Chapter 21 Option Valuation

advertisement

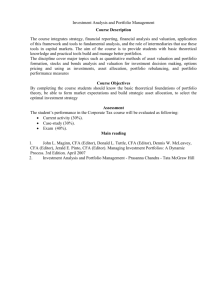

Chapter 21 - Option Valuation Chapter 21 Option Valuation Multiple Choice Questions 1. Before expiration, the time value of an in the money call option is always A. equal to zero. B. positive. C. negative. D. equal to the stock price minus the exercise price. E. None of these is correct. 2. Before expiration, the time value of an in the money put option is always A. equal to zero. B. negative. C. positive. D. equal to the stock price minus the exercise price. E. None of these is correct. 3. Before expiration, the time value of an at the money call option is always A. positive. B. equal to zero. C. negative. D. equal to the stock price minus the exercise price. E. None of these is correct. 4. Before expiration, the time value of an at the money put option is always A. equal to zero. B. equal to the stock price minus the exercise price. C. negative. D. positive. E. None of these is correct. 21-1 Chapter 21 - Option Valuation 5. At expiration, the time value of an in the money call option is always A. equal to zero. B. positive. C. negative. D. equal to the stock price minus the exercise price. E. None of these is correct. 6. At expiration, the time value of an in the money put option is always A. equal to zero. B. negative. C. positive. D. equal to the stock price minus the exercise price. E. None of these is correct. 7. At expiration, the time value of an at the money call option is always A. positive. B. equal to zero. C. negative. D. equal to the stock price minus the exercise price. E. None of these is correct. 8. At expiration, the time value of an at the money put option is always A. equal to zero. B. equal to the stock price minus the exercise price. C. negative. D. positive. E. None of these is correct. 9. A call option has an intrinsic value of zero if the option is A. at the money. B. out of the money. C. in the money. D. at the money and in the money. E. at the money and out of the money. 21-2 Chapter 21 - Option Valuation 10. A put option has an intrinsic value of zero if the option is A. at the money. B. out of the money. C. in the money. D. at the money and in the money. E. at the money and out of the money. 11. Prior to expiration A. the intrinsic value of a call option is greater than its actual value. B. the intrinsic value of a call option is always positive. C. the actual value of a call option is greater than the intrinsic value. D. the intrinsic value of a call option is always greater than its time value. E. None of these is correct. 12. Prior to expiration A. the intrinsic value of a put option is greater than its actual value. B. the intrinsic value of a put option is always positive. C. the actual value of a put option is greater than the intrinsic value. D. the intrinsic value of a put option is always greater than its time value. E. None of these is correct. 13. If the stock price increases, the price of a put option on that stock __________ and that of a call option __________. A. decreases; increases B. decreases; decreases C. increases; decreases D. increases; increases E. does not change; does not change 21-3 Chapter 21 - Option Valuation 14. If the stock price decreases, the price of a put option on that stock __________ and that of a call option __________. A. decreases; increases B. decreases; decreases C. increases; decreases D. increases; increases E. does not change; does not change 15. Other things equal, the price of a stock call option is positively correlated with the following factors except A. the stock price. B. the time to expiration. C. the stock volatility. D. the exercise price. E. None of these is correct. 16. Other things equal, the price of a stock call option is positively correlated with the following factors A. the stock price. B. the time to expiration. C. the stock volatility. D. the exercise price. E. the stock price, the time to expiration, and the stock volatility. 17. Other things equal, the price of a stock call option is negatively correlated with the following factors A. the stock price. B. the time to expiration. C. the stock volatility. D. the exercise price. E. the stock price, the time to expiration, and the stock volatility. 21-4 Chapter 21 - Option Valuation 18. Other things equal, the price of a stock put option is positively correlated with the following factors except A. the stock price. B. the time to expiration. C. the stock volatility. D. the exercise price. E. None of these is correct. 19. Other things equal, the price of a stock put option is positively correlated with the following factors A. the stock price. B. the time to expiration. C. the stock volatility. D. the exercise price. E. the time to expiration, the stock volatility, and the exercise price. 20. Other things equal, the price of a stock put option is negatively correlated with the following factors A. the stock price. B. the time to expiration. C. the stock volatility. D. the exercise price. E. the time to expiration, the stock volatility, and the exercise price. 21. The price of a stock put option is __________ correlated with the stock price and __________ correlated with the striking price. A. positively; positively B. negatively; positively C. negatively; negatively D. positively; negatively E. not; not 21-5 Chapter 21 - Option Valuation 22. The price of a stock call option is __________ correlated with the stock price and __________ correlated with the striking price. A. positively; positively B. negatively; positively C. negatively; negatively D. positively; negatively E. not; not 23. All the inputs in the Black-Scholes Option Pricing Model are directly observable except A. the price of the underlying security. B. the risk free rate of interest. C. the time to expiration. D. the variance of returns of the underlying asset return. E. None of these is correct. 24. Which of the inputs in the Black-Scholes Option Pricing Model are directly observable A. the price of the underlying security. B. the risk free rate of interest. C. the time to expiration. D. the variance of returns of the underlying asset return. E. the price of the underlying security, the risk free rate of interest, and the time to expiration. 25. Delta is defined as A. the change in the value of an option for a dollar change in the price of the underlying asset. B. the change in the value of the underlying asset for a dollar change in the call price. C. the percentage change in the value of an option for a one percent change in the value of the underlying asset. D. the change in the volatility of the underlying stock price. E. None of these is correct. 21-6 Chapter 21 - Option Valuation 26. A hedge ratio of 0.70 implies that a hedged portfolio should consist of A. long 0.70 calls for each short stock. B. short 0.70 calls for each long stock. C. long 0.70 shares for each short call. D. long 0.70 shares for each long call. E. None of these is correct. 27. A hedge ratio of 0.85 implies that a hedged portfolio should consist of A. long 0.85 calls for each short stock. B. short 0.85 calls for each long stock. C. long 0.85 shares for each short call. D. long 0.85 shares for each long call. E. None of these is correct. 28. A hedge ratio for a call option is ________ and a hedge ratio for a put option is ______. A. negative; positive B. negative; negative C. positive; negative D. positive; positive E. zero; zero 29. A hedge ratio for a call is always A. equal to one. B. greater than one. C. between zero and one. D. between minus one and zero. E. of no restricted value. 30. A hedge ratio for a put is always A. equal to one. B. greater than one. C. between zero and one. D. between minus one and zero. E. of no restricted value. 21-7 Chapter 21 - Option Valuation 31. The dollar change in the value of a stock call option is always A. lower than the dollar change in the value of the stock. B. higher than the dollar change in the value of the stock. C. negatively correlated with the change in the value of the stock. D. higher than the dollar change in the value of the stock and negatively correlated with the change in the value of the stock. E. lower than the dollar change in the value of the stock and negatively correlated with the change in the value of the stock. 32. The percentage change in the stock call option price divided by the percentage change in the stock price is called A. the elasticity of the option. B. the delta of the option. C. the theta of the option. D. the gamma of the option. E. None of these is correct. 33. The elasticity of an option is A. the volatility level for the stock that the option price implies. B. the continued updating of the hedge ratio as time passes. C. the percentage change in the stock call option price divided by the percentage change in the stock price. D. the sensitivity of the delta to the stock price. E. volatility level for the stock that the option price implies and the percentage change in the stock call option price divided by the percentage change in the stock price. 34. The elasticity of a stock call option is always A. greater than one. B. smaller than one. C. negative. D. infinite. E. None of these is correct. 21-8 Chapter 21 - Option Valuation 35. The elasticity of a stock put option is always A. positive. B. smaller than one. C. negative. D. infinite. E. None of these is correct. 