food ACP employment gains. Still, the small urban counties had even larger shares of all other manufacturing growth in the state. Regional Distribution of Employment Change Agricultural commodity processing employment growth ebbed and flowed across the state between 1992 and 1998. The south central region had the most dramatic increase in total ACP employment, while the east central region experienced the sharpest decline. All three regions along Iowa's eastern border suffered net losses in ACP employment. The remaining six regions in central and western Iowa had net gains in total ACP employment. Figures 14 and 15 illustrate the nature of these shifts geographically. The first map shows the composition of regional ACP employment gains, while the second map shows the composition of regional ACP employment losses. The size of the pie chart in each region reflects the magnitude of the region's total ACP employment gains and losses, respectively, relative to other regions. 27 All nine regions had at least some share of employment gains in one or two major ACP categories, but only the south central region gained in all three. All in all, the gains and losses by geographic region and county type suggest that ACP employment shifted spatially much more than it grew from 1992 to 1998. Figure 14 Regional Shares of Statewide Employment Gains in Iowa's ACP Industries, and the Composition of Gains by Region, 1992 to 1998 Gains Meat+ Grain+ Other+ 28 Figure 15 Regional Shares of Statewide Employment Losses in Iowa's ACP Industries, and the Composition of Losses by Region, 1992 to 1998 Losses MeatGrainOther- Conclusions Iowa's agricultural commodity processing industries have an undeniably important role in the state's economy. However, expectations about their promise for Iowa's economic future have been growing far more rapidly than the industries themselves. The current popularity of value-added agriculture promotions and policies suggests newness, but in fact, most agricultural commodity processing industries are not new to the state of Iowa. Ninety-five percent of Iowa’s ACP industries involve meat processing, grain processing, or other food production. While new technologies are expanding uses for Iowa commodities, most meat and grain products grown in the state still are 29 channeled through existing, traditional feed and food processing industries. These industries already have a strong presence in Iowa. Much of what is intended in promoting value-added agriculture refers to high-technology firms paying high wages to workers; average earnings in the traditional food processing industries, however, are lower than average earnings in the rest of Iowa's manufacturing sector. In addition to high wages, the value-added agriculture movement promises opportunities for nonfarm employment growth. Yet the industries processing the bulk of Iowa's commodities are generally slow-growth or declining industries in the state. Iowa's dependence on ACP employment has decreased in recent years. With growth rates lagging other manufacturing industries, the ACP industries dropped from 22 to 20 percent of total manufacturing employment between 1992 and 1998. The newer, high-technology firms associated with the value-added agriculture movement might represent greater opportunities for employment growth than the traditional, food processing industries, although this potential is difficult to assess. For this paper, we tried to identify a set of industries with close ties to Iowa agriculture. We may have overlooked some industries that don't have strong, traditional links to Iowa's commodities. At the present time, however, these industries represent just a small fraction of Iowa's nonfarm economy. Agricultural commodity processing produces a high amount of output, and it is important in moving the state's agricultural commodities along in the food and industrial products chain. Its contribution to the state's job base is, however, quite small. Economic evidence for the 1990s suggests it is neither instrumental nor emerging as a major job producer in the state of Iowa. Even if new technologies and new production practices emerge in the state to allow higher growth in these sectors, history suggests they will produce