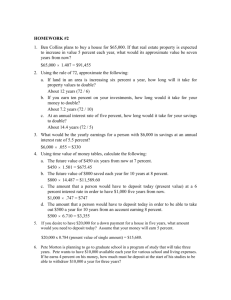

Deposit Interest Retention Tax

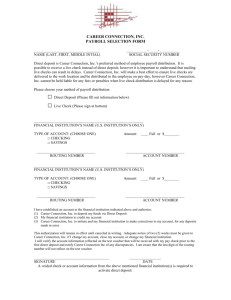

advertisement