36. The gamma of an option is A. the volatility level for the stock that the option price implies. B. the continued updating of the hedge ratio as time passes. C. the percentage change in the stock call option price divided by the percentage change in the stock price. D. the sensitivity of the delta to the stock price. E. the volatility level for the stock that the option price implies and the percentage change in the stock call option price divided by the percentage change in the stock price. 37. Delta neutral A. is the volatility level for the stock that the option price implies. B. is the continued updating of the hedge ratio as time passes. C. is the percentage change in the stock call option price divided by the percentage change in the stock price. D. means the portfolio has no tendency to change value as the underlying portfolio value changes. E. is the volatility level for the stock that the option price implies and is the percentage change in the stock call option price divided by the percentage change in the stock price. 38. Dynamic hedging is A. the volatility level for the stock that the option price implies. B. the continued updating of the hedge ratio as time passes. C. the percentage change in the stock call option price divided by the percentage change in the stock price. D. the sensitivity of the delta to the stock price. E. is the volatility level for the stock that the option price implies and is the percentage change in the stock call option price divided by the percentage change in the stock price. 21-9 Chapter 21 - Option Valuation 39. Volatility risk is A. the volatility level for the stock that the option price implies. B. the risk incurred from unpredictable changes in volatility. C. the percentage change in the stock call option price divided by the percentage change in the stock price. D. the sensitivity of the delta to the stock price. E. is the volatility level for the stock that the option price implies and is the percentage change in the stock call option price divided by the percentage change in the stock price. 40. Portfolio A consists of 150 shares of stock and 300 calls on that stock. Portfolio B consists of 575 shares of stock. The call delta is 0.7. Which portfolio has a higher dollar exposure to a change in stock price? A. Portfolio B. B. Portfolio A. C. The two portfolios have the same exposure. D. A if the stock price increases and B if it decreases. E. B if the stock price decreases and A if it increases. 41. Portfolio A consists of 500 shares of stock and 500 calls on that stock. Portfolio B consists of 800 shares of stock. The call delta is 0.6. Which portfolio has a higher dollar exposure to a change in stock price? A. Portfolio B. B. Portfolio A. C. The two portfolios have the same exposure. D. A if the stock price increases and B if it decreases. E. B if the stock price decreases and A if it increases. 42. Portfolio A consists of 400 shares of stock and 400 calls on that stock. Portfolio B consists of 500 shares of stock. The call delta is 0.5. Which portfolio has a higher dollar exposure to a change in stock price? A. Portfolio B. B. Portfolio A. C. The two portfolios have the same exposure. D. A if the stock price increases and B if it decreases. E. B if the stock price decreases and A if it increases. 21-10 Chapter 21 - Option Valuation 43. Portfolio A consists of 600 shares of stock and 300 calls on that stock. Portfolio B consists of 685 shares of stock. The call delta is 0.3. Which portfolio has a higher dollar exposure to a change in stock price? A. Portfolio B. B. Portfolio A. C. The two portfolios have the same exposure. D. A if the stock price increases and B if it decreases. E. B if the stock price decreases and A if it increases. 44. A portfolio consists of 100 shares of stock and 1500 calls on that stock. If the hedge ratio for the call is 0.7, what would be the dollar change in the value of the portfolio in response to a one dollar decline in the stock price? A. +$700 B. +$500 C. −$1,150 D. −$520 E. None of these is correct. 45. A portfolio consists of 800 shares of stock and 100 calls on that stock. If the hedge ratio for the call is 0.5. What would be the dollar change in the value of the portfolio in response to a one dollar decline in the stock price? A. +$700 B. −$850 C. −$580 D. −$520 E. None of these is correct. 46. A portfolio consists of 225 shares of stock and 300 calls on that stock. If the hedge ratio for the call is 0.4, what would be the dollar change in the value of the portfolio in response to a one dollar decline in the stock price? A. -$345 B. +$500 C. −$580 D. −$520 E. None of these is correct. 21-11 Chapter 21 - Option Valuation 47. A portfolio consists of 400 shares of stock and 200 calls on that stock. If the hedge ratio for the call is 0.6, what would be the dollar change in the value of the portfolio in response to a one dollar decline in the stock price? A. +$700 B. +$500 C. −$580 D. −$520 E. None of these is correct. 48. If the hedge ratio for a stock call is 0.30, the hedge ratio for a put with the same expiration date and exercise price as the call would be ________. A. 0.70 B. 0.30 C. −0.70 D. −0.30 E. −0.17 49. If the hedge ratio for a stock call is 0.50, the hedge ratio for a put with the same expiration date and exercise price as the call would be ________. A. 0.30 B. 0.50 C. −0.60 D. −0.50 E. −0.17 50. If the hedge ratio for a stock call is 0.60, the hedge ratio for a put with the same expiration date and exercise price as the call would be _______. A. 0.60 B. 0.40 C. −0.60 D. −0.40 E. −0.17 21-12 Chapter 21 - Option Valuation 51. If the hedge ratio for a stock call is 0.70, the hedge ratio for a put with the same expiration date and exercise price as the call would be _______. A. 0.70 B. 0.30 C. −0.70 D. −0.30 E. −0.17 52. A put option is currently selling for $6 with an exercise price of $50. If the hedge ratio for the put is -0.30 and the stock is currently selling for $46, what is the elasticity of the put? A. 2.76 B. 2.30 C. −7.67 D. −2.76 E. −2.30 53. A put option on the S&P 500 index will best protect ________ A. a portfolio of 100 shares of IBM stock. B. a portfolio of 50 bonds. C. a portfolio that corresponds to the S&P 500. D. a portfolio of 50 shares of AT&T and 50 shares of Xerox stocks. E. a portfolio that replicates the Dow. 54. Higher dividend payout policies have a __________ impact on the value of the call and a __________ impact on the value of the put compared to lower dividend payout policies. A. negative; negative B. positive; positive C. positive; negative D. negative; positive E. zero; zero 21-13 Chapter 21 - Option Valuation 55. Lower dividend payout policies have a __________ impact on the value of the call and a __________ impact on the value of the put compared to higher dividend payout policies. A. negative; negative B. positive; positive C. positive; negative D. negative; positive E. zero; zero 56. A one dollar decrease in a call option's exercise price would result in a(n) __________ in the call option's value of __________ one dollar. A. increase; more than B. decrease; more than C. decrease; less than D. increase; less than E. increase; exactly 57. Which one of the following variables influence the value of call options? I) Level of interest rates. II) Time to expiration of the option. III) Dividend yield of underlying stock. IV) Stock price volatility. A. I and IV only. B. II and III only. C. I, II, and IV only. D. I, II, III, and IV. E. I, II, and III only. 21-14 Chapter 21 - Option Valuation 58. Which one of the following variables influence the value of put options? I) Level of interest rates. II) Time to expiration of the option. III) Dividend yield of underlying stock. IV) Stock price volatility. A. I and IV only. B. II and III only. C. I, II, and IV only. D. I, II, III, and IV. E. I, II, and III only. 59. An American call option buyer on a non-dividend paying stock will A. always exercise the call as soon as it is in the money. B. only exercise the call when the stock price exceeds the previous high. C. never exercise the call early. D. buy an offsetting put whenever the stock price drops below the strike price. E. None of these is correct. 60. Relative to European puts, otherwise identical American put options A. are less valuable. B. are more valuable. C. are equal in value. D. will always be exercised earlier. E. None of these is correct. 61. Use the two-state put option value in this problem. SO= $100; X = $120; the two possibilities for STare $150 and $80. The range of P across the two states is _____; the hedge ratio is _______. A. $0 and $40; −4/7 B. $0 and $50; +4/7 C. $0 and $40; +4/7 D. $0 and $50; −4/7 E. $20 and $40; +1/2 21-15 Chapter 21 - Option Valuation 62. Use the Black-Scholes Option Pricing Model for the following problem. Given: SO= $70; X = $70; T = 70 days; r = 0.06 annually (0.0001648 daily); = 0.020506 (daily). No dividends will be paid before option expires. The value of the call option is _______. A. $10.16 B. $5.16 C. $0.00 D. $2.16 E. None of these is correct. 