Road Island Reds or Plymouth Barred Rocks

advertisement

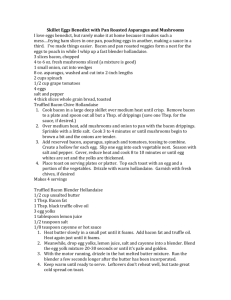

Bacon and Eggs At the beginning of 2008, Hogs-R-Us, Inc., a U.S. publicly traded company, completed the purchase of Egg World, an egg farm that produces, processes, and sells fresh eggs. Egg World was in the egg business for thirty years prior to being acquired. As a result of the purchase, Hogs-R-Us has changed its name to Bacon and Eggs, Inc. The controller, Janice Worthy, is working on the consolidated financial statements and has requested your advice regarding some questions that involve Egg World. In preparation, you attended a meeting with company management and obtained the following information: The egg-laying flock consists of Rhode Island Reds and Barred Plymouth Rocks. These hens can live 8 to 10 years but only have a productive life of about 2-3 years (one egg every 1.5 days). A laying hen will give from 200 up to 300 eggs during its life. After about 50 weeks, when the laying curve decreases too much, the hens are gathered for a few weeks in order to molt (change of feathers), after which a second laying cycle begins. At the end of their productive lives, the hens are sold to soup companies. Worthy considers the egg farm’s operating cycle to be two years and wants to present the cost of the hens as inventory in the current asset section of the balance sheet. Her theory is that the hens are goods awaiting sale to soup companies. The chief financial officer, Maria Ortega, does not agree with this treatment. Ortega thinks that the cost of the flock should be classified as property, plant, and equipment because the hens are used in the production of the eggs. Worthy distributed a report containing the results of a soil inspection Hogs-R-Us ordered prior to the acquisition. The report reveals that fecal contamination containing coliform and streptococcal bacteria were found in the soil under and surrounding the chicken coops, an area covering several thousand square yards. Such contamination resulted from Egg World having operated for many years prior to the existence of tougher standards on poultry contamination and due to the inadequate drainage runoff into the ground when the chicken coops were periodically cleaned. There is concern that the contamination could eventually threaten the water table used by nearby agricultural farms if not abated. Worthy explained how Bacon and Eggs can neutralize the contamination and safely avoid potential legal liability if the land upon which the chicken coops sit is treated with chemical agents in 5 years. In addition to the cleanup, the plan also calls for the old structures to be demolished and replaced with new, more high tech facilities to house the hens. It is estimated that in 5 years it will cost $2,200,000 to clean up the contamination, and Bacon and Eggs has made a legally binding commitment to do so. Worthy is not sure if Bacon and Eggs needs to currently account for this future cleanup. The company uses straight-line depreciation (ignore salvage value) and has a 4% credit-adjusted risk-free rate of interest. On the basis of the information you collected, write a memo to the controller advising her on all accounting issues that will affect the preparation of the financial statements. Include an appendix containing the required 2008 journal entries and a 5-year amortization and depreciation table.