The details of application forms and the documents to be enclosed

advertisement

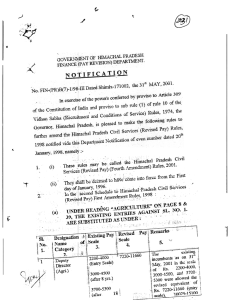

The details of application forms and the documents to be enclosed for filing of applications for major minerals as per Mineral Concession Rules, 1960. S. No 1. Nature of lease / licence R.P. Model form of application A (Rule-4) Authorit y to receive ADMG Appl. Fee / Survey charges Documents to be enclosed Non-refundable fee at Rs.5/- per Sq.KM Rs.250/- per 1st Sq.KM and Rs.50/for every Sq.KM or part thereof. Security Deposit of Rs.2500/for every Sq.KM -do- Valid MRCC and ITCC Topo Sheet. Challans in original. Valid MRCC/Affidavit, ITCC/Affidavit duly demarcated sketch. Challans in original. 2. PL B (Rule 9(1) ADMG -do- -do- Non refundable application fee of Rs.2500 & deposit of Rs.1000. Rs.2500/- Rule 20 3. 4. Renewal of E (Rule 9(3) PL ML I Rule 22(1) & Rule 22(3)(i)(a) 5. RML 6. Transfer of PL -do- 7. Transfer of Rule 37 ML -do- 8. Revision application before GOI J (Rule24A(1) N Rule 54 ADMG -do- By aggrieve d party -do- -do- Valid MRCC/Affidavit, ITCC/Affidavit of both the parties & joint agreement entered into by both the parties and sketch showing the area. Rs.2500/Valid MRCC/Affidavit, ITCC/Affidavit of both the parties & joint agreement entered into by both the parties and sketch showing the area. Rs.5000/in -favour of DD payable on the name of "Pay & Accounts Officer, Department of Mines" Payable at New Delhi or by Treasury Challan in No.0853, 102 The details of application forms and the documents to be enclosed for filing of applications for major minerals as per Andhra Pradesh Minor Mineral Concession Rules, 1966. S. No 1. 2. 3. 4. 5. 6. 7. Nature of lease / licence QPL for Granite QL for granite Renewal of QL for Granite QL for other than granite Renewal of QL for other than granite Revision by aggrieved party Appeal to DMG Model form of application N Rule 12(5) Authority Appl. Fee / to receive Survey charges ADMG Documents to be enclosed P Rule 12(5) Q Rule 12(5) -do- Nonrefundable application fee of Rs.7500 and Security Deposit of Rs.10000/- for every hectare. Rs.7500/- Valid MRCC/Affidavit, ITCC, Affidavit Pattadar consent in case of pattaland / sketch drawn to scale indicating the adjacent permanent features. -do- -do- Rs.5000/- -do- B Rule 9 -do- B Rule 9 -do- Appl. Fee of -doRs.1500/Rs.1500/-do- J Rule 35-A State Govt. Rs.1000/- J Rule 35 Director Rs.500/- Statutory time limit prescribed for the disposal of applications of major minerals. S. Item No 1. Acknowledgement of application 2. Intimation inspection application 3. Report of the ADMG/MRO Proposal to DMG ADMG/MRO Report of MRO Collector to write to Director in case of disagreement with MRO report. Scrutinizing proposals Scrutiny Forest areas Forwarding of the application Inspection by DFO and report to Prl.CCF., under intimation to DMG Prl.CCF report to Govt. Period for submission of AMP MRO Collector 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. of Party concerned Asst. Director 14. Fee for processing of Mining Plan 15. Reconnaissance Permit 16. Prospecting Licence 17. Mining Lease -do- ADMG DMG Govt. ADMG DFO Prl.CCF Applicant Applicant Govt. Govt. Govt. Time limit Rule Same day if the application 9A(4), 10(4), is personally handed over 23(1). or 3 days -doG.O.Ms.No.181 , Ind. & Comm. Dept., dt.28.5.96. 30 days (simultaneously) -do30 days after receipt of -doMRO report. 30 days -do30 days -do- 15 days after receipt of --doMRO report. 30 days -do-doSame day -doOne month -do- 30 days -do- 6 months or extended period by DMG under Rule 24(4) Nonrefundable fee Rs.1000/- for every Sq.KM or part thereof mining area. 60 days from the date of receipt of application 9 months from the date of receipt of application 12 months from the date of receipt of application -do- Rule 22 BB 1(a) Rule 63(A) Rule 63(A) Rule 63(A) For Director of Mines and Geology. Responsibilities of the lessees Reconnaissance Permit: To be executed within 90 days as per Rule 7(A) S. Item No 1. Relinquishment of the area Party concerned By permit holder 2. Further relinquishment -do- 3. -do- 4. Not to enter into forest area To submit report 