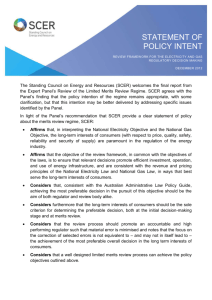

Regulation Impact Statement: Limited Merits Review of Decision

advertisement