comparatively few jobs. 30 Recent employment growth in Iowa's agricultural commodity processing industries, while appearing on the surface to benefit Iowa's smaller counties, may merely represent a shifting in the location of employment from one county to another. Almost half of the gains to small urban counties occurred in meat processing industries, while meat processing employment declined by an almost equivalent number of jobs in Iowa's other county groups. Employment gains in the remaining ACP industries actually showed weaker preference for Iowa's smaller counties than other kinds of manufacturing industries. In other words, agricultural commodity processing employment growth is not an economic cure-all for Iowa's small counties. Iowa's future growth will depend on capitalizing on its strengths, such as production agriculture, agricultural services, and agricultural commodity processing industries. However, a "Value-Added Agriculture" label does not guarantee the contributions of a firm or industry to Iowa's future. This is especially important to remember if public policies result in a form of economic development tunnel vision that blinds us from seeing new opportunities in other industries. 31 Appendix 1. Agricultural Commodity Processing Industries SIC Code Industry Description ACP Industry Group 2011 Meat packing plants Meat Processing 2013 Sausages and other prepared meats Meat Processing 2015 Poultry slaughtering and processing Meat Processing 2021 Creamery butter Other Food Processing 2022 Cheese, natural and processed Other Food Processing 2023 Dry, condensed, evaporated products Other Food Processing 2024 Ice cream and frozen desserts Other Food Processing 2026 Fluid milk Other Food Processing 2032 Canned specialties Other Food Processing 2033 Canned fruits and vegetables Other Food Processing 2034 Dehydrated fruits, vegetables, soups Other Food Processing 2035 Pickles, sauces, and salad dressings Other Food Processing 2037 Frozen fruits and vegetables Other Food Processing 2038 Frozen specialties, n.e.c. Other Food Processing 2041 Flour and other grain mill products Grain & Soybean Processing 2043 Cereal breakfast foods Grain & Soybean Processing 2045 Prepared flour mixes and doughs Grain & Soybean Processing 2046 Wet corn milling Grain & Soybean Processing 2047 Dog and cat food Grain & Soybean Processing 2048 Prepared feeds, n.e.c. Grain & Soybean Processing 2051 Bread, cake, and related products Other Food Processing 2052 Cookies and crackers Other Food Processing 2053 Frozen bakery products, except bread Other Food Processing 2064 Candy and other confectionery products Other Food Processing 2066 Chocolate and cocoa products Other Food Processing 2068 Salted and roasted nuts and seeds Other Food Processing 2075 Soybean oil mills Grain & Soybean Processing 2076 Vegetable oil mills, n.e.c. Other Food Processing 2077 Animal and marine fats and oils Other Food Processing 2079 Edible fats and oils, n.e.c. Other Food Processing 2082 Malt beverages Other Food Processing 32 SIC Code Industry Description ACP Industry Group 2083 Malt Other Food Processing 2084 Wines, brandy, and brandy spirits Other Food Processing 2085 Distilled and blended liquors Other Food Processing 2086 Bottled and canned soft drinks Other Food Processing 2087 Flavoring extracts and syrups, n.e.c. Other Food Processing 2092 Fresh or frozen prepared fish Other Food Processing 2096 Potato chips and similar snacks Other Food Processing 2098 Macaroni and spaghetti Other Food Processing 2099 Food preparations, n.e.c. Other Food Processing 2231 Broadwoven fabric mills, wool Leather & Leather Products 2299 Textile goods, n.e.c. Leather & Leather Products 2396 Automotive and apparel trimmings Leather & Leather Products 2843 Surface active agents Chemicals & Allied Products 2865 Cyclic organic crudes, dyes, and pigments Chemicals & Allied Products 2869 Industrial organic chemicals, n.e.c. Chemicals & Allied Products 2879 Agricultural chemicals, n.e.c. Chemicals & Allied Products 2899 Chemical preparations, n.e.c. Chemicals & Allied Products 3111 Leather tanning and finishing Leather & Leather Products 3131 Boot and shoe cut stock and findings Leather & Leather Products 3142 House slippers Leather & Leather