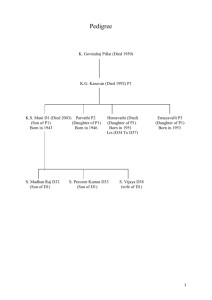

Pedigree - Lawyersclubindia

advertisement

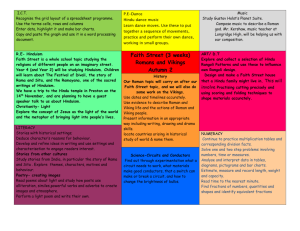

Family Tree Kandaswamy Pillai (Died1905) K. Govindraj Pillai (Died 1950) K.G. Kasavan P1 (Died 1992) K.S. Mani D1 (Son of P1) (Born in 1943) (Died in 2003) Parvathi P2 (1 Daughter of P1) (Married in 1964) (Born in 1946) st G.Gnanasekaran Husband (D34) S. Madhan Raj D32 (1st Son of D1) Hemavathi (Died) (2nd Daughter of P1) (Married in 1972) (Born in 1953) Emayavalli P3 (3 Daughter of P1) (Married in 1974) (Born in 1951) rd G.Devalatha G.Satish Kumar G.Prathiba nd 1 Daughter (D35) Son (D36) 2 Daughter(D37) st S. Praveen Kumar D33 (2nd Son of D1) S. Vijaya D38 (Wife of D1) 1 Only son law 1) P1 father died in 1950. P1 died in 1992 he was only son of his father. D1 was born in 1943 and D1 died in 2003 he was only son of P1 and P2 married in 1964 And P3 married in 1974 are daughter of P1 and P1 had a second daughter by name Hemavathi married in 1970 whose L.Rs have come on record on their own as D34 to D37. P1 wife and mother predeceased him and P1 wife and mother died before filling the suit for partition. D32 and D33 are sons of D1 and grandsons of P1 and D38 wife of D1 and D2 to D31 are tenants. P2 and P3 and D32 to D37 are not entitled to any share of P1 separate property As per Mysore Hindu law women’s rights act 1933. P1 separate property passes by succession to his only son D1 as a single heir As per Mysore act. As per Hindu Succession Act, 1956 sec 5, Act not to apply to certain properties. This Act shall not apply to- (ii) any estate which descends to a single heir by the term of any enactment passed before the commencement of this Act. As per Section 7(2) of Mysore Hindu law women’s rights act 1933. P1 separate property passes to D1 by succession as a single heir. 2) As per Mysore Hindu law women’s rights act 1933. Section 7. Separation of interest by expression of intention. (1) where a member of a joint Hindu family not being a minor has, by conduct or by declaration, expressed clearly and unequivocally, and to the knowledge of the other members, his intention to separate him self from the family, he shall be deemed to have become divided in interest from such other members from the time of such expression of intention. P1 filled the suit on 21-11-1991 date of filling the suit effect partition when P1 decision has been unequivocally expressed and clearly intimated to D1, his right to have his share allocated separately from a title is unimpeachable; neither the co-sharers can question it nor can the court examine his conscience to find out whether his reasons for separation were well- founded or sufficient; the court has Simply to give effect to his right to have his share allocated separately from D1 and it is settled law that in the case of a joint Hindu family subject to the law of the mitakshara, a severance of estate is Effected by an unequivocal declaration on the part of one of the joint holders of his intention to hold his share separately, even though no actual division takes place and the commencement of a suit for partition has been held to be sufficient. To effect a severance in interest even before decree. 2 As per PW -1 in cross page 14 line 23 and 24 and page 15 line 1 and 2. P1 gave instruction to the counsel to prepare the plaint and plaint and the Vakalatnama is prepared by advocate P. R. Chitnis And both plaint and the Vakalatnama are counter signed by P. R. Chitnis a responsible Advocate and it is not likely that he would subscribe his signatures to these documents if they had been executed by a person who was unable to understand the contents. When suit for partition has been filled by P1.Date of filling suit for partition effect partition between P1 and D1. As per Puttarangamma & 2 Ors. Vs. M. S. Ranganna & 3 Ors. 1968 (3) S.C.R.119 refer page 119 C-D, 125 A- H, 126 A-H, 129 A- D. As per Boregowda And Anr. vs Smt. Rangamayamma AIR 1999 Kant. 46 Para 9. As per the mitakshara law in usage prior to the commencement of the 1956 act, once a son was born, he acquired an interest in the coparcenary property as an incident of his birth. Hence a son having been born prior to commencement of 1956 act would retain his share of the property as a coparcener even after the commencement of 1956 act.D1 Born Prior to Hindu succession act 1956. when son Born Prior to 1956 act Partition take place according to the law which stood Prior to 1956 act. So Partition take place Between P1(father) and D1(son) according to mysore act which stood Prior to 1956 act as per sec 7(1)of mysore act. As per SHEELA DEVI V LAL CHAND 2006 (8) SCC 581 Para 1. 