63. Empirical tests of the Black-Scholes option pricing model A. show that the model generates values fairly close to the prices at which options trade. B. show that the model tends to overvalue deep in the money calls and undervalue deep out of the money calls. C. indicate that the mispricing that does occur is due to the possible early exercise of American options on dividend-paying stocks. D. show that the model generates values fairly close to the prices at which options trade; and indicate that the mispricing that does occur is due to the possible early exercise of American options on dividend-paying stocks. E. show that the model generates values fairly close to the prices at which options trade; show that the model tends to overvalue deep in the money calls and undervalue deep out of the money calls; and indicate that the mispricing that does occur is due to the possible early exercise of American options on dividend-paying stocks. 64. Options sellers who are delta-hedging would most likely A. sell when markets are falling. B. buy when markets are rising. C. sell when markets are falling and buy when markets are rising. D. sell whether markets are falling or rising. E. buy whether markets are falling or rising. An American-style call option with six months to maturity has a strike price of $35. The underlying stock now sells for $43. The call premium is $12. 21-16 Chapter 21 - Option Valuation 65. What is the intrinsic value of the call? A. $12 B. $8 C. $0 D. $23 E. None of these is correct. 66. What is the time value of the call? A. $8 B. $12 C. $0 D. $4 E. Cannot be determined without more information. 67. If the option has delta of .5, what is its elasticity? A. 4.17 B. 2.32 C. 1.79 D. 0.5 E. 1.5 68. If the company unexpectedly announces it will pay its first-ever dividend 3 months from today, you would expect that A. the call price would increase. B. the call price would decrease. C. the call price would not change. D. the put price would decrease. E. the put price would not change. 21-17 Chapter 21 - Option Valuation 69. The intrinsic value of an out-of-the-money call option is equal to A. the call premium. B. zero. C. the stock price minus the exercise price. D. the striking price. E. None of these is correct. 70. Since deltas change as stock values change, portfolio hedge ratios must be constantly updated in active markets. This process is referred to as A. portfolio insurance. B. rebalancing. C. option elasticity. D. gamma hedging. E. dynamic hedging. 71. In volatile markets, dynamic hedging may be difficult to implement because A. prices move too quickly for effective rebalancing. B. as volatility increases, historical deltas are too low. C. price quotes may be delayed so that correct hedge ratios cannot be computed. D. volatile markets may cause trading halts. E. All of these are correct. 72. Rubinstein (1994) observed that the performance of the Black-Scholes model had deteriorated in recent years, and he attributed this to A. investor fears of another market crash. B. higher than normal dividend payouts. C. early exercise of American call options. D. decreases in transaction costs. E. None of these is correct. 21-18 Chapter 21 - Option Valuation 73. The time value of a call option is I) the difference between the option's price and the value it would have if it were expiring immediately. II) the same as the present value of the option's expected future cash flows. III) the difference between the option's price and its expected future value. IV) different from the usual time value of money concept. A. I B. I and II C. II and III D. II E. I and IV 74. The time value of a put option is I) the difference between the option's price and the value it would have if it were expiring immediately. II) the same as the present value of the option's expected future cash flows. III) the difference between the option's price and its expected future value. IV) different from the usual time value of money concept. A. I B. I and II C. II and III D. II E. I and IV 75. The intrinsic value of an at-the-money call option is equal to A. the call premium. B. zero. C. the stock price plus the exercise price. D. the striking price. E. None of these is correct. 21-19 Chapter 21 - Option Valuation 76. As the underlying stock's price increased, the call option valuation function's slope approaches A. zero. B. one. C. two times the value of the stock. D. one-half times the value of the stock. E. infinity. 77. The intrinsic value of an in-of-the-money call option is equal to A. the call premium. B. zero. C. the stock price minus the exercise price. D. the striking price. E. None of these is correct. 78. The Black-Scholes formula assumes that I) the risk-free interest rateis constant over the life of the option. II) the stock price volatility is constant over the life of the option. III) the expected rate of return on the stock is constant over the life of the option. IV) there will be no sudden extreme jumps in stock prices. A. I and II B. I and III C. II and II D. I, II, and IV E. I, II, III, and IV 79. The intrinsic value of an in-the-money put option is equal to A. the stock price minus the exercise price. B. the put premium. C. zero. D. the exercise price minus the stock price. E. None of these is correct. 21-20 Chapter 21 - Option Valuation 80. The hedge ratio of an option is also called the options _______. A. alpha B. beta C. sigma D. delta E. rho 81. The intrinsic value of an at-the-money put option is equal to A. the stock price minus the exercise price. B. the put premium. C. zero. D. the exercise price minus the stock price. E. None of these is correct. 82. What is the intrinsic value of the call? Refer To: 21-82 A. $12 B. $10 C. $8 D. $23 E. None of these is correct. 83. What is the time value of the call? Refer To: 21-82 A. $8 B. $12 C. $6 D. $4 E. Cannot be determined without more information. 21-21 Chapter 21 - Option Valuation 84. If the company unexpectedly announces it will pay its first-ever dividend 4 months from today, you would expect that Refer To: 21-82 A. the call price would increase. B. the call price would decrease. C. the call price would not change. D. the put price would decrease. E. the put price would not change. 85. The intrinsic value of an out-of-the-money put option is equal to A. the stock price minus the exercise price. B. the put premium. C. zero. D. the exercise price minus the stock price. E. None of these is correct. 86. Vega is defined as A. the change in the value of an option for a dollar change in the price of the underlying asset. B. the change in the value of the underlying asset for a dollar change in the call price. C. the percentage change in the value of an option for a one percent change in the value of the underlying asset. D. the change in the volatility of the underlying stock price. E. the sensitivity of an option's price to changes in volatility. Short Answer Questions 87. Discuss the relationship between option prices and time to expiration, volatility of the underlying stocks, and the exercise price. 21-22 Chapter 21 - Option Valuation 88. Which of the variables affecting option pricing is not directly observable? If this variable is estimated to be higher or lower than the variable actually is how is the option valuation affected? 89. What is an option hedge ratio? How does the hedge ratio for a call differ from that of a put (or are the two equivalent)? Explain. 21-23 Chapter 21 - Option Valuation 90. You are evaluating a stock that is currently selling for $30 per share. Over the investment period you think that the stock price might get as low as $25 or as high as $40. There is a call option available on the stock with an exercise price of $35. Answer the following questions about hedging your position in the stock. Assume that you will hold one share. What is the hedge ratio? How much would you borrow to purchase the stock? What is the amount of your net investment in the stock? Complete the table below to show the value of your stock portfolio at the end of the holding period. How many call options will you combine with the stock to construct the perfect hedge? Will you buy the calls or sell the calls? Show the option values in the table below. Show the net payoff to your portfolio in the table below. What must the price of one call option be? 21-24 Chapter 21 - Option Valuation Chapter 21 Option Valuation Answer Key Multiple Choice Questions 1. Before expiration, the time value of an in the money call option is always A. equal to zero. B. positive. C. negative. D. equal to the stock price minus the exercise price. E. None of these is correct. The difference between the actual option price and the intrinsic value is called the time value of the option. Time value is always positive before expiration. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Option valuation 2. Before expiration, the time value of an in the money put option is always A. equal to zero. B. negative. C. positive. D. equal to the stock price minus the exercise price. E. None of these is correct. The difference between the actual option price and the intrinsic value is called the time value of the option. Time value is always positive before expiration. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Option valuation 21-25 Chapter 21 - Option Valuation 3. Before expiration, the time value of an at the money call option is always A. positive. B. equal to zero. C. negative. D. equal to the stock price minus the exercise price. E. None of these is correct. The difference between the actual option price and the intrinsic value is called the time value of the option. Time value is always positive before expiration. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Option valuation 4. Before expiration, the time value of an at the money put option is always A. equal to zero. B. equal to the stock price minus the exercise price. C. negative. D. positive. E. None of these is correct. The difference between the actual option price and the intrinsic value is called the time value of the option. Time value is always positive before expiration. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Option valuation 21-26 Chapter 21 - Option Valuation 5. At expiration, the time value of an in the money call option is always A. equal to zero. B. positive. C. negative. D. equal to the stock price minus the exercise price. E. None of these is correct. The difference between the actual option price and the intrinsic value is called the time value of the option. Time value is always zero at expiration. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Option valuation 6. At expiration, the time value of an in the money put option is always A. equal to zero. B. negative. C. positive. D. equal to the stock price minus the exercise price. E. None of these is correct. The difference between the actual option price and the intrinsic value is called the time value of the option. Time value is always zero at expiration. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Option valuation 21-27 Chapter 21 - Option Valuation 7. At expiration, the time value of an at the money call option is always A. positive. B. equal to zero. C. negative. D. equal to the stock price minus the exercise price. E. None of these is correct. The difference between the actual option price and the intrinsic value is called the time value of the option. Time value is always zero at expiration. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Option valuation 8. At expiration, the time value of an at the money put option is always A. equal to zero. B. equal to the stock price minus the exercise price. C. negative. D. positive. E. None of these is correct. The difference between the actual option price and the intrinsic value is called the time value of the option. Time value is always zero at expiration. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Option valuation 21-28 Chapter 21 - Option Valuation 9. A call option has an intrinsic value of zero if the option is A. at the money. B. out of the money. C. in the money. D. at the money and in the money. E. at the money and out of the money. Intrinsic value can never be negative; thus it is set equal to zero for out of the money and at the money options. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Option valuation 10. A put option has an intrinsic value of zero if the option is A. at the money. B. out of the money. C. in the money. D. at the money and in the money. E. at the money and out of the money. Intrinsic value can never be negative; thus it is set equal to zero for out of the money and at the money options. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Option valuation 21-29 Chapter 21 - Option Valuation 11. Prior to expiration A. the intrinsic value of a call option is greater than its actual value. B. the intrinsic value of a call option is always positive. C. the actual value of a call option is greater than the intrinsic value. D. the intrinsic value of a call option is always greater than its time value. E. None of these is correct. Prior to expiration, any option will be selling for a positive price, thus the actual value is greater than the intrinsic value. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Option valuation 12. Prior to expiration A. the intrinsic value of a put option is greater than its actual value. B. the intrinsic value of a put option is always positive. C. the actual value of a put option is greater than the intrinsic value. D. the intrinsic value of a put option is always greater than its time value. E. None of these is correct. Prior to expiration, any option will be selling for a positive price, thus the actual value is greater than the intrinsic value. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Option valuation 21-30 Chapter 21 - Option Valuation 13. If the stock price increases, the price of a put option on that stock __________ and that of a call option __________. A. decreases, increases B. decreases, decreases C. increases, decreases D. increases, increases E. does not change, does not change As stock prices increase, call options become more valuable (the owner can buy the stock at a bargain price). As stock prices increase, put options become less valuable (the owner can sell the stock at a price less than market price). AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Option valuation 14. If the stock price decreases, the price of a put option on that stock __________ and that of a call option __________. A. decreases, increases B. decreases, decreases C. increases, decreases D. increases, increases E. does not change, does not change As stock prices decrease, call options become less valuable (the owner cannot buy the stock at a bargain price). As stock prices decrease, put options become more valuable (the owner can sell the stock at a price greater than market price). AACSB: Analytic Bloom's: Understand Difficulty: Intermediate Topic: Option valuation 21-31 Chapter 21 - Option Valuation 15. Other things equal, the price of a stock call option is positively correlated with the following factors except A. the stock price. B. the time to expiration. C. the stock volatility. D. the exercise price. E. None of these is correct. The exercise price is negatively correlated with the call option price. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Option valuation 16. Other things equal, the price of a stock call option is positively correlated with the following factors A. the stock price. B. the time to expiration. C. the stock volatility. D. the exercise price. E. the stock price, the time to expiration, and the stock volatility. The exercise price is negatively correlated with the call option price. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Option valuation 21-32 Chapter 21 - Option Valuation 17. Other things equal, the price of a stock call option is negatively correlated with the following factors A. the stock price. B. the time to expiration. C. the stock volatility. D. the exercise price. E. the stock price, the time to expiration, and the stock volatility. The exercise price is negatively correlated with the call option price. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Option valuation 18. Other things equal, the price of a stock put option is positively correlated with the following factors except A. the stock price. B. the time to expiration. C. the stock volatility. D. the exercise price. E. None of these is correct. The put option price is negatively correlated with the stock price. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Option valuation 21-33 Chapter 21 - Option Valuation 19. Other things equal, the price of a stock put option is positively correlated with the following factors A. the stock price. B. the time to expiration. C. the stock volatility. D. the exercise price. E. the time to expiration, the stock volatility, and the exercise price. The put option price is negatively correlated with the stock price. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Option valuation 20. Other things equal, the price of a stock put option is negatively correlated with the following factors A. the stock price. B. the time to expiration. C. the stock volatility. D. the exercise price. E. the time to expiration, the stock volatility, and the exercise price. The exercise price is negatively correlated with the stock price. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Option valuation 21-34 Chapter 21 - Option Valuation 21. The price of a stock put option is __________ correlated with the stock price and __________ correlated with the striking price. A. positively, positively B. negatively, positively C. negatively, negatively D. positively, negatively E. not, not The lower the stock price, the more valuable the put option. The higher the striking price, the more valuable the put option. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Option valuation 22. The price of a stock call option is __________ correlated with the stock price and __________ correlated with the striking price. A. positively, positively B. negatively, positively C. negatively, negatively D. positively, negatively E. not, not The higher the stock price, the more valuable the call option. The lower the striking price, the more valuable the call option. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Option valuation 21-35 Chapter 21 - Option Valuation 23. All the inputs in the Black-Scholes Option Pricing Model are directly observable except A. the price of the underlying security. B. the risk free rate of interest. C. the time to expiration. D. the variance of returns of the underlying asset return. E. None of these is correct. The variance of the returns of the underlying asset is not directly observable, but must be estimated from historical data, from scenario analysis, or from the prices of other options. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Option valuation 24. Which of the inputs in the Black-Scholes Option Pricing Model are directly observable A. the price of the underlying security. B. the risk free rate of interest. C. the time to expiration. D. the variance of returns of the underlying asset return. E. the price of the underlying security, the risk free rate of interest, and the time to expiration. The variance of the returns of the underlying asset is not directly observable, but must be estimated from historical data, from scenario analysis, or from the prices of other options. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Option valuation 21-36 Chapter 21 - Option Valuation 25. Delta is defined as A. the change in the value of an option for a dollar change in the price of the underlying asset. B. the change in the value of the underlying asset for a dollar change in the call price. C. the percentage change in the value of an option for a one percent change in the value of the underlying asset. D. the change in the volatility of the underlying stock price. E. None of these is correct. An option's hedge ratio (delta) is the change in the price of an option for $1 increase in the stock price. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Option valuation 26. A hedge ratio of 0.70 implies that a hedged portfolio should consist of A. long 0.70 calls for each short stock. B. short 0.70 calls for each long stock. C. long 0.70 shares for each short call. D. long 0.70 shares for each long call. E. None of these is correct. The hedge ratio is the slope of the option value as a function of the stock value. A slope of 0.70 means that as the stock increases in value by $1, the option increases by approximately $0.70. Thus, for every call written, 0.70 shares of stock would be needed to hedge the investor's portfolio. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Option valuation 21-37 Chapter 21 - Option Valuation 27. A hedge ratio of 0.85 implies that a hedged portfolio should consist of A. long 0.85 calls for each short stock. B. short 0.85 calls for each long stock. C. long 0.85 shares for each short call. D. long 0.85 shares for each long call. E. None of these is correct. The hedge ratio is the slope of the option value as a function of the stock value. A slope of 0.85 means that as the stock increases in value by $1, the option increases by approximately $0.85. Thus, for every call written, 0.85 shares of stock would be needed to hedge the investor's portfolio. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Option valuation 28. A hedge ratio for a call option is ________ and a hedge ratio for a put option is ______. A. negative, positive B. negative, negative C. positive, negative D. positive, positive E. zero, zero Call option hedge ratios must be positive and less than 1.0, and put option ratios must be negative, with a smaller absolute value than 1.0. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Option valuation 21-38 Chapter 21 - Option Valuation 29. A hedge ratio for a call is always A. equal to one. B. greater than one. C. between zero and one. D. between minus one and zero. E. of no restricted value. Call option hedge ratios must be positive and less than 1.0, and put option ratios must be negative, with a smaller absolute value than 1.0. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Option valuation 30. A hedge ratio for a put is always A. equal to one. B. greater than one. C. between zero and one. D. between minus one and zero. E. of no restricted value. Call option hedge ratios must be positive and less than 1.0, and put option ratios must be negative, with a smaller absolute value than 1.0. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Option valuation 21-39 Chapter 21 - Option Valuation 31. The dollar change in the value of a stock call option is always A. lower than the dollar change in the value of the stock. B. higher than the dollar change in the value of the stock. C. negatively correlated with the change in the value of the stock. D. higher than the dollar change in the value of the stock and negatively correlated with the change in the value of the stock. E. lower than the dollar change in the value of the stock and negatively correlated with the change in the value of the stock. The slope of the call option valuation function is less than one. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Option valuation 32. The percentage change in the stock call option price divided by the percentage change in the stock price is called A. the elasticity of the option. B. the delta of the option. C. the theta of the option. D. the gamma of the option. E. None of these is correct. Option price elasticity measures the percent change in the option price as a function of the percent change in the stock price. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Option valuation 21-40 Chapter 21 - Option Valuation 33. The elasticity of an option is A. the volatility level for the stock that the option price implies. B. the continued updating of the hedge ratio as time passes. C. the percentage change in the stock call option price divided by the percentage change in the stock price. D. the sensitivity of the delta to the stock price. E. volatility level for the stock that the option price implies and the percentage change in the stock call option price divided by the percentage change in the stock price. Option price elasticity measures the percent change in the option price as a function of the percent change in the stock price. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Option valuation 34. The elasticity of a stock call option is always A. greater than one. B. smaller than one. C. negative. D. infinite. E. None of these is correct. Option prices are much more volatile than stock prices, as option premiums are much lower than stock prices. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Option valuation 21-41 Chapter 21 - Option Valuation 35. The elasticity of a stock put option is always A. positive. B. smaller than one. C. negative. D. infinite. E. None of these is correct. As put options become more valuable as stock prices decline, the elasticity of a put option must be negative. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Option valuation 36. The gamma of an option is A. the volatility level for the stock that the option price implies. B. the continued updating of the hedge ratio as time passes. C. the percentage change in the stock call option price divided by the percentage change in the stock price. D. the sensitivity of the delta to the stock price. E. the volatility level for the stock that the option price implies and the percentage change in the stock call option price divided by the percentage change in the stock price. The gamma of an option is the sensitivity of the delta to the stock price. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Option valuation 21-42 Chapter 21 - Option Valuation 37. Delta neutral A. is the volatility level for the stock that the option price implies. B. is the continued updating of the hedge ratio as time passes. C. is the percentage change in the stock call option price divided by the percentage change in the stock price. D. means the portfolio has no tendency to change value as the underlying portfolio value changes. E. is the volatility level for the stock that the option price implies and is the percentage change in the stock call option price divided by the percentage change in the stock price. Delta neutral means the portfolio has no tendency to change value as the underlying portfolio value changes. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Option valuation 38. Dynamic hedging is A. the volatility level for the stock that the option price implies. B. the continued updating of the hedge ratio as time passes. C. the percentage change in the stock call option price divided by the percentage change in the stock price. D. the sensitivity of the delta to the stock price. E. is the volatility level for the stock that the option price implies and is the percentage change in the stock call option price divided by the percentage change in the stock price. Dynamic hedging is the continued updating of the hedge ratio as time passes. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Option valuation 21-43 Chapter 21 - Option Valuation 39. Volatility risk is A. the volatility level for the stock that the option price implies. B. the risk incurred from unpredictable changes in volatility. C. the percentage change in the stock call option price divided by the percentage change in the stock price. D. the sensitivity of the delta to the stock price. E. is the volatility level for the stock that the option price implies and is the percentage change in the stock call option price divided by the percentage change in the stock price. Volatility risk is the risk incurred from unpredictable changes in volatility. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Option valuation 40. Portfolio A consists of 150 shares of stock and 300 calls on that stock. Portfolio B consists of 575 shares of stock. The call delta is 0.7. Which portfolio has a higher dollar exposure to a change in stock price? A. Portfolio B. B. Portfolio A. C. The two portfolios have the same exposure. D. A if the stock price increases and B if it decreases. E. B if the stock price decreases and A if it increases. 