Products 3143 Men's footwear, except athletic Leather & Leather Products 3144 Women's footwear, except athletic Leather & Leather Products 3149 Footwear, except rubber, n.e.c. Leather & Leather Products 3151 Leather gloves and mittens Leather & Leather Products 3161 Luggage Leather & Leather Products 3171 Women's handbags and purses Leather & Leather Products 3172 Personal leather goods, n.e.c. Leather & Leather Products 3199 Leather goods, n.e.c. Leather & Leather Products 33 Appendix 2. County Groupings County Name FIPS Code Population Size Group Geographic Region Adair 19001 Rural Southwest Adams 19003 Rural Southwest Allamakee 19005 Small Urban Northeast Appanoose 19007 Small Urban South Central Audubon 19009 Small Urban West Central Benton 19011 Small Urban East Central Black Hawk 19013 Metropolitan Northeast Boone 19015 Small Urban Central Bremer 19017 Small Urban Northeast Buchanan 19019 Small Urban Northeast Buena Vista 19021 Small Urban Northwest Butler 19023 Rural North Central Calhoun 19025 Rural West Central Carroll 19027 Small Urban West Central Cass 19029 Small Urban Southwest Cedar 19031 Small Urban East Central Cerro Gordo 19033 Large Urban North Central Cherokee 19035 Small Urban Northwest Chickasaw 19037 Small Urban Northeast Clarke 19039 Small Urban South Central Clay 19041 Small Urban Northwest Clayton 19043 Rural Northeast Clinton 19045 Large Urban East Central Crawford 19047 Small Urban West Central Dallas 19049 Metropolitan Central Davis 19051 Small Urban Southeast Decatur 19053 Rural South Central Delaware 19055 Small Urban Northeast Des Moines 19057 Large Urban Southeast Dickinson 19059 Small Urban Northwest Dubuque 19061 Metropolitan Northeast Emmet 19063 Small Urban Northwest Fayette 19065 Small Urban Northeast Floyd 19067 Small Urban North Central Franklin 19069 Small Urban North Central 34 County Name FIPS Code Population Size Group Geographic Region Fremont 19071 Rural Southwest Greene 19073 Small Urban West Central Grundy 19075 Rural Central Guthrie 19077 Rural West Central Hamilton 19079 Small Urban Central Hancock 19081 Small Urban North Central Hardin 19083 Small Urban Central Harrison 19085 Small Urban West Central Henry 19087 Small Urban Southeast Howard 19089 Small Urban Northeast Humboldt 19091 Small Urban North Central Ida 19093 Rural West Central Iowa 19095 Rural East Central Jackson 19097 Small Urban East Central Jasper 19099 Small Urban Central Jefferson 19101 Small Urban Southeast Johnson 19103 Metropolitan East Central Jones 19105 Small Urban East Central Keokuk 19107 Rural Southeast Kossuth 19109 Small Urban North Central Lee 19111 Large Urban Southeast Linn 19113 Metropolitan East Central Louisa 19115 Rural Southeast Lucas 19117 Small Urban South Central Lyon 19119 Small Urban Northwest Madison 19121 Small Urban South Central Mahaska 19123 Small Urban Southeast Marion 19125 Small Urban South Central Marshall 19127 Large Urban Central Mills 19129 Small Urban Southwest Mitchell 19131 Small Urban North Central Monona 19133 Small Urban West Central Monroe 19135 Small Urban South Central Montgomery 19137 Small Urban Southwest Muscatine 19139 Large Urban East Central O'Brien 19141 Small Urban Northwest Osceola 19143 Small Urban Northwest Page 19145 Small Urban Southwest Palo Alto 19147 Small Urban Northwest 35 County Name FIPS Code Population Size Group Geographic Region Plymouth 19149 Small Urban Northwest Pocahontas 19151 Rural Northwest Polk 19153 Metropolitan Central Pottawattamie 19155 Metropolitan Southwest Poweshiek 19157 Small Urban Central Ringgold 19159 Rural South Central Sac 19161 Rural West Central Scott 19163 Metropolitan East Central Shelby 19165 Small Urban West Central Sioux 19167 Small Urban Northwest Story 19169 Large Urban Central Tama 19171 Small Urban Central Taylor 19173 Rural Southwest Union 19175 Small Urban South Central Van Buren 19177 Rural Southeast Wapello 19179 Large Urban Southeast Warren 19181 Metropolitan South Central Washington 19183 Small Urban Southeast Wayne 19185 Rural South Central Webster 19187 Large Urban Central Winnebago 19189 Small Urban North Central Winneshiek 19191 Small Urban Northeast Woodbury 19193 Metropolitan West Central Worth 19195 Rural North Central Wright 19197 Small Urban North Central 36