RTZ ` s Kennecott Balances Its Mining Act With Coal

advertisement

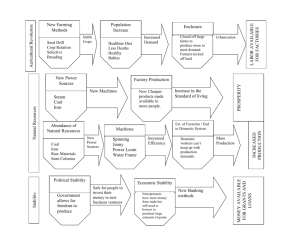

RTZ ' s Kennecott Balances Its Mining Act With Coal --Acquisitions Offset Reliance on Copper After Successful Rise in Productivity By Marj Charlier 03/10/1993 The Wall Street Journal PAGE B4 (Copyright (c) 1993, Dow Jones & Co., Inc.) SALT LAKE CITY -- Kennecott Corp.'s 64-year-old president, G. Frank Joklik, recently inaugurated this town's new 18-meter ski jump, racing down the ramp, sailing into the air and nailing a flawless landing. The secret to his successful firstever jump: Keep your head up and keep your balance when you land, he says. If there were a perfect place to learn those skills, it would have to be Kennecott. Since Mr. Joklik took over management of the company in 1980, the company has struggled to keep its head above water and keep its balance when it fell. As with his Olympic-style ski jump, Mr. Joklik landed on his feet at Kennecott, turning one of the nation's most troubled mining companies into a profitable and growing one. Now as Mr. Joklik prepares to retire in May, he's handing over to his successor -- who still hasn't been named -- a whole new set of challenges. In recent weeks, Kennecott and its parent, RTZ Corp. of London, have agreed to buy two coal companies, which combined will be the nation's fifth largest coal producer. And Kennecott recently started construction of a $880 million copper smelter. RTZ and Kennecott began considering a coal purchase about three years ago. "We were extremely aware that we were becoming an airplane with one wing," says Mr. Joklik, referring to the company's dependence on copper. "We wanted another major commodity." What transpired was a deal to buy Nerco Inc. and Cordero Mining Co., two low-cost Powder River Basin, Wyoming, coal producers for about $590 million, plus the assumption of nearly $700 million in debt. About $225 million will be financed through a production contract with PacifiCorp Holdings Inc., which held 82% of Nerco. Some money will be raised by the sale of Nerco's oil and gas operations and other mineral properties. But delving into the coal business harkens back to Kennecott's difficult past. In 1968, the company bought Peabody Coal, the largest coal producer in the U.S. Kennecott didn't realize at the time Peabody was purchased that the company had no long-term coal contracts to speak of, even though long-term contracts are essential to maintaining profits when spot prices dip. Further, Kennecott took a hands-off approach to managing the company, even though Peabody management was weak. Finally, after a nine-year battle with the Federal Trade Commission over antitrust questions -- it was a case of the nation's largest copper company buying the largest coal company -- the disastrous ownership came to an end. Peabody was sold for less than Kennecott had paid for it. This time, Kennecott is not making the same mistakes in its coal acquisition, Mr. Joklik says. Kennecott will not accept Nerco and Cordero management without scrutiny, he says. And unlike Carborundum's complex businesses, the Powder River coal business is fairly simple, he says. Further, the companies have good, long-term contracts and low costs. Analysts who follow RTZ are largely optimistic about the acquisitions. RTZ has an excellent record of acquisitions, even if Kennecott doesn't, says Rob Davies, analyst for Shearson Lehman Bros. Inc. in London. He also believes RTZ will benefit from the cash flow generated by coal, which the company can mine for $4 to $5 a ton and sell for $12 a ton, he says. Although the ultimate ownership of the Nerco and Cordero reserves will be in British hands, decisions on operations and markets will still be made in the U.S., says Robert Wilson, RTZ's chief executive. "The operating management is very much Kennecott's responsibility," he says. "We don't call the shots from here." Mr. Joklik agrees. "Over the last 13 years, there hasn't been a single decision initiated by our owners," he says. "We paddle our own canoe here." Thirteen years ago, Mr. Joklik's canoe wasn't much fun to paddle, weighted down as it was with a demoralized and unproductive labor force, and antiquated and inefficient facilities. Its financial resources were depleted by disastrous acquisitions. Its miners, hampered by malaise and intricate work rules, were working only a few minutes out of an hour. Ore was still being hauled out of the mine by rail, a clumsy process abandoned by other mines. Some of the mine's equipment had been used in building the Panama Canal in 1904. Management was so layered that when Mr. Joklik asked a question about an operation, it would be answered with seven cover memos from successive managers. "I felt like I'd been appointed the captain of the Titanic," Mr. Joklik says. "But I knew what I was up against." He laid out a three-prong plan: cut costs in labor, management and materials; upgrade facilities; and diversify into other mining ventures that would reduce the company's dependence on copper. At that time, it took 7,000 workers at the company's Bingham Canyon Mine in Utah to produce 200,000 tons of copper ore a year. Over the next four years, the labor force was cut to 4,300. The rails in the pit were pulled and trucks began hauling ore. Managers left in droves, unable to accept the new ethic. "The ones who remained understood what was required," he says. But all that had been wrenched from labor reductions and capital investments was quickly washed out by sliding copper prices, which fell from $1 a pound to 60 cents a pound over the same four years. And Standard Oil Co. of Ohio, which bought Kennecott in 1981, refused to spend the money Mr. Joklik wanted to upgrade its mills. Finally, in 1985, the company closed the mine. In 1986, the company and its dozen unions came to a new agreement that cut labor costs 35% and the mine reopened. In return, British Petroleum, which had bought Standard Oil of Ohio by then, agreed to give Kennecott managers the $400 million they wanted for new mills and concentrators. Today, after $650 million in capital improvements, Bingham Canyon is the lowest-cost copper mine in North America, and one of the lowest-cost mines in the world. Now only 2,400 workers pull 310,000 tons of ore from the half-mine deep hole near Salt Lake City each year -- a nearly five-fold increase in productivity from 1980. The new smelter will further boost productivity, lower costs and reduce pollution when it is completed next year, the company promises. "When we came in in 1989, the hardest part of the job had been done," says Mr. Wilson of RTZ. "But once we've finished this program with the smelter, then I think we're going to have facilities next to none." --- Kennecott's Edge Estimated cash cost per pound of copper produced by major U.S. companies in 1992, in cents Cyprus Minerals 70 Asarco 68 Magma Copper 66 Phelps Dodge 56 Kennecott 43 Source: Doppler & Associates