300 calls (0.7) = 210 shares + 150 shares = 360 shares; 575 shares = 575 shares. AACSB: Analytic Bloom's: Apply Difficulty: Challenge Topic: Option valuation 21-44 Chapter 21 - Option Valuation 41. Portfolio A consists of 500 shares of stock and 500 calls on that stock. Portfolio B consists of 800 shares of stock. The call delta is 0.6. Which portfolio has a higher dollar exposure to a change in stock price? A. Portfolio B. B. Portfolio A. C. The two portfolios have the same exposure. D. A if the stock price increases and B if it decreases. E. B if the stock price decreases and A if it increases. 500 calls (0.6) = 300 shares + 500 shares = 800 shares; 800 shares = 800 shares. AACSB: Analytic Bloom's: Apply Difficulty: Challenge Topic: Option valuation 42. Portfolio A consists of 400 shares of stock and 400 calls on that stock. Portfolio B consists of 500 shares of stock. The call delta is 0.5. Which portfolio has a higher dollar exposure to a change in stock price? A. Portfolio B. B. Portfolio A. C. The two portfolios have the same exposure. D. A if the stock price increases and B if it decreases. E. B if the stock price decreases and A if it increases. 400 calls (0.5) = 200 shares + 400 shares = 600 shares; 500 shares = 500 shares. AACSB: Analytic Bloom's: Apply Difficulty: Challenge Topic: Option valuation 21-45 Chapter 21 - Option Valuation 43. Portfolio A consists of 600 shares of stock and 300 calls on that stock. Portfolio B consists of 685 shares of stock. The call delta is 0.3. Which portfolio has a higher dollar exposure to a change in stock price? A. Portfolio B. B. Portfolio A. C. The two portfolios have the same exposure. D. A if the stock price increases and B if it decreases. E. B if the stock price decreases and A if it increases. 300 calls (0.3) = 90 shares + 600 shares = 690 shares; 685 shares = 685 shares. AACSB: Analytic Bloom's: Apply Difficulty: Challenge Topic: Option valuation 44. A portfolio consists of 100 shares of stock and 1500 calls on that stock. If the hedge ratio for the call is 0.7, what would be the dollar change in the value of the portfolio in response to a one dollar decline in the stock price? A. +$700 B. +$500 C. -$1,150 D. -$520 E. None of these is correct −$100 + [−$1,500(0.7)] = −$1,150. AACSB: Analytic Bloom's: Apply Difficulty: Challenge Topic: Option valuation 21-46 Chapter 21 - Option Valuation 45. A portfolio consists of 800 shares of stock and 100 calls on that stock. If the hedge ratio for the call is 0.5. What would be the dollar change in the value of the portfolio in response to a one dollar decline in the stock price? A. +$700 B. -$850 C. -$580 D. -$520 E. None of these is correct −$800 + [−$100(0.5)] = −$850. AACSB: Analytic Bloom's: Apply Difficulty: Challenge Topic: Option valuation 46. A portfolio consists of 225 shares of stock and 300 calls on that stock. If the hedge ratio for the call is 0.4, what would be the dollar change in the value of the portfolio in response to a one dollar decline in the stock price? A. -$345 B. +$500 C. -$580 D. -$520 E. None of these is correct −$225 + [−$300(0.4)] = −$345. AACSB: Analytic Bloom's: Apply Difficulty: Challenge Topic: Option valuation 21-47 Chapter 21 - Option Valuation 47. A portfolio consists of 400 shares of stock and 200 calls on that stock. If the hedge ratio for the call is 0.6, what would be the dollar change in the value of the portfolio in response to a one dollar decline in the stock price? A. +$700 B. +$500 C. -$580 D. -$520 E. None of these is correct −$400 + [−$200(0.6)] = −$520. AACSB: Analytic Bloom's: Apply Difficulty: Challenge Topic: Option valuation 48. If the hedge ratio for a stock call is 0.30, the hedge ratio for a put with the same expiration date and exercise price as the call would be ________. A. 0.70 B. 0.30 C. -0.70 D. -0.30 E. -.17 Call hedge ratio = N(d1); Put hedge ratio = N(d1) − 1; 0.3 − 1.0 = −0.7. AACSB: Analytic Bloom's: Apply Difficulty: Challenge Topic: Option valuation 21-48 Chapter 21 - Option Valuation 49. If the hedge ratio for a stock call is 0.50, the hedge ratio for a put with the same expiration date and exercise price as the call would be ________. A. 0.30 B. 0.50 C. -0.60 D. -0.50 E. -.17 Call hedge ratio = N(d1); Put hedge ratio = N(d1) − 1; 0.5 − 1.0 = −0.5. AACSB: Analytic Bloom's: Apply Difficulty: Challenge Topic: Option valuation 50. If the hedge ratio for a stock call is 0.60, the hedge ratio for a put with the same expiration date and exercise price as the call would be _______. A. 0.60 B. 0.40 C. -0.60 D. -0.40 E. -.17 Call hedge ratio = N(d1); Put hedge ratio = N(d1) − 1; 0.6 − 1.0 = −0.4. AACSB: Analytic Bloom's: Apply Difficulty: Challenge Topic: Option valuation 21-49 Chapter 21 - Option Valuation 51. If the hedge ratio for a stock call is 0.70, the hedge ratio for a put with the same expiration date and exercise price as the call would be _______. A. 0.70 B. 0.30 C. -0.70 D. -0.30 E. -.17 Call hedge ratio = N(d1); Put hedge ratio = N(d1) − 1; 0.7 − 1.0 = −0.3. AACSB: Analytic Bloom's: Apply Difficulty: Challenge Topic: Option valuation 52. A put option is currently selling for $6 with an exercise price of $50. If the hedge ratio for the put is −0.30 and the stock is currently selling for $46, what is the elasticity of the put? A. 2.76 B. 2.30 C. -7.67 D. -2.76 E. -2.30 % stock price change = ($47 − $46)/$46 = 0.021739; % option price change = ($5.70 − $6.00)/$6 = − 0.05; −0.05/0.021739 = − 2.30. AACSB: Analytic Bloom's: Apply Difficulty: Challenge Topic: Option valuation 21-50 Chapter 21 - Option Valuation 53. A put option on the S&P 500 index will best protect ________ A. a portfolio of 100 shares of IBM stock. B. a portfolio of 50 bonds. C. a portfolio that corresponds to the S&P 500. D. a portfolio of 50 shares of AT&T and 50 shares of Xerox stocks. E. a portfolio that replicates the Dow. The S&P 500 index is more like a portfolio that corresponds to the S&P 500 and thus is more protective of such a portfolio than of any of the other assets. AACSB: Analytic Bloom's: Apply Difficulty: Basic Topic: Option valuation 54. Higher dividend payout policies have a __________ impact on the value of the call and a __________ impact on the value of the put compared to lower dividend payout policies. A. negative, negative B. positive, positive C. positive, negative D. negative, positive E. zero, zero Dividends lower the expected stock price, and thus lower the current call option value and increase the current put option value. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: Option valuation 21-51 Chapter 21 - Option Valuation 55. Lower dividend payout policies have a __________ impact on the value of the call and a __________ impact on the value of the put compared to higher dividend payout policies. A. negative, negative B. positive, positive C. positive, negative D. negative, positive E. zero, zero Dividends lower the expected stock price, and thus lower the current call option value and increase the current put option value. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: Option valuation 56. A one dollar decrease in a call option's exercise price would result in a(n) __________ in the call option's value of __________ one dollar. A. increase, more than B. decrease, more than C. decrease, less than D. increase, less than E. increase, exactly Option prices are less than stock prices, thus changes in stock prices (market or exercise) are greater (in absolute terms) than are changes in prices of options. AACSB: Analytic Bloom's: Understand Difficulty: Intermediate Topic: Option valuation 21-52 Chapter 21 - Option Valuation 57. Which one of the following variables influence the value of call options? I) Level of interest rates. II) Time to expiration of the option. III) Dividend yield of underlying stock. IV) Stock price volatility. A. I and IV only. B. II and III only. C. I, II, and IV only. D. I, II, III, and IV. E. I, II and III only. All of the these variables affect call option prices. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Option valuation 58. Which one of the following variables influence the value of put options? I) Level of interest rates. II) Time to expiration of the option. III) Dividend yield of underlying stock. IV) Stock price volatility. A. I and IV only. B. II and III only. C. I, II, and IV only. D. I, II, III, and IV. E. I, II and III only. All of these variables affect put option prices. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Option valuation 21-53 Chapter 21 - Option Valuation 59. An American call option buyer on a non-dividend paying stock will A. always exercise the call as soon as it is in the money. B. only exercise the call when the stock price exceeds the previous high. C. never exercise the call early. D. buy an offsetting put whenever the stock price drops below the strike price. E. None of these is correct. An American call option buyer will not exercise early if the stock does not pay dividends; exercising forfeits the time value. Rather, the option buyer will sell the option to collect both the intrinsic value and the time value. