Chapter 19

advertisement

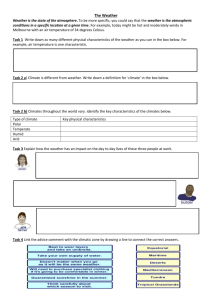

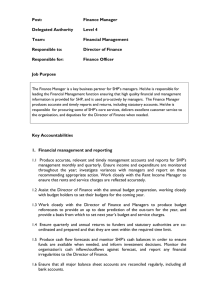

WEATHER DERIVATIVES By Mehdi Sadeghi, Macquarie University Southern Hydro Partnership (SHP) is the largest hydroelectric company in Australia with 600 megawatts of electricity generating capacity. The company is based in Melbourne and operates throughout rural Victoria and New South Wales. SHP’s ability to produce electricity from its hydroelectric system depends largely on annual precipitation. A sustained shortfall of rain or snow reduces stream flows, curtailing the amount of electricity the company can generate. Lower generating capacity, in return, translates into a higher marginal cost and/or lower marginal revenue. Recently developed weather derivatives have helped SHP find a way to protect itself from the adverse effects of low annual rainfall and snowfall on its revenue. In February 2003, SHP made an over-the-counter (OTC) five-year option contract with XL Trading Partners (XLTP) to receive a predetermined compensation based on annual precipitation, in return for an undisclosed premium. It has been agreed that the number of payments will increase as the level of precipitation declines, hedging SHP’s volumetric risk. The precipitation deficit is determined by comparing actual precipitation measurements to a predetermined average precipitation in a reference location (probably Melbourne). However, if the level of rainfall is high, XLTP receives additional payment on the top of the premium. At the end of the five-year contract, SHP will be eligible for a partial refund of unused premium and any payments made to XLTP during years of high precipitation. SHP has also made a three-year precipitation collar1 contract with Credit Lyonnais Rouse Derivatives (CLRD) for the same reason at a notional value of A$20 million. An important aspect of this recent derivative transaction is that it is based on the level of precipitation in a more remote location (Lake Eildon). This automatically eliminates geographical basis risk. The payoff from this derivative is based on the difference between a negotiated weather condition and actual weather observation. According to the contract, SHP receives payments if rainfall is lower than the threshold amount and pays CLRD in years where there is a lot of rainfall. Darryl Flukes, General Manager of Energy Trading at SHP, put a premium on the stability of cash flow and revenue for Southern Hydro and believes derivative contracts protect it from the risk of production variability that is inherent in hydro generation. Weather derivatives are relatively new financial products. The first transaction in weather derivatives took place in the United States in 1996, while in Australia SHP was one of the first hydroelectric companies that realised its benefit. The key advantages of weather derivatives are in covering low-risk, high-probability events compared to the major other type of insurances that cover high-risk, low-probability events. The most recent weather products on the market include off-the-shelf derivatives for cold summers, hot summers, warm winters and long periods of rain. Questions 1. What is ‘exercise price’ in the type of weather derivatives discussed above? 2. What is geographical basis risk? 3. Describe how a collar strategy can help SHP to stabilise its revenue. Source Paul Lyon, ‘Singing in the rain’, Weather, Special Report, August 2004 (www.energyrisk.com) 1 A collar is a combination of a call and a put with identical exercise price. SHP bought a rainfall put option with a low ‘strike’ level of precipitation and sold a call option with a high ‘strike’ level of precipitation. Case studies t/a Business Finance 9e by Peirson et al. 1