3) As per Mysore Hindu law women’s rights act 1933 "8. (1)(a) At a partition of joint family property between a person and his son or sons, his mother, his unmarried daughters and the widows and unmarried daughters of his predeceased undivided sons and brothers who have left no male issue shall be entitled to share with them. P2 daughter of P1 married in 1964 and P3 daughter of P1 married in 1974 and P1 had a second daughter by name Hemavathi she was married in 1972 whose L.Rs have come on record on their own as defendants 34 to 37. Married daughter are not heir as per sec 8 (1) a Hindu law women’s rights act 1933. When partition take between P1 and D1. P1 wife and mother predeceased him and P1 wife and mother died before filling the suit for partition. They are no other female heirs. As per K.VISWESWARIAH & ANOTHER V K.V. SATHYANARAYANA & OTHERS 1990(3) KAR.L.J 286 Para 26. Married daughters are not heir as per sec 8 (1) a Hindu law women’s rights act 1933 and they are not entitled to any share. 3 4) As per Mysore Hindu law women’s rights act 1933. Section 7 (2) separate share or interest to pass by succession in case of intestacy. The share or interest in joint family property of a member becoming divided in interest under sub section (1) shall, in the event of his dying intestate, pass by succession to his own heirs, male or female even though no actual division of property may have been made. As per Section 7(2) of Mysore act P1 separate property passes by succession to his only son D1 as a single heir. As per Annamma vs Pattamma ILR 1993 KAR 755 Refer Para 2,7,9,10,11 Appling sec 4 of Mysore Hindu law women’s rights act 1933. Section 4 of the Act falling under Part I relating to 'Inheritance' exhaustively deals with the order of succession to a Hindu male dying intestate. Therefore, in the case of a Hindu male dying intestate, the succession has to take place when the property left by the deceased male Hindu falls under Sub-section (2) of Section 7 of the Act, in accordance with Section 4 of the Act only. The male issues to the third generation, exclude the widow, daughters, daughter's sons and so on and so-forth as stated in Sub-section (1) of Section 4 of the Act, as explained in Section 5 of the Act. As per Thilliammal & Ors vs Thandavamurthy & Ors. 2007 (6) AIR KAR, R 397 Para 25 Section 4 of the Act deals with order of succession when a Hindu male dies intestate, the male issue to the third generation succeeds through the said estate to the total exclusion of all others. If there is no male issue, it is the widow who succeeds the estate. In the absence of the widow, it is the daughter who succeeds to the estate. P1 separate property passes by succession to his only son D1 as a single heir. As per Mysore act Sub-section (1) of Section 4 of the act male issue to the third generation are sons, grandsons, great grandsons and sons, grandsons, great grandsons are all coparceners get right by birth in separate property as per Sub-section (1) of Section 4 of mysore act. D1 Been coparcener born in 1943 under mysore act. mysore act apply to D1. D1 been coparcener get right by birth in P1 separate property as per Sub-section (1) of Section 4 of mysore act. D1 get right by birth in his father P1 separate property as only male heir. D32 and D33 are grandsons of P1. D32 and D33 do not get right by birth in his grandfather P1 separate property. D32 and D33 born under 1956 act and at the time of birth did not have right by birth in his grandfather P1 separate property. As per Commissioner of wealth tax Kanpur v. Chander Sen AIR 1986 SC 1753 Refer Para 11,14,16, 16A,18,20,21,22. And As per Sheela Devi and others v. Lal Chand and Others (2006) 8 SCC 581 Refer Para 18,19. 4 As per Hindu Succession Act 1956 sec 8 son's son are not mentioned as an heir under class I of the schedule, and, therefore, he could not get any right in the property of his grandfather. under the provision. Section 4 of the Hindu Succession Act 1956, clearly laid down that "save as expressly provided in the Act, any text, rule or interpretation of Hindu law or any custom or usage as part of that law in force immediately before the commencement of the Act should cease to have effect with respect to any matter for which provision was made in the Act". Section 8 of the Hindu Succession Act, 1956 as noted before, laid down the scheme of succession to the property of a Hindu dying intestate. The schedule classified the heirs on whom such property should devolve. Those specified in class I took simultaneously to the exclusion of all other heirs. The right of a son's son in his grandfather's property during the lifetime of his father which existed under the Hindu law as in force before the 1956 Act, was not saved expressly by the Act, and therefore, the earlier interpretation of Hindu law giving a right by birth in such property "ceased to have effect". Further in construing a Codification Act, the law which was in a force earlier should be ignored and the construction should be confined to the language used in the new Act. Under the Hindu law, the property of a male Hindu devolved on his death on his sons and grandsons as the grandsons also have an interest in the property. However, by reason of the Hindu Succession Act, 1956, the son's son gets excluded and the son alone inherits the property to the exclusion of his