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Option valuation 60. Relative to European puts, otherwise identical American put options A. are less valuable. B. are more valuable. C. are equal in value. D. will always be exercised earlier. E. None of these is correct. It is valuable to exercise a put option early if the stock drops below a threshold price; thus American puts should sell for more than European puts. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Option valuation 21-54 Chapter 21 - Option Valuation 61. Use the two-state put option value in this problem. SO= $100; X = $120; the two possibilities for STare $150 and $80. The range of P across the two states is _____; the hedge ratio is _______. A. $0 and $40; -4/7 B. $0 and $50; +4/7 C. $0 and $40; +4/7 D. $0 and $50; -4/7 E. $20 and $40; +1/2 When ST = $150; P = $0; when ST =$80: P = $40; ($0 − $40)/($150 − $80) = −4/7. AACSB: Analytic Bloom's: Apply Difficulty: Challenge Topic: Option valuation 62. Use the Black-Scholes Option Pricing Model for the following problem. Given: SO= $70; X = $70; T = 70 days; r = 0.06 annually (0.0001648 daily); = 0.020506 (daily). No dividends will be paid before option expires. The value of the call option is _______. A. $10.16 B. $5.16 C. $0.00 D. $2.16 E. None of these is correct d2 = 0.1530277 − (0.020506)(70)1/2 = −0.01853781; N(d1) = 0.5600; N(d2) = 0.4919; C = 0.5600($70) − $70[e-(0.0001648)(70)]0.4919 = $5.16. AACSB: Analytic Bloom's: Apply Difficulty: Challenge Topic: Option valuation 21-55 Chapter 21 - Option Valuation 63. Empirical tests of the Black-Scholes option pricing model A. show that the model generates values fairly close to the prices at which options trade. B. show that the model tends to overvalue deep in the money calls and undervalue deep out of the money calls. C. indicate that the mispricing that does occur is due to the possible early exercise of American options on dividend-paying stocks. D. show that the model generates values fairly close to the prices at which options trade; and indicate that the mispricing that does occur is due to the possible early exercise of American options on dividend-paying stocks. E. show that the model generates values fairly close to the prices at which options trade; show that the model tends to overvalue deep in the money calls and undervalue deep out of the money calls; and indicate that the mispricing that does occur is due to the possible early exercise of American options on dividend-paying stocks. Studies have shown that the model tends to undervalue deep in the money calls and to overvalue deep out of the money calls. AACSB: Analytic Bloom's: Apply Difficulty: Challenge Topic: Option valuation 64. Options sellers who are delta-hedging would most likely A. sell when markets are falling. B. buy when markets are rising. C. sell when markets are falling and buy when markets are rising. D. sell whether markets are falling or rising. E. buy whether markets are falling or rising. Options sellers who are delta-hedging would most likely sell when markets are falling and buy when markets are rising. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: Option valuation An American-style call option with six months to maturity has a strike price of $35. The underlying stock now sells for $43. The call premium is $12. 21-56 Chapter 21 - Option Valuation 65. What is the intrinsic value of the call? A. $12 B. $8 C. $0 D. $23 E. None of these is correct. 43 − 35 = $8. AACSB: Analytic Bloom's: Apply Difficulty: Basic Topic: Option valuation 66. What is the time value of the call? A. $8 B. $12 C. $0 D. $4 E. cannot be determined without more information. 12 − (43 − 35) = $4. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: Option valuation 21-57 Chapter 21 - Option Valuation 67. If the option has delta of .5, what is its elasticity? A. 4.17 B. 2.32 C. 1.79 D. 0.5 E. 1.5 [(12.50 − 12)/12]/[(44 − 43)/43] = 1.79. AACSB: Analytic Bloom's: Apply Difficulty: Challenge Topic: Option valuation 21-58 Chapter 21 - Option Valuation 68. If the company unexpectedly announces it will pay its first-ever dividend 3 months from today, you would expect that A. the call price would increase. B. the call price would decrease. C. the call price would not change. D. the put price would decrease. E. the put price would not change. As an approximation, subtract the present value of the dividend from the stock price and recompute the Black-Scholes value with this adjusted stock price. Since the stock price is lower, the option value will be lower. AACSB: Analytic Bloom's: Understand Difficulty: Intermediate Topic: Option valuation 69. The intrinsic value of an out-of-the-money call option is equal to A. the call premium. B. zero. C. the stock price minus the exercise price. D. the striking price. E. None of these is correct. The fact that the owner of the option can buy the stock at a price greater than the market price gives the contract an intrinsic value of zero, and the holder will not exercise. AACSB: Analytic Bloom's: Understand Difficulty: Basic Topic: Option valuation 21-59 Chapter 21 - Option Valuation 70. Since deltas change as stock values change, portfolio hedge ratios must be constantly updated in active markets. This process is referred to as A. portfolio insurance. B. rebalancing. C. option elasticity. D. gamma hedging. E. dynamic hedging. Dynamic hedgers will convert equity into cash in market declines to adjust for changes in option deltas. AACSB: Analytic Bloom's: Understand Difficulty: Intermediate Topic: Option valuation 71. In volatile markets, dynamic hedging may be difficult to implement because A. prices move too quickly for effective rebalancing. B. as volatility increases, historical deltas are too low. C. price quotes may be delayed so that correct hedge ratios cannot be computed. D. volatile markets may cause trading halts. E. All of these are correct. All of these correctly describe the problems associated with dynamic hedging in volatile markets. AACSB: Analytic Bloom's: Understand Difficulty: Basic Topic: Option valuation 21-60 Chapter 21 - Option Valuation 72. Rubinstein (1994) observed that the performance of the Black-Scholes model had deteriorated in recent years, and he attributed this to A. investor fears of another market crash. B. higher than normal dividend payouts. C. early exercise of American call options. D. decreases in transaction costs. E. None of these is correct. Options on the same stock with the same strike price should have the same implied volatility, but they exhibit progressively different implied volatilities. Rubinstein believes this is due to fear of another market crash. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Option valuation 73. The time value of a call option is I) the difference between the option's price and the value it would have if it were expiring immediately. II) the same as the present value of the option's expected future cash flows. III) the difference between the option's price and its expected future value. IV) different from the usual time value of money concept. A. I B. I and II C. II and III D. II E. I and IV The time value of an option is described by I, and is different from the time value of money concept frequently used in finance. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Option valuation 21-61 Chapter 21 - Option Valuation 74. The time value of a put option is I) the difference between the option's price and the value it would have if it were expiring immediately. II) the same as the present value of the option's expected future cash flows. III) the difference between the option's price and its expected future value. IV) different from the usual time value of money concept. A. I B. I and II C. II and III D. II E. I and IV The time value of an option is described by I, and is different from the time value of money concept frequently used in finance. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Option valuation 75. The intrinsic value of an at-the-money call option is equal to A. the call premium. B. zero. C. the stock price plus the exercise price. D. the striking price. E. None of these is correct. The fact that the owner of the option can buy the stock at a price equal to the market price gives the contract an intrinsic value of zero. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Option valuation 21-62 Chapter 21 - Option Valuation 76. As the underlying stock's price increased, the call option valuation function's slope approaches A. zero. B. one. C. two times the value of the stock. D. one-half times the value of the stock. E. infinity. As the stock price increases the value of the call option increases in price one for one with the stock price. The option is very likely to be exercised. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Option valuation 77. The intrinsic value of an in-of-the-money call option is equal to A. the call premium. B. zero. C. the stock price minus the exercise price. D. the striking price. E. None of these is correct. The fact that the owner of the option can buy the stock at a price less than the market price gives the contract a positive intrinsic value. