Google`s IPO – Game Theory Analysis

advertisement

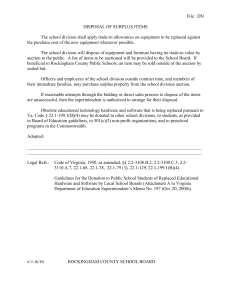

May 10, 2010 3SWM & Oz Final Google’s IPO – Game Theory Analysis Introduction In August of 2004, Google Inc. made its highly anticipated initial public offering after nearly six years as a privately held company. Even under normal circumstances, the IPO of a marquee company such as Google would have drawn considerable investor and media interest. This IPO, however, would become one of the most talked about in recent history because Google stayed true to its roots as an innovative company and chose to conduct an auction to sell its shares. This paper will analyze Google’s decision to shun the typical process of IPO via an investment bank in favor of a modified Dutch auction. In doing so, we will provide an overview of the typical IPO process and an analysis of its strengths and weaknesses, followed by a discussion of Google’s auction and its results. Finally, we will analyze auction IPOs for the industry as whole, discuss their infrequent use, and offer strategies for those involved in the auctions. Initial Public Offerings Since the early 18th century, businesses have been offering shares of their ownership via initial public offerings. Doing so allows companies to raise money to expand or pay off debts, and their owners to sell some of their shares. It also gives employees and business partners the opportunity to become partial owners of the company. May 10, 2010 3SWM & Oz Final However, with these benefits come a number of burdens. The process of going public is typically very expensive as a result of legal, accounting, and printing fees. Additionally, companies usually hire an investment bank to act as an advisor throughout the process, in exchange for lucrative fee arrangements. Once public, companies must also undertake the significant effort and cost of complying with extensive SEC regulations. A. Role of the Underwriter Before going public, companies typically hire an investment bank (or multiple banks for larger offerings) to act as an underwriter and assist with the initial sale of the shares. The goal in hiring an underwriter is to find a partner with the contacts and distribution ability to sell the shares to interested parties. In doing so, the investment bank helps the company set an initial price for the shares and build up demand in the market. To market the IPO, investment banks often leverage their relationships with institutional investors – who make up a large percentage of the market – to arrange purchases. Through a process known as a “road show,” bankers travel around the world meeting with potential investors to promote their client companies. Based on the demand they foresee in the market, and on various financial analyses, underwriters work with the issuing company to set an initial price for the shares. In exchange for these services, investment banks typically earn commissions based on the value of the shares they sell. These fees can become very expensive, equalling as much as 8.0% of the IPO in some cases. B. Under-pricing IPOs A common goal in setting the price for an IPO is to ensure that demand for the shares exceeds supply, so that there is a “pop” in the share price on the first day of trading. The purpose May 10, 2010 3SWM & Oz Final of this initial under-pricing of an IPO is two-fold. First, the bank wants to generate additional interest in the stock when it first becomes publicly traded, as positive news about a company’s “increasing value” can create momentum for the stock going-forward. Second, banks have an incentive to please institutional investors (many of whom are their clients) by giving them a moderate investment gain in exchange for taking on the risk of owning the company before the market. Of course, this can create significant gains for investors who have been allocated shares of the IPO at the offering price. . However, under-pricing an IPO also results in “money left on the table” – lost capital that the issuing company could have raised had the stock been offered closer to the market price. One extreme example of this occurred with the theglobe.com IPO. Underwritten by Bear Stearns on November 13, 1998 the stock was initially priced at $9 per share. In normal conditions, the opening should have been around $10 or $11 per share; yet the globe.comjumped 1,000% at the opening of trading to $97, before closing at $63 after many investors took their quick (and large) profit. Theglobe.com raised approximately $30 million from its IPO. Unfortunately, if it had been priced correctly – that is, if the company captured the value that the market put on it – it might have taken in $200m internally.1 While under-pricing may cost the issuing company some of its initial capital, the inverse can be just as damaging. If a stock is offered to the public at a higher price than the market will pay, the underwriters may have trouble meeting their commitments to sell shares. Even if they sell all of the issued shares, if the stock falls in value on the first day of trading, it may lose its marketability and thus even more of its value. Therefore, investment banks must 1 http://news.cnet.com/2100-1023-217913.html May 10, 2010 3SWM & Oz Final strike a balance between offering a company at a low enough price to stimulate demand, while also ensuring that the company generates sufficient capital. Google’s IPO Google broke with conventional wisdom in approaching its IPO, which was very consistent with its history of attacking the status quo through its introduction of innovative products and services. Instead of following the traditional route of having an investment bank underwrite its shares, Google opted for what they termed a “modified Dutch auction.” In doing so, they sought to deprive the Wall Street banks of their normal complete control over the sale, and make it easier for individual investors to purchase the stock. A. How Google’s “Modified Dutch Auction” Worked Google, working with