5. To submit data -do- -do- Time limit Rule After two years relinquished 1000 Sq.KM or 50% of the area granted. At the end of 3rd year the permit holder to hold any 25 Sq.KM Permit holder not to enter into forest areas. Six monthly progress reports to be submitted to State Govt. The permit holder shall submit the data within 3 months of expiry of the permit 7(1)(i)(a) 7(1)(i)(b) 7(1)(iv) 7(1)(vi) 7(1)(vii) Prospecting Licence To be executed within 90 days under Rule 15(1) S. Item No 1. To plug all bores and fill up or fence excavation in the area under licence 2. To report discovery of any mineral not specified in the licence. 3. To report progress of PL work to submit full report on expiry / termination of licence Party concerned Licence Time limit Rule 6 months of determination or abandonment of PL 14(1)(4) -do- 60 days of such discovery 14(1)(4) -do- 6 monthly reports 16 Mining Lease To be executed within 6 Months under Rule 31 S.No. Item 1 To application for PL/ML for another mineral found in this area and notify to him To Commence Mining operations To pay Royalty and reminded the breaches of terms/conditions Payment of Rs. 200/Revival lapsed lease To apply for renewal of lease in case of M.L 2 3 4 5 6 7 8 To submit Revision application to Government of India To submit comments on Revision application and further comments Party concerned Lessee 6 Months 24 (5) --do-- 1 Year 27(1) --do-- 60 days from receipt of note 27(5) --do-- 3 Months before the expiry of the period 12 Months before the expiry of the lease 3 Months of communication of the order 1. 3 Months of issue of communication 2. 1 month of issued of further communication Two years from the date of the order Two months of grant/Renewal 28(2) --do-- Aggrieved Party State Government impleaded parties Time Limit Rule 24A(1) 54 55(2) To correct Errors and State 56 omissions in any order Government 9 To send copies of every Lessee 57 licence (lease granted or renewed to IBM) 10 To submit consolidated State 30th June of Every -annual returns of all Government year licencess/leases 11 To report discovery of Lessee 60 days -Atomic Minerals to the Department Atomic Energy and State Director of Mines and Geology MINOR MINERALS S.No. Item Party Time Limit Rule concerned 1 Payment of advance dead Lessee On or before one Rule 10(1) rent month of the Schedule I and expiry of financial Schedudle III year of APMMC Rules 1966 2 Execution of the quarry Grantee 90 days or Rule13 (1) lease deed for other than extended period by granite the DM&G 3 Execution of QPL for granite Licensee 4 Submission of AMP for Granite Execution of regular quarry lease Payment of Rs. 2,500/for the revival of Granite quarry lease Payment of Rs. 500/- for Part surrender of the leased area Payment of Rs. 500/- for revival of the lease Lessee 6 months 12(5)(C) Grantee 60 days 12 (5) (c ) Lessee One month from the date of receipt of lapsing order 6 calender months 12(5)(vii)(h) 17 Submission of quarterly returns Dispatch of mineral by paying seigniorage fee in advance Lessee 30 days before the expiry of the lease 30 days before the expiry of the lease Before dispatch of mineral from the quarry 5 6 7 8 9 10 Lessee Lessee Lessee 60 days or extended period by the DM&G Rule 12(5)(e) 16 28(3) 34 The Regional Deputy Director of Mines and Geology shall take up a detailed half yearly inspection of each of Assistant Director of Mines and Geology’s office in his jurisdiction in order to ensure that the direction of the Government for timely disposal of applications are complied with and the proposals being processed in accordance with rules and regulations. HOW TO TRANSPORT MINERALS According to Rule 27(2) (a) of MC Rules 1960, the State Government has to specify the rate , time limit and mode of payment of royalty. In pursuance of the above the State Government has issued the order in GO Ms.No. 674, Industries and Commerce, dated. 