Using Decision Trees to Solve Complex Problems: An Example

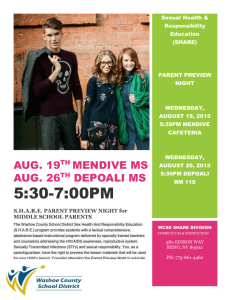

advertisement

Using Decision Trees to Solve Complex Problems: An Example Consider the following problem The Disney Corporation is thinking about taking its hit Broadway musical, The Lion King on tour. It has made the following calculations The tour would cost $12 million There is a .50 chance that it will earn $20 million and a .5 chance it will earn $10 Draw the decision tree for this problem using the following conventions. (Let a box indicate a decision node and a circle indicate a chance node). $0 Don’t Produce $8 million Pr =.50 Produce High Pr=.50 Low -$2 million EV = .5x8-.5x2 = $3.0 million Since the EV from the “Produce” node is greater than the EV from the “Don’t Produce” node, they produce But now consider the following complication Disney can do a preview showing of the production at some cost $P If the audience is favorable, the show is certain to be a success If the audience is unfavorable, the show has only a .1 chance of success. The prior belief is that there is a .50 chance that the preview audience will react favorably. To decide whether to do the preview, look at this decision tree. Note that if they choose not to preview, they are essentially in the previous situation, they go ahead with the production and expect to earn $3.0 million. No Preview $3.0 Produce Preview Pr=.5 Favorable EV = .5x8+.5x0-P Pr =.5 $8.0-P Not Produce -P Not Produce -P $8-P Produce Pr=.1 High Pr =.9 Low EV =.8-1.8-P=-1-P -$2-P The “trick” is to work backwards towards the start of the tree. Doing this, we see that If you get a favorable review, you produce ($8-P>-P). If get an unfavorable review, you don’t produce (-1-P<-P) Since the odds of getting a favorable review are .50, your expected profit if you review is .5x8-.5x1-P=$4-P. Thus, if the preview costs less than $1 million, your better off previewing. Credit Analyst Dilemma • You are trying to decide whether to offer credit to a population of potential borrowers. • Profit from good loan=$10 • Loss From Bad Loan = -$10 • Past Experience leads you to believe that the probability of default is .260 Simple Decision Tree No Loan $0 EV=$4.80 Repay Loan $10 Pr=.74 Default EV=$4.80 Pr = .26 -$10 More Complex Problem: Credit Reports • Suppose that you can buy credit reports that are useful in predicting a good pay • Suppose you have some history with this reporting service and that you see that for every 1000 reports purchased, the customers fall into this classification Credit Rating Good Report Bad Report Total (Payment History) Payment History Good Bad Pay Pay 720 80 20 180 740 Total (Credit Rating) 800 200 260 Note Pr (good pay given good report) = 720/800=.90 Pr (good pay given bad report) = 20/200=.10 • How much would you pay for the report? Decision Tree EV = $8 Good Pay $10 Pr=.90 EV=$8 Loan Pr=.10 Bad Pay -$10 Good Credit $6.4 Pr=.8 No Loan $0 $0 Pr=.20 No Loan Bad Credit $10 Good Pay Pr = .10 Loan Pr =.90 EV = 0 Bad Pay EV = -$8.0 -$10 Computing the Value of Information Notice that the credit reports must have some value since they change your behavior. (Without the reports, you offer credit to 1000 customers, with the report, you offer credit to 800 customers). If you buy the credit reports, you expect to make $6.4. If you don’t buy the report, you will get $4.80. One might reasonably conclude that the value of information is EV (with information) – EV (without information)=6.4-4.8=1.6 Bayes Rule and the Value of Information (Another Example) • Suppose that you are interested in the absentee record of workers and your concerned with measuring the benefits of an anti-smoking program. • A question would be how does smoking affect absenteeism. • Imagine data collected on 1000 workers reveals the following Absentee Record Missed More Than One Missed Less Than One Week Week Smokers 300 200 Non-Smokers 100 400 • If we didn’t know whether a worker smoked, we would conclude that Pr (Absent>One Week) = .4 (40% of all workers miss more than one week). • If a worker is a smoker, we know that Pr (Absent > One Week given Smoker)=Pr (Absent and Smoker)/Pr(Smoker) = .3/.5=.6. (60% of all smokers miss more than one week). Bayes Rule and the Value of Information (Formalities and General Application) Let “A” be interpretted as the some event (say, a worker absent more than one week) and “S” be interpretted as another event (the worker being a smoker). We’ve already seen that Pr (A given S) = Pr (A and S)/Pr (S) By the same reasoning we could have written Pr (S given A) = Pr (A and S)/Pr(A) Rearranging this expression gives Pr (A and S) = Pr (S given A)xPr(A) Substituting this into our first expression, we can write Pr(S given A) Pr( A given S ) Pr( A) Pr(S ) Think about what this expression is good for Pr(A) is your assessment of the prior probability (if you don’t know whether S is true, it is how likely you think it is the event A will occur) In the example, Pr (A) = .40 The term in brackets tells you how to revise your assessment of the liklihood of event A given the new information In the example Pr(S given A)=.75 (75% of those absent more than one week are smokers). Pr (S) = .50 (50% of the workforce smokes). Thus, the prior probability gets multiplied by 75/50=1.5 to get the new revised probability. Can information have some value even if it doesn’t raise the expected value? Modify the previous example by assuming that you are evaluating an investment that has the same basic structure as described above, except that it is a “one-shot” bet with the odds described above. o If you don’t have any added information, you will make $10 million with pr = .74 or lose $10 million with pr .26. o This has an EV =4.8, but it is also quite risky Variance = .5(10-4.8)2+.5(-10-4.8)2=76.96 If you make the investment, your outcomes can be represented with this tree $10 Pr=.74 -$10 Pr=.26 EV = $4.8 Now suppose that for exactly $2.6 million you can hire a consultant who will recommend whether to make the investment. The consultant is never wrong and so there is no real decision: you do what you’re told. You also believe that there is a 74% chance that the consultant will tell you it is a good investment. The tree for this problem looks like Positive Recommendation $10-2.6=$7.4 Pr = .74 Pr=.26 Negative Recommendation -$2.6 EV = .74x7.4-.26*2.6=$4.8 It would appear that this information isn’t worth the price since the EV is the same when you buy it as when you don’t ($4.8 in each case). However, a risk averse investor might consider this to be a good deal since it reduces the variability of the outcomes. Variance = .74x(7.4-4.8)2+.26x(-2.6-4.8)2=19.24 Information “Puzzlers” (Revealing the Limits of Intuition) • Guess the job • Let’s Make a Deal Flight Insurance