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Option valuation 21-63 Chapter 21 - Option Valuation 78. The Black-Scholes formula assumes that I) the risk-free interest rateis constant over the life of the option. II) the stock price volatility is constant over the life of the option. III) the expected rate of return on the stock is constant over the life of the option. IV) there will be no sudden extreme jumps in stock prices. A. I and II B. I and III C. II and II D. I, II and IV E. I, II, III, and IV The risk-free rate and stock price volatility are assumed to be constant but the option value does not depend on the expected rate of return on the stock. The model also assumes that stock prices will not jump markedly. AACSB: Analytic Bloom's: Remember Difficulty: Challenge Topic: Option valuation 79. The intrinsic value of an in-the-money put option is equal to A. the stock price minus the exercise price. B. the put premium. C. zero. D. the exercise price minus the stock price. E. None of these is correct. The intrinsic value of an in-the-money put option contract is the strike price less the stock price, since the holder can buy the stock at the market price and sell it for the strike. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Option valuation 21-64 Chapter 21 - Option Valuation 80. The hedge ratio of an option is also called the options _______. A. alpha B. beta C. sigma D. delta E. rho The two terms mean the same thing. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Option valuation 81. The intrinsic value of an at-the-money put option is equal to A. the stock price minus the exercise price. B. the put premium. C. zero. D. the exercise price minus the stock price. E. None of these is correct. The intrinsic value of an at-the-money put option contract is zero. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Option valuation 21-65 Chapter 21 - Option Valuation 82. What is the intrinsic value of the call? Refer To: 21-82 A. $12 B. $10 C. $8 D. $23 E. None of these is correct. 50 − 42 = $8. AACSB: Analytic Bloom's: Apply Difficulty: Basic Topic: Option valuation 83. What is the time value of the call? Refer To: 21-82 A. $8 B. $12 C. $6 D. $4 E. cannot be determined without more information. 14 − (50 − 42) = $6. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: Option valuation 21-66 Chapter 21 - Option Valuation 84. If the company unexpectedly announces it will pay its first-ever dividend 4 months from today, you would expect that Refer To: 21-82 A. the call price would increase. B. the call price would decrease. C. the call price would not change. D. the put price would decrease. E. the put price would not change. As an approximation, subtract the present value of the dividend from the stock price and recompute the Black-Scholes value with this adjusted stock price. Since the stock price is lower, the option value will be lower. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: Option valuation 85. The intrinsic value of an out-of-the-money put option is equal to A. the stock price minus the exercise price. B. the put premium. C. zero. D. the exercise price minus the stock price. E. None of these is correct. The intrinsic value of an out-of-the-money put option contract is zero. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Option valuation 21-67 Chapter 21 - Option Valuation 86. Vega is defined as A. the change in the value of an option for a dollar change in the price of the underlying asset. B. the change in the value of the underlying asset for a dollar change in the call price. C. the percentage change in the value of an option for a one percent change in the value of the underlying asset. D. the change in the volatility of the underlying stock price. E. the sensitivity of an option's price to changes in volatility. An option's hedge ratio (delta) is the change in the price of an option for $1 increase in the stock price. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Option valuation Short Answer Questions 87. Discuss the relationship between option prices and time to expiration, volatility of the underlying stocks, and the exercise price. The longer the time to expiration, the higher the premium because it is more likely that an option will become more valuable (more time for the stock price to change). The greater the volatility of the underlying stock, the greater the option premium; the more volatile the stock, the more likely it is that the option will become more valuable (e. g., move from an out of the money to an in the money option, or become more in the money). For call options, the lower the exercise price, the more valuable the option, as the option owner can buy the stock at a lower price. For a put option, the lower the exercise price, the less valuable the option, as the owner of the option may be required to sell the stock at a lower than market price. Feedback: The purpose of this question is to ensure that the student understands the relationships of the variables that determine option prices, and the differences and similarities of these variables on put and call option prices. AACSB: Reflective Thinking Bloom's: Understand Difficulty: Intermediate Topic: Option valuation 21-68 Chapter 21 - Option Valuation 88. Which of the variables affecting option pricing is not directly observable? If this variable is estimated to be higher or lower than the variable actually is how is the option valuation affected? The volatility of the underlying stock is not directly observable, but can be estimated from historic data. If the implied volatility is lower than the actual volatility of the stock, the option will be undervalued, as the higher the implied volatility, the higher the price of the option. Investors often use the implied volatility of the stock, i.e., the volatility of the stock implied by the price of the option. If investors think the actual volatility of the stock exceeds the implied volatility, the option would be considered to be underpriced. If actual volatility appears to be higher than the implied volatility, the "fair price" of the option would exceed the actual price. Feedback: The purpose of this question is to determine whether the student understands how some investors use option pricing based on implied volatility to determine if the option appears to be over or undervalued. AACSB: Reflective Thinking Bloom's: Understand Difficulty: Challenge Topic: Option valuation 89. What is an option hedge ratio? How does the hedge ratio for a call differ from that of a put (or are the two equivalent)? Explain. An option's hedge ratio is the change in the price of an option for a $1 increase in the stock price. A call option has a positive hedge ratio; a put option has a negative hedge ratio. The hedge ratio is the slope of the value function of the option evaluated at the current stock price. Feedback: The purpose of this question is to determine whether the student understands hedge ratios and how these ratios vary for puts and calls. AACSB: Reflective Thinking Bloom's: Understand Difficulty: Intermediate Topic: Option valuation 21-69 Chapter 21 - Option Valuation 90. You are evaluating a stock that is currently selling for $30 per share. Over the investment period you think that the stock price might get as low as $25 or as high as $40. There is a call option available on the stock with an exercise price of $35. Answer the following questions about hedging your position in the stock. Assume that you will hold one share. What is the hedge ratio? How much would you borrow to purchase the stock? What is the amount of your net investment in the stock? Complete the table below to show the value of your stock portfolio at the end of the holding period. How many call options will you combine with the stock to construct the perfect hedge? Will you buy the calls or sell the calls? Show the option values in the table below. Show the net payoff to your portfolio in the table below. What must the price of one call option be? 21-70 Chapter 21 - Option Valuation The answers are shown below. What is the hedge ratio? The hedge ratio equals the range of the call values divided by the range of the stock values, which equals (5 − 0)/(40 − 25) = 1/3. [If the stock price ends at $40 the call is worth $5; if it ends at $25 the call is worth $0. How much would you borrow to purchase the stock? Borrow the present value of the anticipated minimum stock price = $25/1.06 = $23.58 What is the amount of your net investment in the stock? The net amount of investment is $30 − 23.58 = $6.42. Complete the table below to show the value of your stock portfolio at the end of the holding period. How many call options will you combine with the stock to construct the perfect hedge? Will you buy the calls or sell the calls? Since the hedge ratio is 1/3 buy one stock and sell three call options. Show the option values in the table below. Show the net payoff to your portfolio in the table below. What must the price of one call option be? The value of the stock portfolio equals the value of three calls. The net investment in the stock portfolio is $6.42 so this must equal the value of the three calls. $6.42 = 3C, and C = $2.14. Alternatively, the value of the whole position must 21-71 Chapter 21 - Option Valuation equal the present value of the certain payoff: S − 3C = $23.58, $30 − 3C = $23.58, and C = $2.14. Feedback: This question tests the student's ability to construct a perfect hedge on a stock portfolio using call options. AACSB: Reflective Thinking Bloom's: Apply Difficulty: Challenge Topic: Option valuation 21-72