correlation between real economy and the financial system

advertisement

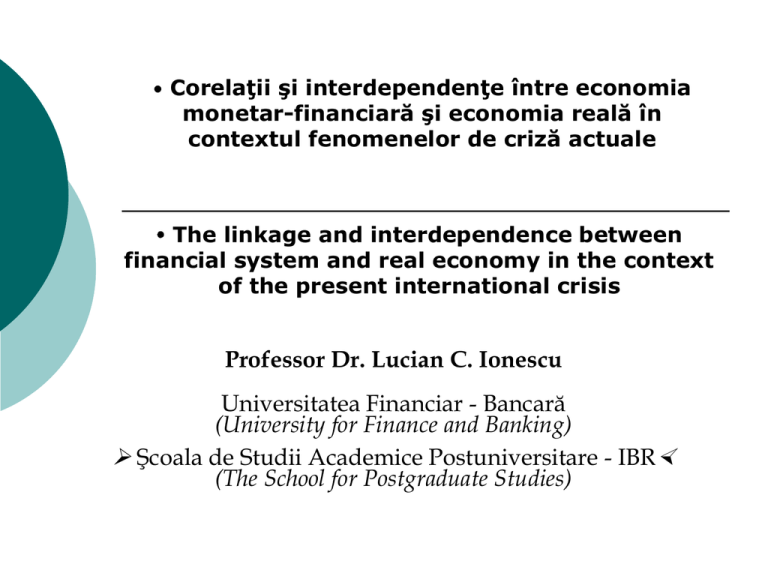

• Corelaţii şi interdependenţe între economia monetar-financiară şi economia reală în contextul fenomenelor de criză actuale The linkage and interdependence between financial system and real economy in the context of the present international crisis Professor Dr. Lucian C. Ionescu Universitatea Financiar - Bancară (University for Finance and Banking) Şcoala de Studii Academice Postuniversitare - IBR (The School for Postgraduate Studies) Research motivation Beginning with 2007/2008, the downturn in the global economy triggered the decrease of the financial institutions’ profitability which encountered severe losses because of the high indebtedness on the back of gains in real estate prices. The uncontrolled development of structured finance that permitted the wide dispersion of credit risk and, consequently, the adoption of an aggressive leverage, generated costly balance-sheet adjustments; the last economic upturn (2003-2006/2007) was founded to a high extent on the grounds of the excessive financial leverage and not on real productivity growth. Thus, the link between financial system and real economy encompasses new dimensions, tending to highlight a strong dissociation between financial and real yields. 1 Research objectives To analyze the inter-linkage between financial system and real economy characteristic to both prior and post period of crisis outbreak. Financial crises are as old as financial intermediation which is exposed to financial fragility; an overestimated investors’ perception of risk conducts to liquidation and puts all the financial system at risk. Since financial system was originally meant as a support to real economy, the inter-linkage becomes effective and economic slowdown is triggered. During the ongoing crisis time-period, a distressed financial system impedes the economic recovery. The experience of Japan crisis as well as the current crisis revealed that despite repeated liquidity injections, real economy has continued to fall under the impact of an overleveraged private sector with frequent low defaults which cause important losses in the financial sector. The research will focus on the characteristics implied by the actual crisis from the perspective of the two-way link between financial system and real economy, concentrating on the mutations within the financial system which contributed to further imbalances 2 The financial crisis started in 2007/2008 represents a highly dangerous chain reaction: → → → → Liquidity shortage → Banking failures Investment deadlock → Real economy deep & prolonged recession Tough increase in budget deficits & public debt Slowing down the economic recovery Causality The rift developed between the real economy and the nominal economy Excessive autonomy of monetary & financial flows vis-à-vis the real economic circuit The “free market“ fundamentalism generated an overwhelming expansion of financial speculation (mainly through financial derivatives) 3 To highlight the transmission vectors of the double-side relationship between financial system and real economy The peculiar transmission chain of the recent financial crisis was generated by a multitude of vectors originating mainly in a mixture of aspects relative to the interaction between real economy and financial system: a) Abundant liquidity; b) Capital market financing; c) Credit risk transfer; d) Pro-cyclical accounting and regulation framework, including the Basel II Accord.. In the context of interest rate reduction and large liquidity in the market, the assets’ prices (especially in the real estate sector) have considerably touched peak levels, rendering the households and, in fact, the real economy highly vulnerable to a potential rise in interest rate. Excessive capital market financing valorized by the intermediary of innovative financial instruments, such as vendor financing and venture capital products, gave incentive to a high vulnerability of real economy to subsequent decrease of credit quality. 4 Long economic & financial cycles from the 20 th to the 21 st century Descending/stagnant stages Ascending/expansinary stages 1929/30 → 1944/45 1946/47 → 1968/69 1970/71 → 1981/82 1983/84 → 2006/07 2007/08 → ~2018/19 (?) The descending/stagnant stages of long cycles generally tend to determine rethinking and restructuring the organizing and functioning models for both real economy and international monetary & financial system. 5 To disclose appropriate strategies in order to manage the linkage between real economy and financial system during the crisis The experience of the actual financial crisis revealed a powerful procyclical character in respect of the various policies that amplified the adverse effects. Therefore, research envisages elaborating complex analyses on the set of policy measures mixed up in a convenient manner in order to reduce the negative effects implied by the transmission chain mechanisms from financial sector to real economy: macro-prudential regulation; forward looking provisioning; strengthening of the financial institutions supervision, especially at the level of the stress tests importance, irrespective of the phase of the business-cycle; reviewing of the global accounting standards; enlargement of disclosure requirements, including loan classification by rating grade; enhancement of effective corporate governance mechanisms, reviewing compensation practices in financial institutions Creating a new mutually beneficial correlation between real economy and monetary & financial system. 6 Conclusion & prospects The organic correlation between real economy and the financial system leads the way to understanding the crucial importance of the interdependence between real and nominal convergence for realizing a viable economic & monetary union. Prospects for adopting Euro (EU single currency) – the Romanian case Combining the basic thesis of this paper with the interpretation of the evolution of long economic & financial cycles, we consider the time horizon of 2017-2019, which would allow: A substantial effective advance for real & nominal convergence; Maintaining the flexibility of macroeconomic policies by an independent monetary policy; Fine-tuning of business cycles - synchronization and complementarity. 7