27.6.1975 the time limit and mode of payment of royalty for the quantities intended to be dispatched. In the lease deed executed by the lease holder in the covenent 3 of part of form ‘K’ the rate and mode of payment of royalty has to be specified. According to the orders issued in GO Ms.No. 674, Industries and Commerce Department dated.27.6.1975 the lessee shall in respect of the quantity of ore or mineral intended to be transported by him each time from the leased area to a place outside the said leased area pay the royalty for such quantity at the time of such transport to an officer authorised in this behalf at the rates specified in the second schedule of the MM)D&R) Act, 1957. The lessee has to file in an application in form A and obtain permit from an authorised officer in form ‘D’ in token of having paid the royalty. Similarly according to rule 34 of APMMC Rules, 1966 in respect of minor minerals also the quarry lease holders is required to pay the seigniorage fee in advance and remove the minerals from the leased area. The lease holders shall inrespect of the quantity of minor minerals intended to be transported by him each time from the quarry lease area to a place outside the quarry pay seigniorage fee for such quantity at the time of such transport to an officer authorised in this behalf at the rates specified in the first schedule to rule 10(1) of APMMC Rules 1966. According to Mineral Conservation and Development Rules, 1988 every lease holder has to file a monthly return showing the production dispatches of closing stock etc., While preparing the assessments the Asst.Director ofMines and Geology will arrive the quantities removed during the year and cross verify with the production and dispatch registers maintained at the mine site and also with other departments/Mineral based industries. Mineral revenue assessments will be prepared and submitted to the Deputy Director of Mines and Geology once in a year who has been empowered to approved the assessments upto anamount of Rs. 50.00 lakshs of current royalty. If it is above Rs. 50.00 laksh the Director of Mines and Geoology is the competent authority for approval. ROLE OF TRADERS/DEALERS Government of India recently amended the provisions of section 23 of Mines and Minerals (Development and Regulation) Act 1957 duly delegating powers to the State Government for preventing illegal mining, transportation and storage of minerals. Accordingly Government have brought out A.P. Mineral Dealer Rules, 2000 to regulate the possession storage, trading and transportation of minerals and mineral products and to check evasion of royalty/seigniorage fee, stopping of illegal mining and quarrying and transportation in the State of Andhra Pradesh and for the purpose connected therewith. According to these Rules those who are dealing with any minerals for the purpose of trading or involved in processing of minerals shall register to the Department of Mines and Geology before the Deputy Director of Mines and Geology in-charge of the region. They shall furnish the account on the procurement of raw material from Mines/Quarries periodically and also they will be issued transit passes for transporting the mineral/finished products from the trading places/processing units. It any processed mineral is dispatched without possessing transit passes such vehicle in liable for confiscation by the officers of the Department of Mines and Geology. ROLE OF PUBLIC IN REALISATION OF TAXES: Mining Sector is one of the important revenue generation to the States. Minerals are natural resources which have to be exploited cautiously and consumed judiciously. If any mineral is removed without sanction of lease as per the rules it amounts to illegal mining and causes loss of revenue to the State besides depriving the nation from proper utilization of the resource given by the nature. Therefore, an appeal from the department to the public in this regards is to ensure that the operations are conducted within the framework of law and contribute to the developmental activities of the State. WEBSITE OF THE DEPARTMENT There is a Government portal (www.aponline.gov.in) and Department website giving statutory application / proformas and Mineral & Mines Information Royalty / Dead Rent on Major Minerals 0853- Non Ferrous Mining and Metallurgical Industries M.H. 102- Mineral concession, Fees, Rents and Royalties S.H. (01) – Royalty on Major Minerals / Dead Rent.