Pedigree - Lawyersclubindia

advertisement

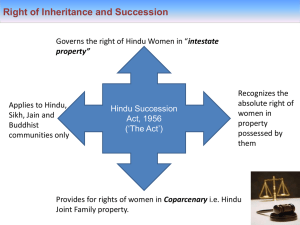

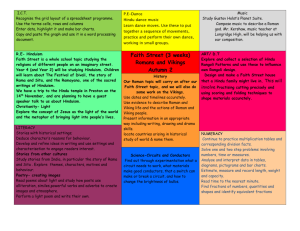

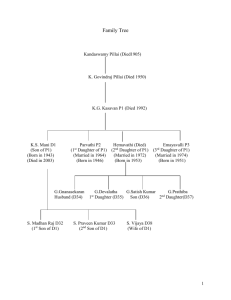

Pedigree K. Govindraj Pillai (Died 1950) K.G. Kasavan (Died 1992) P1 K.S. Mani D1 (Died 2003) Parvathi P2 (Son of P1) (Daughter of P1) Born in 1943 Born in 1946 S. Madhan Raj D32 (Son of D1) Hemavathi (Died) (Daughter of P1) Born in 1951 Lrs (D34 To D37) S. Praveen Kumar D33 (Son of D1) Emayavalli P3 (Daughter of P1) Born in 1953 S. Vijaya D38 (wife of D1) 1 Only son law 1) As per Hindu Succession Act, 1956 sec 5, Act not to apply to certain properties. This Act shall not apply to- (ii) any estate which descends to a single heir by the term of any enactment passed before the commencement of this Act. P1 father died in 1950. P1 died in 1992 he was only son of his father. D1 was born in 1943 and he died in 2003 he was only son of P1 and P2 born in 1946 And P3 born in1953are daughter of P1. P1 had a second daughter by name Hemavathi born in 1951 whose L.Rs have come on record on their own as defendants 34 to 37. all three the daughter are married before 1974. P1 wife and mother predeceased him. D32 and D33 are sons of D1 and grandsons of P1 and D38 wife of D1. D1 his only son of P1 was born in 1943 prior to commencement of Hindu Succession Act 1956. under the Hindu law, the moment a son is born, he gets a share in the father's property and becomes part of the coparcenary. His right accrues to him not on the death of the father or inheritance from the father but with the very fact of his birth. Normally, therefore whenever the father gets a property from whatever source from the grandfather or from any other source, be it separated property or not, his son should have a share in that. as per the mitakshara law in usage prior to the commencement of the 1956 act, once a son was born, he acquired an interest in the coparcenary property as an incident of his birth. Hence a son having been born prior to commencement of 1956 act would retain his share of the property as a coparcener even after the commencement of 1956 act. Reference to be made in In Sheela Devi and Ors vs Lal Chand and Anr. 2006 (8) SCC 581 A to C page 581 and Para 19. 2) D32 and D33 are sons of D1 and grandsons of P1. Grandson do not get right In grandfather property. As per Hindu Succession Act 1956 sec 8 A son's son are not mentioned as an heir under class I of the schedule, and, therefore, he could not get any right in the property of his grandfather under the provision. Section 4 of the Hindu Succession Act 1956, clearly laid down that "save as expressly provided in the Act, any text, rule or interpretation of Hindu law or any custom or usage as part of that law in force immediately before the commencement of the Act should cease to have effect with respect to any matter for which provision was made in the Act". Section 8 of the Hindu Succession Act, 1956 as noted before, laid down the scheme of succession to the property of a Hindu dying intestate. The schedule classified the heirs on whom such property should devolve. Those specified in class I took simultaneously to the exclusion of all other heirs. The right of a son's son in 2 his grandfather's property during the lifetime of his father which existed under the Hindu law as in force before the1956 Act, was not saved expressly by the Act, and therefore, the earlier interpretation of Hindu law giving a right by birth in such property "ceased to have effect". further in construing a Codification Act, the law which was in a force earlier should be ignored and the construction should be confined to the language used in the new Act. under the Hindu law, the property of a male Hindu devolved on his death on his sons and grandsons as the grandsons also have an interest in the property. However, by reason of section 8 of the Hindu Succession Act, 1956, the son's son gets excluded and the son alone inherits the property to the exclusion of his sons. No interest would accrue to the grandsons of P1 in the property left by him on his death. As the effect of section 8 was directly derogatory of the law established according to Hindu law, Further, since the existing grandsons D32 and D33 at the time of the death of the grandfather P1 had been excluded, will not get any interest from his grandfather P1. D1 alone took the interest of P1 by survivorship. As per Commissioner of wealth tax Kanpur v. Chander Sen AIR 1986 SC 1753 Refer Para 11,14,16, 16A,18,20,21,22. and As per Sheela Devi and others v. Lal Chand and Others (2006) 8 SCC 581 Refer Para 18,19. 3) As per Hindu Succession Act, 1956 sec 5, This Act shall not apply to- (ii) any estate which descends to a single heir by the term of any enactment passed before the commencement of this Act. D1 is only son of P1. Interest of P1 passed on to D1 by survivorship has a single heir As per law which stood prior 1956 act. Hindu law women’s rights act 1933 ( Mysore act 10 of 1933) Section 8(1) reads as follows:"8. (1)(a) At a partition of joint family property between a person and his son or sons, his mother, his unmarried daughters and the widows and unmarried daughters of his predeceased undivided sons and brothers who have left no male issue shall be entitled to share with them. (b)At a partition of joint family property among brothers, their mother, their unmarried sisters and the widows and unmarried daughters of their predeceased undivided brothers who have left no male issue shall be entitled to share with them; (c)sub-sections (a) and (b) shall also apply mutatis mutandis to a partition among other coparceners in a joint family. 