Morgan Stanley and Credit Suisse First Boston as its lead bankers, used a modified version of a Dutch auction to sell its shares to the public. Investors (both retail and institutional) interested in bidding on the stock could open accounts with banks working on the IPO and submit orders outlining the number of shares they wanted to buy and at what price. If this were to be a pure Dutch auction IPO, the IPO would be set at a “clearing price”, or the highest price that sells all of the shares being offered. Investors who bid at or above the clearing price would get their shares at the lowest winning price. To illustrate this, consider the following simplified example, where a fictional company is looking to offer 2,300 shares in its auction: May 10, 2010 3SWM & Oz Final Investor 1 Investor 2 Investor 3 Investor 4 Investor 5 Bid Price $100 / share $90 / share $80 / share $70 / share $60 / share Shares Requested 1,000 500 600 400 800 Cumulative Total 1,000 1,500 2,100 2,500 3,300 Investors receive shares in order until the cumulative total of the shares distributed exceeds the actual number of shares that the company is offering. In this case, Investors one, two, three would be granted all of their requested shares at $70 / share, and Investor four would receive 200 of their requested 400 shares at $70 / share. Savvy readers will note that in its purest form, this Dutch auction functions in the exact same manner as a Vickrey auction. The authors suspect Sir John Morgan, esq. helped consult on this IPO. Google modified this approach though. They held a traditional Dutch auction, with investors submitting bids on the stock along with how many shares they were willing to purchase, but instead of letting this determine the market price, Google then used the information gained in this auction to then decide (with their Investment Bank’s input) what price the shares would actually be offered at. Although the Dutch auction would act as an input into the selling price decision, it would not be the sole determinant of the offering price2. B. Why Google Chose This Approach Google’s approach to its IPO very much resembled a populist struggle, attempting to wrestle the power away from the closed and chummy Investment Bank / Institutional Investor 2 Google Made Splash, But Didn’t Start IPO Wave, http://www.marketwatch.com/story/google-made-splash-butdidnt-start-ipo-wave May 10, 2010 3SWM & Oz Final circle and give it back to the individual investor. By using a Vickrey auction, they had two specific goals in mind: 1. Accurate price discovery. By relying on the forces of supply (i.e., the number of shares being offered) and demand (i.e., a market with equal access and free will bidding on the shares), Google sought to eliminate the first day surge of its share price that was so often experienced during the dot-com era. By generating a demand curve for the IPO from the small investor and allowing him / her to receive allocations and participate in the pricing, the actual release price should be a more accurate representation of the underlying value of the stock (given that the dominant strategy in a Vickrey auction is to bid your value). This should also ensure that the full value of the IPO goes to the company that is going public, rather than the favoured clients of the Investment Bank underwriting the IPO. 2. Equal access to shares for all investors. The Dutch auction reduces the corruption in the IPO process, whereby under the traditional method, Investment Banks provide their most profitable clients with the greatest portion of the shares of IPO, reducing the likelihood that small investors will be able to gain access to these shares. By allowing both institutional and retail investors to bid in the auction, and by placing them both on equal ground (by not requiring a minimum number of shares purchased), it democratizes the process. Google’s Results Many watchers view Google’s IPO results as evidence that the online auction process did not serve as an efficient pricing mechanism, as it did not minimize Google’s first day price surge. Google’s offer price ended up being $85/share, and it closed on the first day of trading at May 10, 2010 3SWM & Oz Final $100/share, an 18% increase. GOOG subsequently continued to surge in its first week of trading, further illustrating pent-up demand that was not captured by the initial offer price3: Google's Stock Price - First Week Performance Closing Price / Share $115 $110 $105 $100 $95 Opening Day Surge 18% $90 $85 $80 Open 19-Aug-04 20-Aug-04 23-Aug-04 24-Aug-04 25-Aug-04 26-Aug-04 There is a great deal of controversy, however, of whether the resulting surge is evidence of a failure of the Dutch auction as an IPO methodology, or whether it was the implementation of the “modified” aspect of this particular auction that enabled the opening day surge. Most analysts agree that Google’s actual execution of the IPO was not pretty4: They slashed the opening price the day before the offer went public. Although it is a closely guarded secret what the actual clearing price was resulting from the Dutch auction, up until the day before the offer Google was publicly predicting an offering price range of $108-$135/share. This drastic drop in actual price, and the resulting price surge, may indicate that Google would have been better served following the actual clearing 3 4 GOOG: Historical Prices for Google Inc., http://finance.yahoo.com/q/hp?s=GOOG+Historical+Prices Google Goes Public, http://www.nytimes.com/2004/08/20/opinion/20fri1.html May 10, 2010 3SWM & Oz Final price, instead of arbitrarily deciding on $85/share (although without knowing the actual clearing price from the auction, we cannot verify this). Google did not explain its business model or plans to sceptical investors. Unlike most IPOs, Google did not feel the need to publicly disclose details of how it was going to add value to its shareholders. Left feeling confused and uncertain, many investors, both retail and institutional, chose