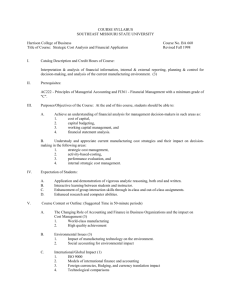

syl - The University of Texas at Dallas

advertisement

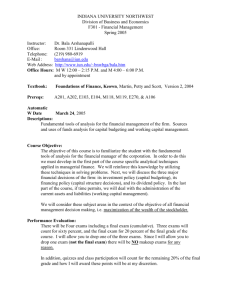

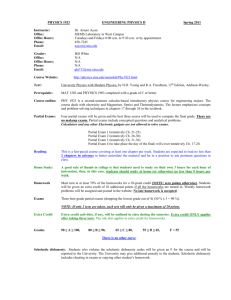

University of Texas at Dallas School of Management FIN 6301 FINANCIAL MANAGEMENT Fall 2004 Course Description: The primary goal of this course is to provide an integrated overview of the most important ideas in corporate finance from the point of view of the manager of a non-financial corporation. The main theoretical principle of the course is the concept of shareholder value. The topics covered include: time value of money and the net present value rule; valuation of stocks and bonds; capital budgeting decisions; uncertainty and the risk-return trade-off; and corporate financing and dividend policy decisions. Instructor: Mary C. Chaffin Classroom: SOM 1.217 Time: Monday, 7:00 P.M. - 9:45 P.M. Office: SOM 2.208 (972-883-2646) Email: chaf@utdallas.edu Office Hours: Monday 4:00-6:30 p.m. Wednesday 2:00-3:30 p.m. and by appointment. Text: Corporate Finance, 7th Edition, Stephen A. Ross, Randolph W. Westerfield and Jeffrey Jaffe. Recommended: Calculator. A financial calculator can speed up tedious calculations. Optional: The Wall Street Journal. The Journal is a good way to begin a lifelong pattern of professional reading. We will discuss significant financial events as they occur. My Web Page: www.utdallas.edu/~chaf Transparencies Solutions to end of chapter problems Old exams Ross, Westerfield, Jaffee web page Exams: There will be three exams. The first two will be weighted so that the one that you score the highest on weighs more. The final exam will be cumulative. You will be allowed to bring a formula sheet for each exam. I will give the specifications for the sheet in class. If you do not abide by them, you will not be allowed to use a formula sheet. No make-up exams will be given. If you have a valid excuse and have the consent of the instructor for missing a midterm, the final will be weighted more heavily. Problem Sets: Three problem sets will be assigned. They are due at the beginning of class on the date due. Some of the problems are easy and some are more difficult. You may discuss the problems in a study group. However, the work that you submit should be your own. Grading: Exam I Exam II Final Exam Problem Sets 30% or 15% 30% or 15% 40% 15% Recommended Practice Problems: Work the examples in each chapter as well as end of chapter problems as needed. Working problems will help you in understanding the material. Solutions to some of the end-of-chapter problems are on my web page. NOTICE OF POLICY ON CHEATING Policy on Cheating: Students are expected to be above reproach in all scholastic activities. Students who engage in scholastic dishonesty are subject to disciplinary penalties, including the possibility of failure in the course and dismissal from the university. "Scholastic dishonesty includes but is not limited to cheating, plagiarism, collusion, the submission for credit of any work or materials that are attributable in whole or in part to another person, taking an examination for another person, any act designed to give unfair advantage to a student or the attempt to commit such acts." Regents' Rules and Regulations, Part One, Chapter VI, Section 3, Subsection 3.2, Subdivision 3.22. COURSE OUTLINE DATE 8/25 CH 1, 4 TOPIC Introduction, Time Value of Money 8/30 2, 3 Cash Flow, Financial Planning and Growth 9/6 Labor Day Holiday 9/13 5 Valuing Bonds and Stocks 9/20 6, 7 Capital Budgeting 9/27 7 Capital Budgeting 10/4 Exam I Chapters 2, 4, 5, 6, 7 10/11 8 9, 9A Capital Budgeting Risk and Return 10/18 10, 10A Risk and Return 10/25 11, 12, 13 Risk and Return 11/1 14,15 Capital Structure 11/8 Exam II Chapters 8, 9, 10, 11, 12, 13, 14 11/15 16 Capital Structure 11/22 18, 19, 20 Dividend Policy, Long-Term Finance Revisited 11/29 31 International Corporate Finance 12/6 FINAL EXAM (Comprehensive)