The Gold Standard

advertisement

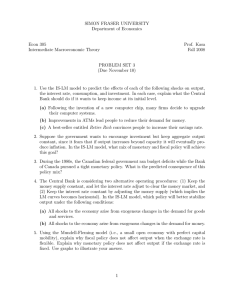

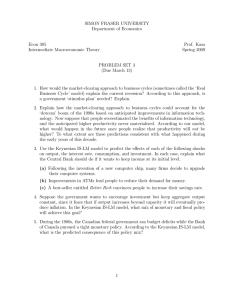

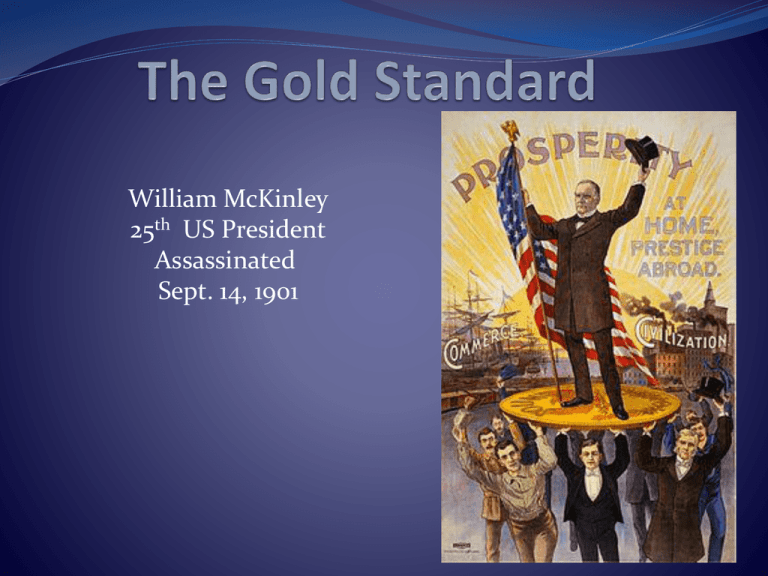

William McKinley 25th US President Assassinated Sept. 14, 1901 William Jennings Bryan - McKinley’s Opponent in 1896 Election The Cross of Gold Speech “You come to us and tell us that the great cities are in favor of the gold standard. I tell you that the great cities rest upon these broad and fertile prairies. Burn down your cities and leave our farms, and your cities will spring up again as if by magic. But destroy our farms and the grass will grow in the streets of every city in the country…… “…we shall fight them to the uttermost, having behind us the producing masses of the nation and the world. Having behind us the commercial interests and the laboring interests and all the toiling masses, we shall answer their demands for a gold standard by saying to them, you shall not press down upon the brow of labor this crown of thorns. You shall not crucify mankind upon a cross of gold.” www.americanrhetoric.com/speeches/williamjenningsbryan1896dnc.htm Crucifixion of Labor www.bankofengland.co.uk/publications/Documents/quarterlybulletin/qb050302.pdf Fig. 19-1: The Macro-Trilemma (Impossible Trinity) David Hume, 1711-1776 Empiricist Philosophy and Monetary Theory MV = PY • When gold reserves low, CBs should decrease Ms • Sell Bonds, reduce Ms, increase R, draw in Gold • When gold reserves high, CBs should • Buy Bonds, increase Ms, decrease R, drive out Gold • But Gold Surplus countries comfortable, no political push for stimulus. • Analogous to position of Germany in Eurozone today. • Comfortable position makes it harder for other countries to achieve surplus. Krugman et. al. note: “The U.S. unemployment rate was 6.8% on average from 1890 to 1913, but it was less than 5.7% on average from 1946 to 1992.” But note: UE 1948 to 2007 = 5.6%. UE 1948 to 2013 (I) = 5.9%. And UE 1869 to 1890 = 4.8% (J.R. Vernon, 1994, Jou. of Macroeconomics) • All major countries pegged to US Dollar – no independent Monetary policy. • All other countries ‘import US inflation.’ • Growth of Trade and accumulation of Dollars meant more Dollars than Gold. • Dollar tied to Gold, $35 per ounce – until 1971. • 1973, most currencies go ‘managed float.’ • Fiscal Stimulus powerful under Fixed Exchange Rates, since Monetary Policy must be Accommodative • Monetary Stimulus powerful under Flexible Exchange Rates, since Fiscal Policy must be Accommodative. IS-LM, Fixed Rates: M accommodates since E (and R) fixed R _2 1 LM1 3 LM2 IS1 IS2 Y IS-LM, Flex Rates: Change in R and E drive IS R _1 3 2 LM1 LM2 IS1 IS2 Y