to remain on the sidelines and not participate in the IPO. There was a great deal of “friction”, preventing some potential bidders from entering the auction. To enter a bid in the Dutch auction, one first had to register online to become an “approved bidder”, and then had to re-register with a broker. Google purposely made the registration process onerous with the goal of limiting demand, hoping to reduce any over-exuberant bids. Google also took the unusual step of not marketing their shares in Europe or Asia, which is unusual for an IPO of this scale. By adding this “friction” into the process, it pent up some of the overall demand, which may have been released during the opening day of trading. The market was rapidly declining during the period between the completion of the auction and the actual IPO. This shook Google’s and its advisors’ confidence that the demand information they received from the auction was still going to hold true in the actual offer. Given the choice of pricing too high (and having a demoralizing price drop on the opening day of trading) or too low, they opted for the conservative price. Instead of offering 25.7MM shares at $135/share, they slashed their opening offer to 19.6MM shares at $85/share. May 10, 2010 3SWM & Oz Final The founders broke the SEC’s “silent period” rule with the publishing of an interview in Playboy containing details not disclosed in their original SEC IPO filing. This further shook Google’s confidence in their opening price, as investors were becoming wary that that Google was ready to become a public entity5. Although the success of the Vickrey style of auction for offering shares is inconclusive based on Google’s results alone, most analysts agree that the publicity and media attention that the process brought to the company was well worth its costs. It also focused the attention of the public on online auctions, and forced companies to begin taking it seriously as a viable alternative to the issuance process. Analysis of Auction IPOs As the Google IPO illustrates, auction IPOs may not always produce the optimal outcome for the company issuing shares. In fact, the relatively tiny number of auction IPOs since Google went public indicates that for the vast majority of companies, auction IPOs are less appealing than traditional IPOs. While there are a number of possible explanations for this, the most widely acknowledged reasons are that investment banks actually provide a valuable service to both issuing companies and investors; that auction IPOs lack transparency and information; and that auction IPOs may attract companies that would not otherwise be successful with traditional IPOs. A. The Value of Investment Banks 5 Google’s IPO, Five Years Later, http://dealbook.blogs.nytimes.com/2009/08/19/googles-ipo-5-years-later/ May 10, 2010 3SWM & Oz Final As discussed earlier, investment banks perform a number of services on behalf of the companies that they take public. Perhaps the most important of these are the role banks play in valuing the company, and in marketing its shares to investors. By pricing the shares of companies going public, investment banks perform the financial analyses necessary to determine projected prices. These pricing models used by the banks are also helpful in selling the company to institutional investors, who will likely perform similar analyses of their own. In addition to these analyses, by meeting with potential investors, banks are able to gauge interest in a company and better set the IPO price. Aside from pricing, investment banks also put considerable effort into marketing the company that is about to go public. Throughout the road-show process, investment banks meet with potential investors and promote their client. The strong relationships that many banks have with investors can have a significant impact on the demand for a company, and is a service that is sorely missed by companies using auction IPOs. A company’s core competency is building its product or service; in most cases, companies that are going through the IPO process do not know the language of the market; investment banks serve as the “translator” between company and investor. These pricing and marketing services are particularly important for companies that have complex business models, or that may not be well known. According to Notre Dame professor Ann Sherman, an auction IPO researcher, the main problem with IPO auctions is “the idea that there’s this automated ‘untouched by human hands’ method that prices shares perfectly every May 10, 2010 3SWM & Oz Final time. Auctions may be a useful way to collect information, but for such complicated securities, there will always be a role for an underwriter.”6 In light of these services provided by investment banks, it is not difficult to understand why companies may feel that they will have more success with a traditional IPO than with an auction IPO. B. Lack of Information In addition to the lack of services provided by investment banks, a general lack of information on companies using auction IPOs may be deterring interest from investors. Compounding the problem is the fact that the small investor, who is supposed to be a primary participant in auctions, may lack access to sufficiently detailed information sources to accurately price the company’s shares based on fundamentals, rather than on name recognition.. This potential problem is made worse by the lack of information that the online auction process requires to be disclosed. Of course, they almost certainly lack the skill to do a detailed financial analysis assuming that they had the information. C. Appeal to Unappealing Companies A third explanation for the lack of popularity with auction IPOs is that, due to the less rigorous scrutiny by investment banks and the consequent reduction in information provided by the issuing firm, the auction process could be used more by companies that may not have a clear idea of how they would use the funds generated by the IPO. Intelligent investors are undoubtedly aware of this possibility, and consequently discount the initial offer price. 