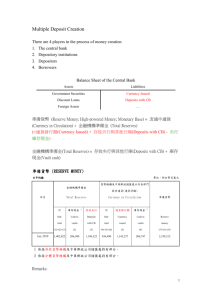

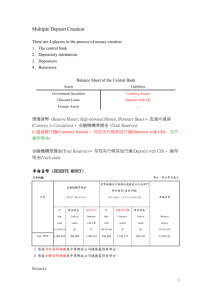

Chapter11: Money in the Modern Economy

advertisement

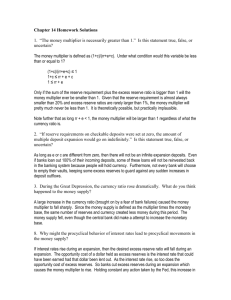

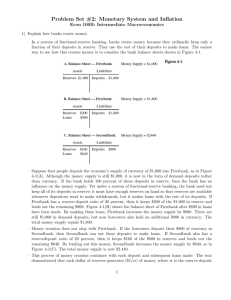

Chapter11: Money, Banking & the Financial Sector I. Money A. Money is defined as anything people accept for goods and services. In modern economies, money is national currency. B. In the absence of money, societies use a “barter” system in which goods are exchanged for goods. 1. Barter economies require a “Double Coincidence of Demand” in that the two market participants must each be supplying what the other demands. 2. Barter also implies negotiations over the exchange (a cost modern economies often avoid), which have the economic cost of the time spent for each purchase an individual makes. C. In a more Modern System, paper currency is the means of exchange. Society’s acceptance of it for goods and services gives money its value. President Nixon took the US off the gold standard in 1971 in response to a massive wave of people redeeming gold for dollars. The panic was induced by double-digit inflation. D. Functions of Money: 1. As a “Medium of exchange,” money exchanges are far more convenient than barter, as they do not require any double coincidence of demand. 2. As a “Standard of value” or monetary unit, the value of any good or service can be compared, whether the goods being compared are very similar to each other or extremely different. 3. As a “Store of value” money enables saving, although inflation can diminish this function. It does not deteriorate (rot) like many commodities, and the ability to earn interest increases the utility of this function. 4. As a “Means of deferred payment,” money facilitates the credit system (includes credit cards and payment plans for durable good purchases) and all other types of loans. E. The purposes people hold money are: 1. Transaction – regular purchases 2. Precautionary – emergency costs or unexpected income adjustments 3. Speculative – stocks or goods purchased in the expectation their value will increase in the future. II. Money Supply: Money in our economy is demand deposits plus currency and coin. A. “Demand deposits” are checking accounts held at financial institutions known as “Depository Institutions.” Mostly these are commercial banks. B. Besides demand deposits, the Money Supply also includes currency and coin in circulation (held by people). C. “Fiat” money has less value as a commodity itself, and more value as a money. If our coins were solid gold, then it would not be fiat money. Literally, fiat means by declaration; in this case, it is the government declaring a national currency as the accepted means of exchange. D. Specifically, the government declares their national currency to be “Legal Tender,” or money that must be accepted for payment of public or private debt. E. The solid gold coin would be called “non-debased” if its value as a metal equals its value as a currency. Modern fiat money is “debased” by the definition of fiat money. F. “Gresham’s Law” is that debased money will drive non-debased money from circulation. This is partly because non-debased money has other uses (e.g., for gold, jewelry and crafts) and partly because non-debased money has become an item for collectors, bidding up its value beyond the original value as money. These factors significantly prevent non-debased money from circulating in the US economy. G. Money is debt, and the supply of money is the monetization of certain forms of debt, meaning your demand deposits and currency holdings are in the form of money (monetized) and it is debt since the demand deposits are a liability to the bank, which must have the money there for account-holders to withdraw, and currency is a liability for the Fed, which ensures that it will provide a new bill in exchange for an old bill. H. Measuring the Money Supply 1. M1: demand deposits, plus currency and coin in circulation. 2. M2= M1 + near monies i. “Near Monies” will store value but cannot themselves be in circulation for purchases. Savings deposits, small time deposits (e.g. a 3-month certificate of deposit), and money market mutual funds (funds that grows your investment in a selected group of money market funds). 