sons. Further, since the existing grandsons D32 and D33 had been excluded, when P1 was alive P32 and P33 do not get right by birth in his grandfather P1 separate property and P32 and P33 will not get any interest from his grandfather P1 separate property. When D32 and D33 do not get right by birth in his grandfather P1 separate property as per sec 4 of 1956 act. Therefore it is contended that D32 and D33 are not heir as per male issue upto three generation as per sub-section (1) of section 4 of mysore act. Mysore Hindu law women’s rights act 1933 does not apply to D32 and D33. Therefore it is contended that D1 is only male heir as per male issue upto three generation as per Sub-section (1) of Section 4 of mysore act. D1 get right by birth in his father P1 separate property as only male heir. D1 alone took the interest of P1 by succession as per section 7(2) of Mysore act. 5) As per Section 7(1) of Mysore Hindu law women’s rights act 1933. Section 7. Separation of interest by expression of intention. (1) where a member of a joint Hindu family not being a minor 5 has, by conduct or by declaration, expressed clearly and unequivocally, and to the knowledge of the other members, his intention to separate him self from the family, he shall be deemed to have become divided in interest from such other members from the time of such expression of intention. When suit for partition has been filled by P1. Date of filling suit for partition effect partition between P1 and D1. As per Puttarangamma & 2 Ors. Vs. M. S. Ranganna & 3 Ors. 1968 (3) S.C.R.119 Refer page 119 C-D, 125 A- H, 126 A-H, 129 A- D. As per Boregowda And Anr. vs Smt. Rangamayamma AIR 1999 Kant. 46 Para 9. When partition have taken place between P1 and D1. Succession to the property fall under Section 7(2) of the Act, As per Mysore Hindu law women’s rights act 1933. Section 7(2) separate share or interest to pass by succession in case of intestacy. The share or interest in joint family property of a member becoming divided in interest under sub section (1) shall, in the event of his dying intestate, pass by succession to his own heirs, male or female even though no actual division of property may have been made. As per Section 7(2) of Mysore act P1 separate property passes by succession to his only son D1 as a single heir. As per Sub-section (1) of Section 4 of mysore act male issue upto third generation are sons, grandsons, great grandsons and sons, grandsons, great grandsons are all coparceners get right by birth in property as per Sub-section (1) of Section 4 of mysore act. D1 been coparcener get right by birth in P1 separate property as per Sub-section (1) of Section 4 of mysore act. D1 been coparcener born in 1943 under mysore act. Under the Hindu law, the moment a son is born, he gets a share in the father's property and becomes part of the coparcenary. His right accrues to him not on the death of the father or inheritance from the father but with the very fact of his birth. Normally, therefore whenever the father gets a property from whatever source from the grandfather or from any other source, be it separated property or not, his son should have a share in that. as per the mitakshara law in usage prior to the commencement of the 1956 act, once a son was born, he acquired an interest in the coparcenary property as an incident of his birth. Hence a son having been born prior to commencement of 1956 act would retain his share of the property as a coparcener even after the commencement of 1956 act. Reference to be made In Sheela Devi and Ors vs Lal Chand and Anr. 2006 (8) SCC 581 A to C page 581 and Para 19. D1 get right by birth in his father P1 separate property as only male heir and D32 and D33 are grandsons of P1. D32 and D33 do not get right by birth in his grandfather P1 separate property. D32 and 6 D33 born under 1956 act and at the time of birth did not have right by birth in his grandfather P1 separate property. As per Commissioner of wealth tax Kanpur v. Chander Sen AIR 1986 SC 1753 Refer Para 11,14,16, 16A,18,20,21,22. And As per Sheela Devi and others v. Lal Chand and Others (2006) 8 SCC 581 Refer Para 18,19. When D32 and D33 do not get right by birth in his grandfather P1 separate property as per Section 4 of the Hindu Succession Act 1956, which clearly laid down that "save as expressly provided in the Act, any text, rule or interpretation of Hindu law or any custom or usage as part of that law in force immediately before the commencement of the Act should cease to have effect with respect to any matter for which provision was made in the Act. When D32 and D33 do not get right by birth in his grandfather P1 separate property as per sec 4 of 1956 act. Therefore it is contended that D32 and D33 are not heir as per male issue upto three generation as per sub-section (1) of section 4 of mysore act. Mysore Hindu law women’s rights act 1933 does not apply to D32 and D33. D1 get right by birth in his father P1 separate property as only male heir as per mysore