6 Taulli, Tom “Bidding Online for Hot IPOs” May 8, 2007 http://www.fool.com/investing/general/2007/05/08/bidding-online-for-hot-ipos.aspx May 10, 2010 3SWM & Oz Final Morningstar's decision in January to use the IPO auction process is seen by some as consistent with this theory. Before its IPO, Morningstar was the subject of an SEC investigation concerning inaccurate data,.7 In light of this phenomenon, issuing companies may feel that their IPO will be viewed as less attractive to investors if they utilize an auction. Recommended Strategies for Auction IPOs In spite of these deterrents, auction IPOs are still a factor when companies determine how best to issue shares. As such, those in the industry need to formulate strategies for dealing with auction IPOs. This section discusses recommendations for companies going public, auction companies, investment banks, and institutional investors. A. Issuing Companies First and foremost, companies that plan to go public need to decide if an auction IPO is the right choice for the company. While certain disadvantages are not inherent to auction IPOs – like the limited marketing effort –, the only major auction IPO platform, WR Hambrecht+Co’s OpenIPO, offers limited support in exchange for reduced fees. Thus, certain companies may be more likely to have poor results. In particular, companies that are not well known may have considerable difficulty garnering demand for their shares from smaller investors. Additionally, companies that have especially complex business models may be hurt by the lack of marketing support from an investment bank that could help explain the company’s value to investors. If an issuing company decides to use an auction, one of the most important things it can do is to provide as much information as possible. Because an investment bank will not be 7 Hensel, Nayantara “Are Dutch Auctions Right for Your IPO?” April 11, 2005 Harvard Business School Working Knowledge May 10, 2010 3SWM & Oz Final disseminating information on its behalf, and because investors will be sceptical about the lack of information, it is critical that the company proactively do so. First, the company needs to be clear about how it intends to use the capital it plans on raising (e.g. growth capital, paying down debts, etc.). Additionally, it needs to provide details on the corporate governance structure of the company and specify how it will address any challenges facing the company in the future. Finally, it needs to clarify why it chose to use an auction for its IPO, as many investors will be sceptical of the choice to avoid investment banks and will assume the company is guilty of hiding some negative news. In addition to providing information, it is critical that the company market itself to investors. As previously discussed, investment banks have strong relationships with institutional investors and are excellent at marketing companies to them. Because issuing companies that use auction IPOs are at a disadvantage without this service, it is important that they actively pursue institutional investors. Of similar importance, companies that use auction IPOs need to market to small investors. If a company is not already well known to consumers, it will be very difficult to drum up any demand from smaller investors without aggressive marketing. B. Auctioneers One of the biggest challenges facing IPO auction sites is a lack of credibility. In many cases, both issuing companies and investors likely perceive IPO auctions as less effective or as higher risk investments. To a large extent, this can be attributed to a lack of familiarity with auctions and the lack of a proven track record of successful IPOs. This could be combated with a significant investment in marketing – at least for a few IPOs until momentum swings – which would result in increased awareness and bidding, and ultimately higher share prices for client May 10, 2010 3SWM & Oz Final companies. In addition to investing in marketing capabilities, auction companies could pursue more high-profile companies (e.g., Facebook or Zynga) which would automatically generate considerable publicity and likely draw more bids from smaller investors. The auction houses need to create a “Fear of missing out” in institutional investors who might otherwise shun an auction IPO; if the investors know that the shares will be purchased immediately (because the IPO is perceived to be of the “can’t miss” variety, like Facebook), then they will be more likely to bid at their personal valuations, which will help the auction system hit the market price correctly. C. Investment Banks For investment banks, the possibility of commonplace auction IPOs poses a potentially serious threat. The most effective way for banks to mitigate this threat is to do everything they can to maintain the status quo. This would likely involve strengthening relationships with institutional investors, and building as many barriers as possible to prevent auction companies from gaining credibility with investors. Similarly, investment banks would be wise to emphasize past auction disappointments with potential issuing companies. D. Institutional Investors For institutional investors, auction IPOs present both a danger and an opportunity. The risk with investing in companies that auction their shares is the potential that they are avoiding investment banks because they will not stand up well to the scrutiny of a traditional IPO. However, auction IPOs may also present an opportunity to purchase shares at a significantly discounted rate. With auction IPOs it may be possible for larger investors to coordinate in keeping prices down by withholding bids, or bidding low. This would be more difficult to do May 10, 2010 3SWM & Oz Final with traditional IPOs, as the investment banks would be more likely to detect it and take measures to protect their clients.