3. M3= M2 + large value CDs. This type of certificate of deposit is denominated in units such as $100,000, is negotiable for resale, and cannot be withdrawn against by check writing. Credit cards are only a method of borrowing money, and are not added into the calculation of money supply. From M1 to the large value CDs in M3, liquidity has changed drastically. Liquidity is how close a given account is to money, a means of making an immediate purchase. Near monies are highly liquid. 4. The book also mentions L as a broad measure of money where L includes M1, M2, and short-term debt instruments (less than 1-year to maturity). I. Banking involves a “fractional reserve principle,” meaning only a small percentage of demand deposits actually has to be on hand all the time, because banks do not have all accounts being used up simultaneously. This enables banks to make loans and grow the overall money supply. J. Electronic exchange systems, and primarily the debit card, have partially offset the need for people to carry currency, or write checks. Still, many suppliers of goods and services take only cash, and debit cards do not eliminate the possibility of theft and fraud. III. Required Reserves and the Money Multiplier A. Imagine the only bank in an economy has Assets and Liabilities listed below: Monopoly Bank Liabilities Deposits Assets Reserves $25,000 $100,000 Loans $75,000 B. Required Reserve Ratio (RRR or just r): The amount the bank has to have on hand as a fraction of total deposits. This is a minimum limit % set by the Fed. The form of the reserves is to be vault cash or in accounts with the Fed. For this example say r=.2 (20%) C. The bank has excess reserves (ER) .2*100,000=20,000 25,000-20,000=5,000 in ER They loan this out but here is where a number of simplifications enter – it’s a monopoly bank, and all the money is immediately spent by borrower 1, deposited by the recipient of Borrower 1’s expenditures ($5,000) into the Bank. Of the new deposit, only .2*5,000 needs to be kept, and the rest is loaned out to Borrower 2, who spends all of it with someone who deposits the spending into the bank. The process repeats a number of times until the loan amounts become insignificant, and the total of all the new loans spurred by the initial 5,000 in ER is change in M (the overall money supply) D. The money multiplier is used to go straight from the initial injection ($5,000) To the change in M: initial injection*(1/r)= change in M 1/r is the simplified Money Multiplier. (This process is described on 274-6 and is the focus of Ch.11-Appendix B) E. Note also that the ER that began this process is one example of an initial injection of new money; another very common example is the purchase of T-Bills by the Fed as a policy move. F. The process can work in reverse, such as through an open-market sale of T-Bills which will be priced to induce banks to purchase (spend some reserves) and the loss of reserves is amplified by the money multiplier, shrinking M. G. Distinguishing the simple money multiplier (1/r) from the real-world (also called “leakage-adjusted” money multiplier). To accurately reflect money supply leakages like banks deciding to keep more than the minimum reserve requirement and borrowers’ tendency to hold cash, thereby reducing deposits from any given loan amount. Calling banks’ propensity to hold ER, as a fraction of total reserves, “e” and borrowers’ tendency to hold cash, as a fraction of loan amounts “c”, the leakage-adjusted” money multiplier = 1/r+e+c So for example if the simple multiplier was 1/.2= 5 And e= .03 and c=.1 1/.2=.03+.1 = 1/.33 = 3 So it is clear why the real-world multiplier is smaller than the simple one used in the model, implying a smaller change in M for any given initial injection that the simple money multiplier predicts. Also it highlights the importance of those factors which can cause e or c to vary. For example, banks may increase ER (which by definition increases e) if they expect worsening economic condition (falling GDP, increasing unemployment) or if they have any other reason to believe that their prospective borrowers are too risky, and lending to them would entail too high a likelihood of default (failure to repay) even when the bank is compensated by the prevailing market interest rate.