act. Therefore it is contended that D1 is only male heir as per male issue upto three generation as per sub-section 1 of section 4 of mysore act. D1 alone took the interest of P1 by succession as per section 7(2) of Mysore act. As per mysore act P2 and P3 and D32 to D37 are not heir and are not entitled to any share of P1 separate property. As per commissioner of wealth tax, kanpur v chander sen Para 16 and 16a. The property obtained by D1 on the death of his father P1 it constitutes his separate and individual property not the properties of the joint family consisting of himself, his wife and sons. And As per K.VISWESWARIAH & ANOTHER v K.V. SATHYANARAYANA & OTHERS 1990(3) KAR.L.J 286 Para 26. Mysore act is not repealed by Hindu Succession Act 1956. As such the said act is still operating. As per Section 7(2) of Mysore Hindu law women’s rights act 1933 D1 get right birth in his father P1 separate property as a single heir. P1 separate property passes by succession to his only son D1 as a single heir as per mysore act. As Provision is been made in 1956 act sec 5(ii) of Hindu Succession Act, 1956 This Act shall not apply to any estate which descends to a single heir by the term of any enactment passed before the commencement of this Act. As per Section 7(2) of Mysore Hindu law women’s rights act 1933 P1 separate property passes to D1 by succession as a single heir. 7 6) As per Annamma vs Pattamma ILR 1993 KAR 755 Refer Para10. "The first and primary rule of construction is that the intention of the Legislature must be found in the words used by the Legislature itself. If the words used are capable of one construction only then it would not be open to the Courts to adopt any other hypothetical construction on the ground that such hypothetical construction is more consistent with the alleged object and policy of the Act. The words used in the material provisions of the Statute must be interpreted in their plain grammatical meaning and it is only when such words are capable of two constructions, one of which is likely to defeat or impair the policy of the Act whilst the other construction is likely to assist the achievement of the said policy, then the Courts would prefer to adopt the latter construction. It is only in such cases that it becomes relevant to consider the mischief and defect which the Act purports to remedy and correct". 7) As per SMT. SATHYAPREMA MANJUNATHA GOWDA Vs.THE CONTROLLER OF ESTATE DUTY, KARNATAKA. SCC 684, 1997 ( 4 ) Headnote The appellant is the widow of Manjunatha Gowda. Manjunatha Gowda was a member of jointfamily consisting of Mallegowda, his father and other members of the Hindu Undivided Family. On may 4,1965, on a partition amongst themselves, he got 4/5th share in the Hindu Undivided Family properties. On his demise, it is claimed that his unmarried daughter has 1/5th share in it and his widow, the appellant also has a share in that property. He died on August 18, 1971 and when estate duty was sought to be imposed, the appellant claimed exclusion of her share and that of her daughter in the property under Section 8(1) (d) of the Hindu Law Women's Rights Act,1933 (Mysore Act No. VIII of 1933), (for short, the `Act'). The Estate Duty officer excluded her share from taxable estate. But, on appeal, it was reversed. on a reference, the high Court held that the view taken by the Tribunal is correct. Thus this appeal. The question on which reference was sought by the assessee is as under : "whether in the facts and the circumstances of the case, the Tribunal was correct in holding that neither the unmarried daughter nor the wife of the deceased had any interest in the above property of the deceased while he was alive" 8 As per mysore act Manjunatha Gowda got the property by partition as a single heir and unmarried daughter nor the wife of Manjunatha Gowda had any interest in his property As per mysore act. as per mysore act Manjunatha Gowda is a single heir. 8) As per Hindu Succession Act, 1956 sec 5, This Act shall not apply to- (ii) any estate which descends to a single heir by the term of any enactment passed before the commencement of this Act. P1 separate property passes by succession to D1 as single heir as per sec 7 (2) mysore Hindu law women’s rights act 1933. When new section 6 of Hindu Succession act 2005 has been substituted for section 6 of Hindu Succession Act, 1956. When law which stood prior to 1956 act apply. Then 1956 act does not apply. Evidently the provision of Hindu Succession act 2005 Would Have No Application. 9 REPLY P1 had second son called Prakash he died in 1969 at the age of 19. Second Son of P1 died 21 years prior to filling of suit. Second Son of P1 did not have any issue or widow. The Interest of deceased second son lapses on his death and merges in the coparcenary property. As per STATE BANK OF INDIA vs. GHAMANDI RAM (DEAD) THROUGH SHRI GURBAX RAI 1969 AIR SC 1330. Para 7 CONTROLLER OF ESTATE DUTY MADRAS Vs. ALLADI KUPPUSWAMY 1977 AIR SC 2069. Para 5 (headnote) Para 8 10