3 (d) Where joint family property passes to a single coparcener by survivorship, it shall so pass subject to the right to share of the classes of females enumerated in the above subsections." As per sec 8 (1) d when joint family property passes to a single coparcener by survivorship, the right to shares is vested in all the females enumerated in all the three clauses (a), (b) and (c). Clauses (a) and (b) refer to four classes of females viz. the mother, the widow, the unmarried daughter and the unmarried sister. All these four classes of females are within Clause (d). Clauses (a), (b), (c) and (d) of sub-section (1) of Section 8 deal with four separate situations. Clause (a) deals with a partition of joint family between a person and his sons. Clause (b) deals with the partition of joint family property among br who have been entitled to shares are the mother of the concerned coparcener, his unmarried daughters and widows and unmarried daughters of pre-deceased sons. when they are one or more female heirs in any of the four classes of females viz the mother, the widow, the unmarried daughter and the unmarried sister assumed partition take place between those coparceners. joint family property does not passes to a single coparcener by survivorship. When P1 wife and mother predeceased him and when they are on female heirs in any of the four classes of females viz the mother, the widow, the unmarried daughter and the unmarried sister assumed partition does not take place between those coparceners. joint family property passes to a single coparcener by survivorship. D1 alone took the interest of P1 by survivorship as per sec 8 (1) d Hindu law women’s rights act 1933. Married daughter are not heir in any of three clauses (a), (b) and (c) as per sec 8 (1) Hindu law women’s rights act 1933 . P2 born in 1946 And P3 born in 1953 are daughters of P1 and P1 had a second daughter by name Hemavathi she was born in 1951 whose L.Rs have come on record on their own as defendants 34 to 37. all the three daughter are born prior to 1956 act and all the three daughter married before 1974. D1 in their written statement have stated P2 and P3 are not the members of the coparcenary and P2 and P3 are not entitled to claim any share in the said properties in Para 2,5,9 and D32 , D33 in their written statement have also stated P2 and P3 are not the members of the coparcenary and P2 and P3 are not entitled to claim any share in the said properties in Para 2,5,9,14,15. Nagendra Prasad Vs. Kempananjamma AIR 1968 SC 209 Refer Para 14 and 22 Thimmaiah v Ningamma AIR 2000 sc 3529 Refer Para 23 4 4) P1 died in 1992 he was only son of his father. D1 was born in 1943 and he died in 2003 he was only son of P1 and P2 born in 1946 And P3 born in 1953 are daughters of P1 and P1 had a second daughter by name Hemavathi she was born in 1951 whose L.Rs have come on record on their own as defendants 34 to 37. all the three daughter are born prior to 1956 act and married before 1974. Married daughter are not heir in any of three clauses (a), (b) and (c) as per sec 8 (1) Mysore act 1933. P1 wife and mother predeceased him. D32 and D33 are sons of D1 and grandsons of P1. D38 wife of D1. Grandson do not get right In grandfather property. As per Hindu Succession Act 1956 sec 8 A son's son are not mentioned as an heir under class I of the schedule, and, therefore, he could not get any right in the property of his grandfather under the provision. The right of a son's son in his grandfather's property during the lifetime of his father which existed under the Hindu law as in force before the1956 Act, was not saved expressly by the Act, and therefore, the earlier interpretation of Hindu law giving a right by birth in such property "ceased to have effect". However, by reason of section 8 of the Hindu Succession Act, 1956, the son's son gets excluded and the son alone inherits the property to the exclusion of his sons. No interest would accrue to the grandsons of P1 in the property left by him on his death., Further, since the existing grandson D32 and D33 at the time of the death of the grandfather P1 had been excluded, will not get any interest from his grandfather P1. D1 alone took the interest of P1 by survivorship as per sec 8 (1) d Hindu law women’s rights act 1933. As per Commissioner of wealth tax Kanpur v. Chander Sen AIR 1986 SC 1753 Refer Para 11,14,16, 16A,18,20,21,22. and As per Sheela Devi and others v. Lal Chand and Others (2006) 8 SCC 581 Refer Para 18,19. Nagendra Prasad Vs. Kempananjamma AIR 1968 SC 209. Refer Para 14 and 19 5) As per Hindu Succession Act, 1956 sec 5, This Act shall not apply to- (ii) any estate which descends to a single heir by the term of any enactment passed before the commencement of this Act. . D1 is only son of P1. D32 and D33 are sons of D1 and D38 wife of D1. D1 alone took the interest of P1 by survivorship as per sec 8 (1) d Hindu law women’s rights act 1933. When new section 6 of Hindu Succession act 2005 has been substituted for section 6 of Hindu Succession Act, 1956. When law which stood prior to 1956 act apply. Then 1956 act does not apply. Evidently the provision of Hindu Succession act 2005 Would Have No Application. 5